- One of the highlights of this role, is getting out into the regions and hearing what’s really going on. In the aftermath of the RBNZ’s decision, I’ve been involved with numerous Kiwi business banking events. On top of some presentations in Auckland, I’ve hit the road and visited Whangārei, Queenstown, Tauranga, Rotorua, Hamilton, and Palmerston North/Manawatū. And I’m looking forward to getting down to Wellywood soon.

- Things just got real. The RBNZ rate cut has enabled us to focus on magnitude, rather than agonising over timing. The discussion focussed on the amount of easing to come. We have been quite vocal in calling for a swift move back to 2.5%. That’s 300bps of cuts.

- Investors have been hunted by policymakers. Since the RBNZ cut on August 14th, eyebrows have been raised, and ears pricked up. The hunted will become the hunters. There’s more positivity around housing.

- The RBNZ will take interest rates from very restrictive levels to much less restrictive, and possibly stimulatory levels. Interest rates are the biggest driver of house prices. Tailwinds are coming.

I love it on the road. There’s nothing better than getting out in front of business owners and talking all things business. It’s the in-depth discussions before and after each presentation. It’s the questions in the Q&A… The ones out of left field… or out of another ballpark… that get me listening. And the conversation has shifted, materially. A glass half empty is now half full. A timeframe for talking forecasts was 6-to-12 months, and is now 1-3 years. The “survive ‘til 25” mentality is shifting. Business owners have lifted their heads, and are now talking more (positively) about future prospects.

Over the last 3 weeks, after the RBNZ cut the cash rate, I’ve travelled the regions. Kiwibankers from our regional cities hosted many-a breakfast, lunch or evening drinks. My life is a never-ending roadshow. I’ve been as far south as Queenstown, I’ve run through the heartland of Tauranga, Rotorua, Hamilton and Palmy. I held the fort in Auckland, and I’ve been north of the wall (game of thrones) in Whangārei. I now have upcoming trips to Whanganui, Taranaki and Wellywood.

Over that time, I delivered 13 presentations, with a few conferences thrown in, to over 800 clients. It was a privilege. And the conversation is much more constructive.

Before the RBNZ’s rate cut in August, we spent too much time talking about “when” they will cut. We agonised over dates. Despite the magnitude of pending rate cuts being more important. And although I focused on 2025 and beyond, it was merely light at the end of a very long, very dark, tunnel. After my presentations clients would say to me: “we appreciate the optimistic outlook, great, BUT… these are the problems we’re dealing with.” And it was a long list. Thoughts of rate cuts were just that… thoughts. Problems persisted, and dominated discussions.

Well now the RBNZ has cut. It’s real. It’s tangible. You can see it. And now the discussion is firmly on the magnitude. It’s the monetary magnitude that matters most. And rate cuts are coming thick and fast. It’s a gift that will keep on giving. See our RBNZ update: “The RBNZ cuts, because it was the right thing to do. And it’s the magnitude that matters most.”

The Qs in Q&A tell the story

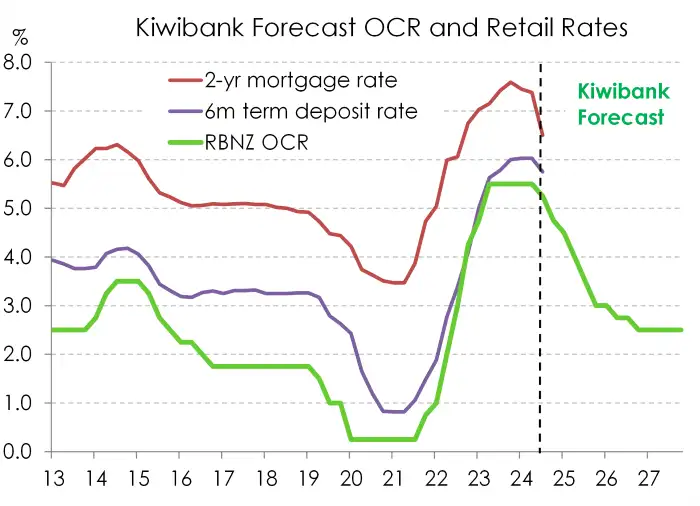

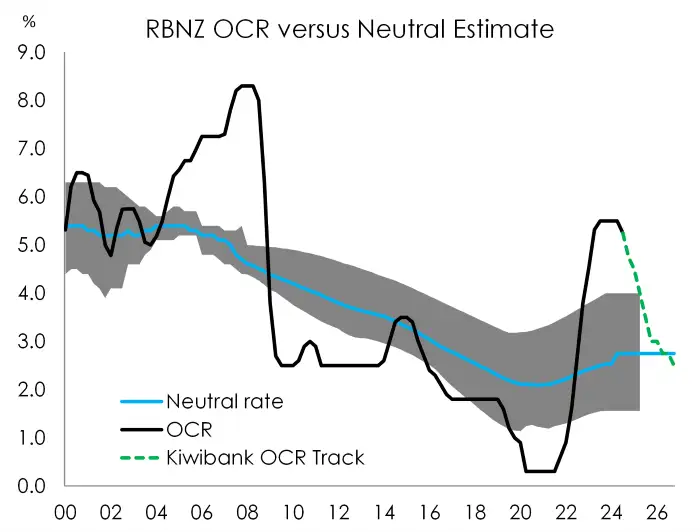

The questions I fielded the most were on interest rates. Business owners were visibly relieved to talk about falling interest rates, and asked about what it all meant for business lending rates, and well, all rates. Property developers and investors went a step further in asking about the follow through to bank test rates, and cap rates. Term deposit rates were also of interest to the handful of savers in attendance. The following chart acted like a cattle prod, stimulating Qs in the Q&A.

Rates are headed a lot lower… what does it mean for me?

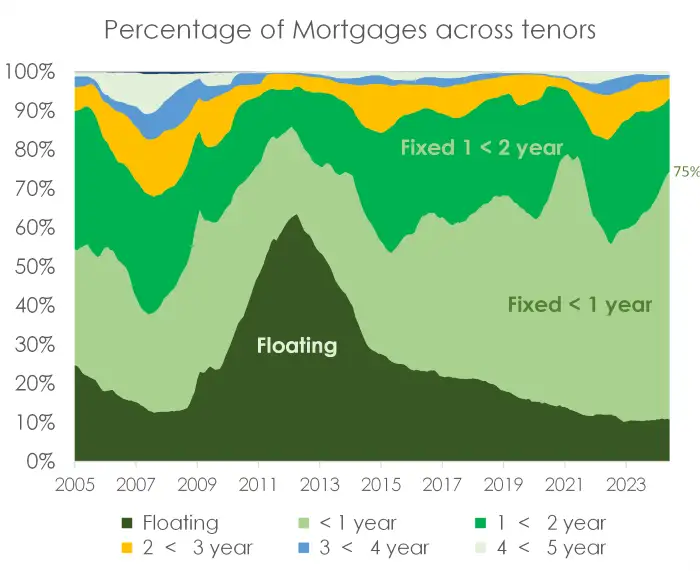

The speed at which the rate cuts will feed through was also of interest. Most people I spoke to had shortened up their fixing, either on mortgages or business lending. This is good news in itself. The historical lag in monetary policy movements is around 18 months. So as a central bank, cutting today has its greatest influence towards the end of 2025, start of 2026. But that has shortened up a bit now. With 75% of outstanding mortgages on fixed rates for less than a year – the 6-month rate has been most popular – rates will roll off faster and cuts will come through quicker.

Bank risk appetite always gets a mention, especially when some of the larger players are pulling back. Too many business owners have expressed their concerns around the availability, not even the price, of credit. A year or so ago, “good deals” would have been approved, and even fought over by the banks. But now, there’s not much love. Credit, and the creation thereof, is the oil in the economic engine. And the adverse appetite of some banks is exacerbating the slowdown. Banks that have the courage to act in a more counter-cyclical fashion are being rewarded with market share. Mortgage defaults are rising, to manageable levels, and business failures are more evident. It will get worse before it gets better. But again, we’re expecting a turnaround over 2025 as the economy picks up speed, and confidence returns. Risk appetite will return. And yes, it’s all about rate cuts.

Financial markets also play into business decisions. We spoke at length about rates markets. But with every Kiwi interest rate, there’s another one in another country being benchmarked. So discussions around central banks globally, fuelled a discussion around currency. For every exporter and importer I meet, there’s a forecast for the Kiwi against the Big dollar, Aussie and Euro. And this is a good discussion to have. Hedging currency risk, and taking advantage of the big moves up or down, can be a worthwhile exercise. Recently, the volatile Kiwi has popped higher… against our expectations. Importers are taking advantage of the stronger bird, contributing to lower tradeables (imported) inflation. It all helps. Whereas the exporters are holding out for better levels. We still expect the bird to drop to 57c by year-end… although our conviction is evaporating somewhat.

Naturally, we get some interest in international events and elections. It’s an interesting year, to put it politely. There are a lot of distractions and potentially dangerous events for the world economy. But ultimately, we think the central banks will keep (some) control. And it’s the pivot towards easier monetary policy that should dominate markets into next year and beyond. The herd of central banks is headed south for the northern winter. Check out our podcast titled: Central banks in focus.

It’s the return of the… Ah wait, no way… the investor?

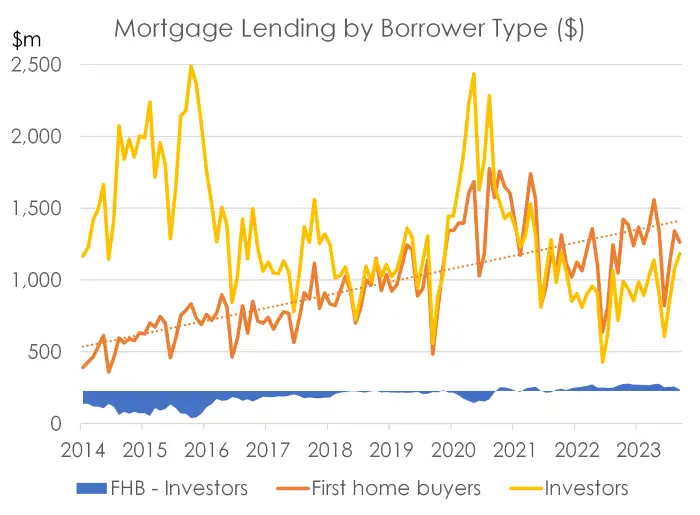

Investors are (highly) likely to return over the warmer months. We’re currently lending more to first home buyers than investors. That’s highly unusual, see chart below.

As interest rates fall, investors will be enticed off the side-lines (and out of cash). Rental yields are still rising as rents are running at the fastest pace in over 30 years, while house prices are still falling in (large) parts of the country. And the Government kept its promise to unshackle restraints. The ‘promised’ reintroduction of interest deductibility, shortening the Brightline test timeline, and possible watering down of the CCCFA, will entice investors. As the DTIs take effect, we expect to see a further loosening in the LVRs.

Hunters will seek opportunities in a ‘buyers’ market. The true test will come in Spring, as the property market thaws out from a cold winter.

So, what can we expect?

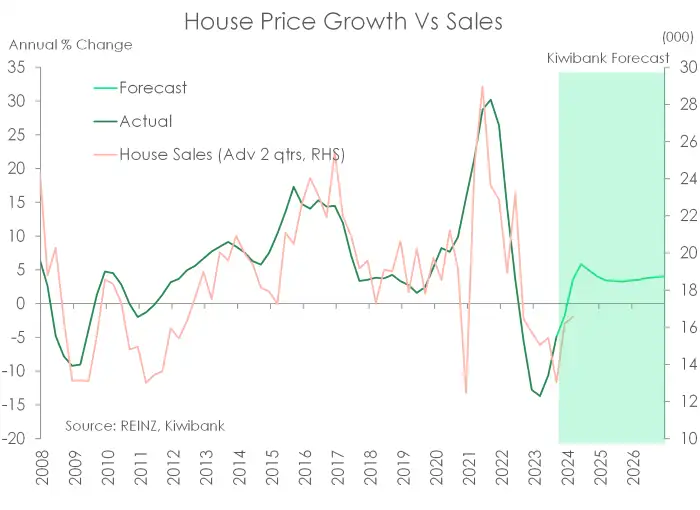

Forecasting is as much an art as it is a science. And we still think we’re much more likely to see price gains over 2025.

The surge in migration will play a role. The demand/supply imbalance will worsen. The surge in migration and the loss of dwellings at high risk of climate change will only exacerbate the housing shortage. The new Government will play a big role. Any added infrastructure spend or incentives for new builds will also be welcomed.

Interest rates will play a larger role, from now.

Our best guess is house prices will rise by 5-to-7% over 2025. Call it 6% to sound precise.

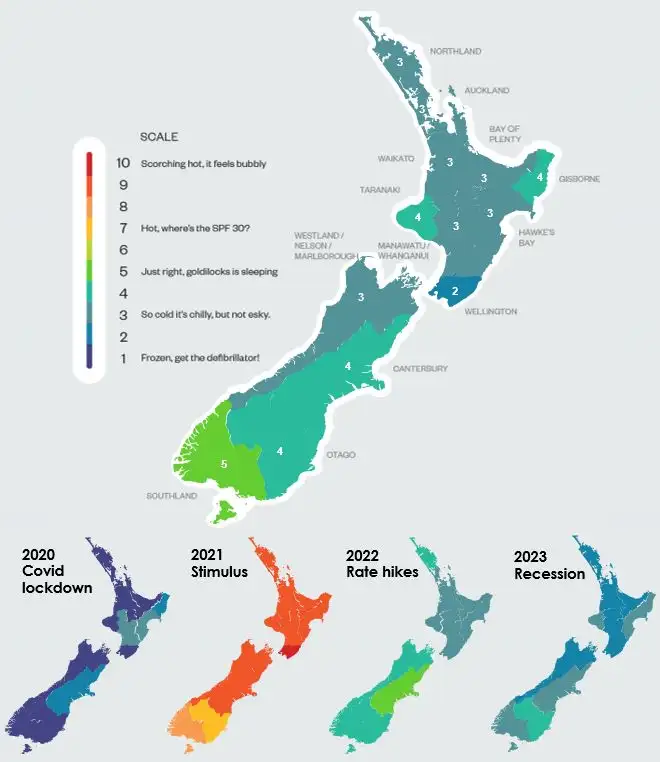

The performance of the provinces reflects housing

We recently published our latest regional outlook, titled: “The regions show signs of recovery. 2025 will be better”. In the report, we draw on the insights of dozens of business bankers and mortgage managers across the regions.

“Economic activity has improved across the motu – but only just. Our regional heatmap has gone from flashing mostly 2s out of 10 to a scattering of 3s, 4s, and a single shining 5. The economic scores are still soft, but it’s an improvement nonetheless.

Southland is the top performing region, with activity boosted by a building boom. Auckland’s activity is still weak, despite strong population growth. And it’s feeling bitterly cold in Windy Wellington, with a Jack Frost score of just 2, the same as last year. The bright spots, hidden beneath the surface, reflect the recovery in tourism. Otago is a strong performer.

Looking ahead, inflation is easing, interest rates will fall, and business confidence should strengthen. Spring is coming, and most regions will defrost.”

The RBNZ’s rate cut is a gift that will keep on giving

The RBNZ’s August cut was the first in a twelve step move. We expect to see twelve 25bp cuts, so 300bps in total. If the RBNZ wants to remove the restrictiveness of interest rates, they need to go back to a neutral (Goldilocks, not too hot, not too cold) setting. That Goldilocks rate is estimated by the RBNZ to be around 2.75%, a long way from 5.25%. And we think they’ll need to go a little below (2.5%), to get things moving. Mortgage rates, business lending rates have a long way to go, south.

It’s the magnitude of rate cuts that impacts business decisions, and household confidence. We forecast, with a much greater degree of confidence, that 2025 will be a better year than 2024, and let’s put 2023 behind us.

I must give a massive shout out to all the business bankers for tirelessly organising each event, and loading every venue with Kiwi business owners.

Pictures from the road

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.