Some of the regions have picked up, however. Aucklanders are leaving. Auckland’s, and therefore New Zealand’s, largest migration boom ever recorded has stretched infrastructure, and house prices. Our ‘green maps’ show slower growth compared to 2016, and the near-term outlook is mixed. But we believe the long-term outlook is much better. Our strengthening ties to Asia will bring more demand for everything from food to education, and tourism to housing.

We expect the Kiwi economy to grow above trend next year. Above trend growth should lead to a faster reduction in spare capacity. The missing piece in our economic jigsaw puzzle, inflation, should be found in time. We believe the stars are aligned for a rise in wages and income from here. At some stage, the RBNZ will take their foot off the economic accelerator and start normalising policy, by hiking the OCR. That would be a good story, for later in the next year. So, what is happening in the regions?

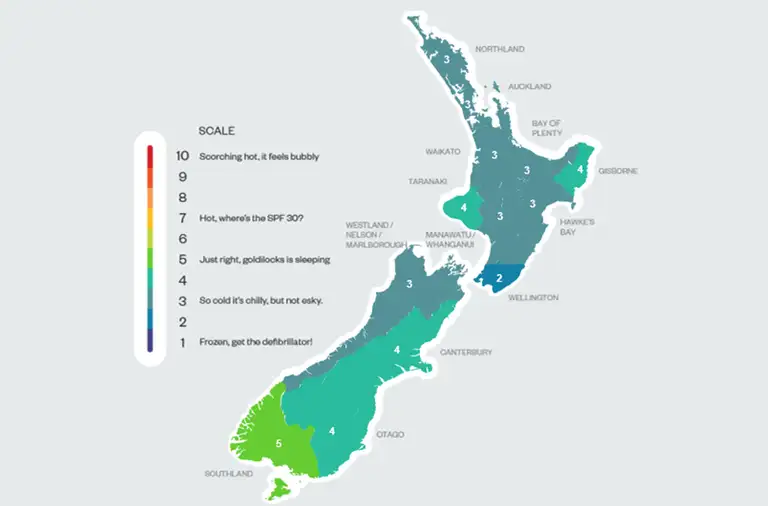

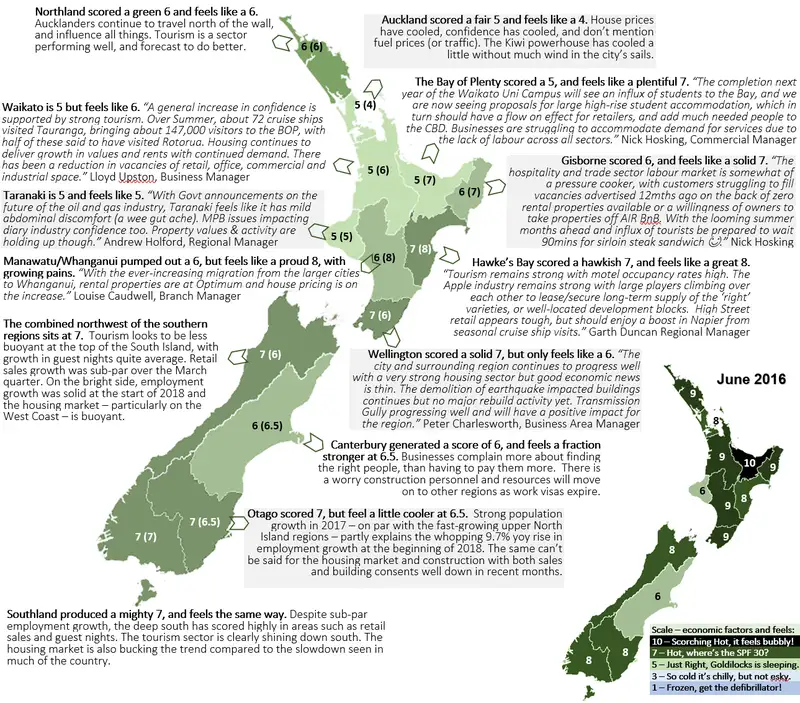

We take a look at the regional indicators and overlay some feel-good (or not-so-good) factors. We use hard data to generate an “economic score”, and anecdotes to give a “feels like” factor. We tap into Kiwibank’s regional networks, to get a sense of how the regions are developing. And we feel the regions are developing rather well. Capacity constraints are common complaints. Uncertainty around political polices plague confidence, but many business face growing pains, rather than contractions.

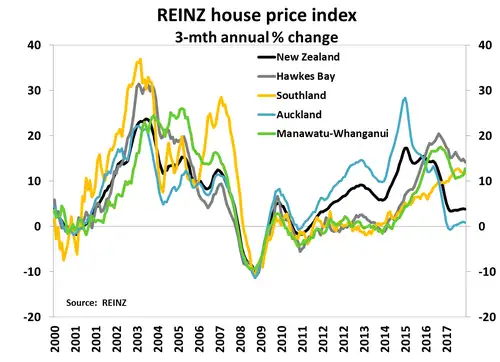

The housing markets of some of the smaller regions (such as the Hawke's Bay and Manawatu) are running at a decent clip. These regions are playing catch-up to the supercity that experienced rapid growth a few years ago. Where Auckland goes, the rest of the country tends to follow. Supply and demand imbalances, particularly acute in Auckland, are starting to show up elsewhere. Retail sales are a mixed bag at the regional level, but have broadly softened in recent quarters. Retailing is an industry facing tremendous digital and Amazonian-style disruption. Labour market indicators are broadly tighter, or stronger, although the data is shockingly volatile at a regional level. A grain of salt is not enough for these stats. But labour markets are tight, and we’re expecting the likely lift in inflation to translate into higher wages. The main concern we heard on the road was around the supply of labour, the ability to find the right people, and threats to migration policy. The rise of the minimum wage was a secondary concern. Although many small businesses, excluding those in Gisborne!, expressed doubt on their ability to pass on higher wage bills.

Housing: what’s hot and what’s not

Housing market activity has gradually recovered from the lows seen in mid-2017, but remains subdued. At present, the wind has died down in City of Sails. The region’s housing market has cooled, and is officially a wee bit chilly. Following a period of phenomenal activity, Auckland housing has been put on ice, and has diverged from most parts of the country. Annual house price growth in Auckland is just above zero. In contrast, house price gains are notably higher in most other parts of the country, as regions play catch-up to Auckland. Sales activity has picked up off the floor in Auckland, and is now rising. But activity is still low compared to a few years ago.

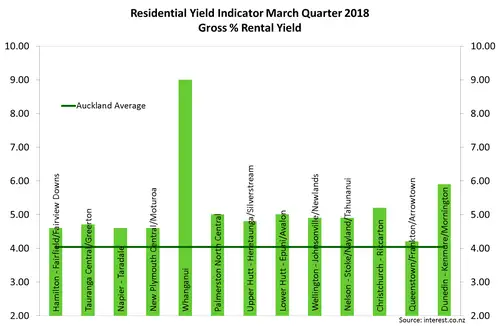

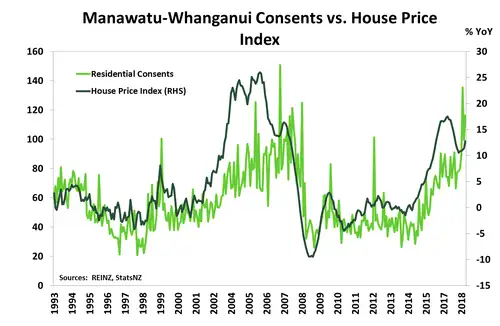

Sales activity quietened quickly across NZ in 2017, but a few regions have experienced a decent recovery. The “hot” areas right now include parts of Gisborne, Rotorua, the Hawke's Bay, and Manawatu-Whanganui. And we confirmed the feverish feeling on the ground with shortened times spent on market. There’s been a flood of interest from northerners (Aucklanders) on a southern pilgrimage. House price growth reached 13% in May in Manawatu-Whanganui, on par with the rate seen July last year. Southland is also a part of the country that has shown a little more resilience is sales activity, and house prices have lifted 12% yoy in May, compared to 9.5% yoy a year ago. Interestingly, these standout regions also have some of the highest rental yields in the country. Could this be good old fashioned economic opportunity at work?

For property investors searching for yield, places like the Hawke’s Bay may offer a higher return. Whanganui is off the charts, offering 9% rental yield. Also, the RBNZ’s loan-to-value ratio (LVR) on investor-related lending may have forced investors to look at cheaper property, given the reduction in available leverage (or larger deposit required). $100,000 deposit goes a lot further south of the Auckland border. North of the wall border, the wildlings are also encountering more Aucklanders in search of cheaper dwellings. Mangawhai has experienced a surge of Aucklanders willing to live on the outskirts of the supercity, and commute the vast distance back. Agents on the ground say ~500 people a day commute from Mangawhai to Auckland, spending a good 1.5-2 hours in a car EACH way. At least they fall outside Auckland’s petrol levy…

The Canterbury housing market is in a cool, still wearing a swanndri category, for reasons specific to the region. For too many years now, the Canterbury market has been distorted by the post-quake rebuild. The resulting recovery in housing supply has had a depressing effect on the housing market. House price appreciation in the region did not experience the highs seen elsewhere. More recently, house prices in Canterbury have flatlined, and so too have sales and activity.

Housing market performance has translated to construction

High demand for housing is evident across the country. Unfortunately, capacity constraints, the cooling in housing price growth, changes in government policy, and difficulty accessing credit, has limited construction activity. Regions that had benefited from the glow of Auckland a few years ago, such as the Waikato, and Bay of Plenty, have seen a fall in building consents more recently. In May, the 338 residential consents issued in the Waikato were 10% lower than the same time last year. May 2017 also happened to be a recent high in consent issuance. The Bay of Plenty has had a similar experience. In contrast, consents issued in Auckland have started to pick-up once again. In May there was a spike in the number of consents in the region, particularly in standalone houses. The 1,530 consents were the highest recorded since late 2002. But questions remain around the capacity to keep this level of building up, in a region that has a significant shortfall of housing. Nevertheless, the lift in consents points to a return to growth for construction in the middle of the year.

Highlights amongst consents mirror some of the housing markets around the country. Manawatu-Whanganui region’s level of residential consents have surged to levels last seen just prior to the GFC. The region’s housing market is currently one of the most resilient in the country. Building consents in the South Island continue to ease, dominated by the fall in Canterbury. Elsewhere, consents look to be following the fortunes of the local housing market.

Tourism is strong in the south, and expected to grow all over

The Canterbury region has seen a solid acceleration in total guest nights (a proxy for tourism activity) since the start of 2017. Guest nights were up 14% in the four months to April compared to the same period last year. Canterbury is a gateway to the South Island, and an increase in guest nights are a positive sign for the tourism sector in the south. All regions in the South Island, excluding Nelson/Tasman/Marlborough, experienced a lift in guest nights since January – a most “welcome” development.

We expect the tourism sector to be a star performer across many regions, for many a year to come. Our currency has depreciated, and we expect the Kiwi dollar to remain lower from longer. Basically, New Zealand is offering a discount to all foreign tourists. We’re a cheaper place to travel with the currency down here, compared to last year. And we’re attracting more and more Asian tourists. The rise of the Asian middle class is a story captured in our agricultural exports, our education industry, and also our tourism sector. China is the obvious hot spot. India will be the next hot spot. It’s a numbers game, and they have more numbers than most.

The labour market was strongest in the south

The labour market performed well in the March quarter, with the unemployment rate hitting a nine-year low of 4.4% and employment growth a respectable 3.1% yoy overall. Employment looked to be strong in the tourism-weighted south. Otago (including the Queenstown-Lakes District) experienced an almost 10% yoy jump in employment, but this is also a region that saw a solid 2.3% lift in its population in 2017 – similar to rates of growth recorded in upper North Island regions. The Tasman/Nelson/Marlborough/West Coast region also experienced a decent 4.8% yoy increase in employment. In the North Island, the far North and east coast regions had decent increases in job numbers. However, employment growth can jump around at a regional level. The Manawatu/Whanganui region experienced a heavy 6.2% yoy fall in the quarter. This was really the only dull spot in the region, one that was otherwise in fine fettle.

Retail sales

Retail sales were broadly weaker over the March quarter, and there were few regions that didn’t reflect the national trend. The Taranaki region has experienced two consecutive quarters of falling nominal retail sales. March quarter sales were 2.5% lower than what was experienced in the September 2017 quarter. And this was before the Government’s announcement to ban future offshore oil and gas exploration. With oil and gas being a major industry in Taranaki, the announcement is unlikely to have been welcome in the region, and it is among the most pessimistic regions. NZIER’s Quarterly Survey of Business Opinion (QSBO) indicated that business sentiment worsened in the region over the June quarter, which might be a sign of continued weakness in spending lies ahead.

Retail sales growth in Auckland growth of 3.2% for Q1 was significantly below par for the region. In the South Island, there seems to be a bit of a north south split. At the top of the island retail sales growth softened substantially at the beginning of the year. Most notable was the 2.6% yoy fall in sales in the Nelson region. Southland once again stood out and experienced the highest rate of retail sales growth (6% yoy) in the country. In addition, Canterbury has experienced a decent lift in quarterly retail sales for the last few quarters.

What are the risks to the regions? They’re foreign and ugly

The risks to our outlook are all foreign and ugly, however. The rising risk of a trade war, between economic giants, will hurt global confidence and growth. A full-blown trade war is still an unlikely outcome. But the characters we are dealing with look like something off a B-grade Hollywood horror. With Trump in charge, the intellectual debate with Jong-un, Jinping, Merkel and others is baffling, but we’re forced to focus on it. To date, the tariff announcements are a rounding error when considering economic impact. But the potential for something far worse, is too high to ignore. Our largest trading partner China is involved in the scuffle. And our second largest trading partner Australia, is more leveraged to China than we are. So in a downturn, we could get hit directly and indirectly. Luckily will grow more inelastic goods – that’s economist speak for “you need it” – but we’re not immune to a sharp downturn or global recession. And all regions will be impacted to some extent.

So, what does it mean for the regions? Well not much, for now. Every part of the country will react differently to foreign distress, but we’re all impacted by a severe slowdown in foreign trade. For now, we focus on what’s actually happening, and what’s likely to happen. And what’s actually happening is good enough. For a fun read on all the risks, see what we put in the interest.co.nz site Top 10 risks to the Kiwi economy; weak income growth, trade war, agriculture risks, the Springbok induced 2008 global financial crisis & more.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.