Our forecast terminal cash rate of 5.5% is unchanged

Although the RBNZ’s threatening to do more. Interest rates could back up near term. But we forecast an inevitable decline later in the year. It’s a game of two halves. We expect RBNZ rate cuts from November.

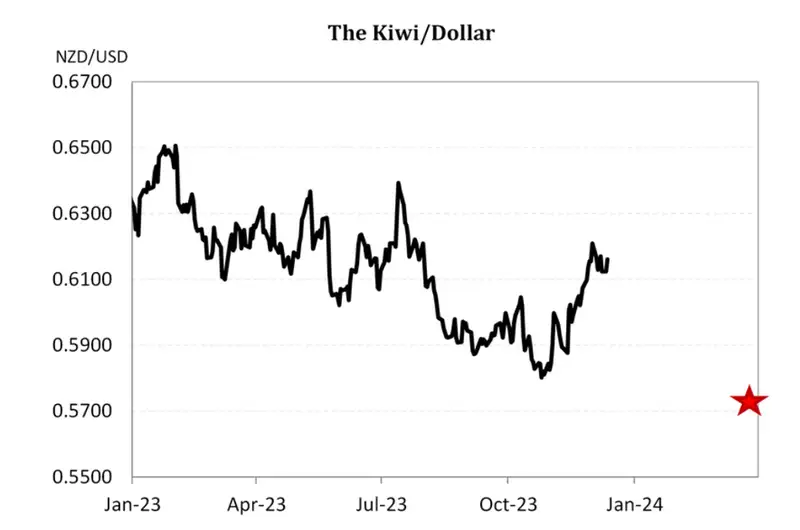

Kiwi dollar has outperformed our expectations this year

For the same reasons we forecast a decline to 55c this year, we forecast a decline to 57c next year. It will be a volatile downward glidepath. It always is.

Currencies have traded in a volatile range

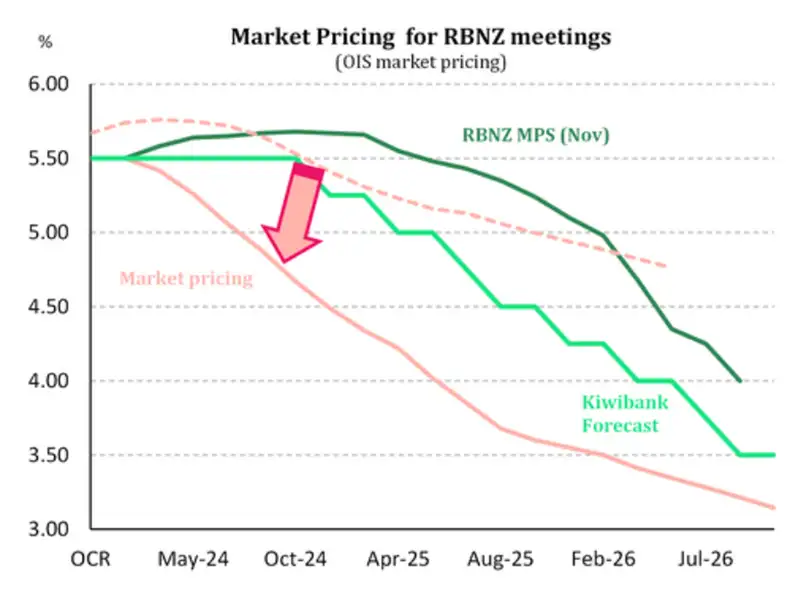

Thoughts of rate hikes have quickly shifted to thoughts of rate cuts. And markets are factoring in aggressive monetary policy easing next year. We’ve been firmly on the dovish side of the ledger. And even we think the market is getting ahead of itself. Time will tell.

Last week, we published our outlook for 2024, see “We’ve updated our forecasts. Mounting migration means more demand, and higher house prices.” We continue to see the current economic climate as particularly awkward for many businesses and households.

We expect to see a shallow recession, that will feel worse than the migrant-inflated figures suggest. On a per capita (per person) basis, we are likely to record a prolonged contraction. Households will continue to feel the pinch. And businesses will continue to put out fires as order books shrink, costs inhibit, and profitability shrivels. Downbeat employment and investment intentions of many businesses speak volumes. Unemployment will most likely continue to rise, wage growth will cool, and inflation will return to target. It is likely to be something close to the ‘soft landing nirvana’ touted in financial markets.

The outlook for interest rates is interesting

The ‘soft landing nirvana’, the consensus forecast, involves a swift return of inflation back to 2%, very modest growth without harsh recessions, and a fair and reasonable loosening in labour markets. Calling it (too) early, market traders are positioning for a quick and easy loosening in financial conditions. Rate cuts are being priced in the first half of 2024. A playbook the RBNZ does not yet endorse. Over the year, wholesale markets have 100bps of cuts priced in. The first cut is expected in May 2024, to 5.25%, followed by a move to 4.5% by November.

We have sympathy for the view that the RBNZ could start cutting from May next year. We recently adjusted our call for cuts to start in May, to November. We did so after the RBNZ delivered a threateningly hawkish diatribe in November’s MPS. So near-term, rates markets could back up, partially removing the chance of cuts. But ultimately, we believe the next big move is down.

Interest rates will remain elevated (and even rise) in the first half. And then a big swing lower in the second. If rate cuts come next year, our prediction (and a year ahead of the RBNZ’s guidance), then the move could be abrasive. We’d expect the RBNZ to move swiftly back towards a neutral setting. Neutral is currently estimated to be around 2.5%. The market currently has a move to 3.65%. That’s too high if the RBNZ are moving back to neutral. The second half of the year could see an even more pronounced shift lower in interest rates (globally).

The Kiwi dollar has outperformed our expectations this year. We had forecast a decline to 55c. Instead, the recorded low in the Kiwi was a short-lived 57.70c. We came close, but not close enough. The Kiwi was in a downdraft for much of the year, as expected, but bounced in November. It was the RBNZ’s stern message that gave the Kiwi wings. Growing speculation of Fed cuts early next year, ahead of the RBNZ, also fuelled the rally. Now the Kiwi is flying high at over 62c. It’s down from the 63-to-65c range at the start of 2023. But it’s higher than we thought. We think the Kiwi will remain elevated into 2024, as the RBNZ’s hawk-like feathers fly higher and shine brighter than their central banking peers. Ultimately, we think the cooling in global demand and reduction in inflation pressures will weigh on the bird. But that may take many a month to see. For the same reasons we forecast a decline to 55c this year, we forecast a decline to 57c next year. It will be a volatile downward glidepath. It always is. But we expect the Kiwi to ultimately fall into a 55c-to-59c range. Basically, we expect to re-record the recent lows.

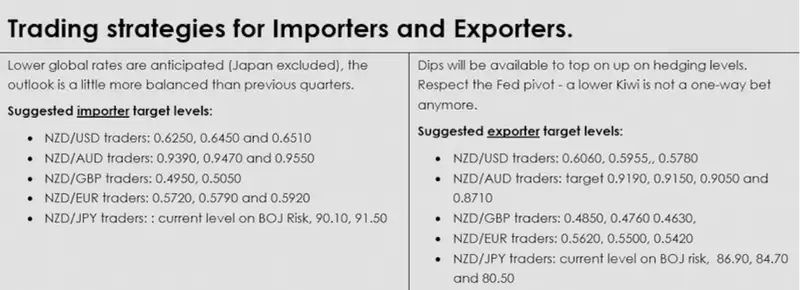

Trading view, what’s next?

In our last FX tactical we called a lower Kiwi, and that did happen for a little while. But now we are changing tack…when the information changes, sometimes you need to update your view. However, the outlook for early 2024 is a little complicated. We believe that the fundamentals are there to indicate a lower Kiwi dollar. However, the market is in a push/pull debate with the RBNZ as to where it thinks interest rate differentials may take us in the short to medium term.

On the balance of probabilities, we think it is more likely that we will see the Kiwi falling in 2024, with stagnant global growth and falling commodity prices likely to be in play. Our forecasts for growth in NZ are also pretty lacklustre, which was hammered home further in our last key data point for the year, Q3 GDP released last week, which showed negative growth in Q3 and a downward revision to Q2. So the fundamentals for a downward correction in the Kiwi dollar are there.

However, complicating matters is the global interest rate story, or more specifically the rate differentials. The markets are pricing different timings and aggressiveness on the rate cut side. At the moment that Fed is priced to be cutting from about the first quarter/half of 2024, and the Fed (almost) confirmed this with their median forecast in the FOMC released last week. On the other hand, the RBNZ have stated higher rates for longer, possibly even another hike.

But, it would appear that the market doesn’t think that will actually happen. We think at this point that the Fed and RBNZ are more likely to start cutting roughly at the same time, or as close as will make little difference. We did see the Kiwi around 0.5700/0.5800 into mid 2024 on a fundamental basis, that is, ignoring interest rate projections from the RBNZ.

However, they have issued some tough talk on fighting inflation. They may not cut until they see inflation at or below 2%, whereas the Fed appear to be ready to accept inflation at a higher level, provided it is heading in the right direction. If we do see the RBNZ rhetoric remain on the hawkish side, whilst the Fed is looking to cuts next, then this will see the Kiwi pretty well supported. At the moment, we see a break of 0.6250 to open the door to 0.6400 pretty quickly. But we won’t hear from the RBNZ until late February. After that…..what else is gonna happen in the world first?!

Kiwi crosses in the months ahead

NZDUSD (5-year daily)

When the Fed pivots, things change. Over the past few weeks as markets (correctly) anticipated Fed easing in 2024, NZDUSD traded back towards the top of its freshly defined multi-year trend channel resistance zone. Whilst the broader bearish technical picture remains in place, clearly a greater risk now exists of a break beyond a key 0.6250 level as the USD loses favour with a lower interest rate environment looming. From this point, 0.6450/0.65 is the next broader area of resistance. On the flipside, the domestic situation doesn’t necessarily lend itself to a higher Kiwi and as such, expect bouts of NZDUSD weakness in the quarter ahead. The Dec-quarter CPI print (due out Jan 24) will likely be a key moment. Should the data embolden the RBNZ’s ‘no cuts until 2025’ view, then expect NZDUSD to live more closely to 65 than 57 cents.

NZDAUD (5-year daily)

It won’t happen overnight, but it might happen this quarter! The picture remains the same as recent update(s). A continued narrowing triangle with support now at around 0.9190/92 and resistance at 0.9380/90 is all that matters. The view that ultimately the RBNZ will have to pivot to a more aggressive easing stance than the RBA in 2024 still argues for a break lower for the cross. But again, January’s CPI could throw a spanner in the works. A break of 94 cents would encourage Kiwi bulls towards 0.95/0.9550. While Kiwi bears would be looking to target 0.9150 and then 0.9050.

NZDJPY (3-year daily)

Is it tomorrow or is it January? Recent hints from BOJ officials of a looming end to its negative rates regime has the JPY bulls licking their lips at last. The carry on long JPY positioning has being brutal, but a combination of anticipated Fed easing and BOJ tightening in 2024 has the potential to put a rocket under the JPY. Technically, the picture is starting to break lower for NZDJPY, but ultimately it will be a rate hike from the BOJ that really gets things going. As previously highlighted, watching for moves back towards 2022 lows around the 80.00 level should the BOJ deliver on the market’s anticipation.

NZDEUR (3-year daily)

Failure to make a new low in Oct / Nov and then a breach of 2022/23 downtrend provides a more supportive outlook for NZDEUR. Whilst the ECB are yet to commit to a pivot like the Fed as this point, market pricing anticipates 145bp of policy easing over the next year from the ECB. Such heavy pricing has provided support to NZDEUR. With only seven meetings to deliver this 145bp of easing, the risk to ECB disappointing easing expectations is now high. If so, this could be a catalyst to trigger a retest of the 2023 lows. Like NZDUSD, January’s NZ CPI will be important for the coming quarter. For now, respect the recently developing channel with support towards 55 cents and resistance around 0.5720 currently.

NZDGBP (5-year daily)

In similar fashion to NZDUSD and NZDEUR, the Kiwi has found support vs the pound as markets anticipate a BOE victory over inflation – pricing just under 100bp of easing in 2024 from May onwards. Arguably, the RBNZ and BOE easing paths, at least in the initial phase, may largely occur in a similar fashion and with it in turn neutralising any large price action in either direction for NZDGBP. Technically however, a now developed head-and-shoulder pattern in the second half of 2023 would argue for a break above 0.4950 with a move to 0.5050 from there. On the downside, 0.48/0.4840 would be a key level for renewed NZDGBP weakness.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.