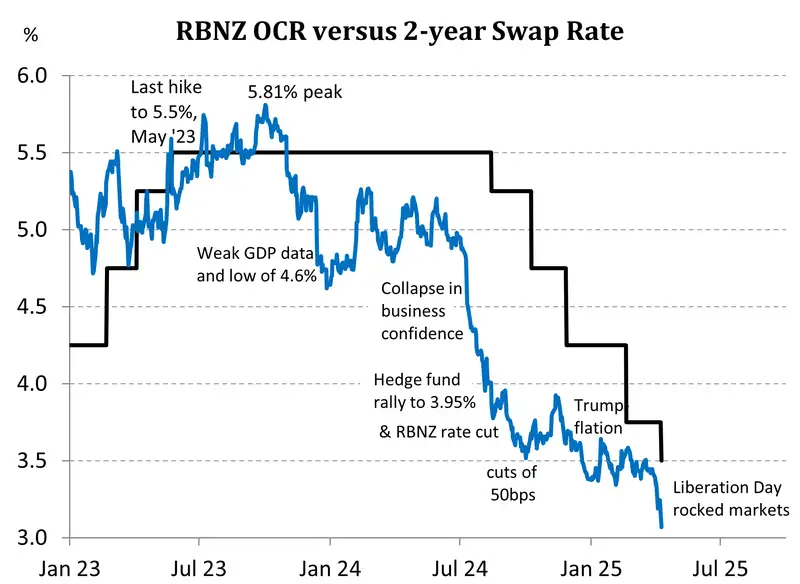

- Following a trio of 50bps rate cuts, the RBNZ slowed its pace of easing. The RBNZ delivered a 25bp cut, bringing the cash rate to 3.5% and completing 200bps of easing in just eight months.

- The downside risks we have all feared are coming from offshore and knocking at our door. We now call for a further 100bps of rate cuts to 2.5% by the end of the year.

- The outlook is weaker and global risks are escalating. The current environment simply demands more rate relief. And the Reserve Bank has rightly pronounced scope to lower the OCR further as appropriate.

The RBNZ stepped down its pace of cuts, from 50bp to 25bp, bringing the cash rate to 3.5%. That completes 200bps of easing in just eight months. Today’s cut came with no surprise, but was doused in dovish commentary. Like us, the RBNZ is rightly more concerned about the growing downside risks to global growth stemming from the tariff tit-for-tat. The outlook for the global economy has dimmed significantly. And as a small, heavily trade-dependent economy, our forecast recovery hangs in the balance. The RBNZ will need to step in to shore up confidence and support activity.

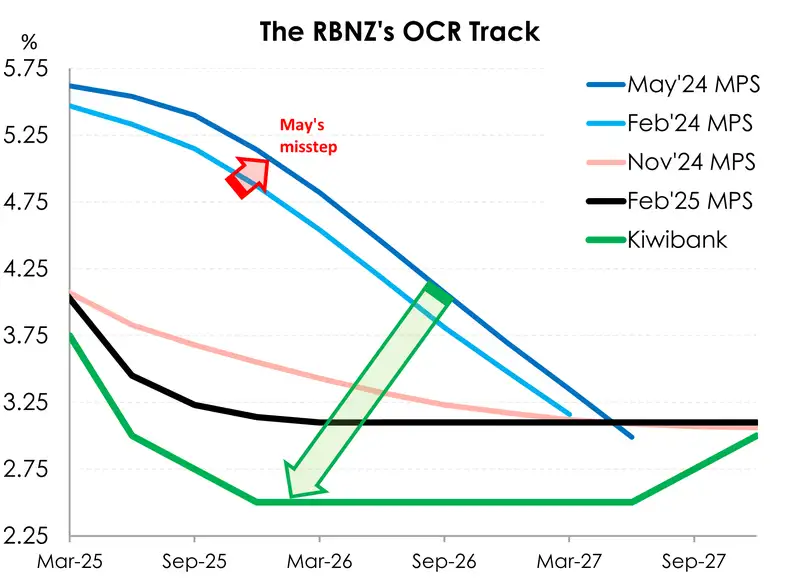

We have long-advocated for more stimulatory policy settings. In fact, we called for a 2.5% terminal rate prior to the RBNZ’s November MPS. But they let their hawkish flag fly high with a confusing lift in their OCR projections. We reluctantly lifted our forecast end point to 3%. We’re here to forecast what the RBNZ is likely to be (not so much what we think they should do). But we strongly warned: We think the RBNZ’s bias may be moving in the wrong direction, as they did in May. They’re too hawkish. Time will tell. Well, today, time is telling us that the RBNZ must lower the cash rate below neutral (3%). The downside risks we have all feared are coming from offshore and knocking at our door. We now call for a further 100bps of rate cuts to 2.5% by the end of the year. And with a 2.5% cash rate, all wholesale and retail rates have further to fall.

Like its peers, the RBNZ were sure to discuss the prevailing risks of the escalating trade tensions. The issues on tariffs for our domestic outlook as the RBNZ have pointed out remain around the negative impact on global growth. And while measuring the inflationary impacts is less clear cut with a multitude of sway factors, the RBNZ saying that on balance there’s “downside risks to the outlook for inflation in New Zealand over the medium term” (RBNZ April MPR) adds more fuel to our change in call for the need of a stimulatory cash rate.

Market reaction

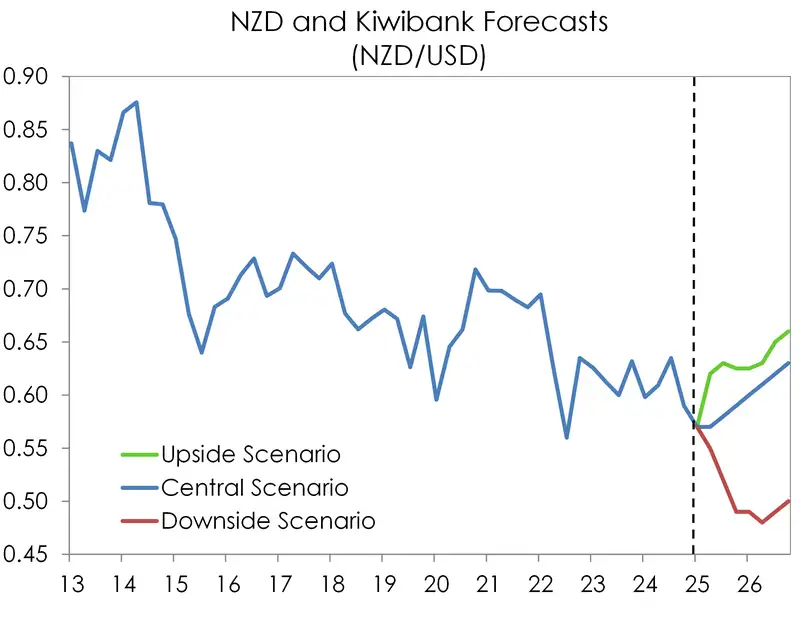

The Kiwi dollar has been flirting with 55c this morning. The Kiwi has been under pressure since Trump delivered his outsized tariffs and markets started factoring in a more violent and uncertain period ahead. Exporting nations like Australia and New Zealand are exposed. With thoughts of a possible 50bp cut today sneaking into the market psyche, the Kiwi hit an intra-day low of 54.90c before bouncing back above 55c. At 55.40, the Kiwi has retraced some of its losses, but remains at risk of significant downward turbulence. Our forecast of 55c has been met, sure. But it’s our downside scenario, where the Kiwi potentially falls below 50c, that is increasingly more likely.

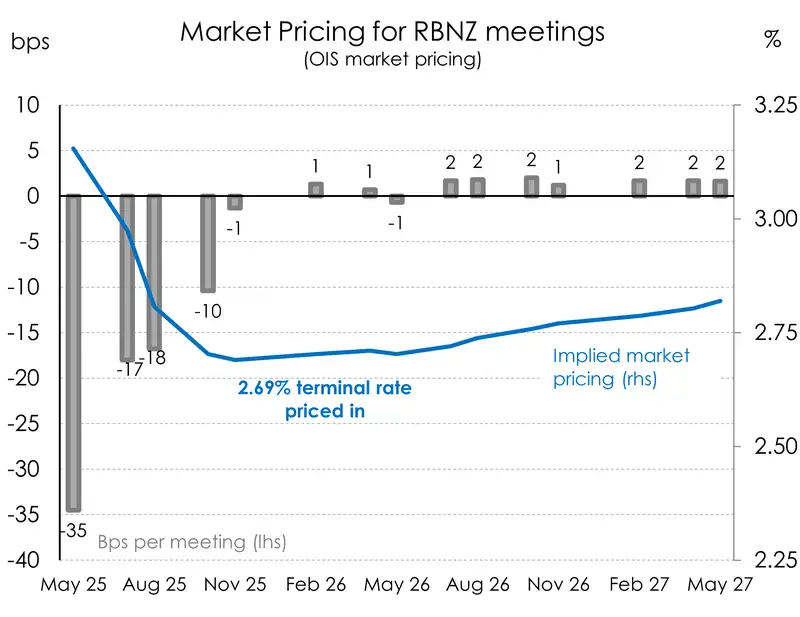

In rates markets, where the cool kids play, it was all about the risk of a 50bp move, and the likely endpoint for the cash rate – which is clearly lower. The OIS wholesale rate market has a terminal rate of around 2.69%. That’s a move to 2.75%, fully priced, and a (6/25) 25% chance of another move to our forecast of 2.5%. The RBNZ’s OCR track stops at 3.1%. But that was updated in February. We think the RBNZ’s OCR track will drop below 3% in their next forecast round in May. The pivotal 2-year swap rate is reflecting the lower for longer cash rate expectations, falling to 3.07%, the lowest level since they were hiking in 2022 out of Covid. Again, we see downside risk to the 2-year swap rate, with 2.75% or lower in range (well, a new range).

RBNZ statement

"The Monetary Policy Committee today agreed to reduce the Official Cash Rate by 25 basis points to 3.5 percent.

Annual consumer price inflation remains near the mid-point of the Monetary Policy Committee’s 1 to 3 percent target band. Firms’ inflation expectations and core inflation are consistent with inflation remaining at target over the medium term.

Economic activity in New Zealand has evolved largely as expected since the February Monetary Policy Statement. Higher-than-expected export prices and a lower exchange rate have supported primary sector incomes and overall economic growth. While monetary restraint has been removed at pace, household spending and residential investment have remained weak.

The recently announced increases in global trade barriers weaken the outlook for global economic activity. On balance, these developments create downside risks to the outlook for economic activity and inflation in New Zealand.

Having consumer price inflation close to the middle of its target band puts the Committee in the best position to respond to developments. As the extent and effect of tariff policies become clearer, the Committee has scope to lower the OCR further as appropriate. Future policy decisions will be determined by the outlook for inflationary pressure over the medium term."

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.