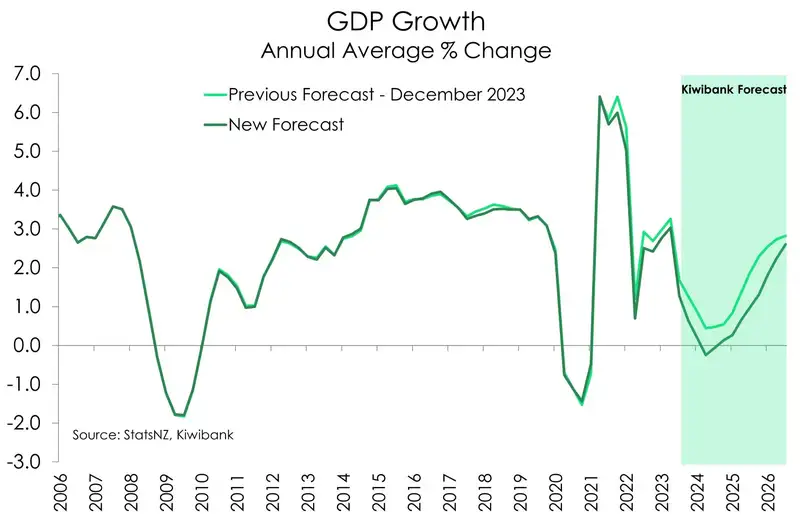

The Kiwi economy has clearly weakened since we last looked under the hood. Over the past 18 months, the economy has been at a standstill, recording a double-dip recession. And the forward-looking indicators point to an economy that will struggle to eke out much growth in 2024. We have downgraded our forecasts for the Kiwi economy. We now see the economy growing just 0.1% this year, down from an already soft 0.5%. The RBNZ has been among the most aggressive central banks in a quest to tame inflation. The “higher for longer” rates environment hurts. And the impact of restrictive monetary policy is undeniable.

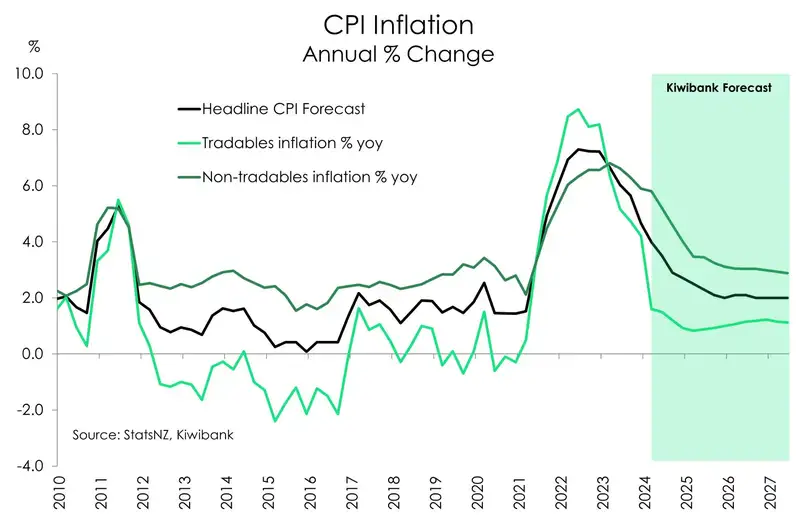

At the end of the day, it’s all about inflation. Kiwi inflation has fallen at pace from a 7.3% peak to 4%. We always knew that leg of the descent would be the easiest. A rapid deceleration in imported inflation has done most of the hard yards. It is the path back to 2% that is laden with frustrations. Home-grown inflation is proving persistent which is problematic. Rents, insurance costs, and council rates are all moving in the wrong direction. A slightly stimulatory fiscal pulse, in the near-term, isn’t helping either.

It will be a slower return to 2% from here. But aggressive tightening from the RBNZ is working. Current and expected weakness in the economy should quell domestic inflation pressures. The labour market is already responding as demand indicators soften. The unemployment rate has lifted off its lows, and we expect it to exceed 5% by the middle of next year. Wage growth is moving south and will ensure a sustainable return to target. We still forecast inflation falling back within the RBNZ’s 1-3% target band by the end of the year. It’s been a long time coming - three years above the target band, to be exact.

Where does this leave monetary policy?

For now, the RBNZ are in a holding pattern. There’s no need for further tightening. The RBNZ’s heavy hand has hurt households and halted business investment. But it is too early to cut interest rates. Inflation remains outside the target band. And interest rates will remain restrictive for now. But we think the RBNZ will be able to ease policy earlier than they currently expect (second half of 2025). If the economy evolves as we expect, we forecast the first rate cut to come in November. The risks, however, are tilted toward a delayed kick-off. Regardless, we are confident that the next move in rates is down. We may be wrong on timing, but it’s the direction and magnitude of policy moves that’s important.

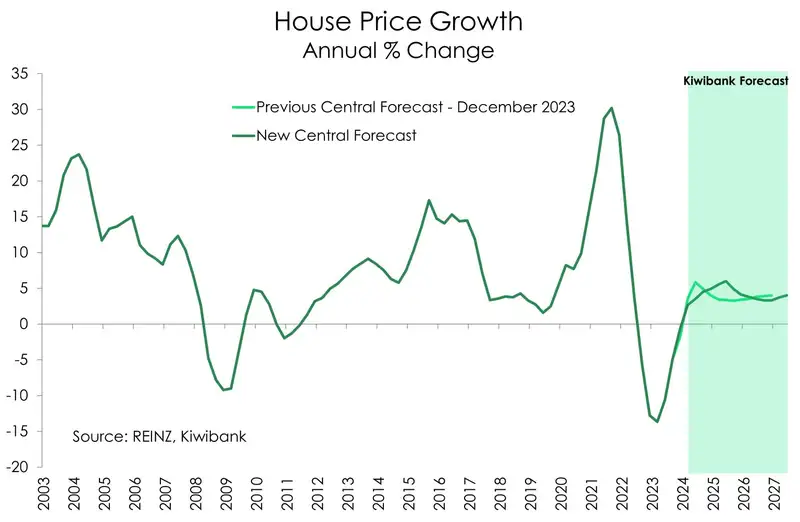

Rate cuts will be a breath of fresh air in a rather deflated economy. The housing market is also in need of rate relief. House prices have not performed as strongly as we had expected. Since the trough, prices are up just 2.3%. The expected pivot in monetary policy and tweaks to investor tax policy, should bolster demand. Rental yields are also strengthening, with rising rents and soft house prices. And investors should be enticed back to market. However, it is more a story for 2025.We’ve pushed out our forecast lift in house prices. It is not until next year that we see house price gains of around 5-6%.

2024 may be another lacklustre year for growth, but it’s always darkest before the dawn. And the good news is, dawn is approaching. We see the economic outlook improving into next year. Because 2025 will be the year of significant rate cuts.

We are privileged to meet many of Kiwibank’s business banking clients. And the anecdotes and insights we gain are invaluable. One client summed up our current situation perfectly: “We must survive until 25”. It’s a white-knuckle ride for many, but next year should be a better year. And it’s at the hands of the RBNZ.

See our full review.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.