Overseas visitors is running at around 80% of pre-pandemic levels

It’s been almost two years since our drawbridge was let down. International tourism, however, is not yet back to full strength. Supply-side constraints were key impediments to tourism’s recovery. Now, the return to full strength largely hinges on a continued recovery in key international tourist markets – notably China.

Unlike migration, short-term travel has been slower to recover

The first of our two-part “At the border” series examined the state of long-term cross-border flows. This note takes a closer look at short-term visitor arrivals.

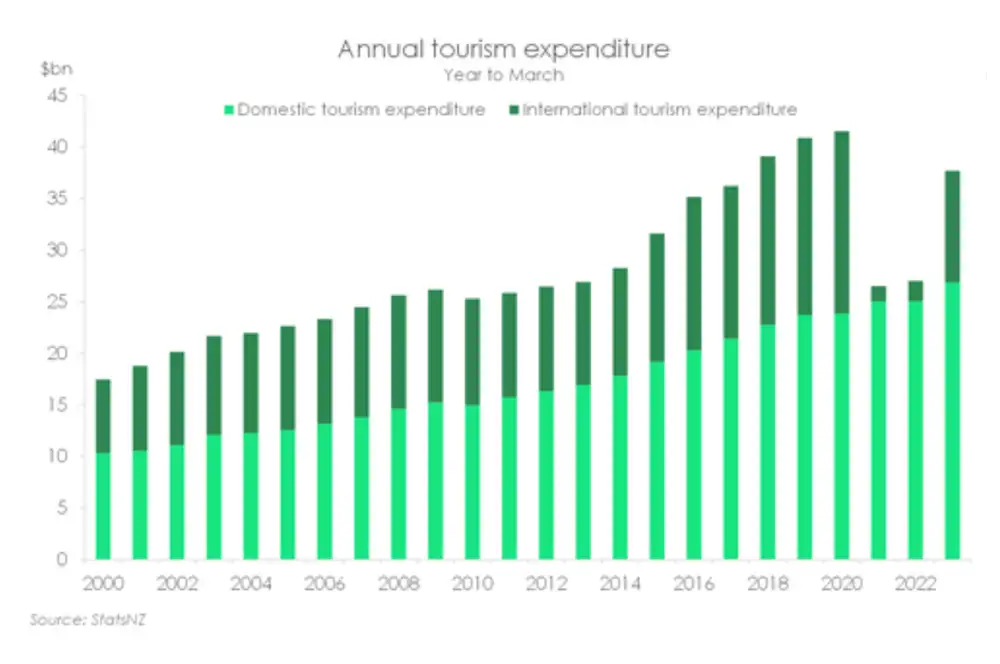

Tourism was once one of New Zealand’s largest export industries. In 2015, tourism accounted for around 20% of total exports, dethroning dairy as the top export earner. But along came Covid in 2020. International travel came to an unprecedented standstill. Tourism’s contribution to total exports fell to just 2%, and it’s reign abruptly ended. Following an extended period of border closures – with the exception of travel bubbles – October 2022 marked Aotearoa’s grand reopening to the rest of the world.

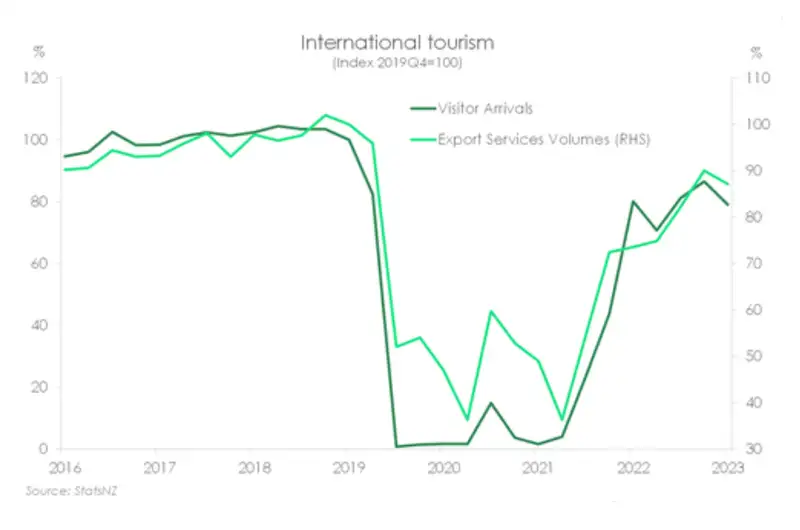

It's been almost two years since our drawbridge has been let down. International tourism, however, is not yet back to full strength. During the 2023/24 summer, short-term overseas visitor arrivals were running at just 80% of pre-pandemic (2019/20) levels. In the year to March 2023, tourism’s contribution improved to 11% of total exports, just 60% of pre-pandemic levels. The gradual recovery in tourism in part explains the rather lacklustre end to 2023 for the Kiwi economy.

While international tourism is only slowly recovering, domestic tourism rebounded strongly. Overseas trips were off the cards in 2020, and Kiwi were left exploring God’s country. There’s no doubt that the strength of domestic demand was the lifeline needed by local tourist operators. But the absence of international visitors still left a deep void. And despite a lift in domestic spend, overall tourism expenditure declined 35% in the year to March 2021. Since the border has reopened, departures have climbed as Kiwi ventured abroad once again.

Labour shortages and insufficient airline capacity were key constraints. However, with the help of a surge in migration, supply-side constraints have now eased. The return to full strength now largely hinges on a recovery in key international tourist markets – notably China.

A downside risk, however, is the global economic outlook. Financial conditions are tight and unemployment across the globe is slowly rising. Such circumstances may temper demand for expensive, long-haul travel. A mitigating factor, however, is our expected depreciation of the Kiwi dollar. We expect the Kiwi economy to be weaker relative to our trading partners. A weaker exchange rate means travelling to our corner of the globe becomes cheaper.

80% recovered

Internationally

It’s been four years since Covid sumo-slammed international arrival numbers to the ground. The recovery since has been gradual. Because the timing and extent of the recovery has been rather uneven across countries. Some governments were relatively quick to remove restrictions, while others experienced a more protracted recovery. Globally, UN Tourism estimates that international tourism ended 2023 at 88% of pre-pandemic levels, with around 1.3bn international arrivals.

In Aotearoa

The recovery too has been slow yet steady. First, we experimented with a trans-Tasman travel bubble which led to a slight rise in international arrivals in mid-2021. However, it was not until October 2022 – when our drawbridge was fully let down – and arrivals began to climb. Short-term overseas visitor arrivals picked up to be around 40% of pre-pandemic levels by the end of 2022. Fast-forward to today, arrivals have recovered to a little over 80%. Looking ahead, we are likely to see a return to full health this year with ongoing release of pent-up demand as well as a continued recovery of Asian markets (more below).

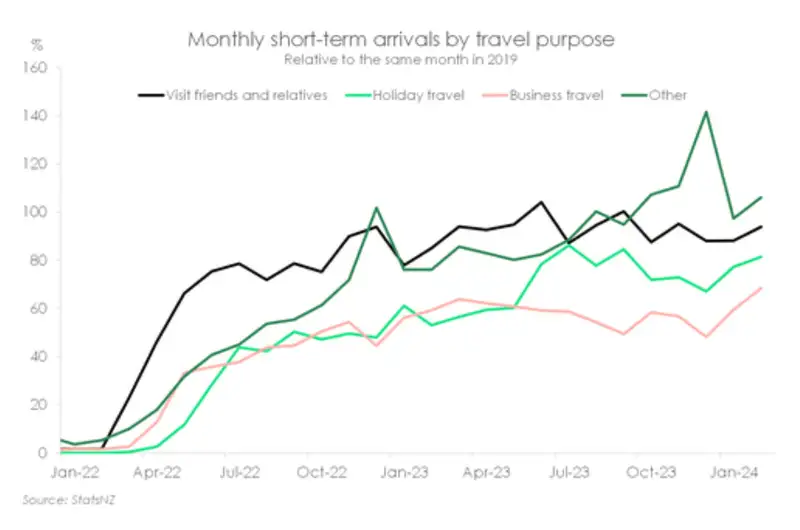

The recovery in short-term travel has been especially pronounced among those visiting friends and relatives (VFR). That comes as no surprise. Border closures deferred family reunions and limited catch-ups with friends overseas to laggy FaceTime calls. Since the border reopened, VFR arrivals accounted for over a third of all overseas arrivals in the year to October 2023 (first full year of the border reopen). That compares to a just a 27% share of all arrivals pre-Covid (year to October 2019). The number of visitors arriving for holiday travel has been the slowest to recover. Again, no surprises there. Holiday travel has lifted to about 80% of pre-Covid levels. It follows a later reopening of the border to key tourist markets, notably China.

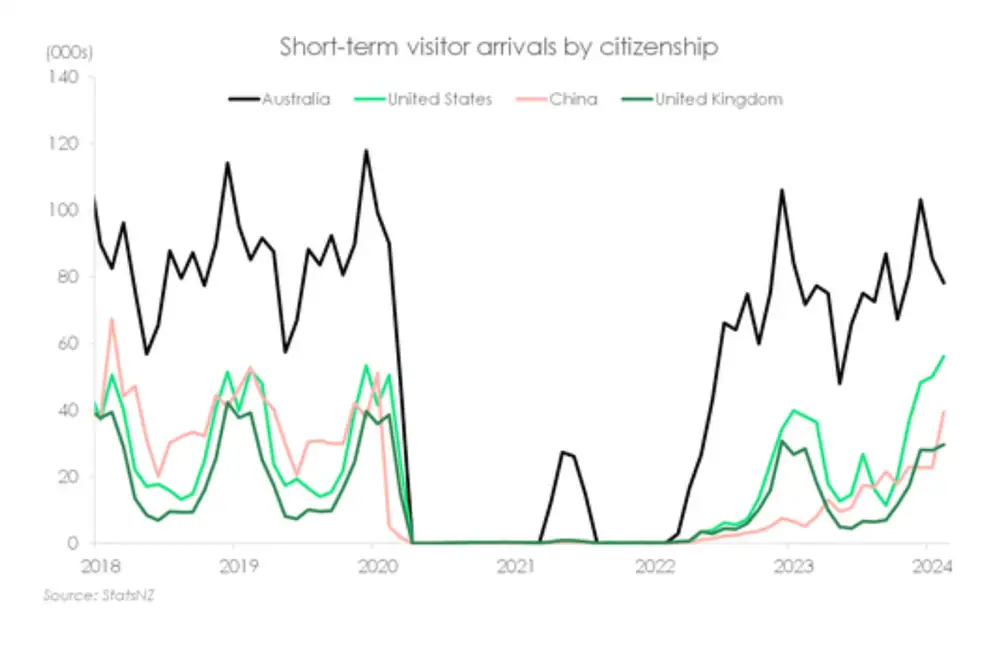

Visitors from China

Indeed, the gradual recovery in arrivals largely reflects fewer visitors from China. Prior to Covid, China was our second largest source of arrivals, after Australia. Today, China has dropped to 3rd place, surpassed by the arrivals from the United States. Chinese arrivals are currently running at just 75% of 2019 levels. In saying that, momentum is picking up. Chinese short-term arrivals are making up for a growing share of monthly arrivals. During the 2023/24 summer – peak international tourism season – Chinese arrivals accounted for 8% of all arrivals. That’s a big improvement from the 2% share during the 2022/23 summer. They’re (slowly) making up for lost time.

Australia

In contrast, short-term visitor arrivals from Australia have recovered the fastest. International travel in Australia was also limited. But the travel bubble extended the backyards of both countries. The relatively rapid recovery is also consistent with the speedy recovery in VFR arrivals. Prior to Covid, Aussies made up over half of all short-term VFR travel. Today, nothing has changed.

From the United States

Arrivals from the United States have also quickly recovered to above pre-pandemic levels. In mid-2023, we saw a flurry of US arrivals during the 2023 FIFA world cup, which was jointly hosted by NZ and Australia. Auckland was home base for the US team. US arrivals averaged close to 20,000 from June to August, exceeding the 16,000 pre-pandemic average.

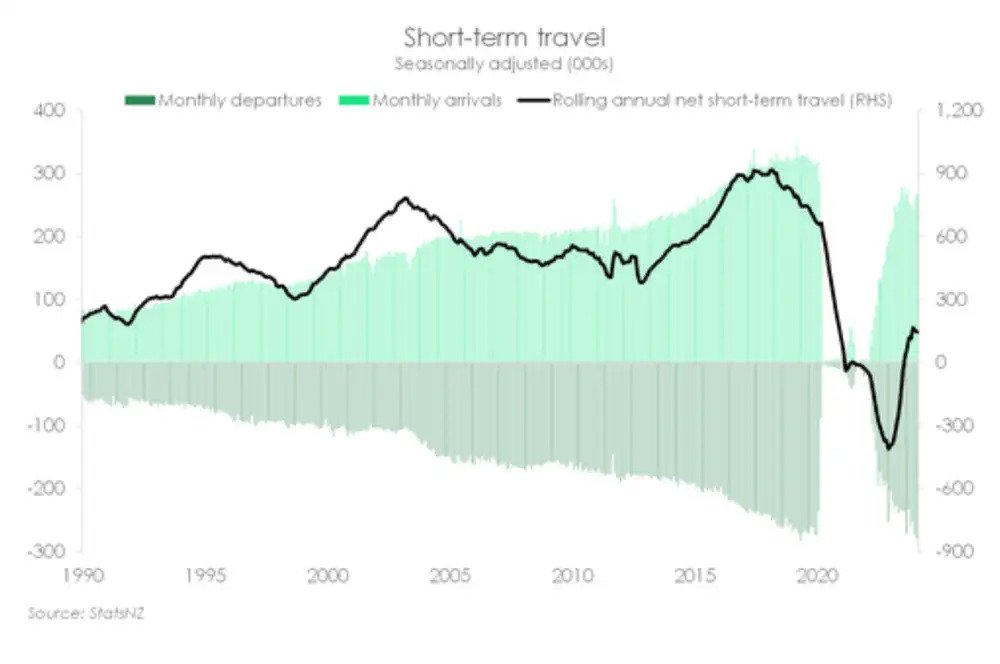

Departures from New Zealand

On the other side of the ledger, short-term departures of NZ residents have climbed steeply. The exodus is largely reflective of strong pent-up demand to see sights abroad. For much of 2020 and 2021, our backyard was our world. And we explored every corner of it. Domestic tourism was especially strong. And with the absence of overseas visitors, domestic tourists helped to fill some of the void. International spend collapsed to near-zero in 2020 and 2021, while domestic tourism expenditure increased 6% in the year to March 2021. Undoubtedly, the unprecedented strength in domestic spend helped to keep many local tourist operators afloat.

However, overall tourism still plunged to 40% compared to pre-pandemic levels. The latest data from Stats NZ show that spend recovered to around 90% of 2019 levels in the year to March 2023, likely helped by inflation working behind the scenes.

At the same time, Kiwi have ventured abroad once again. In fact, the rise in short-term departures of NZ residents has outpaced the rise in short-term arrivals of overseas visitors. For the first time on record, we witnessed a net outflow of short-term travel in 2022. It was not until the middle of last year did the annual balance turn positive.

More staff, and fuller planes

The gradual recovery in tourism has also been a function of capacity constraints and labour shortages. Like many industries during Covid, tourism was crying out for workers. But no more. The good news is that the recent surge in migration is plugging those staffing gaps. Employment in tourism-related industries returned to pre-Covid levels by the middle of last year. And tourism claimed a disproportionately large share of annual employment growth. Only around 10% of the those employed work in key tourism-related industries. But 25% of all employment growth in the year to June 2023 came from tourism.

The recovery also depended on whether there was ability for visitors to arrive – by air or by sea. Since the border closures have been lifted, capacity has steadily grown. NZ welcomed the first cruise ship since the closed border in August 2022. And the 2023/24 summer was set to be a record cruise season with more than 1000 planned port visits over the summer. More visitors are also flying in and airline capacity has now exceeded pre-pandemic levels. According to Tourism New Zealand, air capacity has increased to around 120% of pre-pandemic levels as new airlines and routes have opened.

Getting back to full strength

Looking ahead, the recovery in tourism is expected to continue as international tourism picks up further. Supply-side constraints have eased and are no longer an impediment to the recovery. It’s likely that 2024 is the year international demand returns to pre-pandemic levels.

However, there are a number of uncertainties that will affect the return to full strength:

-

1Tahi

The recovery in Chinese arrivals

As noted above, China was an important international tourist market in terms of both value and volume, prior to Covid. A recovery in Chinese arrivals is key for the future of the tourism industry. Since Covid restrictions in China have been relaxed in early 2023, we have seen Chinese arrivals make up a larger share of total arrivals. We expect this to continue, especially as NZ is among the 20 approved destinations for Chinese group tourism.

-

2Rua

The global economic outlook

A downside risk for the recovery is the expected slowdown of the global economy. Central banks from Washington to Wellington have hiked interest rates to the highest in at least a decade. Economic growth is weak across the globe, with some regions – like Europe – falling into recession. Unemployment is also on the rise. Tight financial conditions and growing job insecurity could make long-haul, short-term travel less attractive.

-

3Toru

The exchange rate

The Kiwi economy is also expected to grow below-trend this year. And it’s likely that our slowdown is worse than that of our trading partners. Because the RBNZ has been among the most aggressive in lifting interest rates. By consequence, we expect the Kiwi dollar to depreciate. The purchasing power of foreign dollars will effectively be stronger. So, travelling to our corner of the globe may actually be a relatively cheap option.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.