Let us know before you travel

If you'll be using your Visa Debit Card or credit card while you're overseas, you should contact us prior to leaving New Zealand so we can better protect your accounts and cards while you're away.

The best way to do this is by adding a travel notice within the mobile app or internet banking.

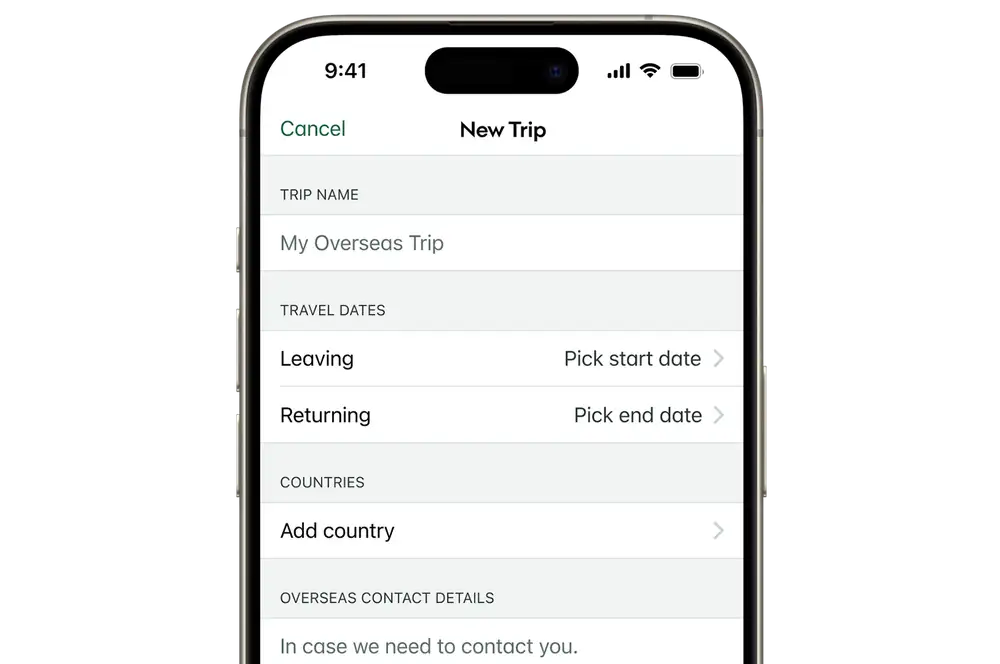

Mobile app

-

1 / 2

Add an overseas trip

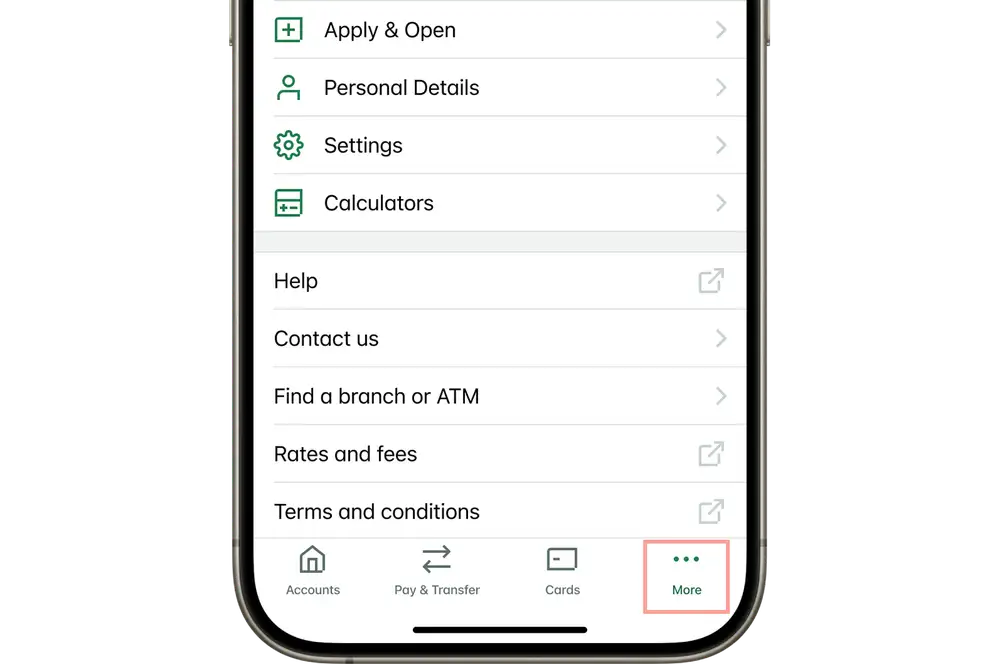

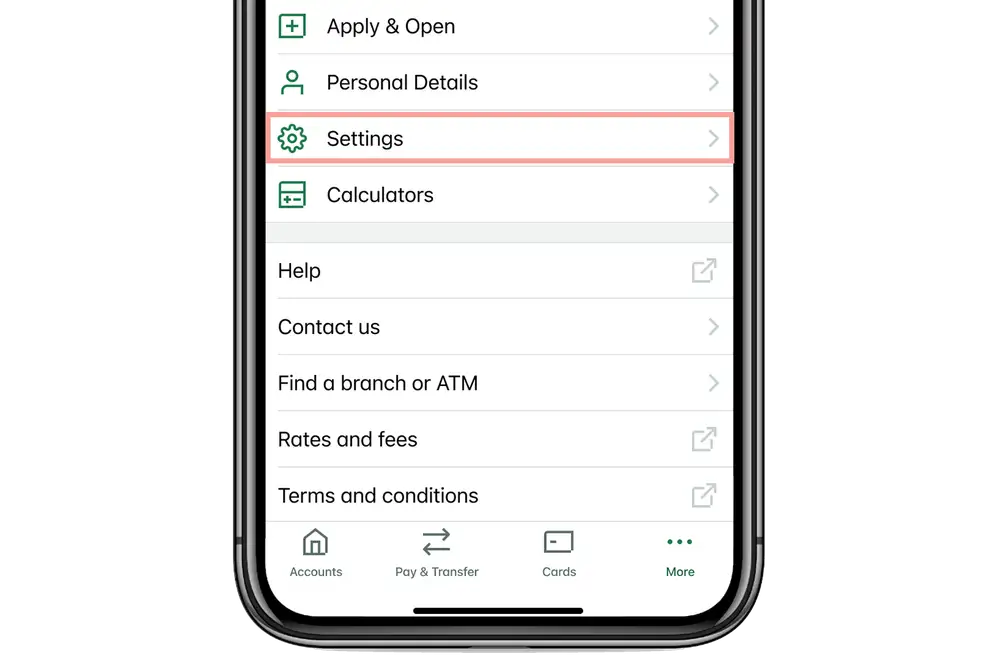

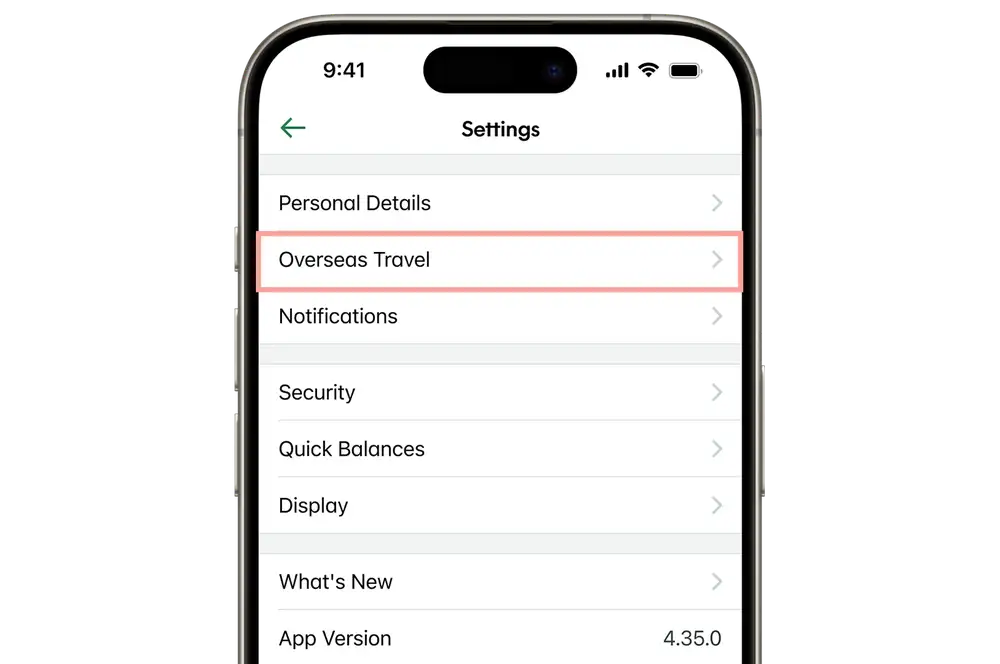

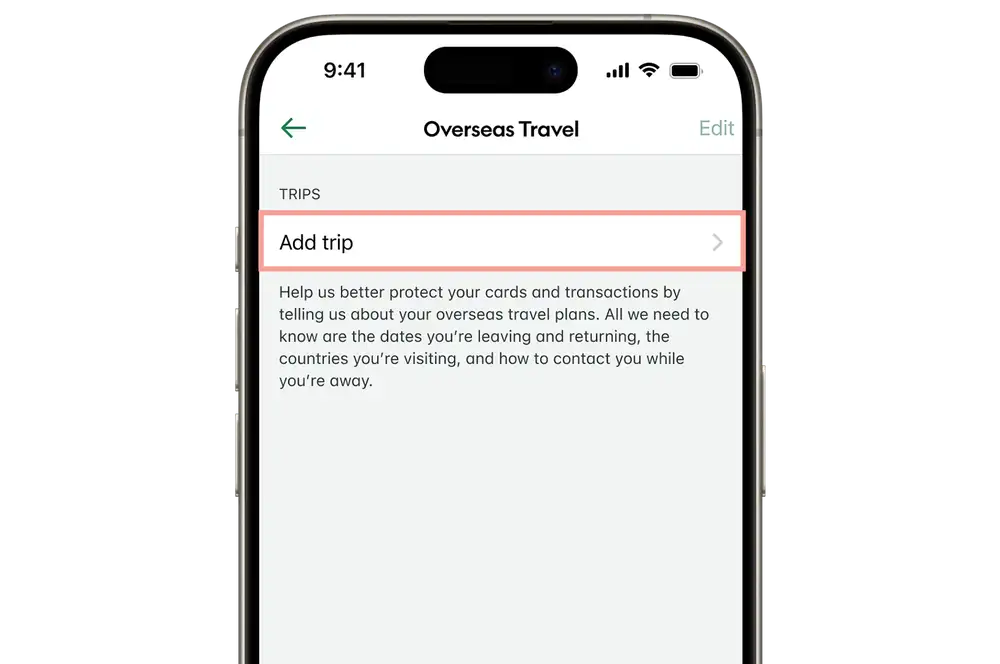

- Log in to the mobile app.

- Tap 'More' at the bottom of the screen.

- Select 'Settings'.

- Tap 'Overseas travel'.

- Select 'Add trip'.

-

2 / 2

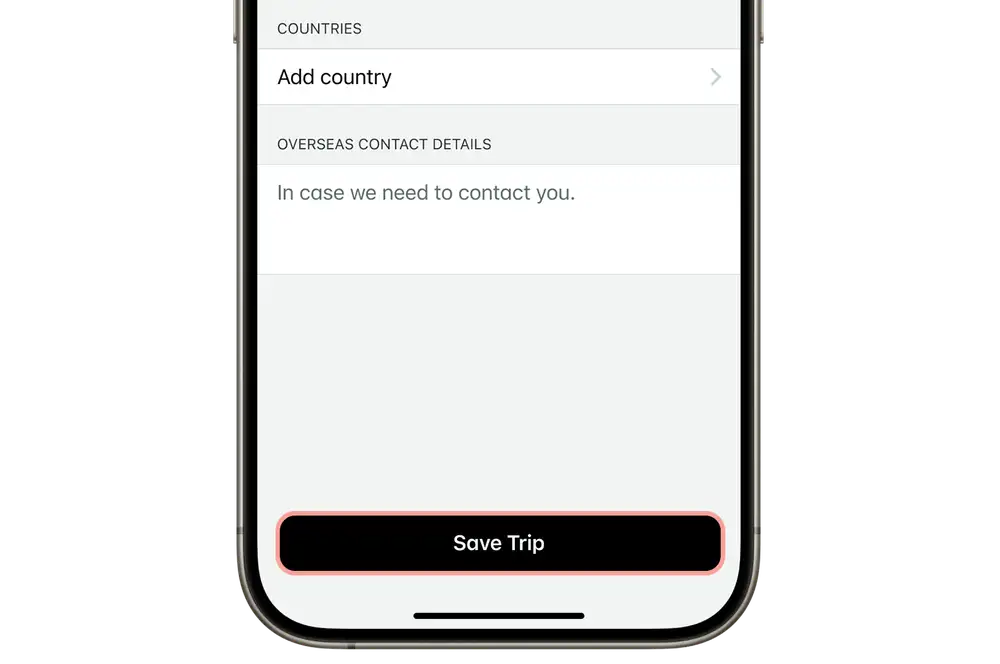

Add travel notice details

Add a travel notice with:

- The dates you’ll be overseas

- Countries you’re visiting

- The best way to contact you

Tap 'Save trip'.

Internet banking

-

1 / 2

Add an overseas trip

- Log in to internet banking.

- Click 'Settings' at the top of the screen.

- Under 'Personal settings and details', click 'Overseas travel notice'.

- Click 'Add trip'.

-

2 / 2

Add travel notice details

Add a travel notice with:

- The dates you’ll be overseas

- Countries you’re visiting

- The best way to contact you

Click 'Save trip'.

Get the essentials

Credit card and travel insurance

Our Air New Zealand Airpoints™ Platinum Visa gives you flexibility for bigger purchases. If you travel overseas, you’ll get built-in travel insurance for you and any immediate family travelling with you, simply by purchasing your travel and/or accommodation with your Air New Zealand Airpoints™ Platinum Visa before leaving New Zealand.

Every eligible purchase on our Airpoints credit cards also adds up to more Airpoints Dollars™ for your next trip.

Visa Debit Card

If you don't want to use a credit card while you're away, then consider getting a Visa Debit Card. You can use it around the world to access money direct from your Kiwibank account and can also use it to make online bookings, or for shopping anywhere that accepts Visa cards. Your transactions will be subject to currency conversion rates and fees.

See if a Visa Debit Card is available on your account.

Organise your paperwork

- Make copies of your passport, tickets, itinerary and insurance. Keep a copy for yourself and leave one with someone you know (and trust) at home.

- Have a think about whether you want to give someone you trust power of attorney to act in your name and run your affairs while overseas (e.g. pay bills, access your accounts).

- Set up automatic payments or direct debits for recurring bills while you're overseas.

- Check out the safety of the countries you’re travelling to. The Ministry of Foreign Affairs publishes travel advisories on it's SafeTravel site, and also lets you register your travel plans so they can contact you in case of emergency.

While you're overseas

You need to be able to keep an eye on your accounts while you're on holiday, as well as take care of your normal bills and financial obligations while you're overseas, so set up your banking to take care of your finances while you're home and away.

Manage your accounts and money from afar

- Manage your accounts overseas on our mobile app. Make sure you download and login to the app before leaving New Zealand.

- Within internet banking and our mobile app, you’ll be able to keep an eye on your balances and transactions, transfer money if you need to and make sure that any direct debits or automatic payments you've set up have gone through. However, if you’re making an internet banking payment to someone new while you’re overseas, we can't guarantee you’ll receive the one-time PIN via SMS. If you're able to receive a SMS from us from overseas, there could be charges to receive it, please check with your provider. If you're experiencing any problems receiving your one-time PIN, please call us 0800 113 355 or +64 4 473 1133 if you're overseas and we'll help you make the transaction.

- Consider our international transaction fees or ATM fees when you use your ATM/EFTPOS, Visa Debit or credit cards overseas. When you use your card for foreign currency transactions, your transactions will be charged to your account in New Zealand dollars at a rate of exchange determined by Visa or Mastercard® on the date it sends the transaction details to us. An international transaction fee will also apply.

- You can use Visa payWave anywhere in the world you see the payWave logo – but the transaction limit before you are asked for your PIN will vary from country to country. For transactions or purchases over those amounts, you can still use your card, you just won't be able to tap and go, you'll need to use a PIN.

- Save our contact details – you can contact Kiwibank when overseas on +64 4 473 1133.

Keep your money safe while you travel

- Keep your contact details up-to-date so we can let you know if we notice any suspicious transactions on your accounts.

- If you can, never let your card out of your sight. When in overseas restaurants, staff will often take your card away for payment. Consider going with them to sign and complete the payment or pay with cash instead.

- If your credit card has been lost or stolen or if you notice dodgy transactions on your account, let us know as soon as you can and we’ll cancel the card immediately. If you’re in New Zealand, call 0800 521 521 and if you’re overseas call +64 4 473 1133. You can also put a temporary block on your card using the mobile app.

- Try to only use ATMs that are attached to banks.

- Use caution when using public or shared computers or free wifi. Free wifi and computers at public places like internet cafés and libraries may not be as safe as your personal computer.

Air New Zealand Airpoints Credit Card

Lending criteria, terms and conditions, and fees apply. Interest rates, fees and limits subject to change. See all credit card terms and conditions.

Kiwibank is the issuer of the Air New Zealand Airpoints credit cards. Airpoints terms and conditions apply. See airpoints.co.nz for details.

*Eligible purchases exclude fees or interest, balance transfers, credit card repayment insurance, gambling chips, money orders, travellers cheques or foreign currencies in cash, cash advances or cash withdrawals made from an ATM, or any transaction that is reversed, refunded or charged back.

Travel Insurance

Travel Insurance for Kiwibank Credit Cards is provided by Tower Insurance Limited, and Tower Insurance Limited is solely responsible for any claims under the policy. Kiwibank Limited does not guarantee the obligations of, or any products provided by, Tower Insurance Limited. Important terms, conditions and exclusions are set out in the Travel Insurance for Kiwibank Credit Cards policy wording.