Kiwibank electronic card spend

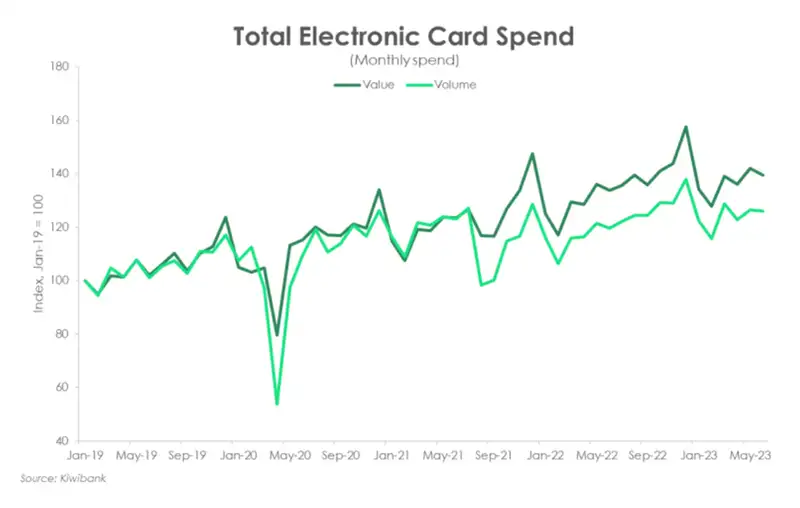

Following a seasonally soft start to the year, Kiwibank electronic card spend rebounded 4% over the June quarter. Compared to a year ago, spend is up almost 5%. Although, that is the smallest annual increase since June 2021. Both the value and volume of spend are sitting above precovid levels. Historically low levels of unemployment continues to support Kiwi incomes and, in turn, consumption. Although, a growing Kiwibank customer base, as well as a stronger preference for contactless payments in the covid era, may also explain today’s inflated spending levels.

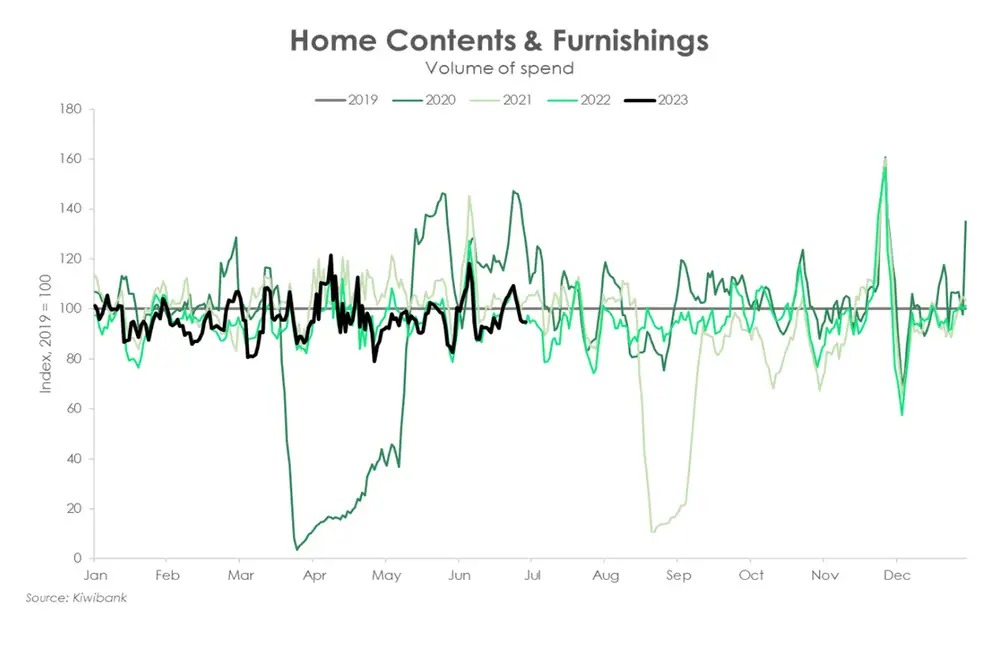

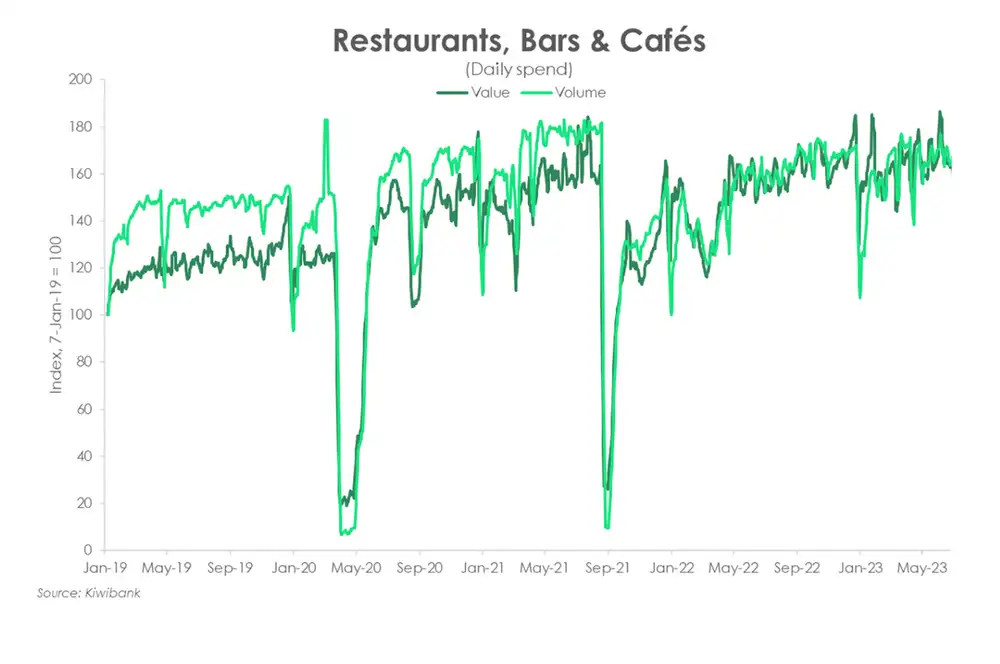

While aggregate spend is holding up (also helped by high consumer prices), a deeper dive into the categories reveals shifting preferences. There’s little willingness among Kiwi households to splurge on the big stuff. The average monthly volume of spend on home contents & furnishings is sitting around 3% below pre-covid levels. But there’s still appetite for the little things in life, like a well-brewed cup of coffee. Over the June quarter, spend at restaurants, bars and cafés lifted 4%.

Consumer confidence remains historically weak

Inflation is still too high, interest rates have risen fast, and house prices have steadily fallen for the last 18 months. The wealth effect for households is much weaker than it once was. Disposable incomes are being squeezed and discretionary spending is being restrained as a result.

Household consumption

The outlook for household spending remains unchanged. Over the last year, most of our mortgages rolled off low rates. And 40% of our mortgages will soon (next 6 months) jump aboard the high rates train. There’s more downside to come for household consumption.

The detail

Growth in dollars spent at Grocery Stores continues to outpace the growth in the volume of transactions made. The nominal value of spend rose 3.5% over the quarter, while the volume of transactions rose just 1.8%.

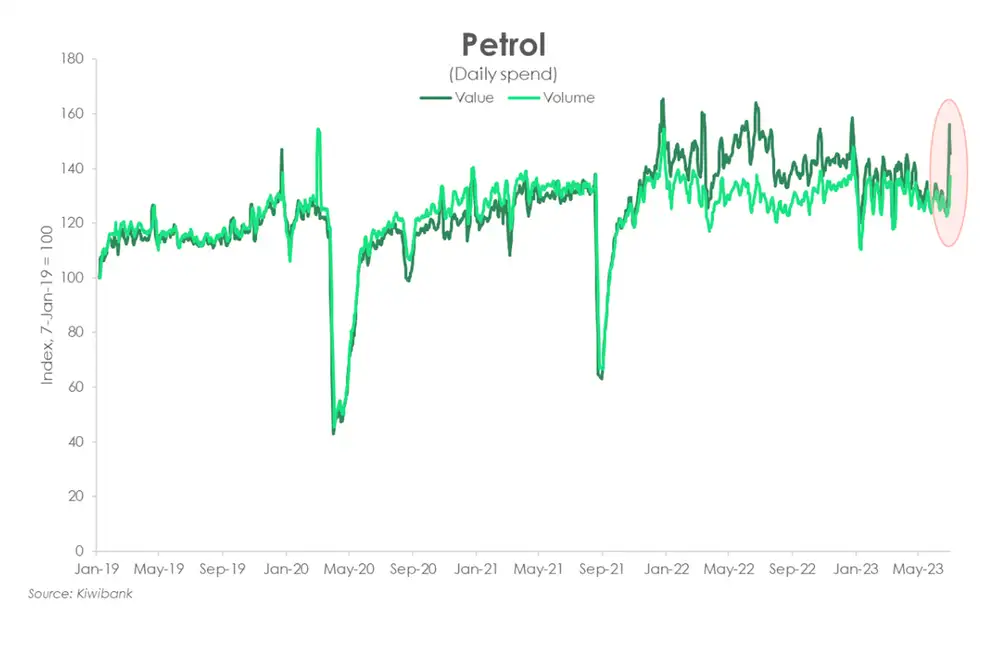

Spending on petrol spiked 67% in the last three days of June, ahead of the reintroduction of the 25c fuel excise duty tax from July 1.

As households cut back on spend, discretionary items are in the firing line. Demand for home contents & furnishings, in particular, is waning. Compared to last year, spend is down 6%.

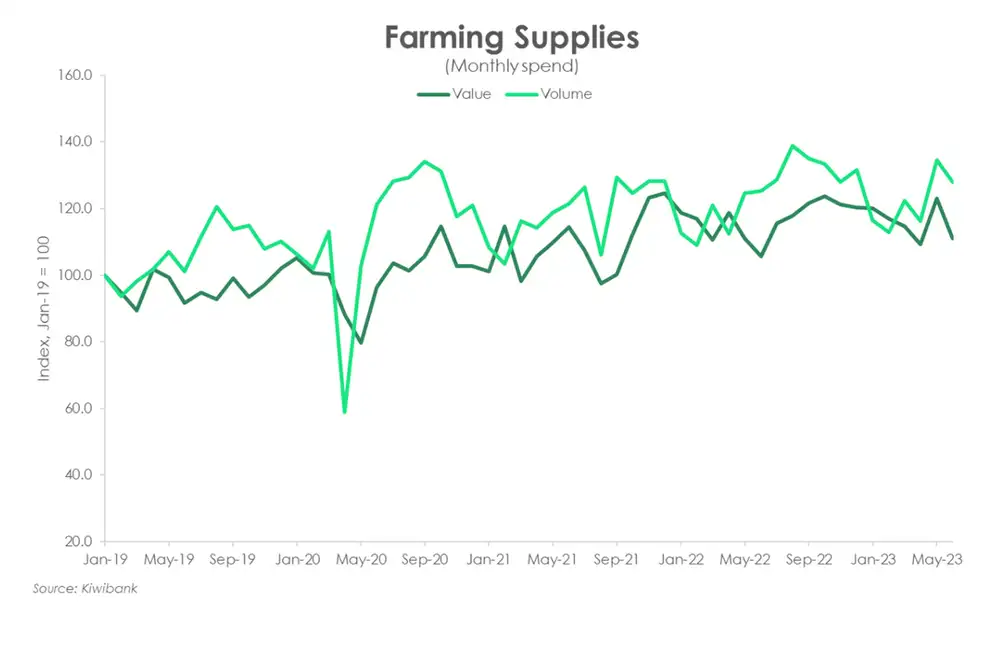

The annual Fieldays event returned to its traditional winter slot this year. Several media reported strong sales, but that the search for the best deal was on. Our data reflects a similar sentiment. The average number of transactions made on farming supplies was 5% more than the June quarter last year. But the average value of spend lifted just 2%.

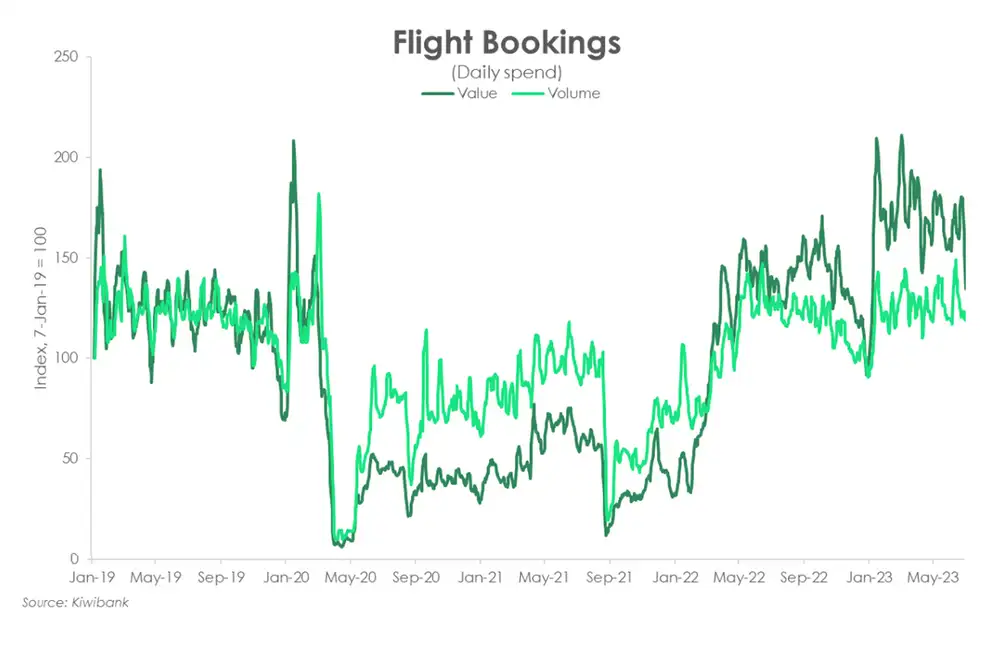

As airline capacity recovers from the pandemic, airfares look to be normalising from such lofty highs. Total spend on flight bookings declined 4.5% over the quarter, despite the 2.3% lift in transactions.

Entertainment spend fell 4.4% over the quarter. And unfortunately there was no sign of Swift lift with no plans of Taylor Swift’s Eras Tour making a pit stop in Aotearoa.

Spend on sporting events was on the rise over the quarter, likely ahead of the upcoming FIFA.

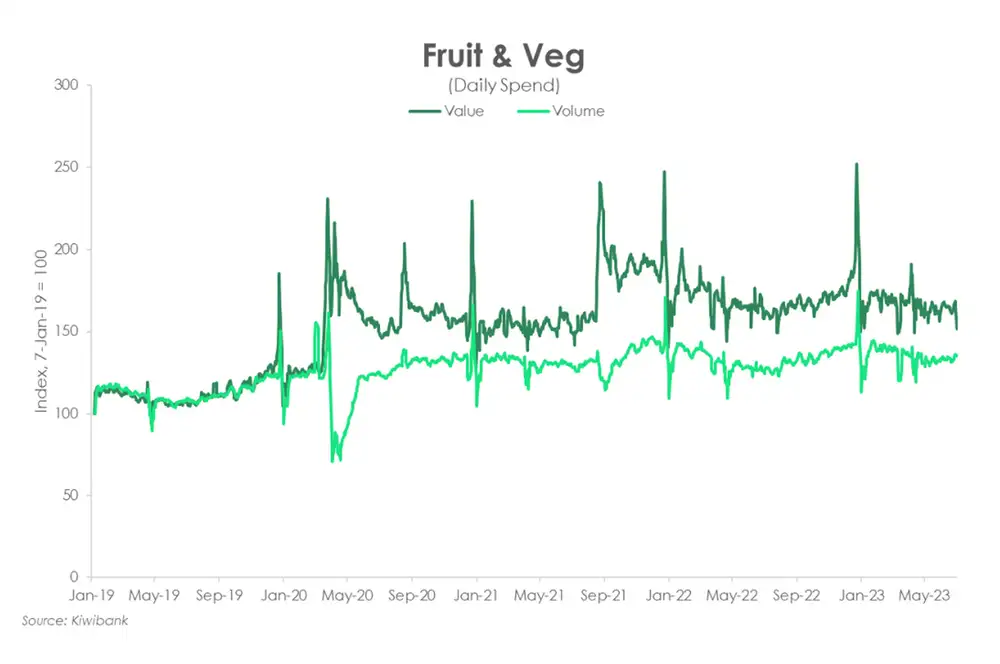

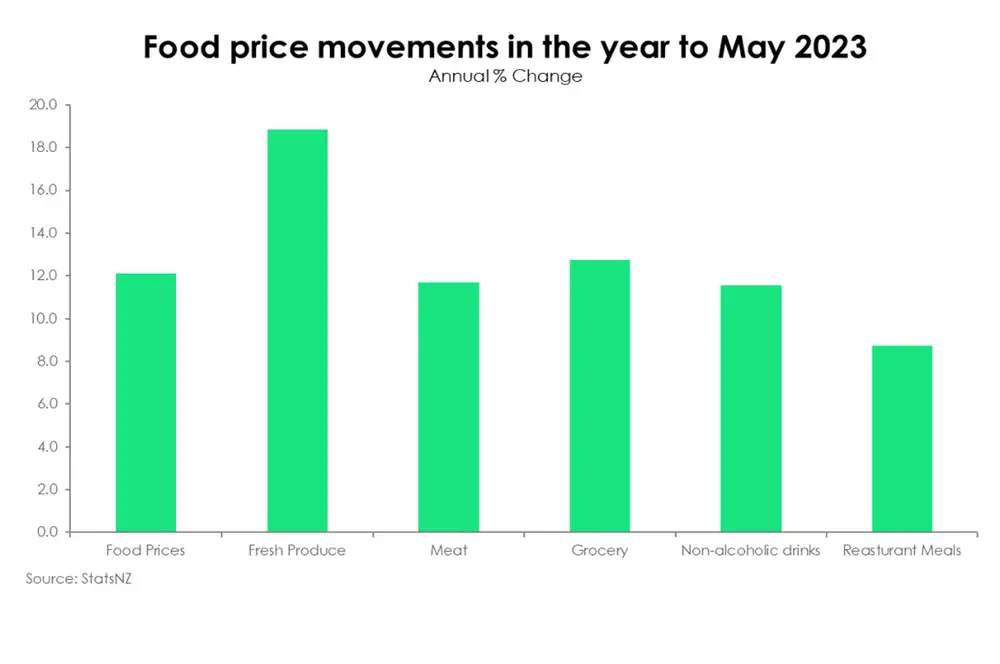

Pricey peppers

The rise in consumer prices continues to work behind the scenes, boosting the value of transactions. The (very) visible hand of inflation is most obvious when it comes to supermarket spend. Food is among the goods/services that have experienced the fastest rise in prices. Since the beginning of the pandemic, there has been a marked divergence between the value and volume of spend at grocery stores and on fruit & veg.

For spend at grocery stores, the growth in dollars spent continues to outpace the growth in the volume of transactions made. The nominal value of spend rose 3.5% over the quarter, while the volume of transactions rose just 1.8%.

We expect the value of spend to face some downward pressure in the year ahead. Especially for fruit and veg. We are already seeing signs of this. Compared to last year, the value of spend declined 0.2% despite the 4% lift in transactions. Central banks have moved swiftly to combat inflation and its actions are weighing on global demand, as intended.

Jerry cans filled to the brim

The value of petrol spend lifted just 0.2%% in the June quarter. And compared to last year, spend is down 10%. A year ago, global oil prices spiked with the war in Ukraine and the continued disruption to supply changes. Global oil prices have since declined, and there’s likely more downside as global demand wanes. According to our data, as petrol prices have cheapened, spend volumes have lifted. Over Q2, the volume of transactions rose 1%. The value and volume of spend re-converged over the quarter.

The value of petrol spend was also kicked higher as Kiwi rushed to fill up their fuel tanks and jerry cans before the re-application of the fuel excise tax (from July 1). Long queues formed at petrol stations and spend spiked 67% in the last three days of June. The 25c fuel excise duty tax was first removed in March 2022, as part of a suite of measures tackling the cost-of-living crisis. The removal was initially intended for three months. But the persistence of inflationary pressures on households led to further extensions. Nonetheless, June 30 marked the end of the policy support. Petrol spend will likely track higher from here. The volume of spend will give a better indicator as to the appetite for petrol consumption.

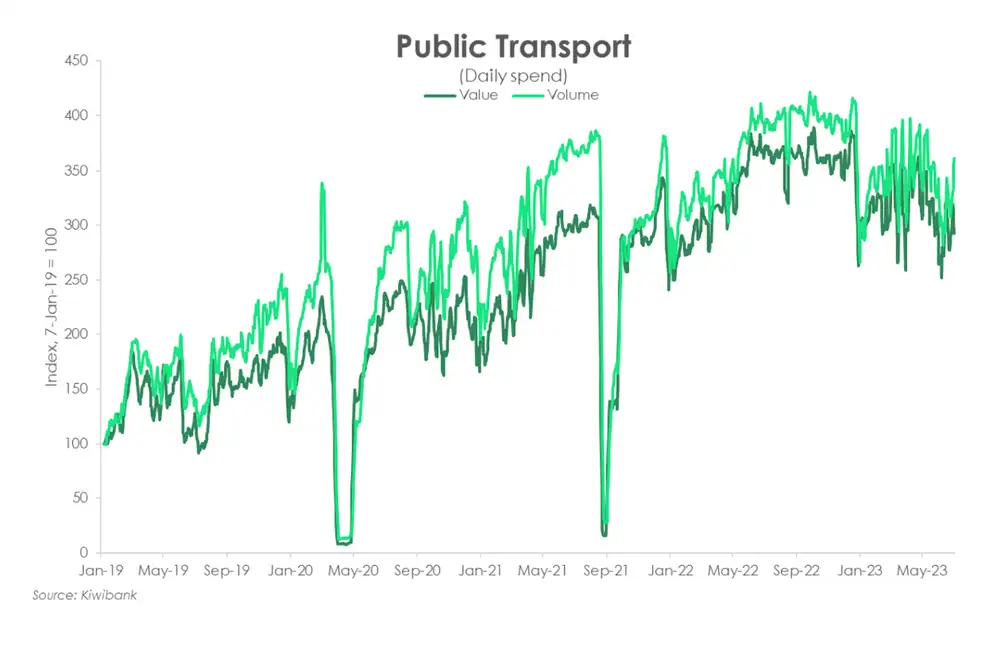

Public transport spend will also likely shift higher from here. Public transport has experienced a boost in demand following the Government’s move to subsidise fares back in April 2022. But from 1 July, half-price fares no longer apply for those aged 25-years and older. Although fares are now free for children aged 5-12 years.

Pulling back

Household disposable incomes are being squeezed with high consumer prices and rising interest rates. Consumer confidence is low and there’s little appetite to spend on big ticket items. Our data confirms as much. As households cut back on spend, it’s discretionary items that are being slashed from the budget, Demand for home contents & furnishings, in particular, is waning. Compared to last year, spend is down 6%.

The average monthly volume of spend on home contents & furnishings is sitting around 3% below pre-covid levels. Kiwi are also putting down the tools, with the average number of purchases on home build and reno over the June quarter up just 1% from last year. Compared to pre-covid levels, the volume of spend remains elevated. There’s always something to build or repair around the home. And for many Kiwi households, the clean-up from the recent weather events will support this type of spend in the near-term.

Spend on home electronics however is well above pre-pandemic levels. With the adoption of working from home, many have sought to create a home office. There was and will continue to be demand for office equipment as hybrid working has become the norm for many workplaces.

It’s not just households that are pulling back, but those in the agri space look to as well. The annual Fieldays event returned to its traditional winter slot this year. And despite the latest gadgets on display, attendees weren’t exactly splurging. Several media reported strong sales over the four-day event, but the search for the best bargain was on. Our data reflects a similar sentiment. The average number of transactions made on farming supplies was 5% more than the June quarter last year. But the average value of spend lifted just 2%. Global commodity prices have come under pressures recently. And in anticipation of a economic slowdown in the year ahead, many are understandably holding onto their pennies.

Commiseration coffees

Consumers are feeling downbeat and no longer willing to splurge on a new TV or couch. But there’s still appetite to spend on the little things in life. A well-brewed cup of Joe in the morning or brunching in the weekend is one way to get through the today’s tough times. Over the June quarter, spend at restaurants, bars and cafés lifted 4%.

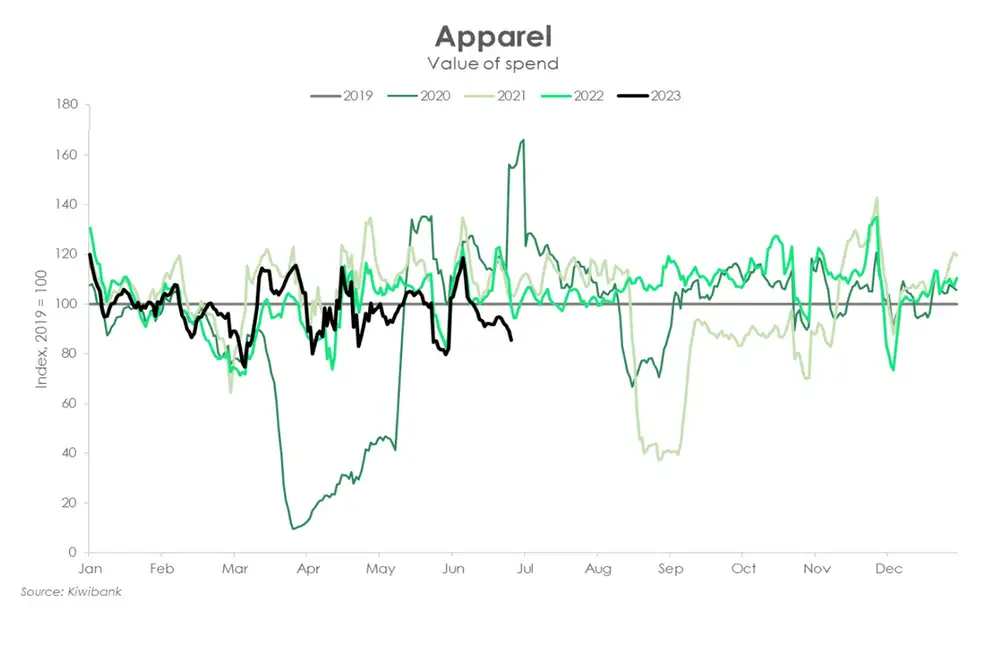

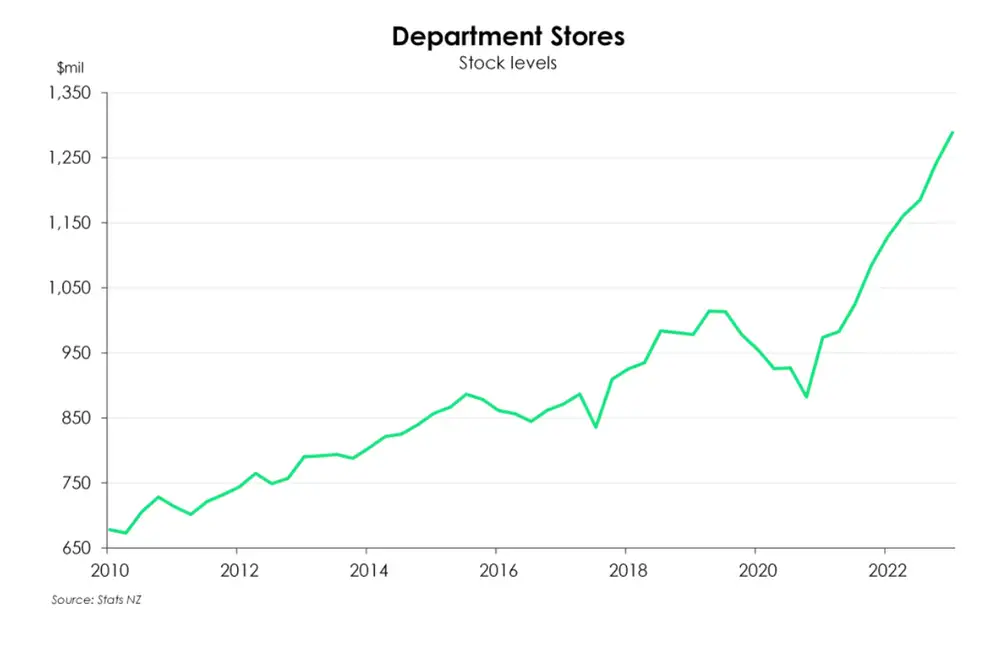

Spend on apparel rebounded from the subdued spending over March quarter. But compared to a year ago, the value of spend has fallen nearly 6%. Annual growth in volumes was just as weak, down 6.4%. The dollar value of spend may experience further downward pressure in the coming quarters. Retailers built up their stock over the pandemic with a shift in inventory management style from ‘Just in Time’ to ‘Just in Case’. But as consumer demand weakens and stock needs to be cleared, we could be in for some discounting. And that’s good news for inflation.

No sign of a “Swift lift” in entertainment spend…

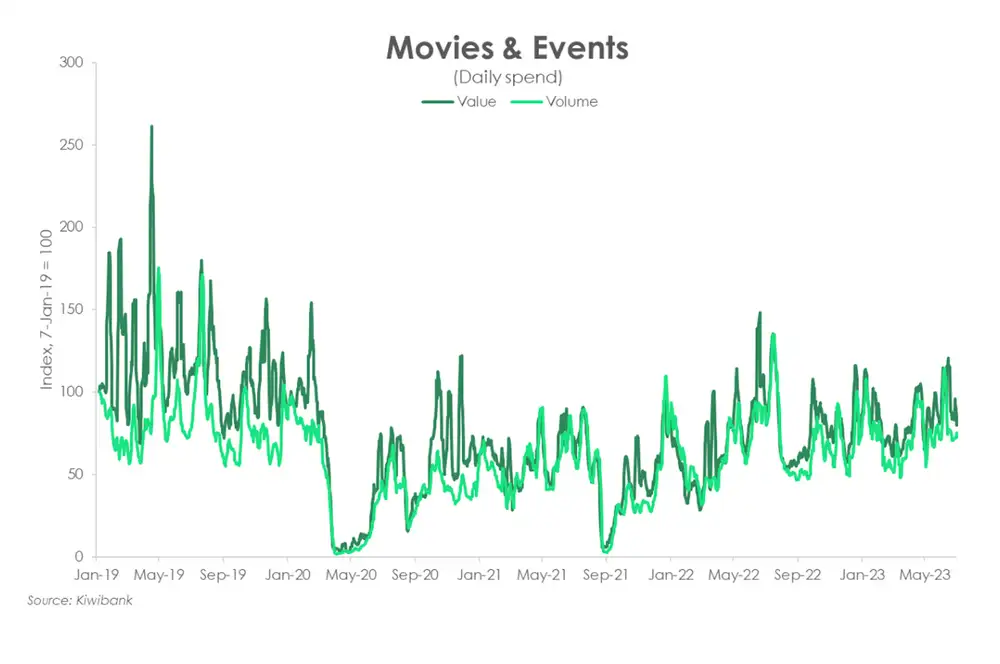

Entertainment spend fell 4.2% over the June quarter. And unfortunately there was no sign of Swift lift with no plans of Taylor Swift’s Eras Tour making a pit stop in Aotearoa. Kiwi Swifties will have to take their coin abroad instead (next slide).

Spend at movies and ticketing agencies may be up 7% compared to a year ago, but is yet to return to pre-covid levels (down over 20%). The pandemic propelled streaming services into popularity, from Neon to Netflix and everything in-between. Subdued cinema spending suggests that there’s a preference to watch the big stars on the small (home) screen instead. But we could see a lift in spend at the movies in the upcoming quarter. Blockbuster movies from Oppenheimer to Barbie are all lined up for July. It’s a battle for the Box Office Crown. And it coincides with the July school holidays.

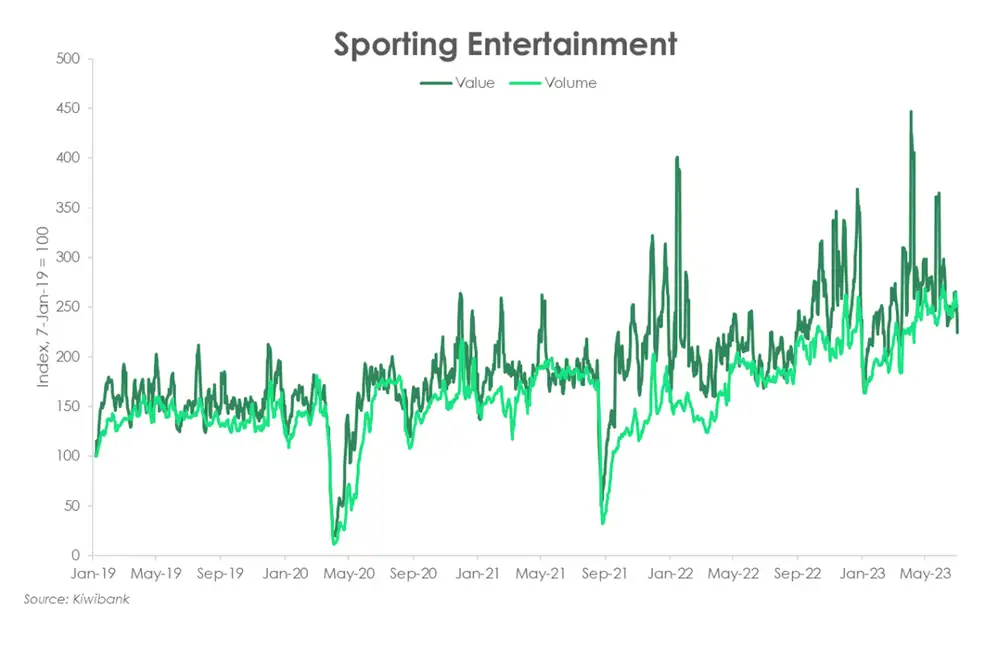

Kiwi may not be screaming Taylor Swift lyrics, but we will be cheering on the Football Ferns. Spend on sporting events was on the rise over the quarter, likely ahead of the upcoming FIFA Women’s World Cup. We saw a similar lift in spend in October/November last year during the Women’s Rugby World Cup. There’s just 10 days to go before kickoff.

…but a “Swift exit” with flight bookings on the rise

Since Covid-related border restrictions were relaxed in 2022, we have seen an exodus of Kiwi heading offshore. The exodus was in part due to the pentup desire of many young Kiwi to see the world. We have witnessed a return to net outflows of Kiwi offshore. There is still strong demand for travel beyond our border. Our data confirms as much. The volume of spend on flight bookings is up 2% over the quarter (although, spend may also have been kicked higher with Tay-Tay fans making their ‘Swift exit’ across the Tasman). As capacity among airlines builds, prices look to be normalising, with total spend down 4.5%, despite the lift in transactions.

With the world back open, the surge in domestic tourism may have run its course. The good news is, overseas tourists are coming back. Visitor arrivals have risen steadily with the removal of border restrictions last year. Arrivals are running at about 70-80% of the pre-Covid levels which means there is more upside to come. Especially from China, which was our second largest market (after Australia) prior to the pandemic. Chinese short-term visitor arrivals are currently running at 10% of 2019 levels. Tourism was once our biggest export industry, contributing 20% of total exports. That contribution has fallen to 2.4%. The return of tourists comes at an opportune time. Because the spend up of foreign dollars will help to offset the weakening demand by Kiwi consumers.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.