Re-fix online

Re-fix to a fixed interest rate online

You can re-fix up to 30 days before your current term ends, with peace of mind:

- If the rate decreases before your new term starts, we'll give you the lower rate. Your repayments will reduce unless you specify otherwise.

- If the rate increases before your new term starts, we'll honour the lower rate you selected.

Your current fixed term will continue until it expires — it's not replaced by your new term.

If you don't re-fix by the end of your fixed term, you'll automatically roll onto a variable interest rate. You can start a new fixed term at any time.

-

1 / 3

Choose your new fixed rate

Using the mobile app

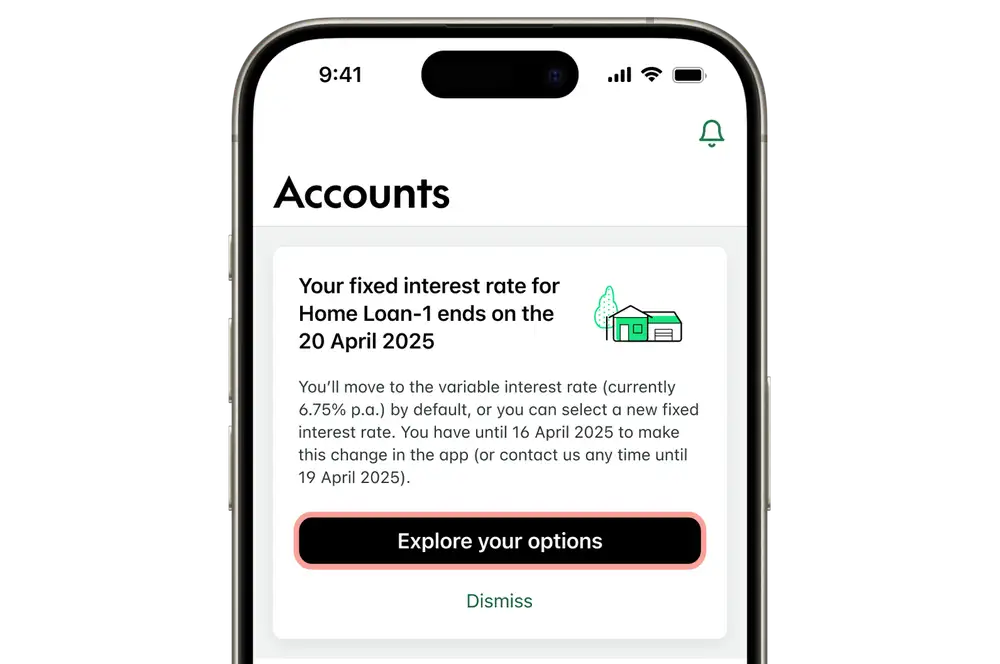

- Log in to the mobile app.

- When your fixed rate is about to expire, you'll see a message. Tap 'Explore your options'.

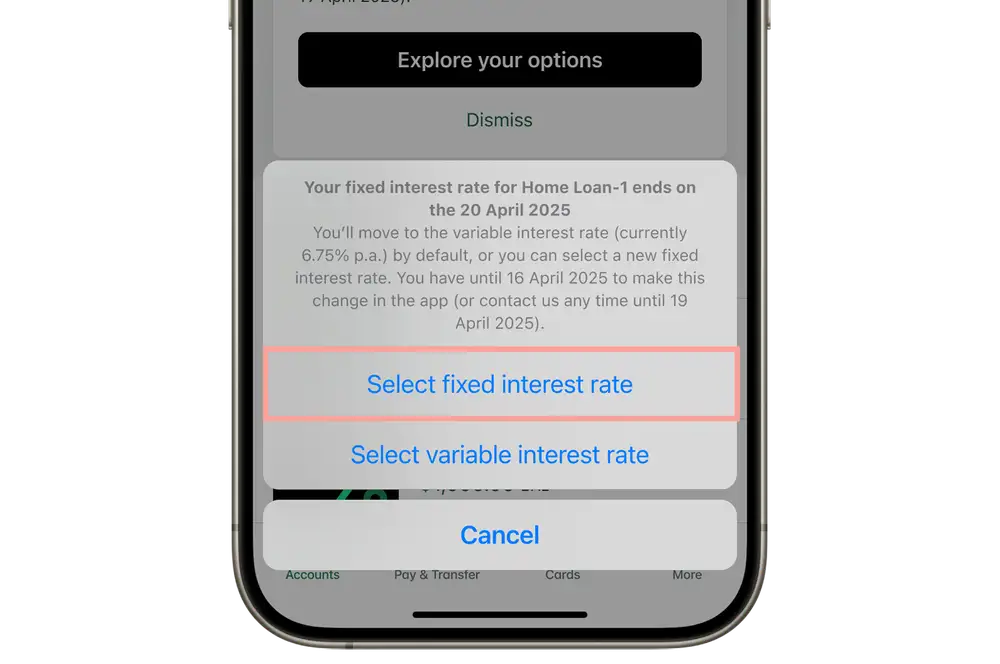

- Select 'Select fixed interest rate'.

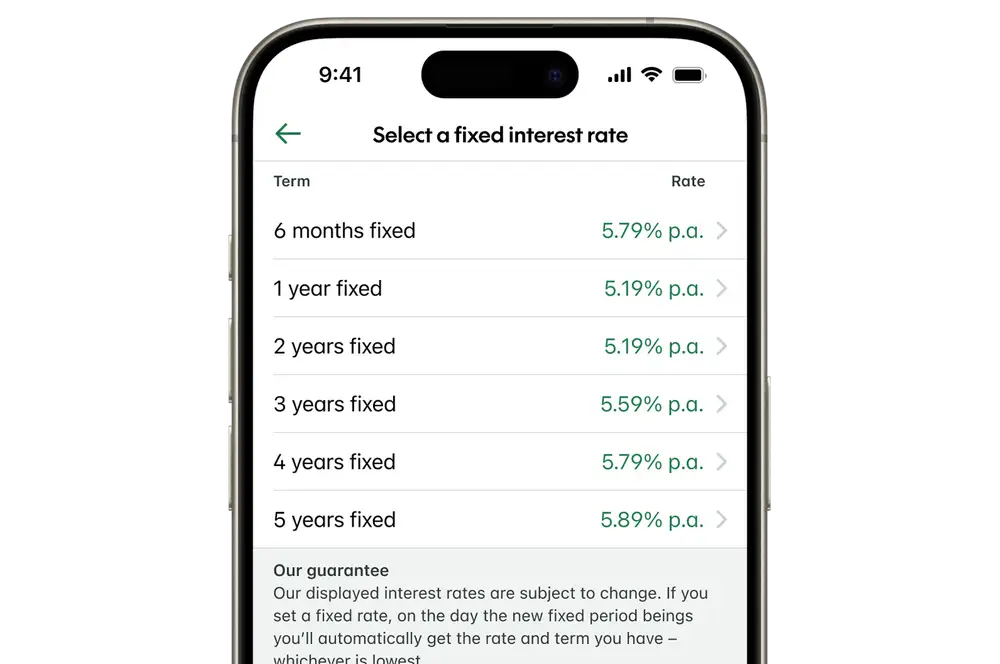

- Select the new fixed interest rate and term you'd like to have next.

Using internet banking

- Log in to internet banking.

- Select your home loan account.

- When your fixed rate is about to expire, you'll see a message. Click 'Choose a new fixed rate'.

- Select the new fixed interest rate and term you'd like to have next.

-

2 / 3

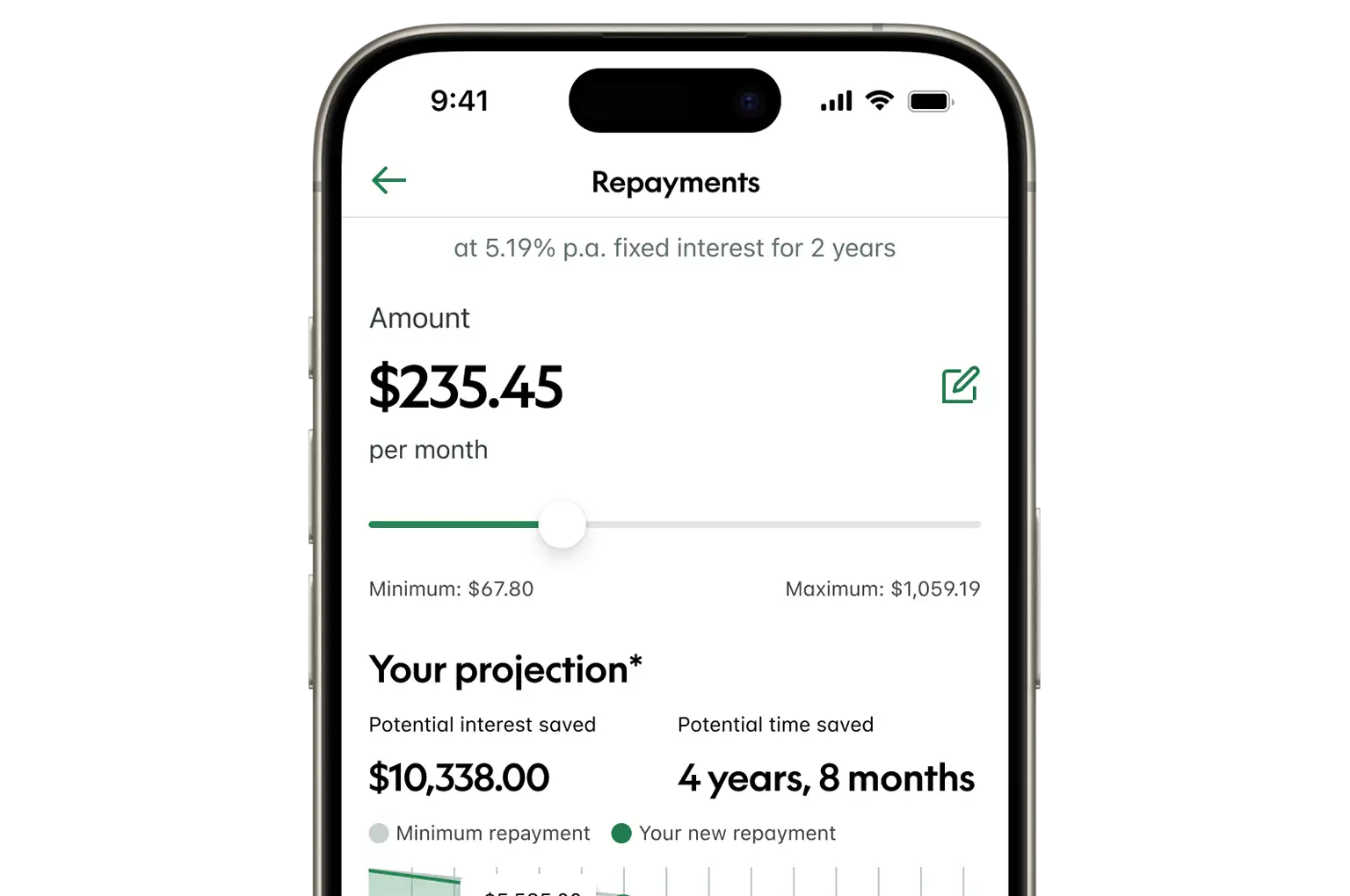

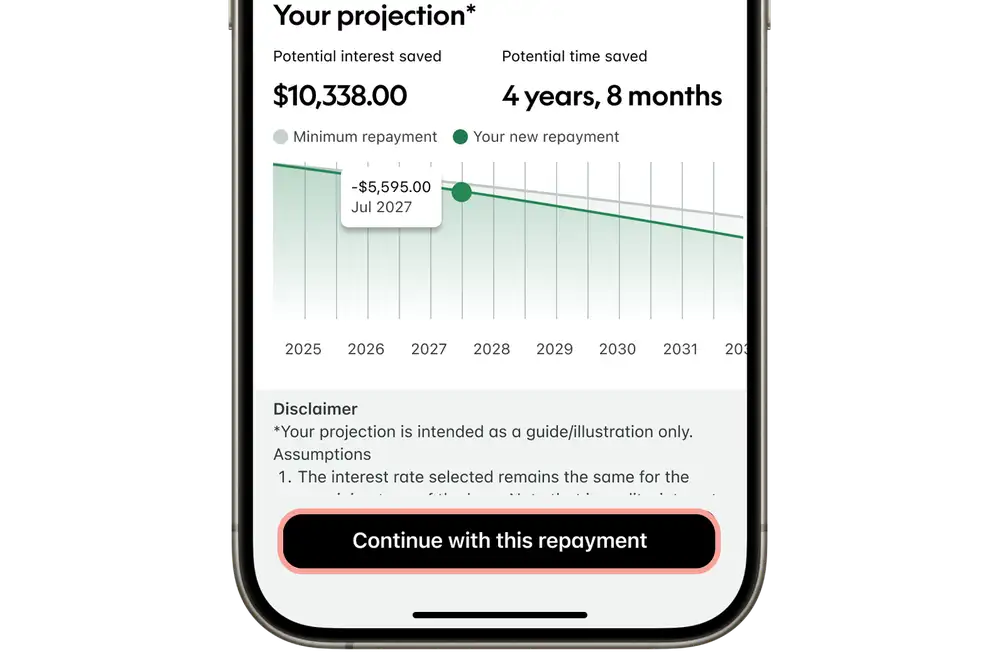

Review your repayments

Move the slider left or right to adjust your repayments.

- A higher repayment amount could mean that your home loan gets paid off faster and you'll pay less interest in the long run.

- Repaying the minimum amount could give you more flexibility in your current situation, but you might not pay off your loan as fast as if you select a higher repayment amount.

You can explore different scenarios using our repayment calculator.

If you're in internet banking, click 'Next page'.

-

3 / 3

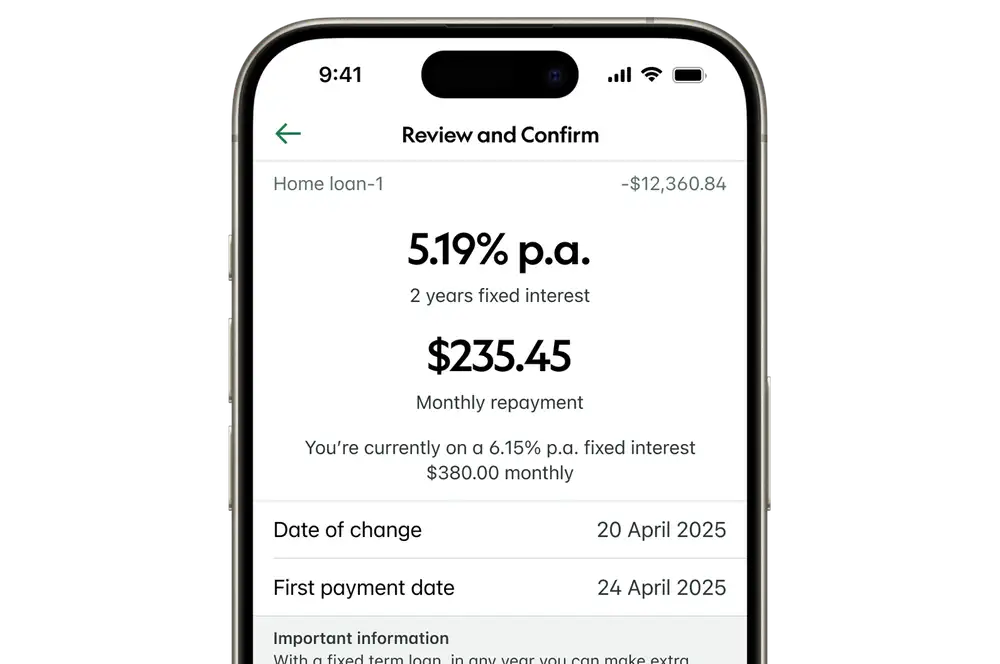

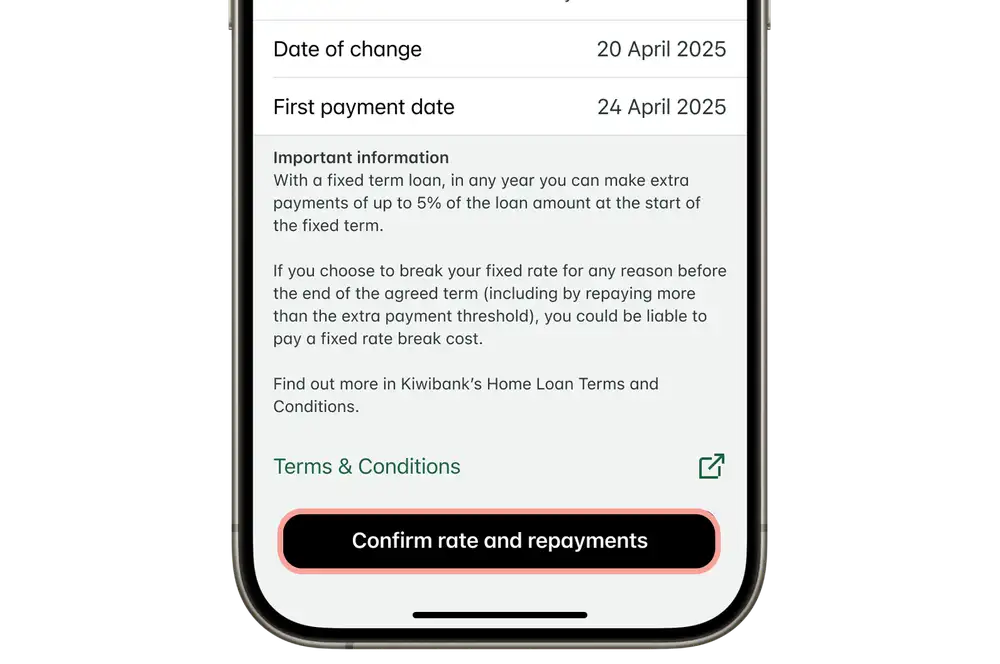

Confirm your new rate and repayment amount

Using the mobile app

- Scroll to the bottom of the screen, then tap 'Continue with this repayment'.

- Review each detail that you've selected.

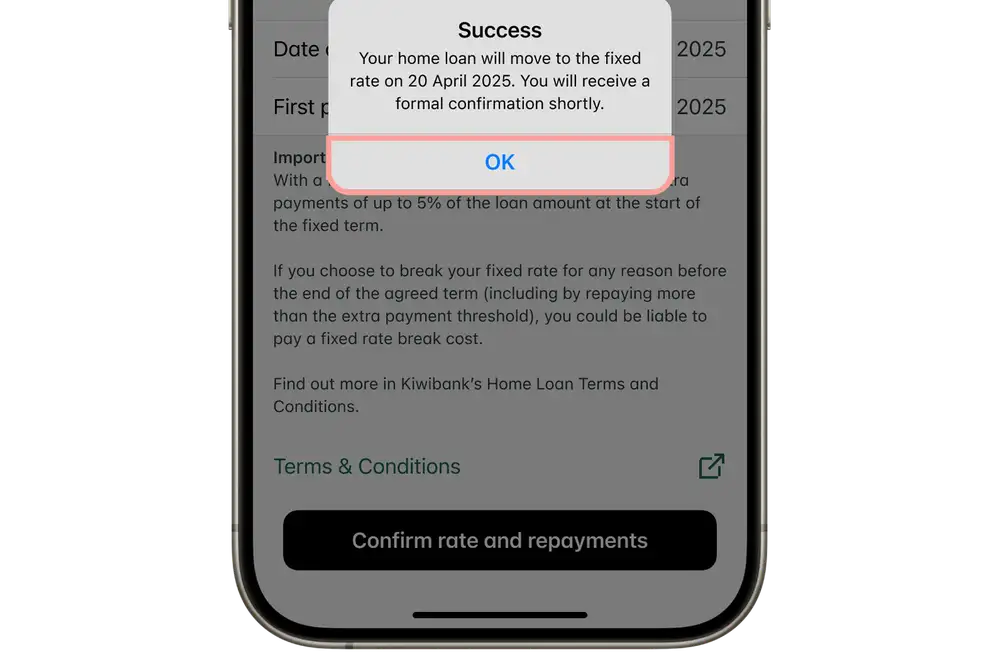

- Tap 'Confirm rate and repayments'.

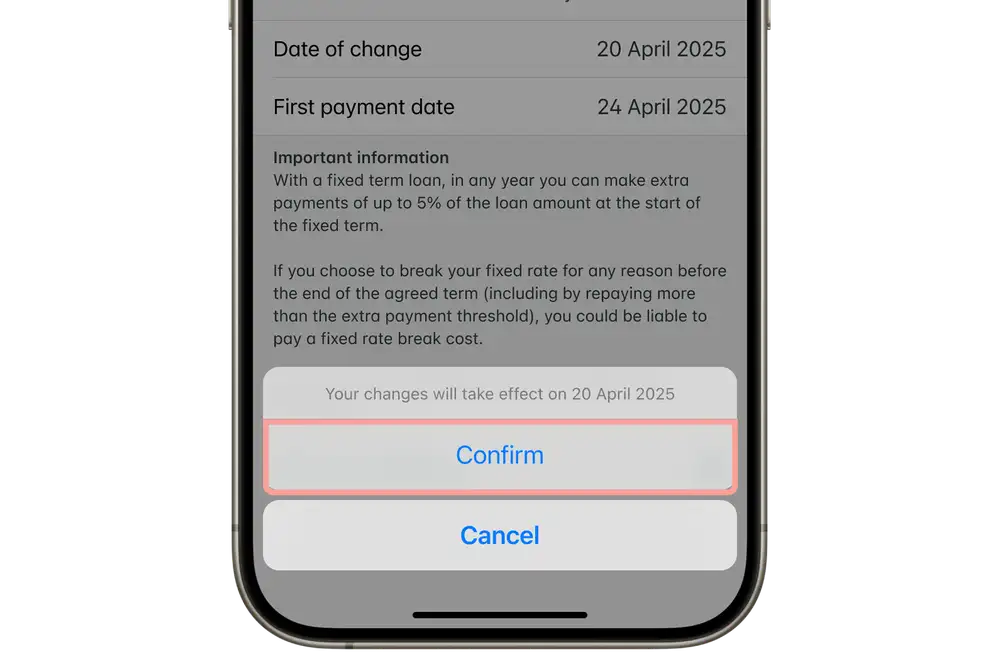

- Tap 'Confirm' to lock in the new interest rate. If you're not sure, tap 'Cancel' and go back to review your options.

- Tap 'Ok' on the success message. The new account details will then be shown.

Using internet banking

- Review each detail that you've selected.

- Click 'Confirm rate and repayments'. If you're not sure, tap 'Cancel' and go back to review your options.

A final confirmation showing the date the changes take effect and your new account details will appear. You'll also receive a confirmation letter in the post.

Talk to us

Talk to us via secure mail to re-fix

Send us a secure message within the mobile app or internet banking to request a re-fix.

You can re-fix up to 30 days before your current term ends, with peace of mind:

- If the rate decreases before your new term starts, we'll give you the lower rate. Your repayments will reduce unless you specify otherwise.

- If the rate increases before your new term starts, we'll honour the lower rate you selected.

Details to include in your secure mail

- Subject line: 'Home loan re-fix'

- Home loan account number: The last two digits of your home loan account number

- Loan term: E.g. 're-fix for 1 year'

- Interest rate: The rate you'd like to lock in — see current interest rates

- Requested repayment amount: Specify whether you'd like to pay the minimum amount, a new set amount, or keep your repayments the same.

- Preferred contact number: Mobile phone or landline

You can also request other home loan changes such as:

- Making a lump sum payment: Include the relevant account number to make the lump sum payment from

- Splitting or combining portions: Include details of which portions

Things to know

- Re-fixing doesn't replace your current fixed term — this term will continue until it expires.

- If your current fixed term ends while we're processing your request, it might roll onto a variable rate until processing is complete. We’ll ensure the fixed rate is applied from the date your new term starts and we'll adjust your interest if needed.

- There are no fees for re-fixing your home loan within the 30 day re-fix window. If you're requesting something with a cost associated, we'll let you know.

- There may be a delay between the secure mail confirmation of your new rate, and the new rate appearing in your mobile app and internet banking.

- When your home loan has been re-fixed, we’ll send you an email or letter to confirm the details of your new fixed rate period.

- If you don't re-fix by the end of your fixed interest rate term, you'll automatically roll over to a variable interest rate. You can start a new fixed term at any time.

If you'd prefer to talk to someone on the phone, call 0800 000 654.

Variable option

Let your fixed term expire & move to variable

If you'd rather move to a variable rate than re-fix to another fixed term interest rate, you can choose that too.

You'll automatically roll onto a variable rate when your current fixed term comes to an end, if you haven't re-fixed. So to choose variable instead of fixed, you don't need to do anything.

After your fixed term has finished, when you log in to the mobile app or internet banking, you'll see that you're now on a variable rate.

Review your loan structure

This is a good opportunity to re-evaluate your loan structure, repayments and more.

Use our repayments and structuring calculator to compare what repayments are on your current fixed term rate, what they'd be on a new fixed term rate, and what they'd be on our current variable rate.

Going from variable to fixed again is easy — you can begin a new fixed term at any time.

Home loan standard terms and conditions

Displayed interest rates are subject to change. Kiwibank’s lending criteria, terms and conditions, and fees apply.