- Demand for economic updates has exploded since the RBNZ started cutting in August. It’s a fun time to be an economist. Since the last “travelling economist” update in September, my rolling roadshow has intensified. I’ve been in a different city for each of the last 6 weeks. On top of a series of presentations around Auckland, I’ve been in Wellywood, twice, New Plymouth, Hamilton, the mighty Hawke’s Bay, and Tauranga. And MJV covered ground in Christchurch. Dunedin is next, Nelson will follow.

- Businesses have seen an easing in cost pressure. Business owners are much more willing to look to next year in a better light. But they are still cautious, with more talking about headcount reductions (not expansion). The recovery may have started, but it’s going to take a good 12 months, and many more rate cuts, to see activity lift.

- Mortgage brokers have seen a lift in enquires. It’s early days, but confidence is returning, and house prices are likely to rise over 2025.

We love getting in front of businesses, investors and mortgage advisers. To give some context, we have delivered 91 talks, presentations and roundtable discussions over the last 3 months since the RBNZ first cut in August. We did 183 in total last financial year. To say things have ramped up, is a bit of an understatement. Now that the RBNZ is moving, there’s a lot more interest in how far? And what does it mean for (the economy) my business? I’d almost go as far to say that economists are cool again. But a ‘cool economist’ is an oxymoron.

After years of struggle, turbulence and volatility, with restrictive policies, we’re delivering good news. And the outlook is simply much brighter. Our forecast recovery next year is unchanged, but our conviction in our call has strengthened. 2025 will be a better year than 2024, and let’s put 2023 behind us and look to 2026 with some vitality.

Business owners are much more willing to look to next year in a better light. But they are still cautious. Talk of investment and hiring intentions is still too early. When I ask of recruitment plans, more business owners talk about headcount reductions (not expansion). It is a stark reminder that the unemployment rate is still rising, and has a ways to go. Our forecast peak is still 5.2% by mid-2025, with upside risk to 5.5%. We’re currently sitting uncomfortably at 4.8%. And when I ask of investment intentions, I get a mixed response. A few say yes, depending on bank credit. But many say no, not now. We need the lift in confidence to feed through to activity and to restore profitability, before investment and expansion plans are put back on the table.

One positive theme I kept hearing is that businesses have seen an easing in costs. We’ve heard of easing cost pressures in construction, some primary industries and manufacturing. One CEO of a cake company told me all ingredients, from eggs to kūmara, have dropped back following last year’s cyclone. And it’s this drop in costs that has helped inflation expectations fall back towards 2%... Although the last print lifted a little, see inflation expectations up, we’re not far from the RBNZ’s target 2%.

Tourism operators are keen to hear any thoughts on tourist flows, especially out of China. Our tourist flows and industry have rebounded to about 80% of pre-Covid levels. It’s the remainder that has related businesses asking. And China’s weak economy, with a crisis in their property market, suggests the weakness in Chinese tourism will continue into next year. But we’re watching with interest over summer.

Retailers are asking about the strength of the Kiwi household into Christmas. But it seems they’ve already made up their minds. They had to, in many cases well before the rate cuts. We have heard that retailers (hopefully not my favourite retailers) are going into Christmas light on inventory. Once bitten, twice bitten, third time shy. Retailers have been caught with too much inventory in recent times, and they’re running lean this year. The idea is to not get caught with too much stock, and be forced to sell at painful discounts in the new year. It sounds prudent. The risk now becomes, what if consumption picks up into Christmas? What if the rate cuts are being felt now, and consumers have a bit of pent-up demand? Well, it’s a risk retailers are willing to take. It may be better to miss out on a few potential sales, rather than lose money on excess stock. Now that says a lot about the mindset of many businesses, not just retailers. The recession may be ending, but the recovery will take time…

The Qs in Q&A tell the story

The themes I presented in the last “travelling economist” note remain front and centre. Business owners want to know how far rates are falling, and what it means for their business. And there’s always a question on currency movements – see below.

Leaving the rates question aside, as I covered it in the last note, politics has become a leading question, especially in the US. Tariffs are of concern, as it’s a supply shock that reduces growth and increases inflation.

Trumpflation

Following the US election, and Trump’s victory, businesses are concerned about the global outlook. The threat of sizeable tariffs on all countries, not just China, has many concerned. And the impact on New Zealand is difficult to think through. There’s a risk that the tariffs are broad, and impact New Zealand’s direct trade with the US – our third largest trading partner. But it’s the indirect impacts that has us (all) thinking. One school of thought is that the tariffs could be deflationary for us… with Chinese goods diverted from the US at a cheaper price. The other school of thought centres around the growing protectionist movement… which is not good for a small, open, exporter like NZ. There are no definitive answers.

Financial markets have taken the Trump victory as being inflationary, at least in the US. And interest rates have popped higher. The US rates curve is higher and, being the global benchmark, has pulled Kiwi rates higher.

It’s all about housing…

Is now the time the housing market will actually recover? We covered this topic, and some anecdotes, in our Markets, Mystics and Mayhem podcast, episode 11. Check it out on YouTube or Spotify.

When talking to frontline lenders, mostly external mortgage advisers, we’re hearing that enquiry is picking up. There was some interest following the RBNZ’s first cut in August, and a lot more interest following the RBNZ’s 50bp cut in October, which will continue after the RBNZ’s next (50bp) cut in November (next week).

The lift in enquiry is one thing, a lift in activity is another. And it’s still a waiting game. Investors are showing interest, but they’re tentative. It appears investors are waiting for interest rates, and more so bank test rates, to fall further. And we’re hearing that many investors are wanting/needing to rebuild some equity, after falling house prices. Again, interest is one thing, action is another. And the true litmus test for the housing market is now, in spring.

The latest data on the Kiwi housing market is showing some signs of improvement. The days to sell are falling. See: “Longview: house prices stagger sideways. But we’re looking to 2025, with a strong sense of optimism.” Readers are asked to listen to Greenday while reading… everything sounds better with Greenday blaring in the background.

One interesting anecdote was on the quality of housing stock on the market. The quality of stock on the market has been poor. So what we’re seeing in the data at least partially reflects the low quality on the market. It is hard to get a feel when the stock is of a low quality. There are many investors wanting to sell, but they have held off in a weak market. If you don’t have to sell, why would you, in a falling market. So the increase in listings recently may reflect sidelined sellers re-entering the market.

Christchurch: The place to be

Mary Jo Vergara went to Christchurch a few weeks ago… here’s what she had to say...

The timing of the Christchurch visit couldn’t have been better. The sun was shining, the weather was warm, and the conversations (cautiously) optimistic. The US Presidential race was also happening in the background, making for some interesting discussion and brainstorming of Trump’s return to the White House (see above). On the whole, the Christchurch business community was feeling upbeat - “finally, some good news” was a common comment. Cost pressures have eased, and the RBNZ is on a journey back to neutral. Rate relief is desperately needed, but the “good news” is that cuts are coming thick and fast. Sentiment is recovering and so too will activity. 2025 will be the year we climb out of the recession.

Housing, as always, centred many-a discussion. The broader Canterbury property market has been among the best performing over the last four years. House prices were swept up during the post-Covid boom. But unlike other regions, like Auckland and Wellington, the downturn was not as keenly felt. House prices corrected just 8%, compared to the 18% decline in national prices, and are up 5%. Christchurch is becoming the city when it comes to investing or buying property compared to other main centres. There’s lots to love about Christchurch. Firstly, price. Properties are relatively more affordable, with the median price around 30% below that of Auckland’s. And with the low price point, there’s potential for price growth. Also, the more affordable the investment, the higher the yield – particularly for student accommodation. And the city can expect a lot more students dripping in UC (university of Canterbury) Murrey Red and Gold in the coming year. Domestic enrolments have surged, with Canterbury recording the most NZ students in its 150 years. The halls of residence are filling up fast. Those students who miss out are then left to explore other options like a home stay or private rental.

Not only is property relatively affordable in Christchurch, but the stock is of better quality. New developments are constantly springing up, especially in and around the much-improved city centre. At each corner there were new apartments and townhouses being built. With all that Christchurch offers, investors are slowly coming back. And the change in investor property tax has helped lower the hurdle. But who exactly is investing in Christchurch? Well, it’s out-of-towners seated in the auction rooms. And just like the Jaffas rolling down Baldwin Street, it’s Aucklanders rolling through the gates of the Garden City. Indeed, the resounding message I heard from everyone I spoke to – whether in the property game or not – was: Auckland-based investors have their sights (and wallets) set on the Christchurch market.

The flight of the Kiwi (dollar)

DANGER: Rockfall – move quickly through this area

As always, importing and exporting businesses were interested in the flight of the Kiwi (dollar). And it has been volatile, as always.

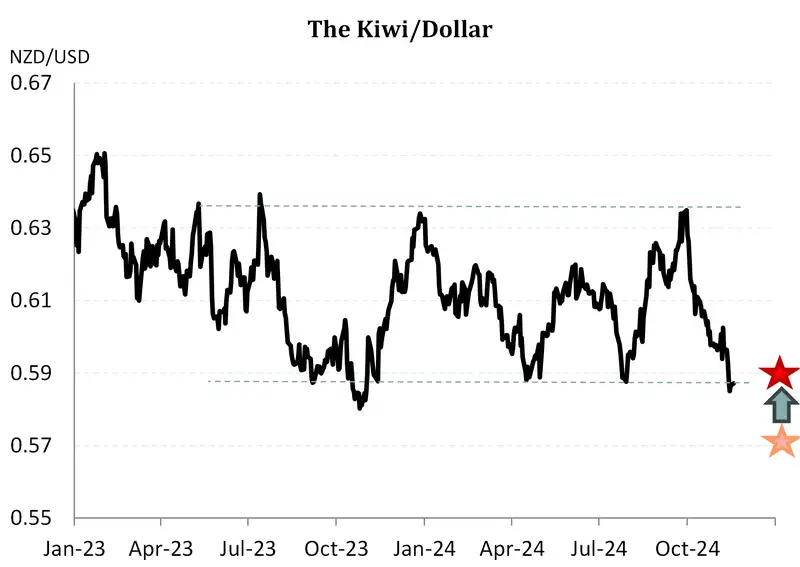

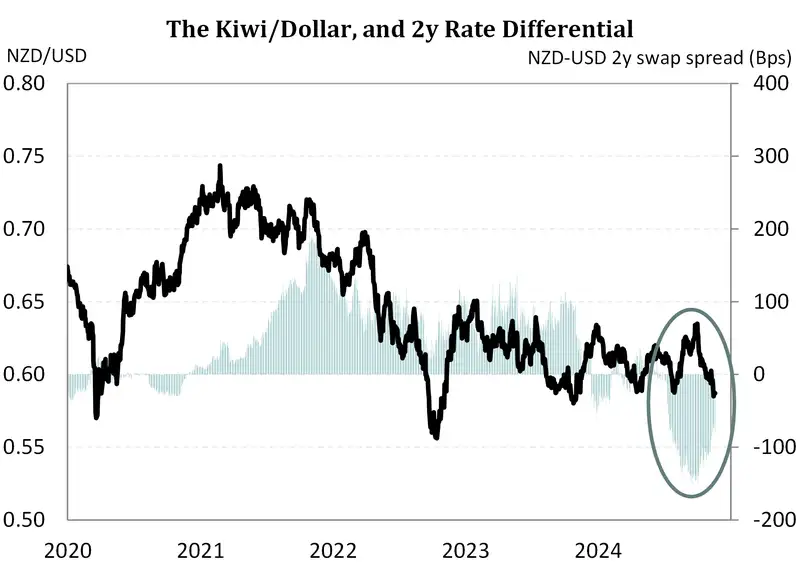

The Kiwi took flight in August, despite the RBNZ beginning its rate cutting cycle, to hit a rather high peak of 0.6379 in September. That move blew many traders out of the water. It was more of a US dollar story, but it hurt Kiwi traders nonetheless. To quote one trader: “we made money on our rates trades, and gave it back on the Kiwi currency… the Kiwi was the most obvious short… but that didn’t happen”. Well, as the Kiwi often does, it moved in the wrong direction, defying the fundamentals. And then it does exactly as you expect it to do, after it wipes you out. And we got caught up in the move as well. At 63c, our call (forecast) for 57c by year end looked one step too far. So we changed our forecast to 59c (from 57c). Sure enough, as soon as we did that, the Kiwi plummeted. In October, the Kiwi fell from +63c to sub-60c. And the fall has continued in November with a current low of 0.5840. It looks like our old forecast of 57c may be on the money after all.

The fall in the currency is a good thing for exporters… although we’re not hearing a lot on this side. Exporters are enjoying the move lower, waiting and watching for new lows. The Kiwi is at the lowest level seen since the brief dip to 0.55 recorded in October 2022.

The flightless Kiwi is another point of friction for importers however. And we are hearing their concerns. The more active importers took some cover (hedging) when the currency hit 63c. At 59c and below, they’re waiting for another pop higher. The less active importers will have to hit the market when they need it, at any level. And now is not the best time. The Kiwi will frustrate importers into Christmas and the new year.

We have been quite bearish on the Kiwi since last year. We have expected, and seen, a sharp deceleration in the economy. We’ve recorded a 2-year long recession. And that’s hurting households and businesses. Compared to the US economy, and the Australian economy, we’ve underperformed. The RBNZ has been much more aggressive in its monetary policy.

Next year may be a different story.

The downside DANGER to the dollar will dissipate, and the Kiwi will head higher over 2025

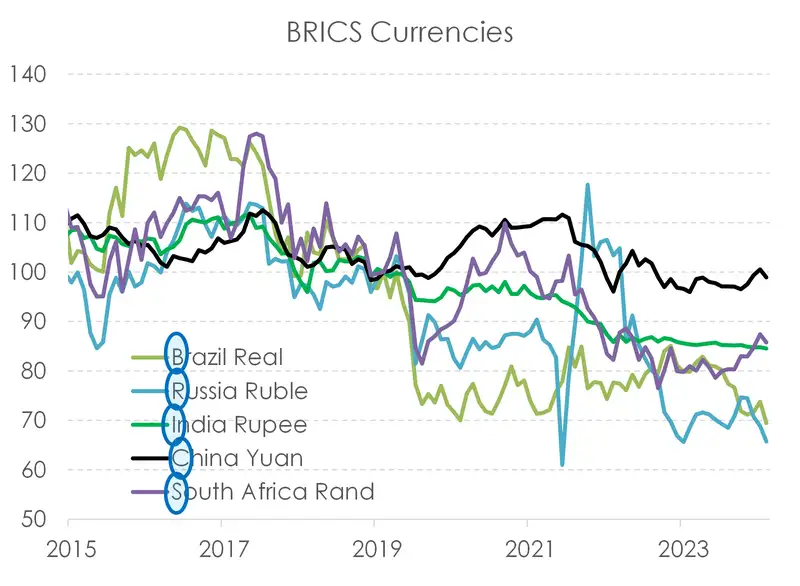

It’s a bit early to be talking about the next move in the Kiwi… but if we’re right, and the Kiwi economy recovers next year… then yeah, we will see the Kiwi dollar rise. But that’s a story for the second half of 2025. Let’s hold off for now. There has been another pick up in questions around a BRICS currency. It’s an anti-dollar question. When will the US dollar be dethroned? My thoughts on BRICS are simple. Take a look at each letter. B stands for Brazil, a commodity currency – not a bedrock currency you need in this block. R stands for wRong side of the war. I stands for India. Absolutely, I fully support this sentiment. Investment in India, either physically or through strengthened trade ties is essential for the next decade(s). India will be a star performer, I believe, for the rest of my life. And I’m planning on living for a long time… just to annoy my wife. Of course, the C stands for China, our largest trading partner. So yeah, I agree. But China’s managed currency is unlikely to challenge the US dollar, in my opinion. And now we have S for South Africa. You’re not really adding much here. Maybe in the distant future, but not now.

You can create your own BRICS currency if you want, just buy each currency independently. If you had done so 5 years ago, you’d be quite proud of yourself right now. You would have lost a big chunk (up to 35%) of your money.

BRICS and stones have broke my bones

The US dollar is the global reserve currency. The dominance of the US dollar in international trade means most central banks and financial institutions hold large amounts. The majority of FX reserves are held in US dollars. The US currency and debt markets are the most liquid in the world. And liquidity (the ability to buy and sell, especially in times of stress) is important. The next most traded currency is the Euro, but it is nowhere near as popular as the US dollar. About 60% of global reserves are held in dollars, with the Euro attracting only 20%, according to the IMF. BRICS are not yet part of the equation. And cryptocurrencies will continue to emerge, and gain in importance. But central banks will fight back with CBDCs. Watch this space. In the foreseeable future, at least, the US dollar will remain on top.

This photo was taken on the road to the Hawkes Bay and back via Tauranga. Plus, it’s a shameless plug for our podcast. A great way to keep up with the economic developments and madness in markets, while stuck in traffic. Life’s good, regardless.

I must give a massive shout out to all the business bankers for tirelessly organising each event, and loading every venue with Kiwi business owners.

On top of a series of presentations around Auckland, I’ve been in Wellywood, twice, New Plymouth, Hamilton, the mighty Hawke’s Bay, and Tauranga. And MJV covered ground in Christchurch. Dunedin is next, Nelson will follow.

Prior to this run, I’ve hit the road and visited Whangārei, Queenstown, Tauranga, Rotorua, Hamilton, and Palmerston North/Manawatū.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.