Your monthly Kiwibank Credit Card statement

-

1

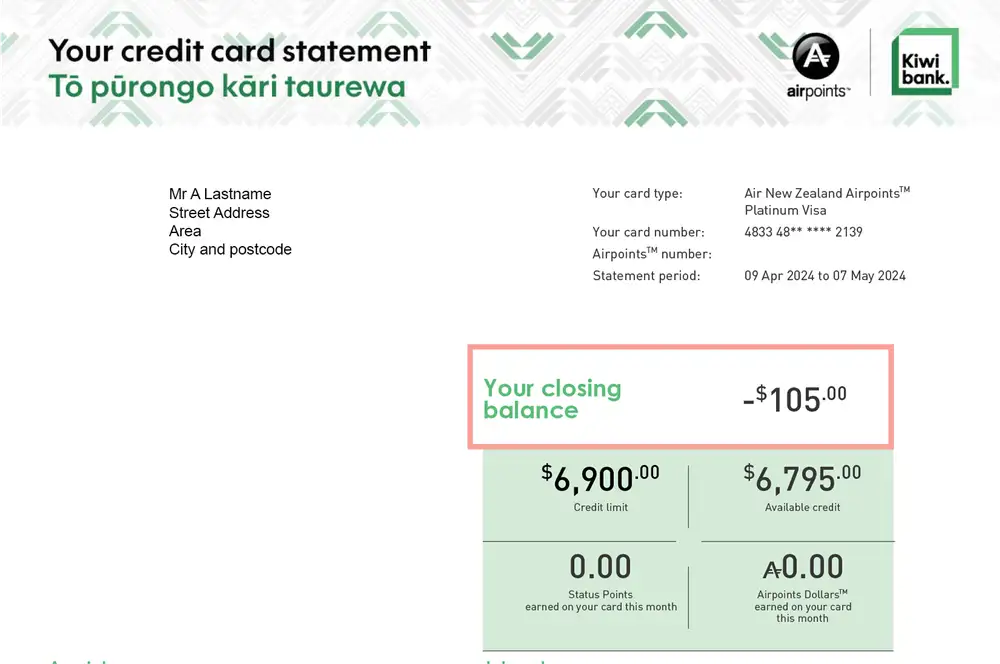

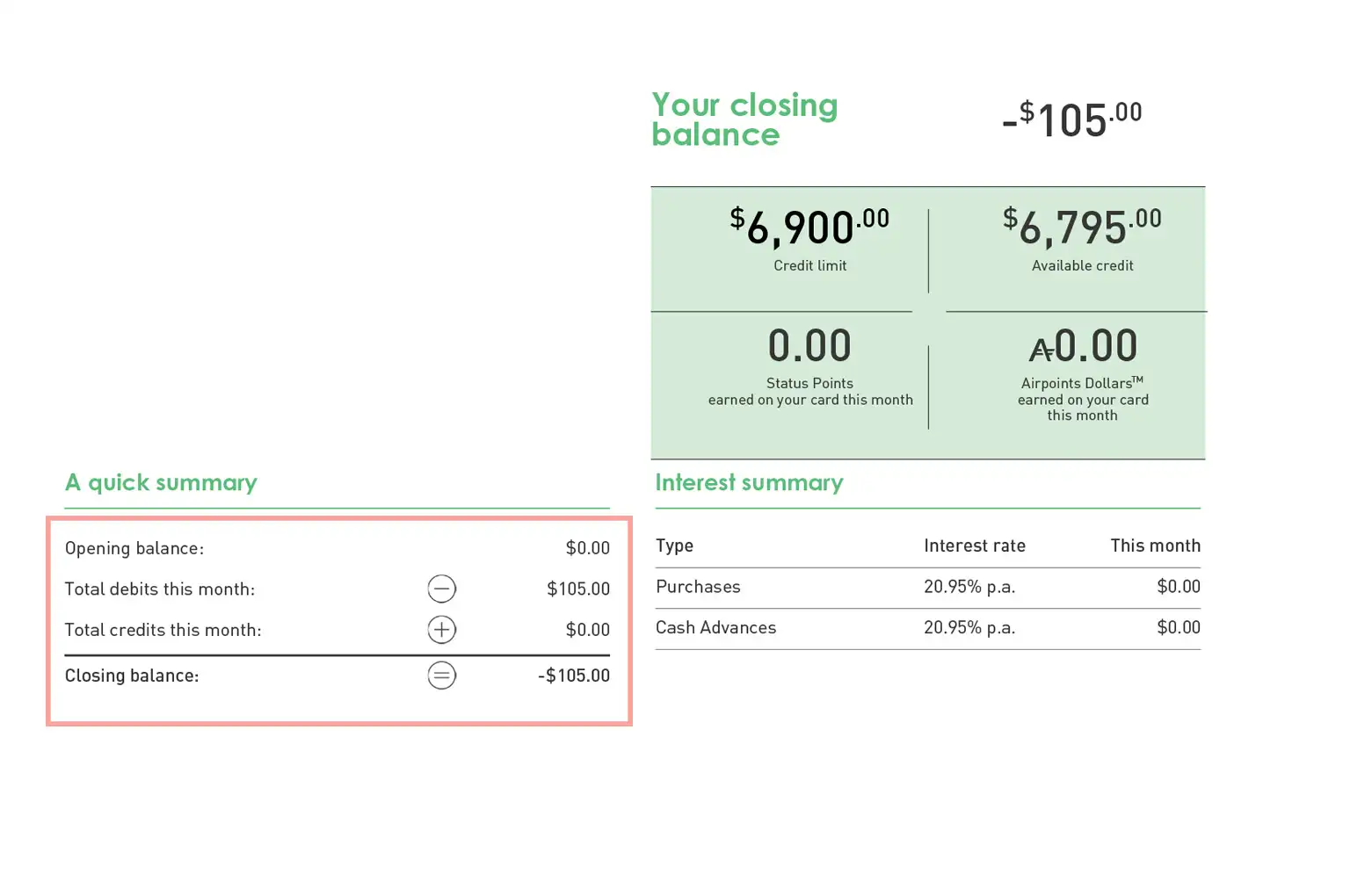

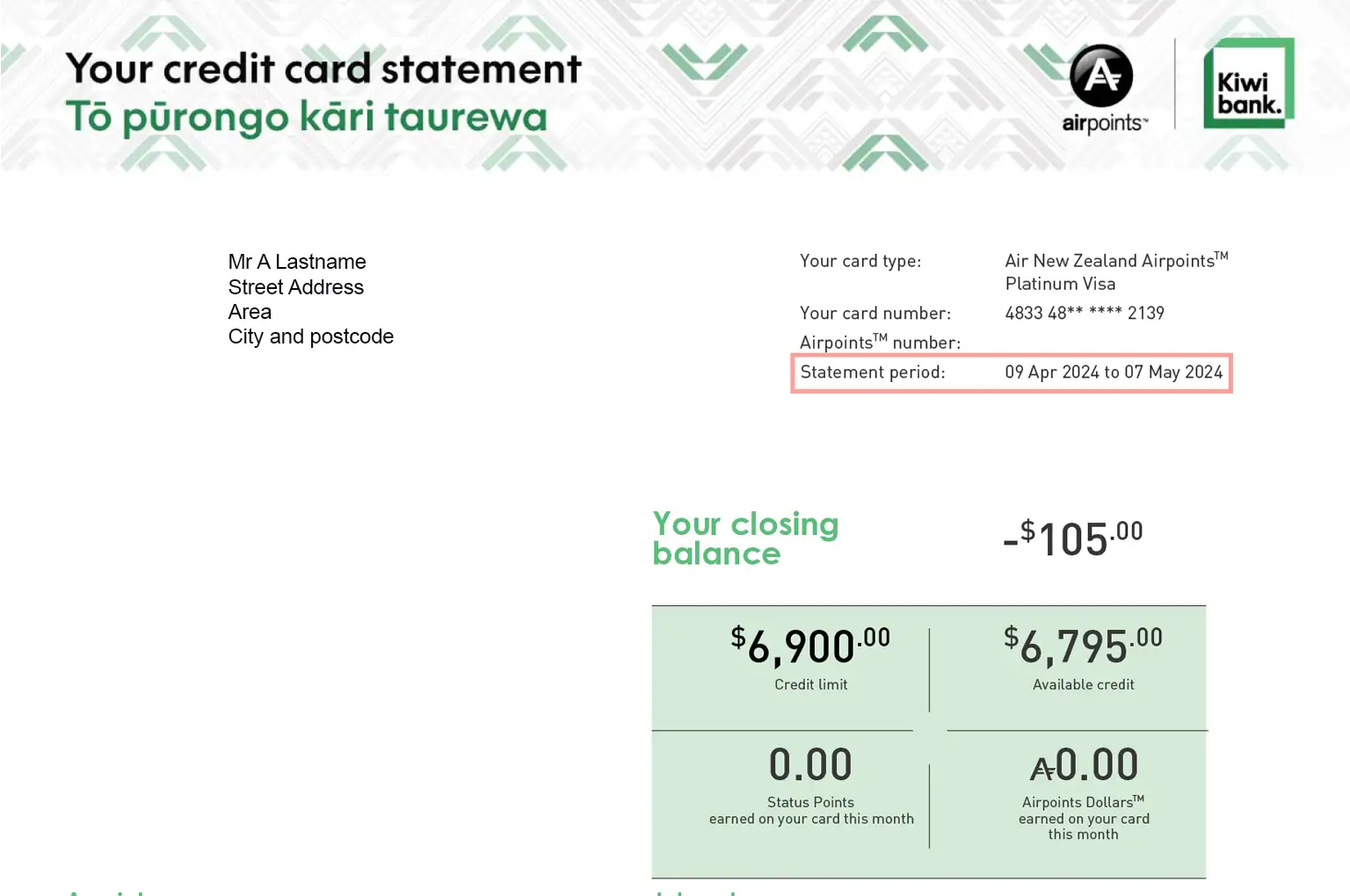

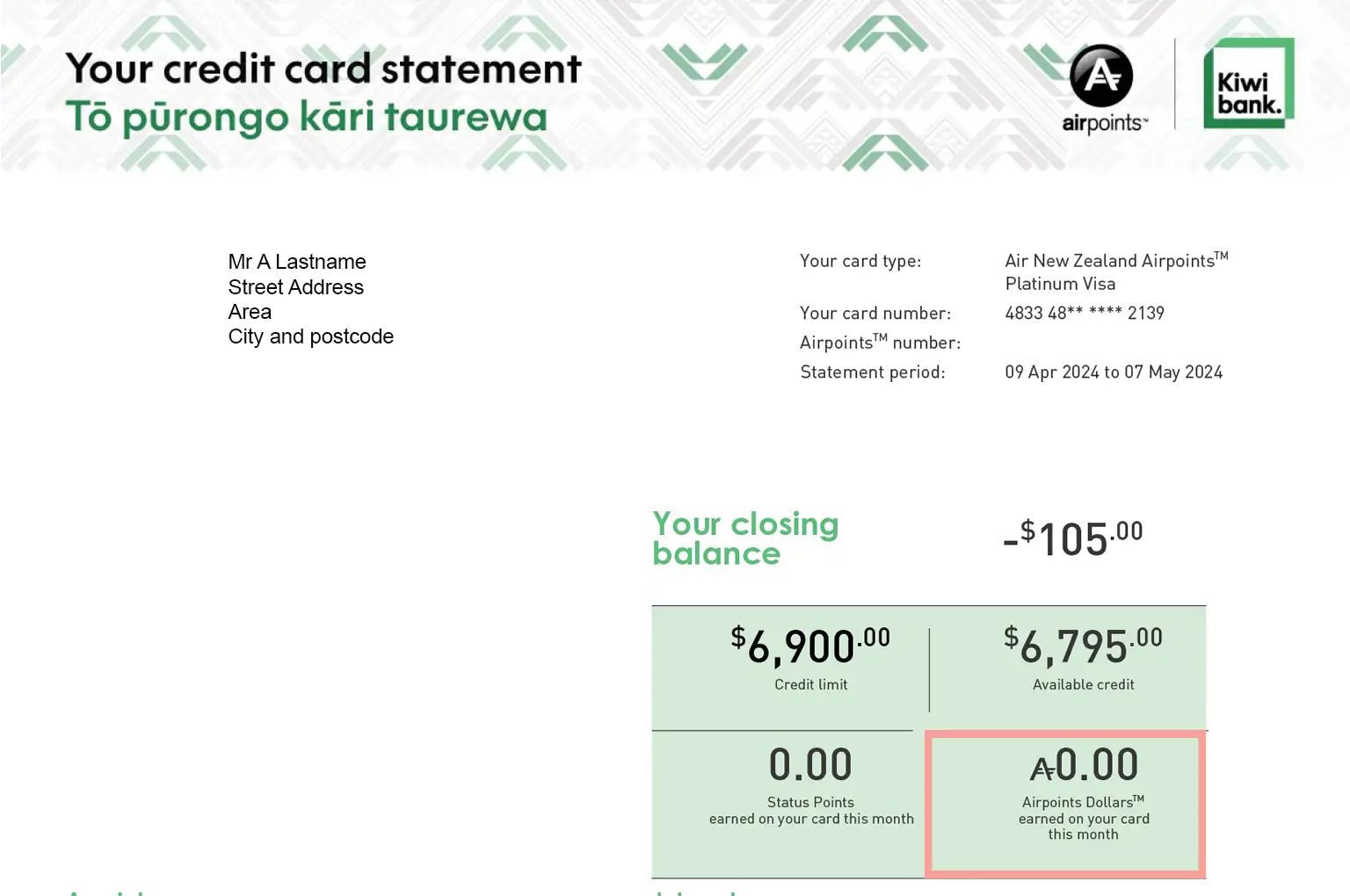

Your closing balance

The total amount owing on your credit card at the end of your statement period.

Paying off your closing balance in full each month ensures you avoid paying any interest on your purchases during the month.

-

2

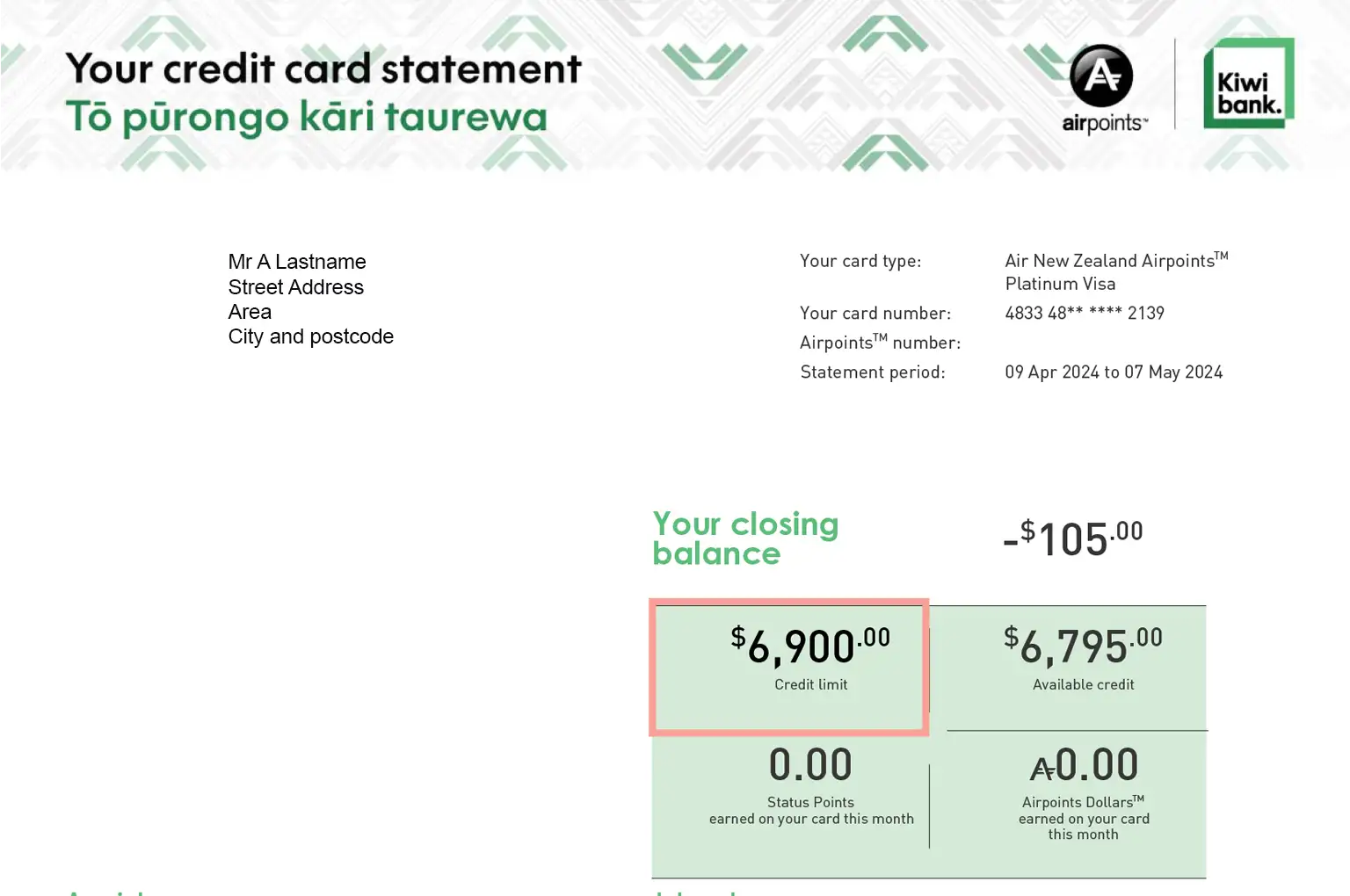

Credit limit

Your credit limit is the highest amount you can spend on your credit card. In this example the credit limit is $6,900.

-

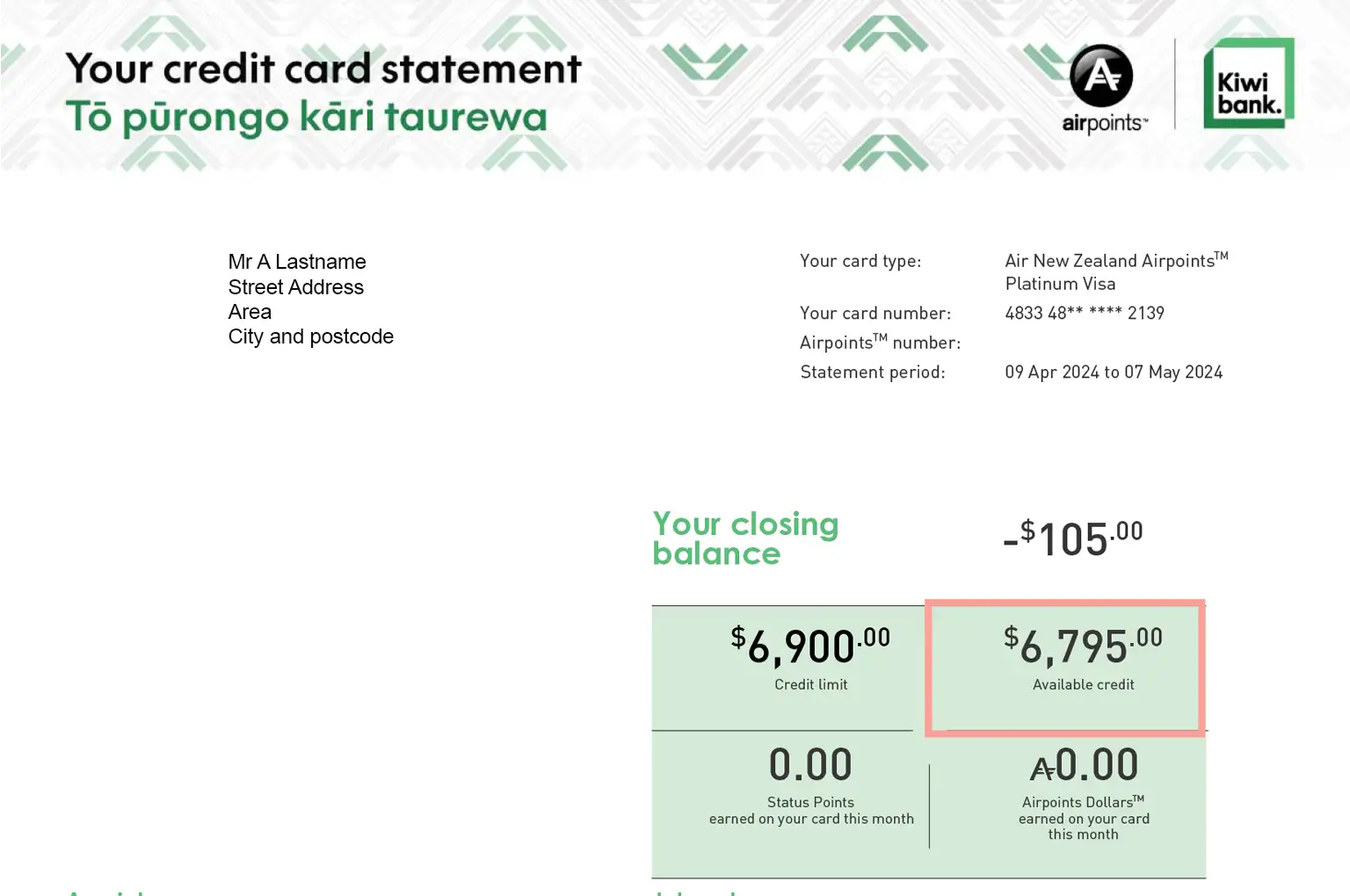

3

Available credit

This is the amount of your credit limit you haven't used. It’s worked out by subtracting your closing balance from your credit limit. So in this example, the credit limit is $6,900 and $105 is the closing balance, leaving $6,795 available to spend.

-

4

Opening balance

This is the amount you owed at the start of your statement period is your opening balance. Once your debits (what’s you’ve spent) and credits (what you’ve paid off your card) during the statement period are taken into account, you’re left with your closing balance.

-

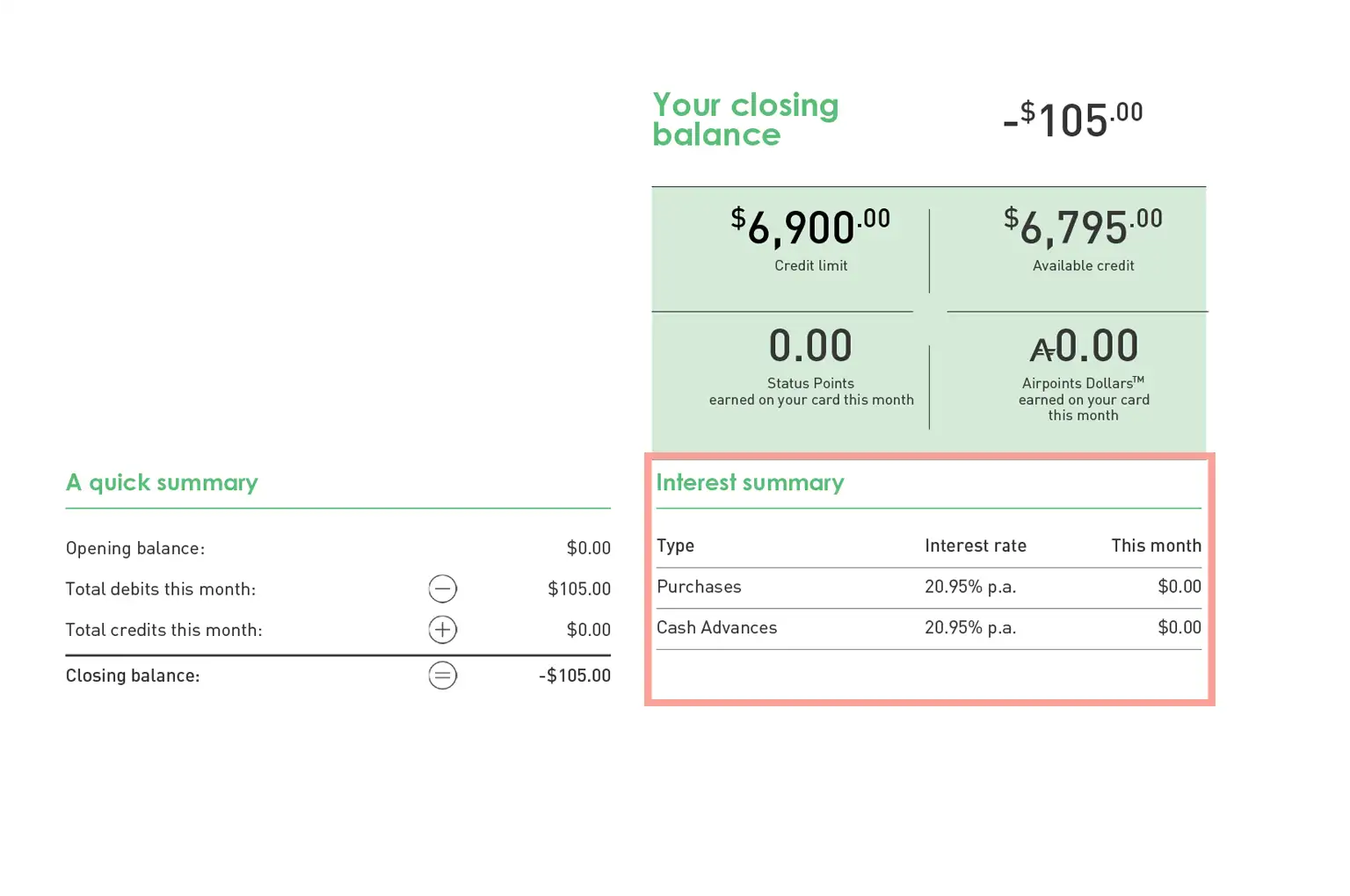

5

Interest summary

This is a summary of the interest you've been charged for the statement period. This shows the interest rate and the amount for purchases, cash advances and balance transfers (if applicable). More about credit card rates and fees.

-

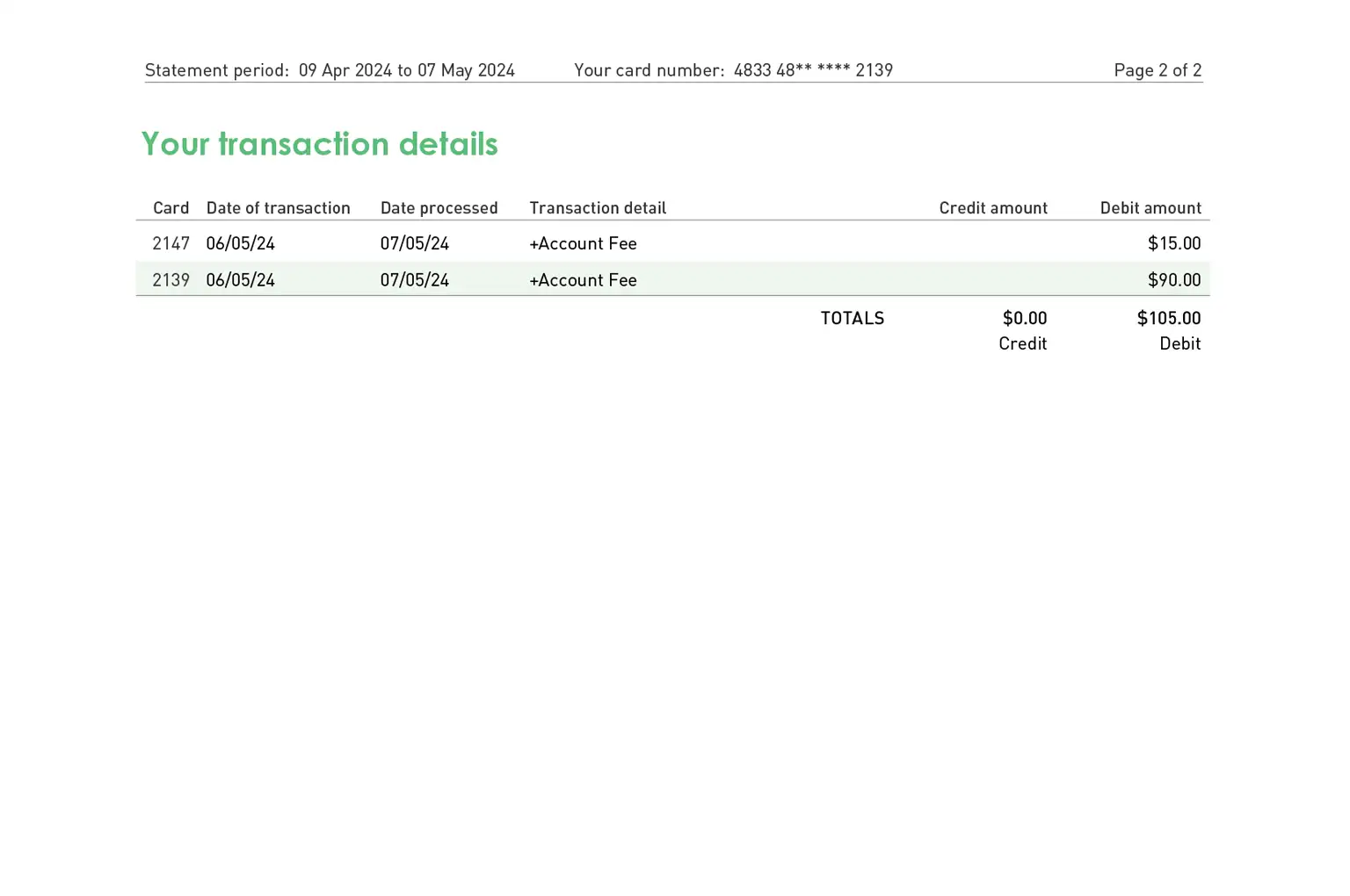

6

Transaction details

This outlines all the purchases, cash advances and interest or fees charged to your card during the statement period, as well as any credits such as payments or refunds.

-

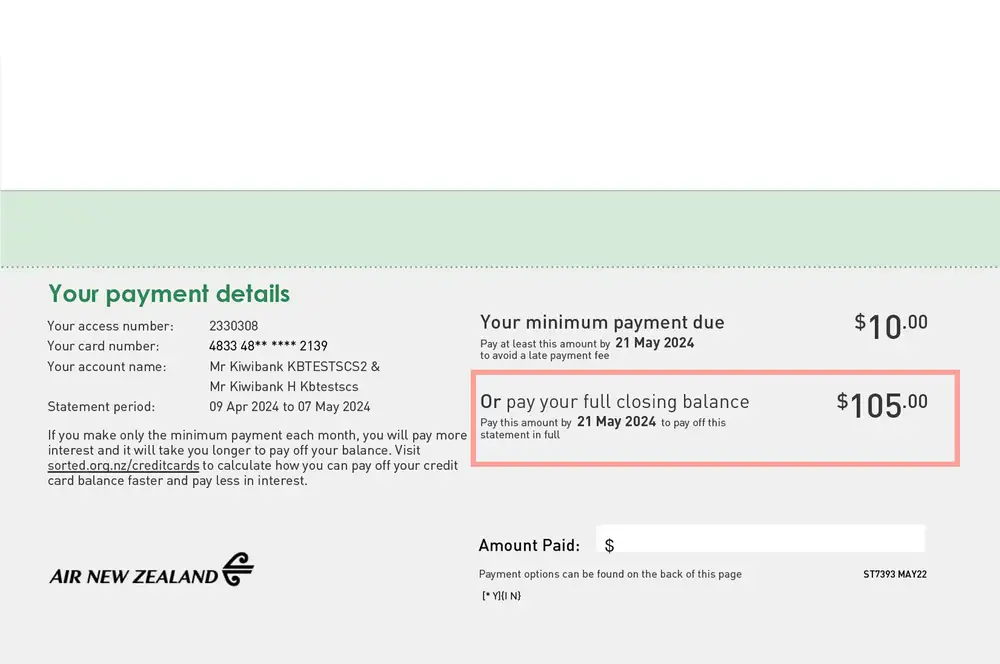

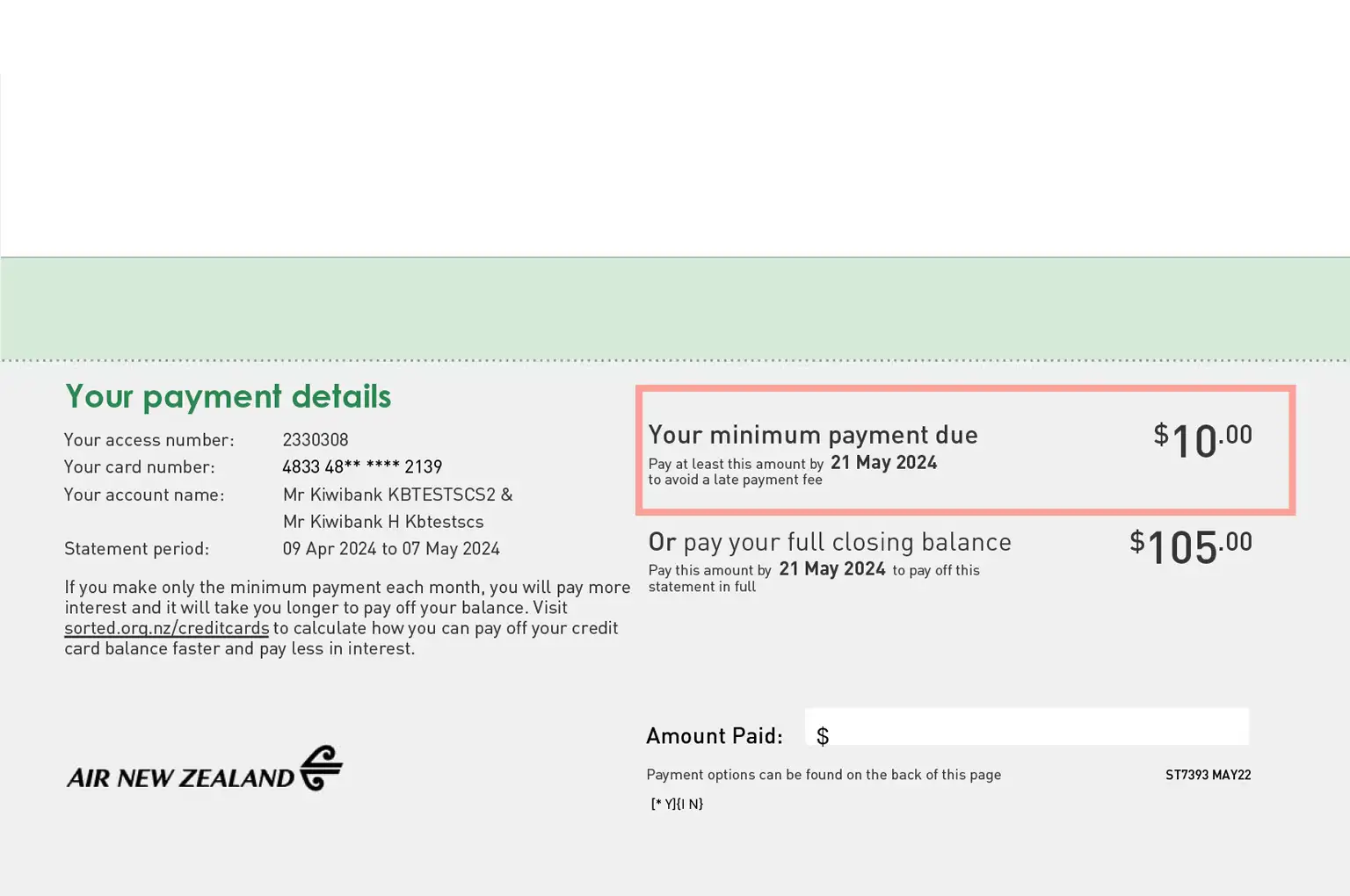

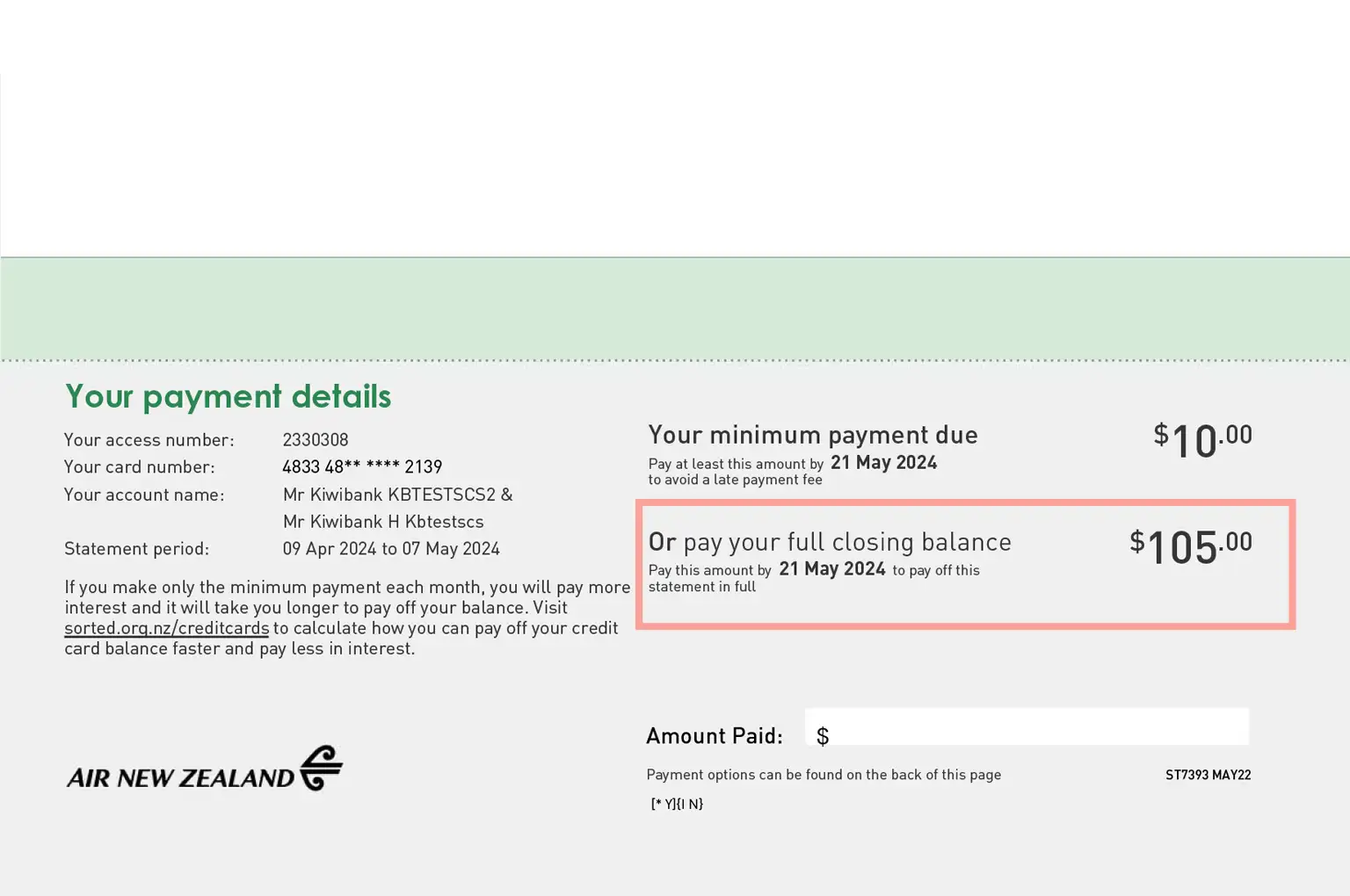

7

Minimum payment due

This is the minimum payment you have to make towards your credit card bill for the month.

It’s calculated as either 5% of your closing balance or $10, whichever is greater. The amount will be shown on your statement.

Our minimum repayments may be higher than other banks because we want you to pay down your debt faster – this will save you interest in the long run. It means that if you switch to a Kiwibank Credit Card from another bank’s card you might find that your minimum monthly repayments are higher.

If you can, try to pay more than the minimum monthly payments. If you only pay the minimum, you’ll end up paying more in interest and will take longer to pay off your balance.

-

8

Payment due date

This is the date you have to make a payment by in order to avoid a late payment fee.

If there’s a red amount labelled ‘due now’, this could be one of two things: a past due amount – which is any amount that you were due to pay the previous month but didn’t; or, an overlimit amount – any amount you’ve charged to your credit card over your credit limit.

-

9

Payment window

You’ll see the statement period dates at the top of each page of your statement.

Depending on which credit card you have, you’ll have either 14 or 25 days after your statement period ends to pay the closing balance in full to take advantage of interest-free purchases. This will show up as the due date on your statement.

For example, if your credit card has ‘up to 44 days interest-free’ on purchases, it allows 14 days after your monthly statement period ends to be paid off. If your card has up to 55 days interest-free on purchases, you have 25 days after the statement period ends.

-

10

Reward points

If you earn Air New Zealand Airpoints Dollars, the total amount you earn each month will be displayed.

-

11

Errors or disputed transactions

Make sure you check your statement each month to ensure there are no errors or transactions you're not expecting. You need to let us know within 60 days from the closing date of your monthly statement if you think there are any errors or if there’s been an unauthorised transaction on your credit card. If you don’t report an error within the 60-day timeframe we won’t be able to reverse the transaction. More about disputing a card transaction.