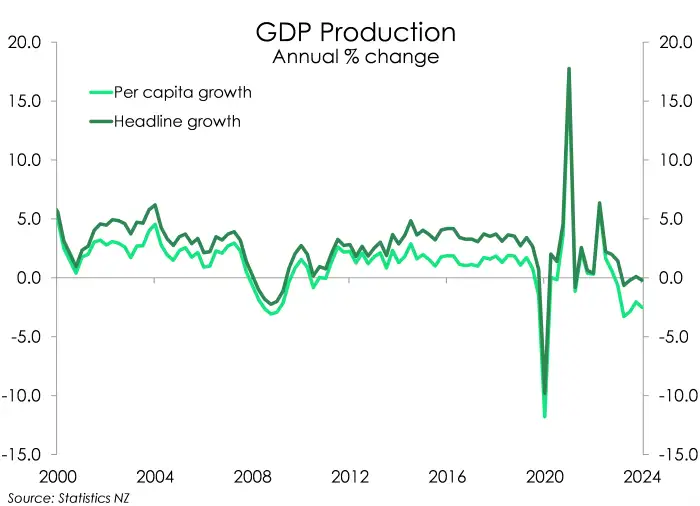

- Today’s data was weak, maybe not as weak as expected, but still weak. The 0.2% fall in the June quarter followed a downwardly revised 0.1% gain in March (previously +0.2%qoq). The GDP report is already old and dated. And it told us what we already knew. New Zealand remains in a prolonged recession.

- We’ve experienced strong population growth, which is supporting output. Activity would have been much worse without the surge in population. But on a per person basis, economic output declined for the seventh straight quarter (down 0.5%qoq). Compared to a year ago, per capita GDP is down 2.7%.

- Forward-looking indicators suggest that the September quarter will record another contraction. That makes the recession two years old. It’s not until next year, that we expect to see some growth. 2025 will be a better year than 2024, and let’s forget about 2023.

- The light at the end of the tunnel is coming out of the RBNZ. Policy settings are restrictive, but more interest rate cuts are coming. High interest rates have hurt, and the economy demands more easing.

The Kiwi economy contracted in the June quarter. The fall of -0.2% was not as deep as we, and the consensus of -0.4%, expected. But it’s still a fall. RBNZ had forecast a fall of -0.5%. But this was revised down from a +0.2% gain in their estimates in May. On a per capita basis, the report is miserable. We’ve seen seven consecutive contractions, with a sizable -0.5% in the June quarter. Activity per head is down 2.7% over the year, and down 4.6% from September 2022 – far worse than the cumulative 4.2% decline during the GFC. There is light at the end of the tunnel, and it’s burning brighter. We think the RBNZ’s decision to cut the cash rate in August, marks the turning point in this cycle.

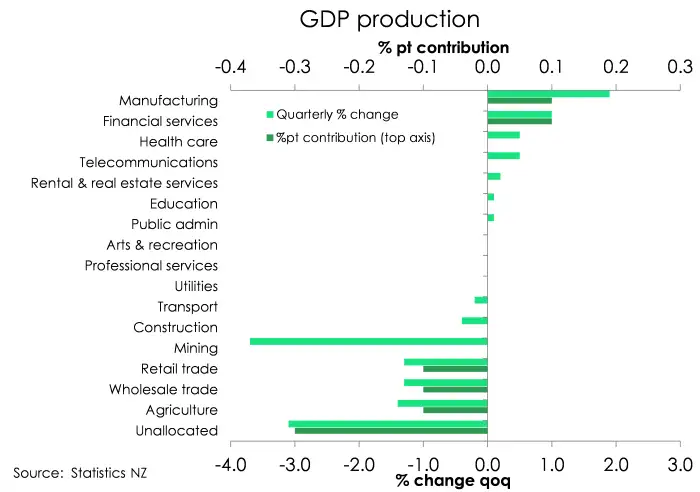

Scratching beneath the surface of today’s report, there was some bad news. Dairy exports were down, with the primary sector underperforming, and spending throughout the economy remains soft, super soft. The large contraction in imports highlighted the softness of local demand. If we’re not buying stuff, we’re not importing stuff.

And there was some good news. "7 out of the 16 industries increased. The largest rise was in manufacturing... A rise in transport equipment, machinery, and equipment manufacturing drove the increase in manufacturing. This was the largest rise in manufacturing activity since the December 2021 quarter." StatsNZ The good news out of manufacturing was a positive surprise, and stronger than our estimates. More importantly, on the expenditure side, household consumption lifted 0.4%qoq, off a low base.

The recession, by RBNZ design, will lead to more people unemployed. It's the dark side of the Phillips curve. We expect the unemployment rate to continue climbing from here. By our calculations, unemployment will exceed 5% by year-end. That’s some distance from the 3.2% low recorded in 2021. As the recession continues, the risks are tilted toward an even higher peak. And a higher peak means more defaults and more failures.

Today’s miserable economic report card proves that restrictive monetary policy has done enough damage to restrain inflationary pressures. Enough is enough. And the RBNZ are responding – late, but in earnest. A rate cut in October is as close to a done deal as you get. In fact, we’d argue the only discussion should be on delivering 25 or 50. We’d advocate 50. And again, 50 in November. The RBNZ’s first 25bp cut in August marked the start of a move towards 2.5-to-3%. That’s at least 250-to-300bps. We argue the RBNZ needs to get the cash rate below 4%, asap. It takes up to 18 months for rate cuts to filter through the economy. We all love fixed rates. And fixed rates need time to roll off. Effectively, the RBNZ are cutting today for an economy at the end of 2025, the start of 2026. Get moving…

Dairy and durables are down in the doldrums

On the other side of the same coin, the expenditure measure of GDP was flat on the quarter. Household spending, government spending and business investment were all up over the quarter. But the gains made across these three segments were offset by the 0.8% decline in exports. And leading the decline was the 4.4% fall in goods exports. According to Stats NZ, the 1.4% decline in agri production has been mirrored by falls in exports of dairy and forestry products.

Private household consumption increased 0.4% over the quarter, far stronger than the 2.2% decline the RBNZ had pencilled in. Despite the June quarter jump, private consumption remains weak, with the March quarter 1.6% print significantly downgraded to 0.5%. We’re not surprised by the revision, as Covid has disrupted the seasonal patterns of expenditure. And that’s created some challenges for StatsNZ’s modelling. Nonetheless, StatsNZ’s new series of household consumption - excluding spend by Kiwi overseas and including overseas visitors still paints a restrained consumer. The new series of household consumption was flat on the quarter. And the rotation away from goods and towards services continued. Mirroring the decline in retail trade on the production side, consumption of durable goods declined a chunky 3.4% over the quarter. On an annual basis, durables spend is down almost 10%! – the fourth straight decline. Households are reining in their big-ticket spending as tight financial conditions weigh on wallets. Consumption on services increased, but by a smaller magnitude compared to the start of the year, up 0.8%. Annual services consumption increased 1.3% - the first positive print since September 2022, but still running well below the long-term average.

Beyond households, business investment picked up with a 1.1% over the quarter. Investment in plant and machinery lifted almost 2%. Similarly, the downtrend in building consents has seen a 5.8% decline in residential buildings compared to a year ago. Nonetheless, overall gross fixed capital formation eked out a 0.2% gain over the quarter – the first increase after four quarters in decline.

Super Thursday did not disappoint

It was an early start for market traders and strategists this morning. The US Fed delivered a 50bp rate cut, taking the funds rate (upper bound) to 5%, from 5.5%. And with that, the Fed leapfrogged the RBNZ. The RBNZ may have cut a little earlier, but the Fed has cut a little more. It’s worth noting that the US economy has outperformed the Kiwi economy. And with these cuts, the US economy will continue to outperform. So, the question amongst traders and strategists is: if the Fed sees the need to cut 50bps with a stronger economy, will the RBNZ do the same? Yes, they should. Both central banks are aiming to get their cash rates below 4%, quick, and looking towards a neutral rate of 2.5-to-3%. In our opinion, the RBNZ are responding – late, but in earnest. A rate cut in October is as close to a done deal as you get. In fact, we’d argue the only discussion should be on delivering 25 or 50. We’d advocate 50. And again, 50 in November. The RBNZ’s first 25bp cut in August marked the start of a move towards 2.5%. That’s 300bps. We argue the RBNZ needs to get the cash rate below 4%, asap. It takes up to 18 months for rate cuts to filter through the economy. We all love fixed rates. And fixed rates need time to roll off. Effectively, the RBNZ are cutting today for an economy at the end of 2025, the start of 2026. Get moving…

The reaction in the Kiwi markets was subdued, all things considered. The pivotal 2-year swap rate rose from 3.66% to 3.695%, and remains comfortably off the low of 3.60%. The very slight increase in wholesale interest rates was fair, as the data came in a little stronger-than-expected. The Kiwi did a whole lot of nothing. The bird bounced around this morning, as the Fed delivered a outsized 50bp cut, seeing a spike from 0.6213 to 0.6268, and a nosedive to 0.6182 before a full retracement back to 0.6213. We could have just said the Kiwi was pretty much unchanged. The moves were hardly worth mentioning. But we’re economists, we’d be out of things to say if we didn’t mention the things not worth mentioning.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.