About Confirmation of Payee

Confirmation of Payee is a service that will be phased in by participating banks from the end of November 2024.

The Confirmation of Payee service applies to payments between New Zealand banks when using our mobile app or internet banking, such as when you:

- Make a one-off payment

- Save a new payee

- Edit an existing payee.

The service will not apply to all types of payments. Checks will not be done on payments to:

- Overseas bank accounts

- Foreign currency accounts

- Registered bill payees e.g. councils, water or power companies

- Your existing saved payees (unless you edit the payee details).

Modal to play video

Common questions

Why is Confirmation of Payee important?

Confirming the payee’s name and account number match helps give you greater confidence that you're paying the right person or business and adds another layer of protection to protect yourself from scams and fraud.

What if I go by a name that’s different to my legal name? e.g. nickname or preferred name.

When you provide your account details for a payment, it’s essential to give the account owner name that’s registered to your bank account. For personal customers, your account owner name is your legal first and last name; you do not need to share your middle name.

If your legal name has changed and you'd like to update your name in our systems visit our update your name or gender page to find out what's needed to do this.

If you provide a different name to people who pay you, they're likely to receive a 'partial match' or 'not a match' response, which might cause confusion or delay them paying you.

How do I find and share my account owner name and number?

We have a step-by-step guide on our share your account details page for how to share your account owner name and account number in the mobile app and internet banking.

What does a 'match' response mean?

You'll get a 'match' response if the account owner name matches the account number. Even with this response, it's important you consider whether you know and trust the payee.

What does a 'partial match' response mean?

You'll get a 'partial match' response if the account owner name you have entered is similar to the name registered to that account, but it's not exactly the same.

You may want to check for typos in the account owner name and number. Make sure you haven't entered a nickname, initials or a shortened version of the person or business' name.

You'll need to carefully check the details you've entered and consider whether you know and trust the payee. If the account details are incorrect your payment might not be recoverable.

What does a 'not a match' response mean?

You'll get a 'not a match' response if the name you've entered doesn't match the name registered to that account. If you continue with the payment, you could send money to the wrong place and it might not be recoverable.

We strongly encourage you to consider whether you know and trust the payee. You may want to check for typos in the account owner name and number and verify the account owner's identity. If you decide to double check the account details with the payee, be particularly alert if you’re told to ignore a 'Not a match' response.

What does a 'checking is temporarily unavailable response mean?

You'll get a 'checking is temporarily unavailable' response if there's a temporary technical issue at the time we're trying to make the match. You may want to attempt to make the payment at a later time when checking is available again or continue if you know and trust the payee, if the account details are incorrect your payment might not be recoverable.

What does a 'payee's bank or account type doesn't support checking' response mean?

You'll get an 'payee's bank or account type doesn't support checking' response when we cannot check this name and account number, either because this payee's bank doesn't provide the Confirmation of Payee service yet or it may be an account type we cannot check, for example a KiwiSaver.

You'll need to consider whether you know and trust the payee before you make the payment, if the account details are incorrect your payment might not be recoverable.

What does a 'account may not exist' response mean?

You'll get a 'account may not exist' response when the account number entered was not found at the payee’s bank, this could mean the account could be closed or it doesn't exist.

You'll need to carefully check the details you've entered and consider whether you know and trust the payee before you make the payment, if the account details are incorrect your payment might not be recoverable.

What will happen to my existing saved payees?

All your saved payees will remain unchanged. Once the service is available, you'll only be prompted to check payee details if you're editing any of the saved payee information.

What name do I share for my joint account with people who are paying me?

If you have a joint account and you're wanting to share your account details to receive a payment, you only need to share your account owner name. You don't need to provide the joint account owners name for the person paying you to receive a 'match'. Find out more about how to share your account details.

What name do I share when I’m authorised to operate someone else’s account?

If you're an authority to operate (ATO) i.e. a parent operating their child’s account or a Power of Attorney, and you’re wanting to share their account details for receiving money, use the account owner’s first and last name, not your own.

Is there a risk to my data privacy when a Confirmation of Payee check is performed?

To perform the Confirmation of Payee service, only an account owner name and bank account number is collected and processed to perform the matching service. The service uses data encryption to perform the match and provide match notifications, without storing any personal information. The service is built to comply with the Privacy Act 2020 and adheres to high security standards.

Are international payments included in the service?

The Confirmation of Payee service only applies to domestic payments.

What else do I need to know?

The matching response will help you decide if you want to proceed however, it won't stop you from completing a payment. The service won't eliminate scams or mistakes so it's important to always check who you're paying and why, even if the response is a Match.

Be particularly alert if you’re told by the person you’re paying to ignore a 'Not a match' or 'Partial match' response. If the payment details are incorrect or turn out to be a scam, the payment may not be recoverable.

Where can I find out more about Confirmation of Payee?

You can find out more about Confirmation of Payee by visiting getverified.co.nz.

What name do I share with my customers to receive payments into my business account?

When sharing your account details with customers via invoices, your website and any other places your customers go to find your business account payment details, you'll need to share the exact business name registered to your account, this may be different to your trading name.

If you're unsure about what name is registered to your account, you can find this in your internet banking or mobile app. Let us know if your registered business name needs to be amended to ensure you don't experience payment delays once the Confirmation of Payee service is available.

What happens if I'm a registered bill payee?

Customers can easily search for your business' name in internet banking and our mobile app, they won't need to complete the Confirmation of Payee checks and your details will also be registered with all other banks in New Zealand.

How do I become a registered bill payee?

Our become a registered bill payee page has more information on the benefits of being a registered bill payee, as well as how to become one.

What this looks like for you

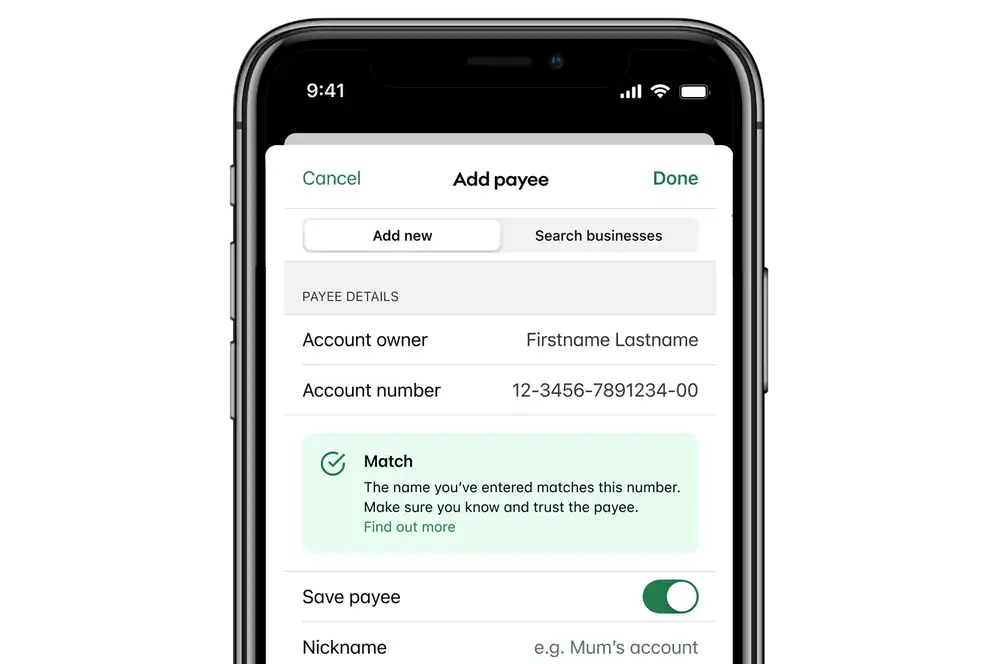

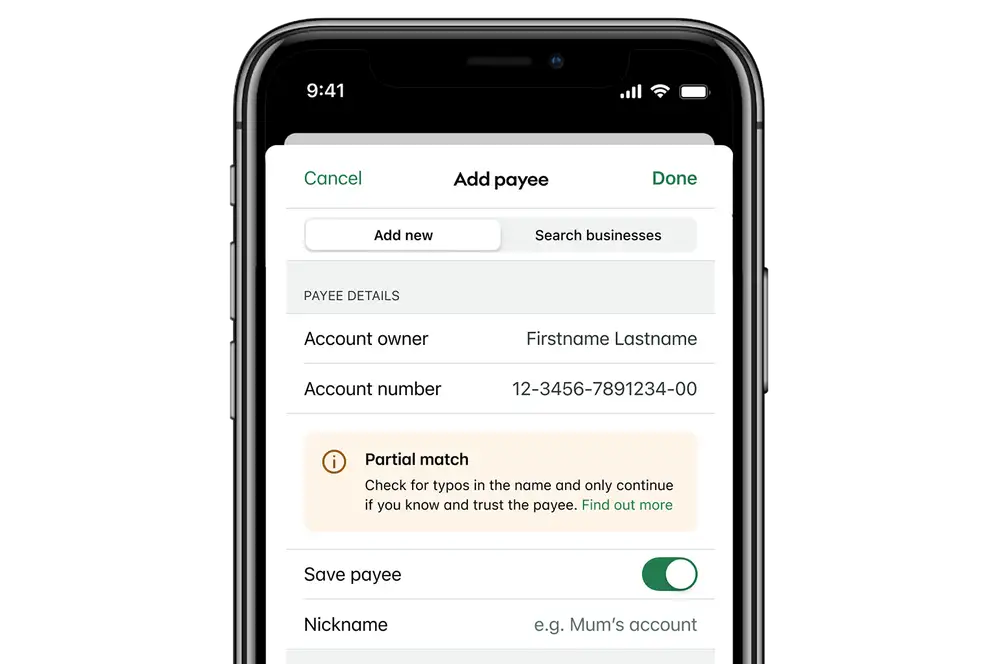

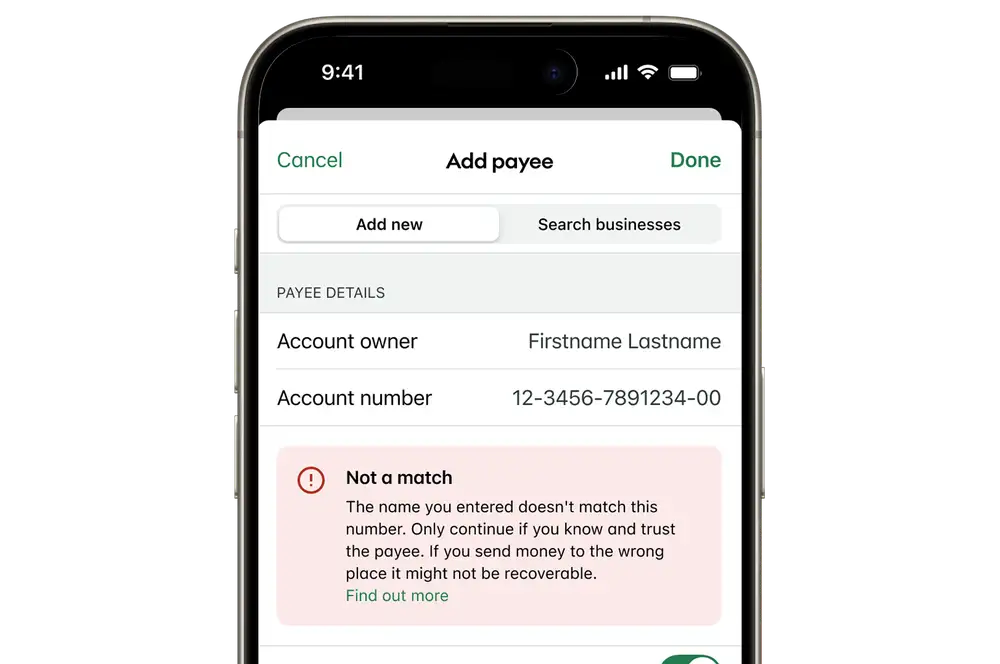

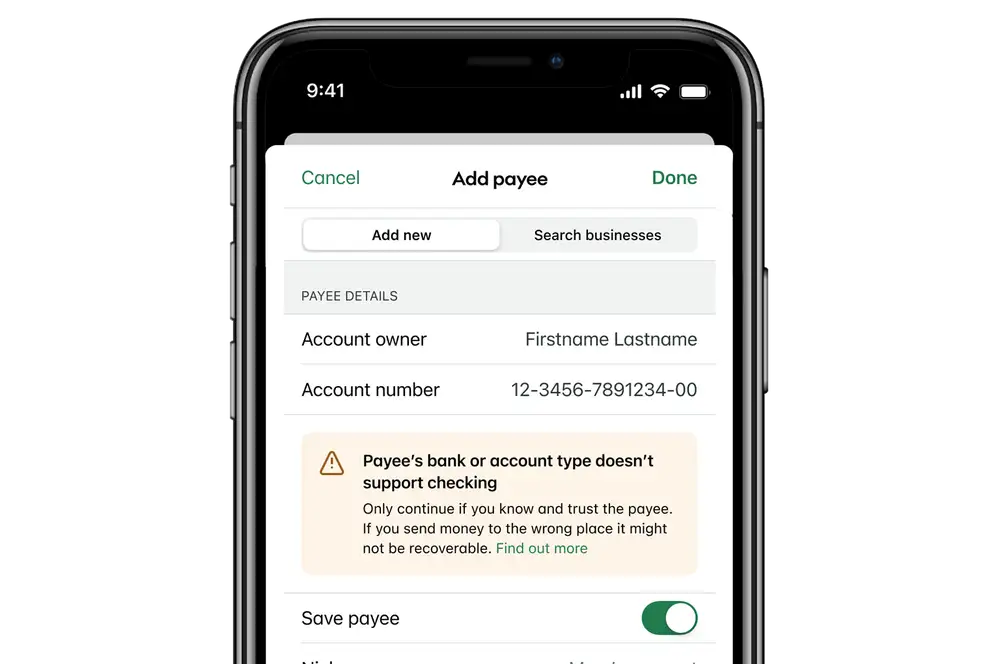

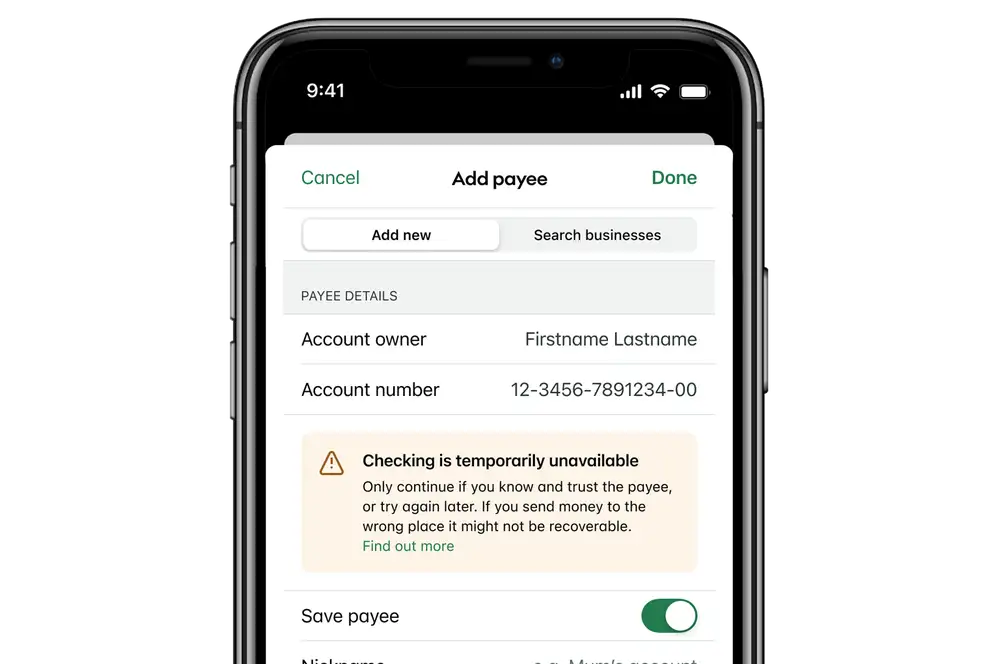

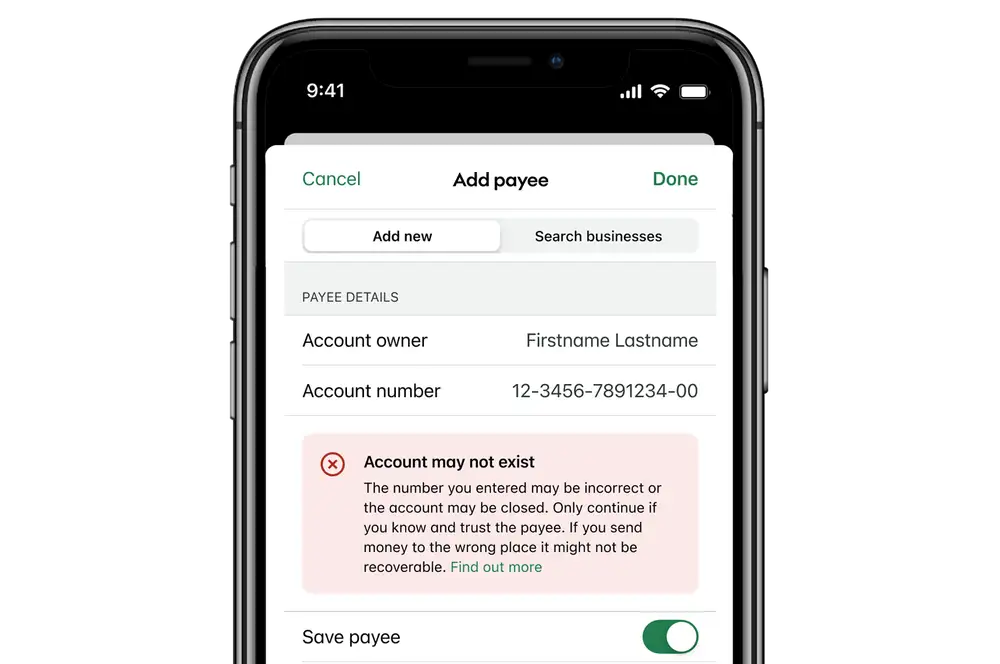

Mobile app match responses

You'll get a 'match' response if the account owner name matches the account number.

You'll get a 'partial match' response if the account owner name you have entered is similar to the name registered to that account, but it's not exactly the same.

You'll get a 'not a match' response if the name you've entered doesn't match the name registered to that account.

You'll get an 'payee's bank or account type doesn't support checking' response when we cannot check this name and account number, either because this payee's bank doesn't provide the Confirmation of Payee service yet or it may be an account type we cannot check, for example a KiwiSaver.

You'll get a 'checking is temporarily unavailable' response if there's a temporary technical issue at the time we're trying to make the match.

You'll get a 'account may not exist' response when the account number entered was not found at the payee’s bank, this could mean the account could be closed or it doesn't exist.

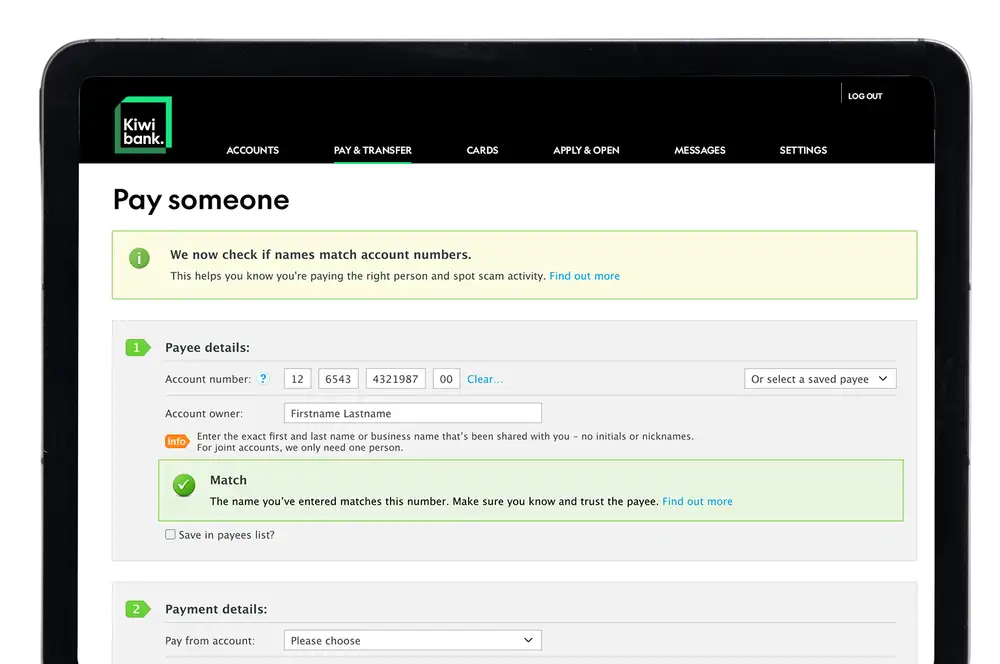

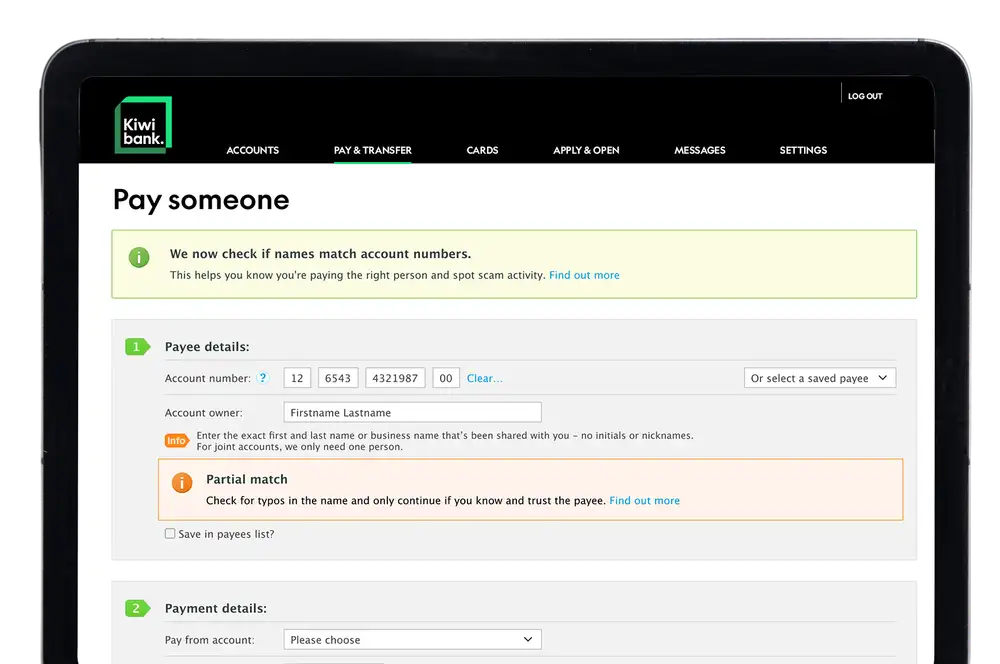

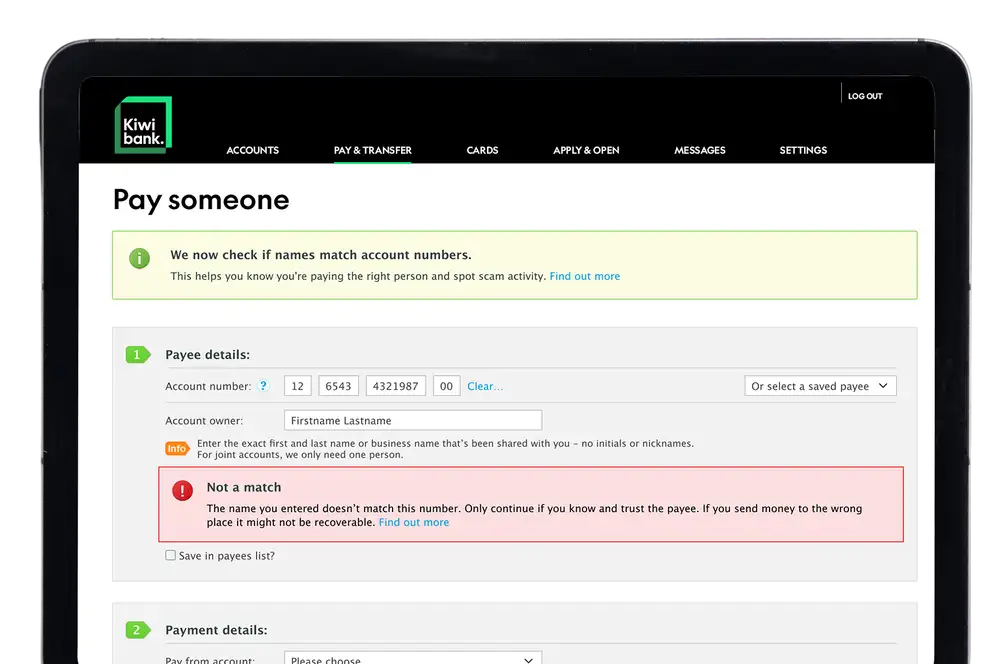

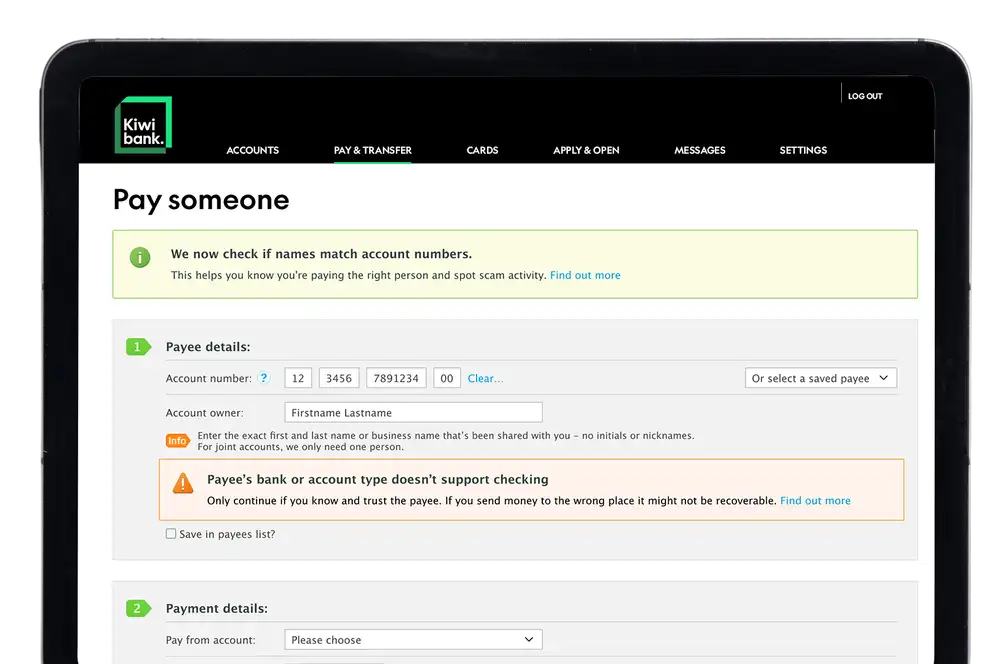

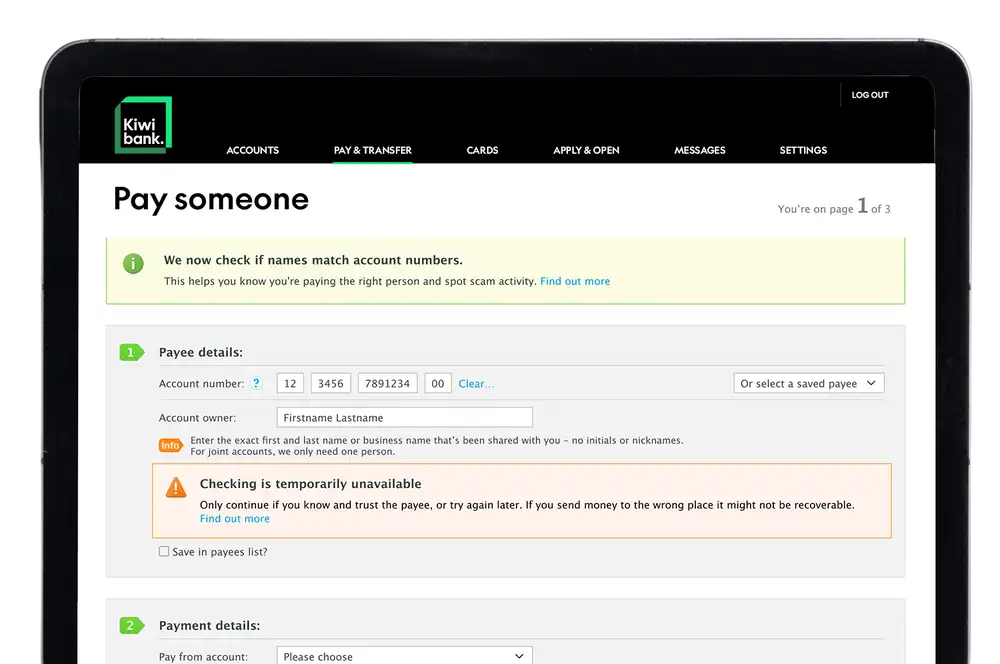

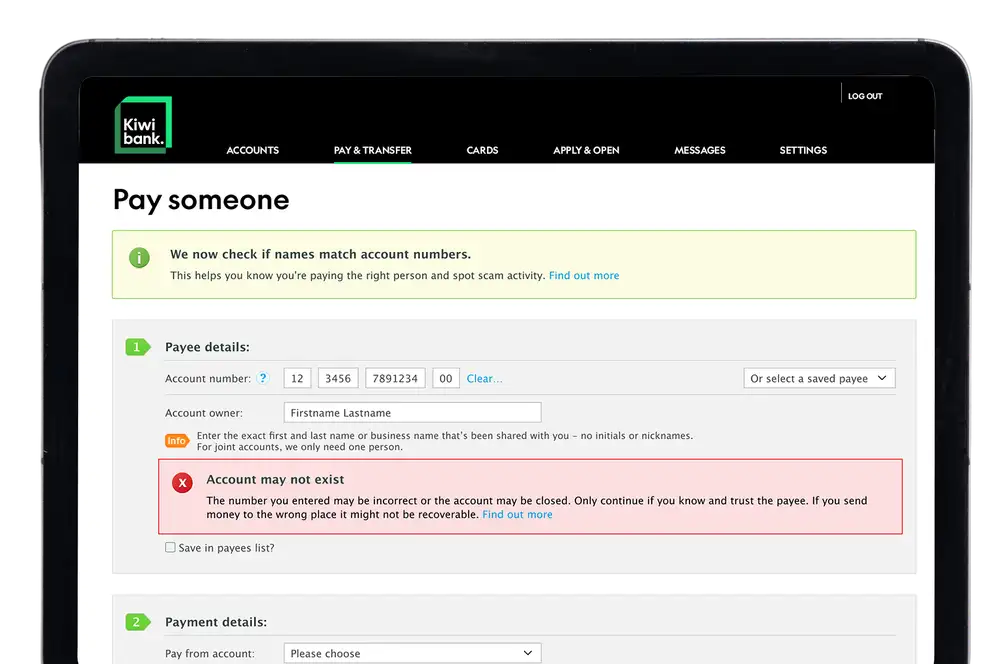

Internet banking match responses

You'll get a 'match' response if the account owner name matches the account number.

You'll get a 'partial match' response if the account owner name you have entered is similar to the name registered to that account, but it's not exactly the same.

You'll get a 'not a match' response if the name you've entered doesn't match the name registered to that account.

You'll get a 'payee's bank or account type doesn't support checking' response when we cannot check this name and account number, either because this payee's bank doesn't provide the Confirmation of Payee service yet or it may be an account type we cannot check, for example a KiwiSaver.

You'll get a 'checking is temporarily unavailable' response if there's a temporary technical issue at the time we're trying to make the match.

You'll get a 'account may not exist' response when the account number entered was not found at the payee’s bank, this could mean the account could be closed or it doesn't exist.

Payment times

See more about when your payment will be processed.

Stay alert about impersonation scams

We'll never ask you to provide us with any information to make the Confirmation of Payee service work, once it's available it'll be automatically applied to your online banking.

Be aware that scammers may take this opportunity to contact you, pretending to be a bank employee with information about the new service. Stay vigilant to avoid falling victim to impersonation attempts.