- “We should increase the intensity of countercyclical adjustment of fiscal and monetary policies,” Chinese officials say. The Chinese economy continues to struggle and faces deflationary pressures. Officials will come to a “whatever it takes” moment, soon.

- Despite the weakness of our largest trading partner, Fonterra is creaming it. Debt levels are down, profits are up, and a massive dividend was paid. Great news for dairy farmers and rural NZ.

- The next RBNZ monetary policy announcement is coming around quickly, on October 9th. We advocated for a cut in August, and now we’re advocating a 50bp cut in October and November. Why not? The economy needs it.

Chinese officials boosted stock markets last week, with the promise of more stimulus. The Fed’s 50bp cut the week earlier, has enabled the Chinese central bank to move as well. But if Chinese officials are to come close to their 5% growth target, they need to get more heavily involved. The Chinese economy has been floundering around for too long. The property market crisis, which has weighed on domestic household spending, has seen the PBoC deliver savage interest rate cuts and billions in funds to restore confidence and activity in both property and share markets. Local economists deem the moves as positive, but falling short of what is required to reflate the economy. Chinese officials will need to have a “whatever it takes” moment, announcing bazooka-sized spending aimed more at households (middle-income) and not so much on infrastructure (as they have done in the past). And or allow a faster devaluation in the Yuan. Chinese officials know too well that the property market and share market are measures of success, but more importantly, social stability.

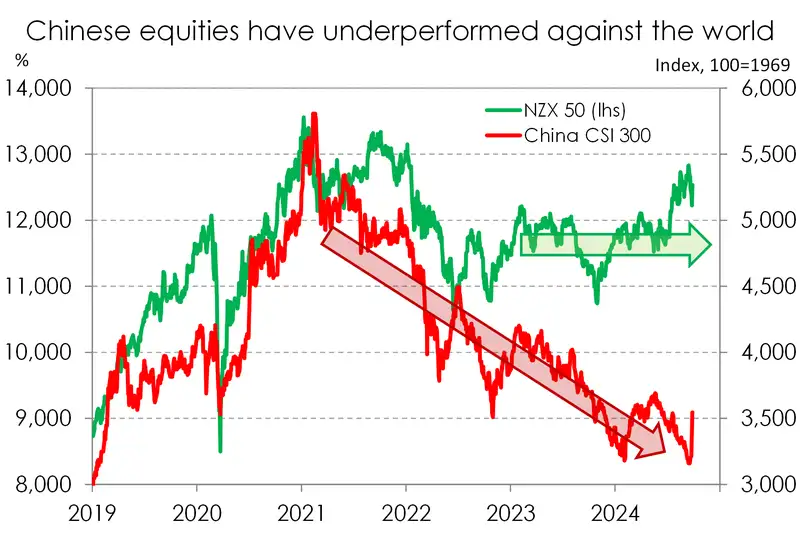

Our chart highlights two underperforming equity markets. The Kiwi stock market has underperformed our friends across the Tasman, and most international benchmarks, including US markets. But our underperformance is not so bad when compared to China. Even with the 13% policy induced spike last week, China’s stock market remains down 40% from the peak in 2021. That’s four years…

In what was a welcome development, Fonterra is paying its second largest dividend in its history, at 55c. More importantly, its forecast Farmgate milk price is $9 per kgMS, within a forecast range of $8.25-$9.75 per kgMS. The solid result and forecast, despite mixed demand out of China, is good news for dairy farmers and rural New Zealand. According to CEO Miles Hurrell, the solid result is a “couple of years of catch up” following difficult times, and will enable farmers to get back into some capital expenditure.

This week, we will learn more from Kiwi corporates, with the NZIER’s quarterly survey of business opinion. Since the RBNZ’s August rate cut, business leaders have become much more upbeat, and willing to approach 2025 with a spring in their step. We expect to see a jump in confidence, but we will need to see how that feeds into activity. The future path for monetary policy will play a big role.

We took a quick poll of our dealers and traders, and most respondents (65%) went for a 25bp cut in October and a 50bp cut in November. There is a long wait between November’s decision and the first for 2025 in February. November is like a double decision. Interestingly, 30% are for two 50bp cuts in October and November. The no mucking around option. Only one person thought the RBNZ should cut 25bp in October and November, as planned.

We continue to advocate harder and faster 50bp rate cuts in October, and again in November. It takes up to 18 months for rate cuts to filter through the economy. We all love fixed rates. And fixed rates need time to roll off.

Financial Markets

The comments below were provided by Kiwibank traders. Trader comments may not reflect the view of the research team.

In rates, the Kiwi curve continues to steepen:

“In a largely uneventful week Kiwi short end rates continued slouching toward pricing a series of outsized 50bp cuts. This saw the curve continue to steepen with the 2yr rate dropping another 10bps over the week while the 10yr swap rate up 3bps higher. Diverging further from current consensus among domestic commentators, none yet calling for a 50bps cut. The pricing of 40bps into October has the potential to become self-fulfilling though the RBNZ has a strong record of ignoring market pricing.

In contrast the RBA held their cash rate steady as widely expected, in keeping with their much more patient stance toward inflation. Moreover, Governor Bullock delivered a press statement that was taken as dovish by the market as hikes were seemingly taken off the table going forward.

On the supply front NZDM announced a tap of the 2030 line to come before year end. Swap spreads continued to cheapen with nothing supportive for demand or supply on the horizon. Another tepid bond tender on Thursday suggests a market still struggling to digest 500m of weekly supply.

With no major data releases before October meeting, ANZ and QSBO business confidence survey on Tuesday will be read with considerable interest, pricing intentions in particular. End of the week employment data in the US will also be relevant locally.” Matthew Crowder, Balance Sheet Manager – Treasury.

In currencies, the Kiwi dollar attempts to break higher:

“After opening the trading week around the 0.6250 level, the Kiwi benefitted from a slew of announcements out of China around both policy and fiscal stimulus as Chinese authorities moved decisively to bolster their economy. The Kiwi first had a run higher to 0.6343, before falling back to the 0.6250 support level. Late in the week we managed another rally to 0.6367 before closing the week closer to 0.6340. The 0.6369 level is important, as this was the high for the Kiwi in December last year. If we manage to sustain a break above 0.6370/0.6380 then we may well see the Kiwi ultimately push higher towards the 0.6500 level. The US dollar remains weak as the US economic picture supports the likely delivery of further cuts from the Fed this year. Friday’s PCE data certainly adds support, and at the end of the week we have US non-farm payrolls which provides further data around the US labour market. With the Fed focusing on employment as well as inflation, we will see further cuts from the Fed imbedded into market pricing. However, our longer term view for the Kiwi is still to the downside. It’s more of a matter of when. With the NZ economic picture continuing to deteriorate, the RBNZ are going to need to play catch up, and soon. But we may not see a 50bp cut at the next meeting, and this is ultimately what is needed to get the Kiwi lower. But for now it looks like the Fed may be more proactive than the RBNZ. For the NZDAUD cross, we traded in a pretty tight range last week between 0.9140 and 0.9210. The RBA last week stuck to their guns, leaving their cash rate unchanged at 4.35%, with continued vigilance around inflation meaning the RBA are not likely to cut rates this year until the data indicates that inflation is well and truly put to bed.” Mieneke Perniskie, Trader - Financial Markets.

The Week Ahead

- NZIER's quarterly survey of business opinion (QSBO) is the key domestic economic release this week. Other market surveys have reported a meaningful boost to business confidence following the RBNZ's August rate cut. The NZIER will likely print similarly. Indicators of past activity are likely to remain subdued. The focus will be on expected activity, as well as hiring and investment intentions. Other high-frequency data to watch this week is August building consents and August employment indicators, with both expected to remain in broad decline.

- In the US, the September jobs report is the main economic data release for financial markets this week. Around 145k jobs are expected to have been added to the US economy over the month, largely the same as the 142k gain in August. The market broadly expects the unemployment rate was unchanged at 4.2%. Other key US data releases this week include the September prints for both the ISM manufacturing and services indexes. The manufacturing PMI likely remained in contractionary territory, but the gauge likely improved from 47.2 to 47.6. For services, activity likely maintained a similar pace to August, with the index largely unchanged at 51.6.

- Over in Europe, market consensus expects headline inflation to hit the ECB's 2% target in September for the first time since 2021. Base effects in fuel prices which rose almost 3% last year, likely led the decline in headline inflation. Core inflation, however, is expected to remain unchanged at 2.8%yoy. The performance of services inflation will be keenly watched, which is currently running at 4.1%yoy.

- China's official PMIs are likely to rise in September, due largely to seasonality than a stronger economy. The gauges offer a snapshot of business conditions before monetary officials announced their stimulus package. The official manufacturing PMI will likely record the fifth month in contraction, but with a slightly improvement in the index to 49.5 from 49.1. The non-manufacturing PMI likely rose to 50.5 from 50.3, a still-weak expansion.

See our Weekly Calendar for more data releases and economic events this week.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.