- We were pounding the table in favour of a rate cut today. Now is the time. But we admit, we didn’t think the RBNZ would do it. We thought it was too much of an about face, from their misstep in May. As it turns out, what they “should” do was exactly what they did do. And we applaud the move.

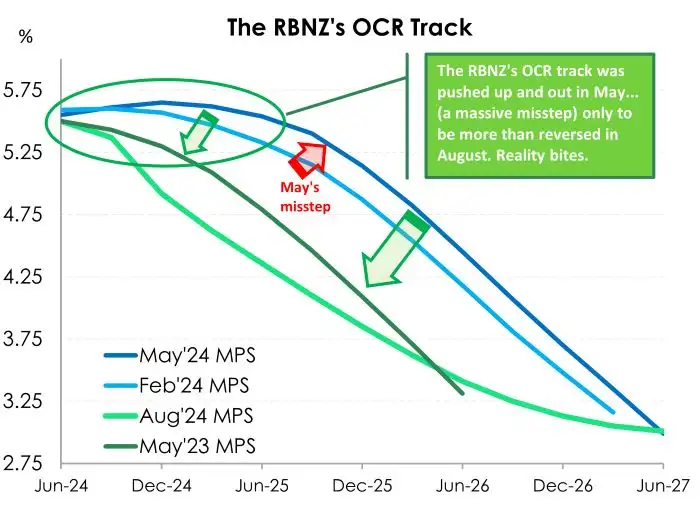

- The OCR track chart highlights the move outwards from Feb to May, and the dramatic 180 degree move today. Today’s OCR track better resembles their OCR track from May last year (after their last hike), and when we started calling for cuts.

- The timing is one thing, but the magnitude is more important. The RBNZ are on a path back towards neutral of around 2.75%. We think they’ll hit 2.5%. That’s 300bps in total. We expect a 25bp cut at every meeting from here, well into 2026.

The rate cut we had to have, but didn’t think we’d get

The RBNZ has finally kicked off. They did what we didn’t think they’d be comfortable doing, but did anyway. The Governor noted today’s 25bp cut from 5.5% to 5.25% was a “relatively safe first step”. And that’s important. It’s just the first of many steps. We applaud their confidence to cut. And we expect to see many more.

We’ve spent a lot of time talking (and agonising) about the timing of the first move. And now that it is out of the way, we’re going to spend a lot more time talking about the magnitude. And it’s the magnitude that matters most. Today’s move was the first step in a twelve step move. We expect to see twelve 25bp cuts, so 300bps in total. Mortgage rates, business lending rates have a long way to go, south. And so too do savings rates.

It’s the magnitude of rate cuts that impacts business decisions, and household confidence. We forecast, with a much greater degree of confidence, that 2025 will be a better year than 2024, and let’s put 2023 behind us.

A complete 180 on their forecasts from May

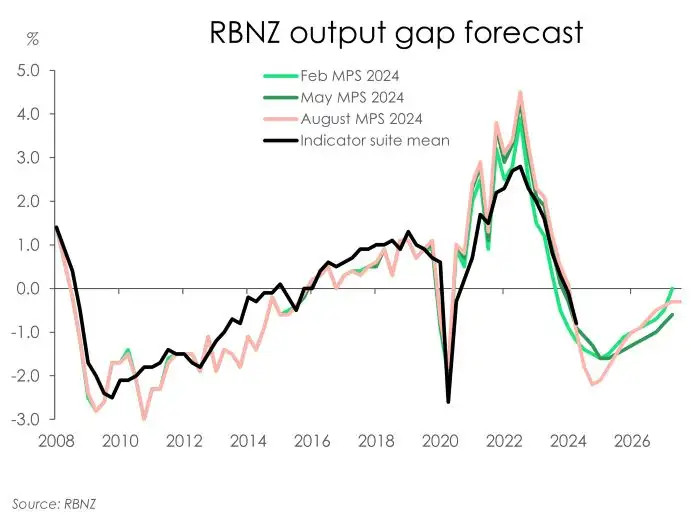

Today, the RBNZ formalised their dovish pivot with a significant downgrade to their economic outlook. Central to their updated view is the downward revision to their estimations of the output gap – the extent to which demand is running above or below sustainable supply. The RBNZ now assumes increased spare capacity in the economy, meaning less inflation pressure, compared to their thinking back in May.

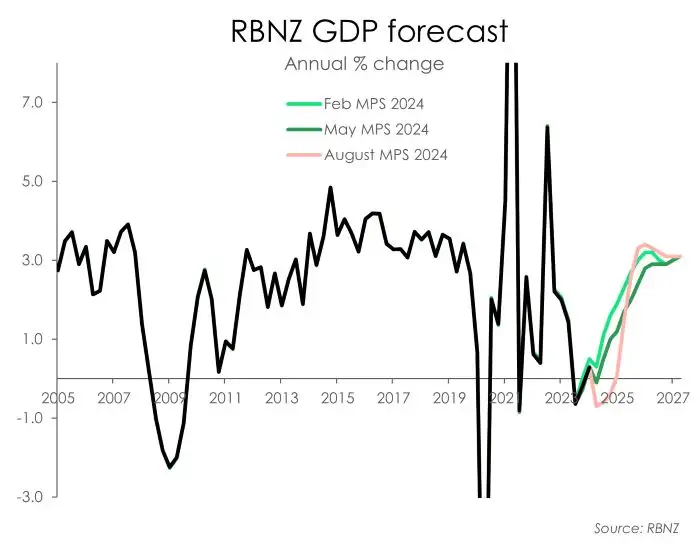

Previously, the RBNZ forecasted moderate economic growth with the economy expanding 1% over 2024. However, that view is proving optimistic. High-frequency indicators have been signalling a slowdown in activity for some time now. And the RBNZ has updated its outlook accordingly. A mid-year recession is now expected, with the economy seen contracting 0.5% and 0.2% in the June and September quarter respectively. The Kiwi economy is forecast to shrink 0.4% this year. Looking beyond, the economy is expected to resume growing circa 3% on an annual basis.

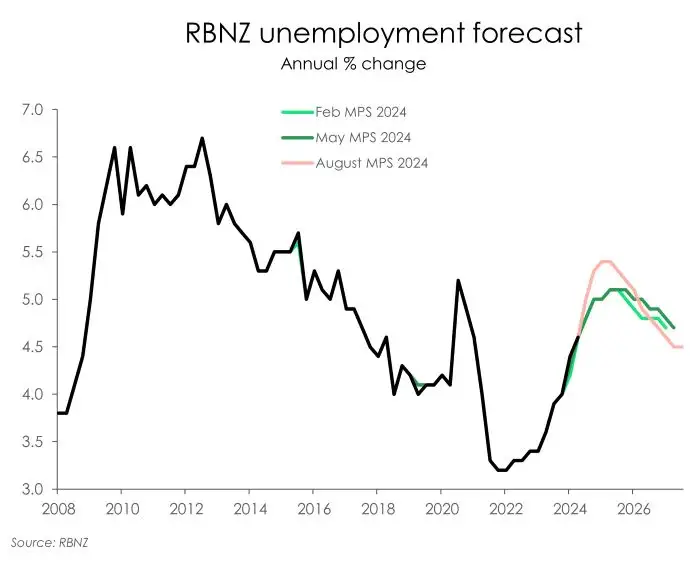

Along with a deteriorating economic outlook, the unemployment rate is forecast to peak higher than previously expected. The unemployment rate is seen exceeding 5% by year-end, and peaking at 5.4% early next year – 0.3%pts above the previous peak – consistent with a declining output gap. The loosening in the labour market has so far been driven by an increase in labour supply as migration surged over 2023. But early indicators point to a slowing in employment growth, which will drive further loosening in the labour market. Along with a softer labour market outlook, wage inflation is now forecast to moderate faster than previously expected.

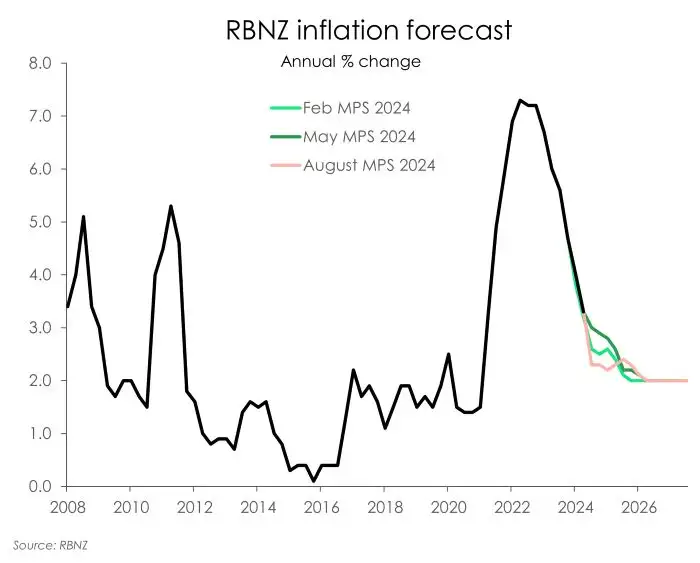

The biggest surprise in the RBNZ’s fresh set of forecasts surrounded the inflation outlook. Inflation is expected to print at 2.3% in the current (September) quarter, a big downward revision from the May forecast of 3%. The rapid deceleration in imported price growth is expected to strengthen, with tradables falling into deflationary territory. On the domestic inflation side, the persistent strength in some components that are relatively insensitive to interest rates – e.g. council rates, insurance, utilities – is keeping inflation from hitting 2% until mid-2026. Nonetheless, domestic inflation is seen to decline slightly faster given the RBNZ’s revised assumptions around a smaller output gap.

A change in what some would call secondary data

From the press conference to featuring in its own section in the report, the RBNZ made sure to really drill home the weakening in high frequency data as of late. In fact, they claimed it was one of the main reasons they had the confidence to cut today. They’re not wrong. The high frequency data as of late have been shocking. And have pointed to further declines in economic output for the Kiwi economy. Business confidence from across a range of surveys but most notably NZIER’s quarterly survey of business confidence showed massive declines across firms expected trading activity. Meanwhile monthly manufacturing and service indexes have continued their descent into contractionary territory. Along with notable mentions on the falls across electronic card transactions, filled jobs, dwelling consents and heavy vehicle traffic. It's all well and true to say these indicators are suggesting a weaker economy and thus stronger confidence that inflation will return within the band. But, and here’s the important part, we’d argue that the high frequency data turned and deteriorated a long time ago. It’s why we have always called for an earlier cut from the RBNZ. Even back in May, when they signalled that they wouldn’t cut until the second half of 2025. And it’s why we recommended they cut today as well.

Special Topic: A faster response for price setters

Another interesting note in today’s MPS, was the RBNZ discussion on price-setting behaviour in a low inflation environment. Given the key role that price-setting behaviour plays on inflation, the RBNZ decided to relook into how quickly price-setting behaviour responds to inflation outcomes. Their research found that given large increases and subsequent declines in inflation in recent years that price-setting behaviour is now more responsive to inflation data. And as such, this faster adjustment contributes to lower inflationary pressure over the medium term. It seems on track to us. Inflation has been in the limelight and front of mind for business for quite some time now. And it makes sense that with such large changes in inflation, that price-setters would be quicker to respond. Just like we have started to see a fast response from retailors heavily discounting stock.

The reaction in financial markets said it all

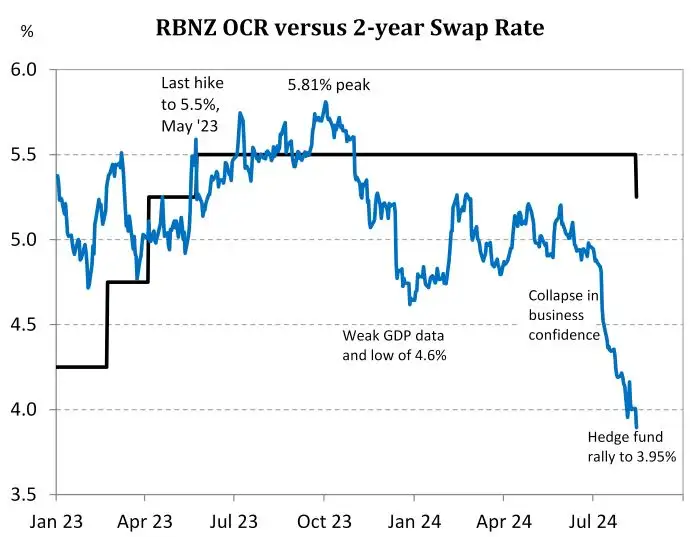

In the lead up to today’s decision, rates market traders, namely large international hedge funds, placed some very large bets. Over the last month we experienced a remarkable run in rates. The pivotal 2-year swap rate dropped from 5% in early July (and 5.2% in early June) to a low of 3.95% - currently 3.90%. The rally in rates has looked like a rampant bull on steroids, stung by a bee. There has been no time to stop and smell the flowers. Rates have been crushed, and rightly so.

Today’s meeting had as much as a 90% probability of a cut, with 5.27% implied, only last week. Immediately before the meeting today, however, market pricing had pulled back to around 50% (flip a coin) at 5.36% (14/25bps). Well, the 25bp move as reinforced the bias amongst traders.

The market has priced in around 213bps of cuts priced to August next year (3.37%). The terminal rate has collapsed from 4% a few weeks back, to 3% today. We forecast a continued fall in all wholesale rates from here.

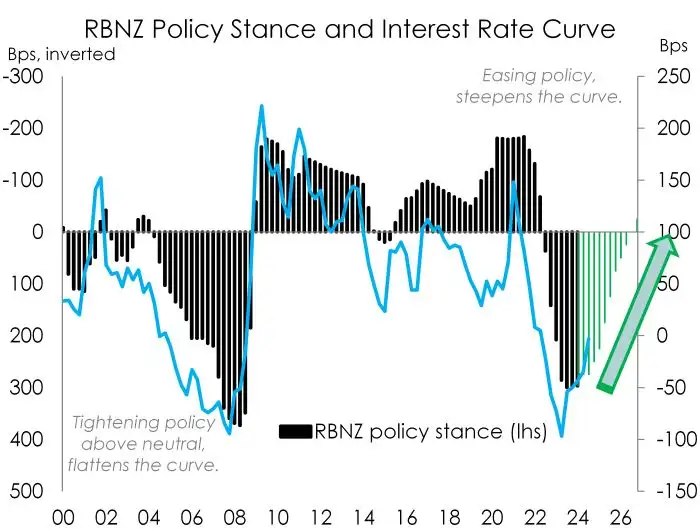

The massive “bull steepening” has pulled the 2-year swap rate versus the 10-year swap rate (2s10s spread) up from -56bps to near 0bps. That’s the move we had been expecting and positioning for. Interest rate curves generally steepen (short term rates fall further than long term rates) during interest rate cutting cycles. And they flatten (short term rates rise up above long term rates) during rate hiking cycles.

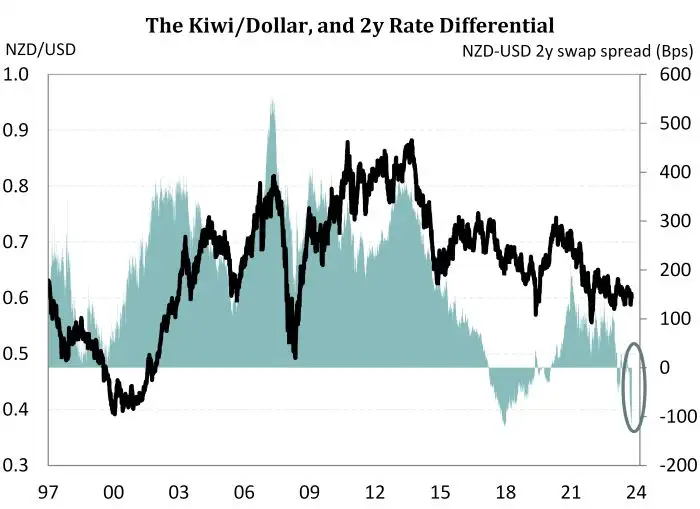

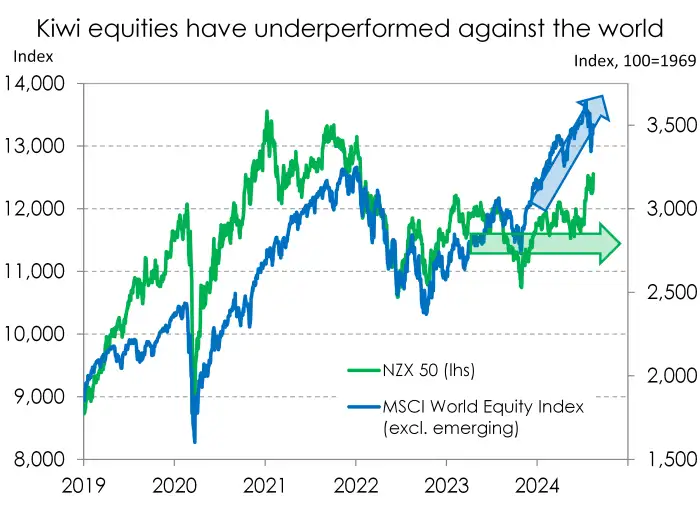

The Kiwi dollar has also faced its fair share of volatility in recent weeks/months. The recent high in the Kiwi was 0.6222c in June… before it fell out of bed and hit a low of 0.5850c a few weeks back. In the lead up to today’s decision, the Kiwi had climbed all the way back to 0.6030. At time of writing, the Kiwi was trading at 0.6000 post announcement. Our fundamental view remains unchanged… we’re sticking with our call for a fall to 0.57c by year-end. We think the interest rate differentials, see chart, will exert downward pressure. The US economy is simply performing better than the Kiwi economy. And the relative (under)performance in our stock market illustrates our differences.

RBNZ’s August statement

“New Zealand’s annual consumer price inflation is returning to within the Monetary Policy Committee’s 1 to 3 percent target band. Surveyed inflation expectations, firms’ pricing behaviour, headline inflation, and a variety of core inflation measures are moving consistent with low and stable inflation.

Economic growth remains below trend and inflation is declining across advanced economies. Some central banks have begun reducing policy interest rates. Imported inflation into New Zealand has declined to be more consistent with pre-pandemic levels.

Services inflation remains elevated but is also expected to continue to decline, both at home and abroad, in line with increased spare economic capacity. Consumer price inflation in New Zealand is expected to remain near the target mid-point over the foreseeable future.

The Committee agreed to ease the level of monetary policy restraint by reducing the OCR to 5.25 percent. The pace of further easing will depend on the Committee’s confidence that pricing behaviour remain consistent with a low inflation environment, and that inflation expectations are anchored around the 2 percent target.”

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.