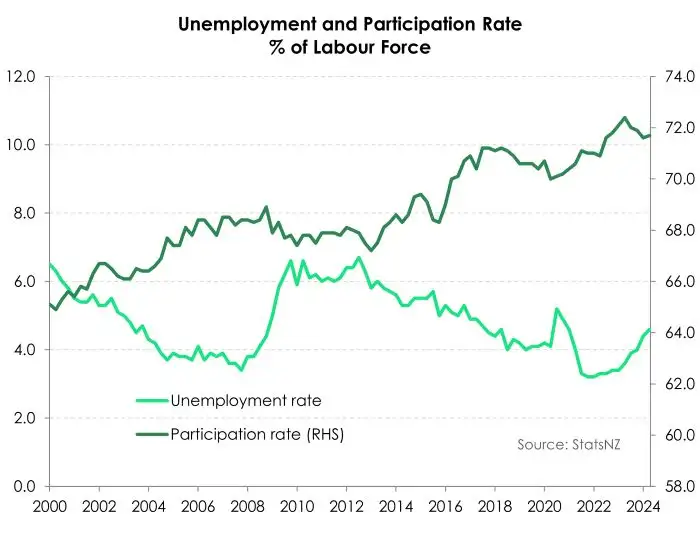

- Today's jobs report was weak. Although it was slightly better than we had expected. The unemployment rate rose to a 3-year high of 4.6%, with the participation rate rising to 71.7%. The underutilisation rate, a better measure of slack, lifted to 11.8% from 11.2%, as total hours worked fell 1.2% over the quarter.

- Wage inflation continued to rise, but at a slower pace. Annual wage growth has slowed to 3.6%, moving further – albeit slowly – away from the 4.5% peak. Weaker wage inflation should help drive an easing in domestic inflation. 65% of employees received a pay rise, which sounds good, but their hours are down. So you may earn more per hour, but you’re getting fewer hours.

- Amid the slowing economic landscape, the labour market should continue cooling from here. As demand for labour deteriorates, the unemployment rate is on track to exceed 5% by year-end – peeling further and further away from the 3.2% low.

Today’s jobs report was weak. Although, it was slightly better than we had expected. The rise in the unemployment rate was not as big of a jump. From an upwardly revised (really, a case of rounding – previously 4.3%) 4.4%), the unemployment rate rose to 4.6% - marginally below our estimate of 4.7%. It’s the highest it’s been since March 2021. Employment growth surprisingly lifted over the June quarter by 0.4%, against expectations of another quarterly decline. It’s likely a bit of payback from the 0.2% contraction at the beginning of the year. 12,000 more Kiwi entered employment over the quarter, with 10,000 of them women. Annually, employment growth has slowed to just 0.6% from 1.3%.

Another surprise was the lift in the labour participation rate. After hitting a record high of 72.4% in June 2023, the participation rate had begun its descent. But over the June 2024 quarter, it edged up – from an upwardly revised 71.6% (previously 71.5%) to 71.7%. Despite clear evidence of the decline in job ads, it seems that people are still trying their luck with the Kiwi labour market. The downtrend should resume over the coming year. As the economic slowdown continues, demand for workers will wane and people will head (or be forced) to the exits.

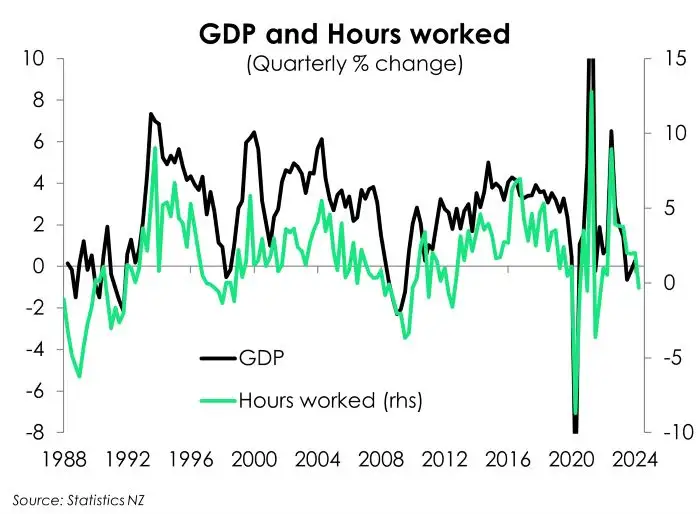

The underutilisation rate is a better measure of slack in the market. And the ongoing rise suggests that spare capacity within the broader market is growing. Over the June quarter, the underutilisation rate rose to 11.8% from 11.2% - the highest since March 2021. Measures beneath the umbrella term also moved higher with the underemployment rate – those working part-time and wanting more hours – rising from 4.1% to 4.2%.

The increase in spare capacity may likely have been larger if not for a slowing in labour supply. According to StatsNZ, working age population rose 0.4% in Q2, the smallest quarterly increase in two years. Annual growth has slowed to 2.6%. A sharp turnaround in net migration explains the slowdown. New migrants tend to arrive at a working age, helping to boost the talent pool. But the tap has now gone from an open fire hydrant to a leaking faucet. Labour supply is not growing as fast as it once did. Compared to June last year, the total labour force has expanded 1.6%, down from the 4.8% increase between 2022 and 2023.

In a sign of what’s to come, the number of hours worked declined the first time since September 2021. Over the quarter the (seasonally adjusted) total hours worked fell 1.2%. At the cusp of a downturn, firms typically try to hold onto their staff for as long as they can. And typically, hours are cut before headcount. The decline in hours over the June quarter may be the precursor to much bigger increases in unemployment in the coming year. Fewer hours worked is yet another early warning sign of a contraction in June quarter economic activity. Linked to the decline in hours worked was likely the 0.1% contraction of the full-time workforce, following the 0.3% decline in Q1. Annually, growth of the full-time workforce has slowed to just 0.3%. At the same time, the part-time workforce increased almost 2% over the June quarter.

Lingering heat in wage inflation

Another upside surprise was the softer slowing in wage growth. The private labour cost index (LCI) – a measure of pure wage inflation – accelerated over the quarter, up 0.9%. Annually, the wage bill edged down from 3.85 to 3.6% - slightly higher than our 3.5% estimate, but still easing. The distribution of annual wage growth was little changed from the last quarter. Of the surveyed salary and wage rates, 65% received a pay rise over the last year. Majority are still receiving a pay rise of over 5%. However, the share of those receiving a pay rise of between 3%-5% ticked up 1%pt to 22% - with the cost-of-living a leading reason. It’s a sign of softening employer demand.

The Quarterly Employment Survey (QES) showed similar lingering heat in pay growth over the quarter. Private sector average hourly earnings rose 1.1% in the three months to June, up from 0.3%. Annual growth slide from 4.8% to 4.5%, widening the distance from the 8.6% September 2022 peak.

While we and the RBNZ mostly focus on the private LCI as a measure of pure wage growth, it’s worth mentioning the series high lift in public sector wages. Over the year, the public sector LCI lifted to 6.9% from last quarter’s 5.5%. It’s a new record in the series which dates back to the early 1990s and comes off the back of the collective agreements across healthcare and education industries.

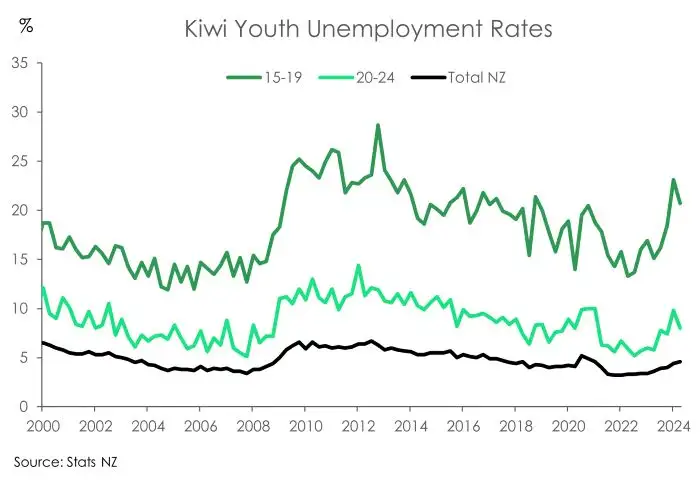

Youth employment

Amid the loosening in the labour market, some are doing it tougher than others. The youth in our economy are in the ‘firing’ line (quite literally). Young people accounted for almost half the increase in the lift in unemployment and underutilisation numbers over the year. For those between 15 and 24 years of age, the number of people unemployed lifted by (a non-seasonally adjusted) 14,400 over the year. That’s seen the unemployment rate for 15-19 years old lift to 20.7%, from last year’s 15.1%. And as expected the rise coincides with a slowdown in part time employment to 1.5% down from 10.1% last year. Those in their early twenties are also finding the slowdown particularly tough with their unemployment rate up 8% compared to 5.8% last year.

Staying ahead

Employment may have lifted over the quarter, but it’s losing its shine. We must remember that the Kiwi economy has been through a significant recession. Four of the last six quarters have recorded a contraction. And we've seen a massive 4.3% contraction on a per head (capita) basis. The labour market lags the economy by about 9-to-12 months. So there's still another year of softness ahead.

We expect the unemployment rate to continue climbing from here. By our calculations, it is still on track to exceed 5% by year-end. That’s some distance from the 3.2% low recorded in 2021. Amid the prolonged recession, there’s risks of an even higher peak. And as the unemployment rate drifts higher, so too does the risk of a hard landing.

Today’s update was an important one ahead of the RBNZ’s policy update next week. And it’s just another piece of evidence proving that a pivot in monetary policy is well past due. The labour market is crumbling under the weight of the RBNZ’s heavy-handed interest rates. Today’s report was not as bad as we feared. But the high-frequency indicators point to a further weakening. The Kiwi labour market has been remarkably resilient over the past two years of restrictive interest rates. But it's important for the RBNZ to stay ahead of any further labour market slowing by proceeding with rate cuts sooner rather than later. We recommend a cut next week. What we think the RBNZ will do, is somewhere in between. We’re not convinced the RBNZ will pull the trigger next week. They should. But it’s still unlikely. It would be hard to go from pushing out rate cuts and raising the probability of rate hikes in the May MPS, to cutting in August (see our full preview “From missteps to sprained ankles, the RBNZ pivot is").

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.