- The RBNZ delivered on expectations, cutting the cash rate 50bps to 4.25%. There was no discussion of a 75bp move or a 25bp move… so the decision was straightforward. Anything other than a 50bp would have been a shock, and hard to explain.

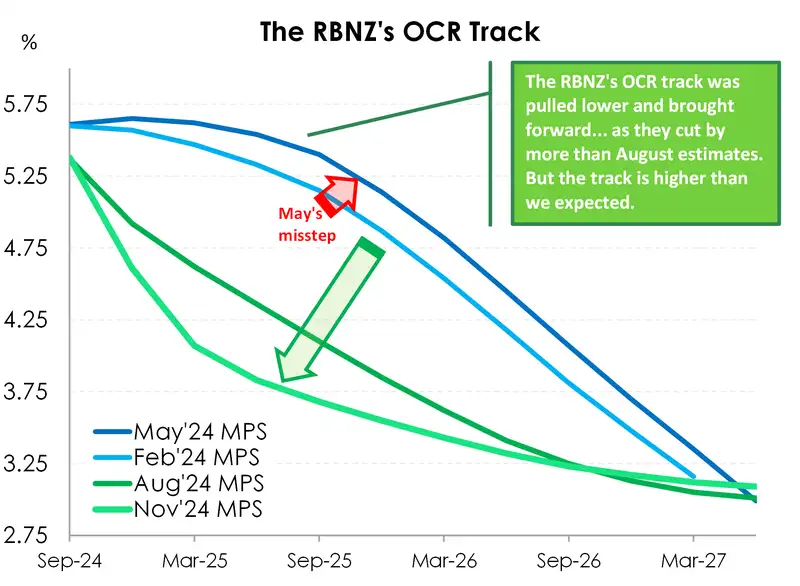

- Today’s move was just the tip of the iceberg. The really interesting stuff was underneath. The RBNZ’s OCR track, which provides guidance on future policy moves, was lowered and pulled forward. It had to be… because they’re cutting in 50s not 25s. But the endpoint was lifted a little to 3.06% (from 2.98%). That’s bang on the 3.1% rate implied in wholesale rates.

- Our view has been tweaked, a little. More cuts are required. And we need the cash rate below 4% asap. We advocate another 50bp move in February… but we’ve lifted our forecast terminal rate to 3%, from a slightly accommodative 2.5%. We've made these changes on the back of the RBNZ's tweaks. But we note that the RBNZ may be too hawkish, again (as they were in May).

The rate cut we knew we’d get, but we still want more

The RBNZ delivered. The cash rate has been cut again, by 50bps, to 4.25%. However, the path thereafter is higher than we expected. We had forecast a continuation of cuts to 3%, followed by a pause, and then a slightly stimulatory boost to 2.5%. Well now we just expect the RBNZ to stop at 3%. The RBNZ is more comfortable than we are with the economic scarring inflicted and likely recovery. We think the RBNZ’s bias may be moving in the wrong direction, as they did in May. They’re too hawkish. Time will tell. And we have a lot of time until their next decision in February.

For market players, there was no mention or consideration of a 75bp cut, or a 25bp cut in the record of the meeting… So all the hype around 75bps fell of deaf RBNZ ears.

The argument for a 75bp move was fair. There’s a long wait for the next OCR cut in February. The RBNZ like their summer break, seasonally adjusted. So today’s decision is effectively a double decision, given the gap. But more importantly, we’re still a long way away from neutral. At 4.25%, rates are restrictive, and we’re deep in recession. We’re at least 75bps off the more pessimistic estimate of neutral at 3.5%, and 175bps off the lower estimate of 2.50%. No one sees neutral at 4% or above.

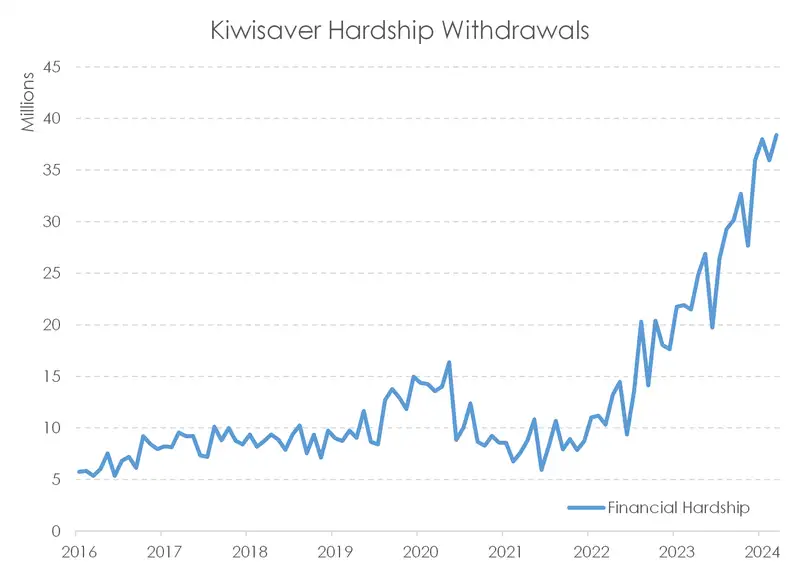

If you need more proof of the recession, and the pain inflicted, then Kiwisaver withdrawals is it. “Hardship withdrawals” have spiked from $10 million is January 2023, to $38 million in October. These withdrawals are not easy to make. “To withdraw savings you will need to provide evidence you are suffering significant financial hardship.” Significant financial hardship as a direct impact of restrictive monetary policy settings.

The admission of guilt may have been problematic. A 75bp move today would have been more of an admission that the RBNZ had overtightened. Even more so than the 50bp moves we’re getting – compared to the RBNZ’s August forecast of 25bp moves.

The argument for a 25bp move was premature. A 25bp move wasn’t discussed. Although a 25 may get more airtime in February. We think the RBNZ will scale down to 25bp moves as the size of choice later in 2025, as they slow their approach to neutral. And the discussion of neutral took a leg higher, again. The long-term neutral rate was lifted from 2.75% to 2.9%. That’s significant, and points to a higher terminal rate. Hence, we adjusted our call higher.

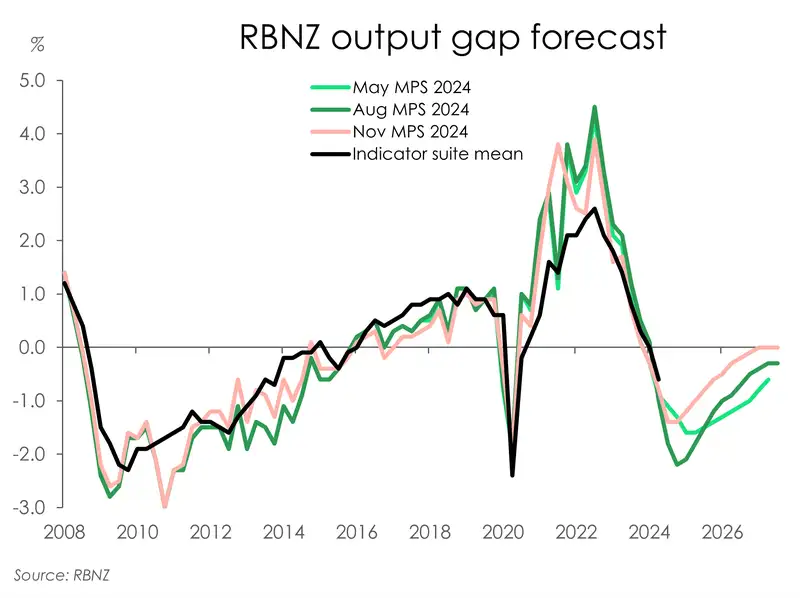

A faster stabilisation of a weaker economy

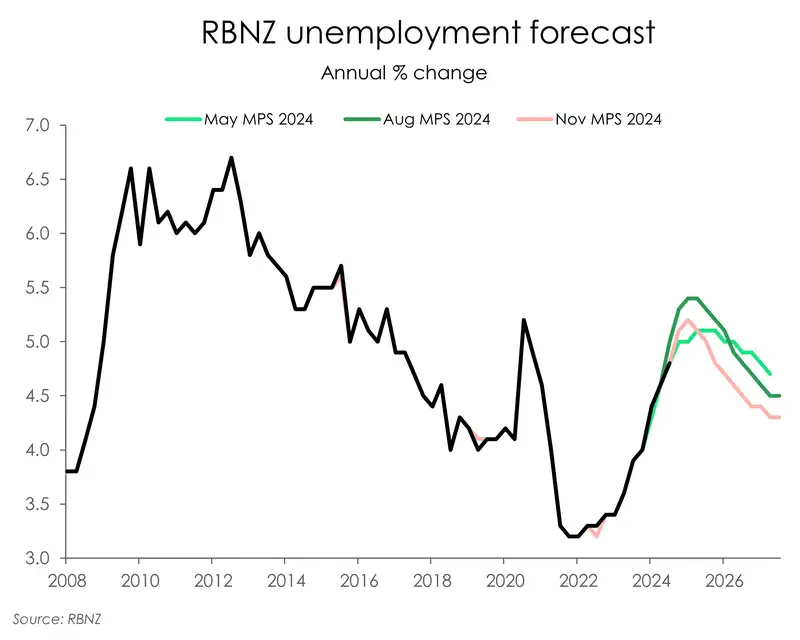

There were a few notable changes made to the RBNZ’s economic projections. Overall, the outlook is one of a faster stabilisation of the Kiwi economy, more persistent (domestic) inflation, as well as a lower peak and faster drop in the unemployment rate. Central to their updated view is the upward revision to their estimations of the output gap – the extent to which demand is running above or below sustainable supply. The RBNZ continues to forecast growing spare capacity, but the output gap is assessed to be less negative – meaning more inflation pressure – compared to their thinking back in August. Spare capacity is expected to diminish over 2025.

Consistent with a less negative output gap, the RBNZ’s forecasts for unemployment have been revised lower and brought back in line similar to their expectations in May. The RBNZ now sees unemployment peaking at 5.2% in the first half of next year (in line with our forecast). Compared to the peak of 5.4% they saw in August. Though consistent with a less negative output gap, the revision to their forecasts is likely aided by a falling labour force participation rate and a decrease in net migration. As such the upgrade in the unemployment rate is not necessarily reflective of a stronger labour market. Similar to how the September quarter saw unemployment rise to 4.8%, mostly a result of a steeper decline in the participation rate as many left the labour market and employment growth contracted substantially. Both of which are signs of a weaker labour market itself.

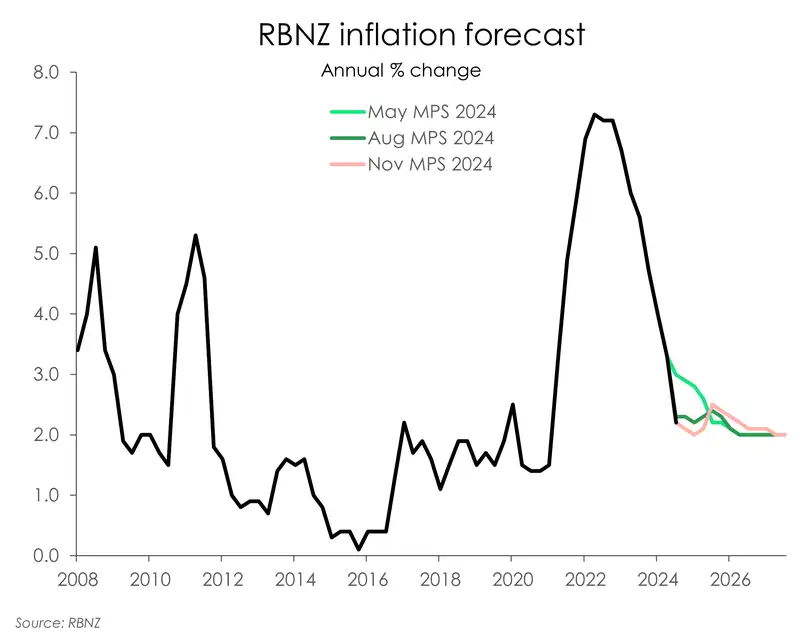

Inflation has fallen back within the RBNZ’s 1-3% target band, but there is a frustrating kink in 2025, where inflation is forecast to rise to 2.5%. Base effects are in play, but there are also some sticky components of domestic inflation – including council rates, insurance and rents – which continue to run hot. Relatively insensitive to monetary policy changes, it will take some time for these components to ease. But overall, the RBNZ is more confident that inflation is sustainably back within the band. And that keeps rate cuts on the horizon.

The reaction in financial markets said it all

In the lead up to today’s decision, rates market traders were subjected to some very strong undercurrents out of the US. In the lead up to the US election, traders in the US started betting on a Trump victory. Such a victory was (and is) seen as inflationary first (the potential for large tariffs), pro-growth and pro-US business second, and inflationary third (more growth, more spending, more inflation). Add to that, more US Government debt. And all that requires higher interest rates. The large surge higher in US yields, put upward (steepening) pressure on Kiwi yields.

Longer-end Kiwi yields were pushed higher, the hardest, rising 60bps. Whereas, shorter-end Kiwi yields were pushed higher, a little less, rising 40bps. And then it all reversed.

The pivotal 2-year swap rate rose from a low of 3.52% on 1st October, to 3.93% by mid-October, and then back down to 3.61% leading into today’s announcement. Following today's announcement, we saw the 2-year lifted 14bps to 3.75%. That's quite the hawkish reaction. And then we saw a slight pullback to 3.71%.

The rates market had 55bps priced in for today’s move. That’s a full 50bps, plus some bets on a 75bp move. Basically traders were willing to bet 5bp for a 20bp gain, if they’d cut 75bp today. It didn’t happen. And the RBNZ were much more hawkish than we expected. We had flashbacks of the MPS in May, when the RBNZ stepped in the wrong direction (again).

On currencies, the Kiwi has had a whirlwind 24hours. And it’s mostly a Greenback story. Yesterday, incoming President Donald Trump grabbed hold of a phone and let loose on his Truth Social platform. Trump promised a 25% tariff on all imports from Mexico and Canada as well as an additional 10% tariff on Chinese goods on his first day of administration. Markets were volatile, with the USD appreciating strongly on the news and the Kiwi dropping to new 2024 lows. The Kiwi had recovered to above 58USc overnight, and today’s hawkish cut saw the Kiwi kicked higher. The Kiwi was trading at around 58.30USc heading into the announcement, and spiked to a high of 58.82USc. Governor Orr’s signal for a 50bp cut in February saw a slight pullback, with the Kiwi trading at ~58.70USc (at time of writing). The Kiwi posted a similar rise against the Aussie dollar, up 70pts, before giving up 20pts following the press conference.

We expect the Kiwi dollar to remain in a broad downtrend in the next 3-6 months. The speed and magnitude of expected easing (rate cuts) underpins our currency forecasts. And we expect the RBNZ to deliver a more aggressive cutting cycle than its peers. That is indeed the case for the US Federal Reserve. Recent comments from officials signal a preference for a more gradual pace of easing. We hold a similarly bearish view for the Kiwi dollar against the Euro, Sterling, and most especially the Yen and Aussie dollar.

RBNZ statement

“The Monetary Policy Committee today agreed to reduce the Official Cash Rate by 50 basis points to 4.25 percent.

Annual consumer price inflation has declined and is now close to the midpoint of the Monetary Policy Committee’s 1 to 3 percent target band. Inflation expectations are also close to target and core inflation is converging to the midpoint. If economic conditions continue to evolve as projected, the Committee expects to be able to lower the OCR further early next year.

Economic activity in New Zealand remains subdued and output continues to be below its potential. With excess productive capacity in the economy, inflation pressures have eased. Domestic price and wage setting behaviours are becoming consistent with inflation remaining near the target midpoint. The price of imports has fallen, also contributing to lower headline inflation.

Economic growth is expected to recover during 2025, as lower interest rates encourage investment and other spending. Employment growth is expected to remain weak until mid-2025 and, for some, financial stress will take time to ease.

Global economic growth is expected to remain subdued in the near term. Geopolitical conditions and policy uncertainty could contribute to increased economic and inflation volatility over the medium term.

The Monetary Policy Committee agreed that having consumer price inflation close to the middle of its target band puts it in the best position to respond to any shocks to inflation.”

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.