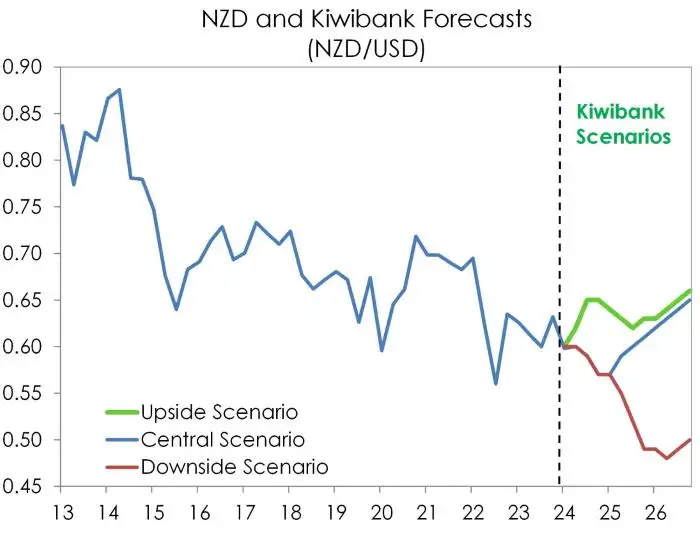

- The Kiwi dollar has broadly outperformed our expectations. And that’s despite the weak local economic backdrop. It’s all about interest rate differentials. And the RBNZ has maintained a relatively hawkish tone, compared to its central banking peers.

- The timing of rate cuts is one thing – and we’re still waiting for the Fed to lead the RBNZ. Magnitude of cuts is another – and we believe the RBNZ will be forced to ease policy at a greater rate than its peers.

- Near-term, the Kiwi will likely remain elevated as the RBNZ’s hawk-like feathers fly higher. Beyond, the cooling in global demand and easing in inflation should weigh on the Bird. We expect the Kiwi to ultimately fall into a 55c-59c range in 2025. But it’s likely to be a volatile downward glidepath.

Since our FX Tactical in April, the Kiwi dollar has broadly outperformed our expectations. We had expected the Kiwi to be trading in closer proximity to a 57-59c range, with the clear deterioration in the economy. But the Kiwi is currently trading around 61c. For traders, it’s all about interest rate differentials. Not even the weak economic data of late has spurred much (sustained) price action. Instead, it’s inflation prints and central bank statements that set the trajectory of exchange rates. And the relatively hawkish tone of the RBNZ continues to support the Kiwi dollar. Although we have also been surprised by the hawkish tone out of the Fed, as the US economy continues to outperform. We are still waiting for the Fed to lead the RBNZ.

As we noted in March: “If the Fed leads, then the Kiwi currency should hold up against the greenback, helping to ease imported inflation. We need that sort of help. It is only when the RBNZ comes into action that the Kiwi is likely to depreciate, helping exporters. Indeed, we see the Kiwi holding strong near term, before falling to 57c by year-end. It is only when the RBNZ comes into action that the Kiwi is likely to depreciate, helping exporters. Indeed, we see the Kiwi holding strong near term, before falling to 57c by year-end.” (Soft landing nirvana, March 2024).

The Kiwi may have regained flight, but it still faces the same headwinds. We stick with our long-held forecast for the Kiwi flyer of 57c by year-end. Although the risk is towards a postponement of that descent until 2025. Because the RBNZ may choose to hold into 2025.

Near-term, we think the Kiwi will remain elevated, as the RBNZ’s hawk-like feathers fly higher and shine brighter than their central banking peers. The stronger Kiwi flyer will assist with the inflation fight, and help importers.

Ultimately, we think the cooling in global demand and reduction in inflation pressures will weigh on the bird. But that may take many-a-month to see. It will be a volatile downward glidepath. It always is. But we expect the Kiwi to ultimately fall into a 55c-to-59c range in 2025. Basically, we expect to re-record the recent lows. The downward glidepath for the Kiwi flyer will eventually help our exporters, with tourism and agriculture in need of a boost.

Interest rates will hold, for now, and hopefully fall

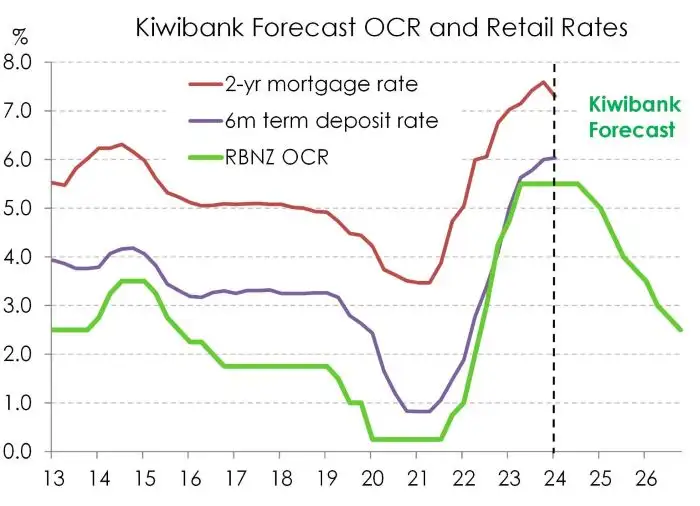

The outlook for interest rates is becoming clearer, if only delayed. We have experienced a great deal of volatility in rates markets, with rate cut expectations being pushed back (and forth), but not out. Because the path for policy is ultimately pegged to the path of inflation.

Current wholesale rates have factored in a full 25bp rate cut in November, followed by a second in February. Thereafter, rates decline and imply a cash rate around 4% in early 2026. That’s 150bps of easing. We agree with the market’s pricing near term. But the market is light on cuts over the medium term. We expect 25bp cuts in November, February, and at every meeting until we get back towards neutral. Neutral is the Goldilocks rate, currently around 2.75-3%, that’s neither too hot nor too cold.

Based on our view, the market is well priced until mid-2025, but under-priced thereafter. In our financial market update, titled “Soft landing nirvana: ‘on a plain’”, we noted that:

“Bets on rate hikes have swung to rate cuts. If we look at the OIS (overnight index swap) curve, traders are placing some handsome bets on cuts to come as early as August (-26bps at 5.24%). And there is 66bps of cuts priced by November (at 4.84%). Our call is for the first 25bp cut to come in November, ahead of most commentators, and even we’re surprised at the speed at which cuts are expected… The cuts priced into July, and out to February, are likely to be pushed back… as the RBNZ under-delivers on over-priced cuts.”

Our expectations have come through, with fewer cuts priced near-term. But the next big move in rates is yet to come, and it will. It’s more a 2025 story.

When the RBNZ start easing, whether it’s in November or February, or later, the big move in rates will be over 2025-26 as the terminal cash rate is adjusted towards a neutral setting. The rates market will need to adjust to a 3% terminal rate, and that’s another 100bps of decline, or bull-steepening.

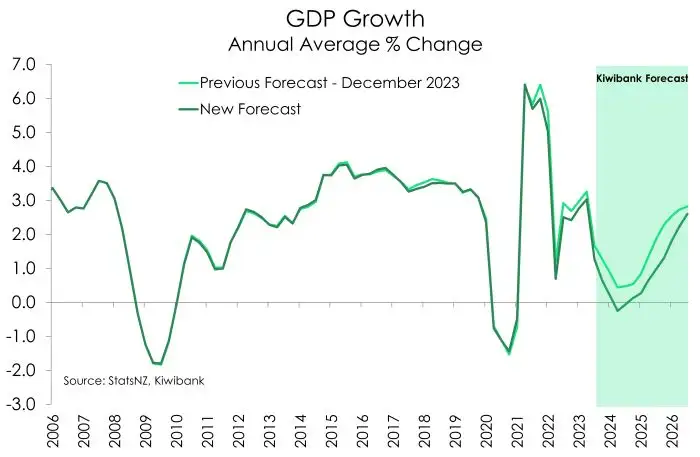

Economic outlook: Survive til ’25. It’s a white-knuckle ride

Over the past 18 months, the Kiwi economy has been at a standstill. And the forward-looking indicators suggest that the economy will struggle to eke out much growth in 2024. We have downgraded our forecasts for the Kiwi economy. We see the economy growing just 0.1% this year, down from an already soft 0.5%. The RBNZ has been among the most aggressive central banks in a quest to tame inflation. The “higher for longer” rates environment hurts. And the impact of restrictive monetary policy is undeniable.

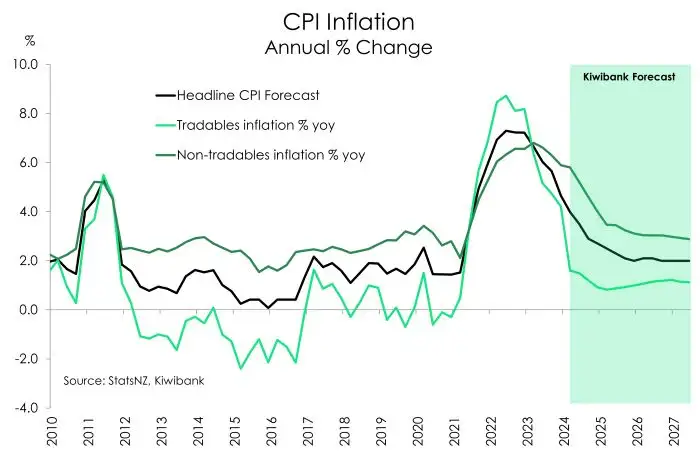

At the end of the day, it’s all about inflation. Kiwi inflation has fallen at pace from a 7.3% peak to 4%. But it will be a slower return to 2%. Home-grown inflation is proving persistent which is problematic. But aggressive rate hikes are working. Weakness in the economy should quell domestic inflation pressures. We still forecast inflation falling returning to the RBNZ’s 1-3% target band by the end of the year.

For now, the RBNZ are in a holding pattern. Inflation remains outside the target band. And interest rates will remain restrictive. But we think the RBNZ will be able to ease policy earlier than they currently expect (second half of 2025). If the economy evolves as we expect, we forecast the first rate cut to come in November. The risks, however, are tilted toward a delayed kick-off. Regardless, we are confident that the next move in rates is down. We may be wrong on timing, but it’s the direction and magnitude of policy moves that’s important.

2024 may be another lacklustre year for growth, but it’s always darkest before the dawn. And the good news is, dawn is approaching. We see the economic outlook improving into next year. Because 2025 will be the year of significant rate cuts.

See our latest economic projections.

Trading view, what’s next?

In our previous update, we outlined a general downside bias to the NZ Dollar outlook driven by overpriced Fed easing expectations and earlier, but more aggressive RBNZ rate cuts from late 2024. Fundamentally, the Fed story has ebbed and flowed across the past quarter, but the timing of the start of US rate cuts now looks to be sometime between Sep and Dec. The anticipated divergence in interest rate differentials through to 2025 is key to the outlook for the Kiwi. We believe the RBNZ will eventually be forced to ease policy at a greater rate than that of the Fed. The Fed's latest “dot plot” (outlook for the federal funds rate) signalled that the monetary easing path in the US will more likely be an elongated cutting cycle i.e. don't expect a 25bp cut at each meeting date. The RBNZ easing cycle however may well more aggressive given the ever-weakening domestic data outlook. When the RBNZ moves, the speed of cuts we may see 25bp increments at each meeting. Against a more conservative Fed, this is not supportive for the NZ Dollar.

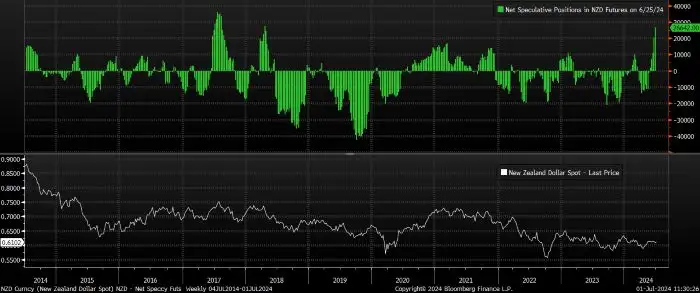

Over the past few weeks, we have also witnessed a big build-up in long CFTC (Commodity Futures Trading Commission) speculative positioning in the Kiwi over the past few weeks. Typically, an increase in long futures positioning is accompanied by a strengthening underlying currency (as can be observed in the chart below). Given this position build-up, we would have expected the Kiwi to be at least at 62c. But this price action has not played out. We suspect this behaviour is largely driven by offshore investors seeking a diversification of yield into other currencies in addition to the US Dollar – i.e. a flow from the likes of the EUR, JPY, and GBP into the Kiwi. Given the economic weakness, and without the recent positioning support, the Kiwi should have a 59c-handle by now. However, we remain wary that this fast money can leave as quickly as it arrives. Should we see a lower-than-expected Q2 CPI print led to any form of RBNZ dovishness in the coming quarter, then watch out for an unwind of this position build-up (selling Kiwi). Offshore speculative investors will soon catch up in their understanding of how the NZ economy is truly performing. Carry erosion will also become an even greater risk going into 2025.

For now,

It won’t happen overnight, but it will happen.Rachel Hunter, Pantene 1990s - and believe it or not, the Kiwi was at 60c back then as well

We remain patient for a lower Kiwi to play out and continue to respect a broader 0.5910 – 0.6200 range in NZDUSD in the weeks ahead. – Hamish Wilkinson, Senior Dealer – Financial Markets

Kiwi crosses in the months ahead

NZDUSD (5-year daily)

The triangle continues to converge on November 2024 – is there something in the tea leaves here? Following an attempt to break out of either side of the triangle support and resistance levels, the broader picture remains unchanged. Whilst this triangle is largely symmetrical in formation, it could be argued the shape is a slightly bearish descending triangle - meaning a higher likelihood of an eventual break to the downside. We believe the fundamentals will ultimately support this outcome as time moves towards the end of 2024

NZDAUD (5-year daily)

0.9030 – 0.9050 remains the key zone to open up further downside moves in NZDAUD. The past quarter has seen the cross largely respect both upside and downside medium term levels between 0.9050 and 0.9300. Now as the fundamental differences in the economic performances of both NZ and Australia start to play out, we are becoming more emboldened of an eventual move lower to retest of levels below 90 cents – and perhaps ultimately a test of the 2022 low at 87 cents. The slow and steady approach of the RBA in its monetary settings means there is perhaps either further tightening to come or simply that rates in Oz will remain high for even longer. Given our outlook for NZ rates over this same period, it is hard to argue for upside performance in NZDAUD. AUD buyers should remain active on rallies into 0.9250/ 0.9300.

NZDEUR (3-year daily)

Last quarter we commented that we would expect the Kiwi to hold its own versus both the Euro and Pound as the ECB and BoE lead the pack with policy easing. This has largely played out to plan, with both NZDEUR and NZDGBP trade towards the top end of expected ranges. Pass marks there. Across the coming quarter, further gains may now be limited as a number of central banks including the ECB indicate easing cycles will likely play out in a protracted nature. We are also mindful of the developing political situation in France and the potential longer-term impacts for the European community. Following a solid move higher across the quarter, NZDEUR ran into a strong intersection of long-term channel and multi-month resistance circa 0.5750, NZDEUR is once again easing lower as selling pressure resumes. Expect to see initial support develop around the 0.5550 (0.5416 – 0.5750 61.8% Fibo) level.

NZDGBP (5-year daily)

Consolidation reigns. The market has largely readied itself for a change in UK government in coming weeks. The continued improving inflation and growth outlook in the UK will enable the BoE to start policy easing in the late UK summer. NZDGBP will likely maintain a broader 0.4720 – 0.5020 range in the quarter ahead. A more fiscally expansive UK Labour government will likely lead to GBP outperformance in time.

NZDJPY (30-year monthly)

There’s always one. A number of commentators have tried and failed to call an end to the JPY deprecation story…and we are one of them. In markets we call it “trying to pick up pennies in front of the steamroller” – it’s a dangerous game which can often flatten you, and this one seems to be playing out that way. Pulling out the 30-year chart greatly illustrates where things sit historically. There has only ever been one time in the post-Kiwi-float period that NZDJPY has traded at current levels – a year or so before the GFC…Ultimately, it is all blue sky beyond this point from a technical perspective. Lines don’t matter there. The last few weeks of NZDJPY strength has clearly being driven by a chase for yield perspective (demonstrated in the speculative positioning data) as the BoJ continues to throw warnings but with little follow-through to the JPY deprecation. But maybe, just maybe, traders will respect this current level going back to 2007. It’s a long way down from here once yield differentials start to unwind!

– Hamish Wilkinson, Senior Dealer – Financial Markets

Glossary

Commodity currencies: include the Kiwi dollar, Aussie dollar, Canadian dollar, Norwegian krone as well as currencies of some developing nations like the Brazilian real. These countries export large amounts of commodities (raw materials like oil, metals and dairy) to the world. And commodity currencies are highly correlated with the global prices of such commodities. When the global economy is strong and demand for commodities is high, commodity prices and thus commodity currencies, tend to outperform. The Aussie and Kiwi dollars are famously known for the sensitivity to good news (risk on) and bad news (risk off).

Interest rate differentials: The difference between the interest rates earnt on two different currencies. New Zealand may offer a significantly higher interest rate than those in Japan, for example, and we see an inflow of Yen into Kiwi dollars (known as the “carry trade”). The widening, and narrowing, of interest rate differentials can have a material impact on capital flows and therefore the exchange rate.

Monetary hawk (hawkish) and Monetary dove (dovish): Characterisations of central bank monetary policy. The hawk is a bird of prey and describes a central bank aggressively raising interest rates to slow economic growth and tame the inflation beast. The peace-loving dove however, reflects a central bank trying to stimulate economic growth by cutting interest rates.

Moving averages: A common method used in technical analysis to smooth out price data by showing the average over various time periods.

Relative Strength Index (RSI): is a popular momentum indicator used by forex traders to measure the speed and change of movements in currencies. It is a useful tool to evaluate overbought or oversold market conditions, in turn signalling whether a currency pair is due a trend reversal or a corrective pullback in price. Low RSI levels indicate oversold conditions (buy signal), while high RSI levels indicate overbought conditions (sell signal).

Reserve currency: The US dollar is the global reserve currency. The dominance of the US dollar in international trade means most central banks and financial institutions hold large amounts. The majority of FX reserves are held in US dollars. The US currency and debt markets are the most liquid in the world. And liquidity (the ability to buy and sell, especially in times of stress) is important. The next most traded currency is the Euro, but it is nowhere near as popular as the US dollar. About 60% of global reserves are held in dollars, with the Euro attracting only 20%, according to the IMF.

Safe haven currencies: A safe haven currency is one where investors hide from extreme market turbulence. The US dollar tops the list of safe haven currencies. But the Yen and Swiss Franc are also beneficiaries of save haven flows (money searching for safety). If a war breaks out tomorrow, we’re likely to see a spike in the USD, Yen, and Swiss Franc. The Kiwi dollar would be hit quite hard, and fall against these three currencies. Gold is also considered to be a safe haven asset during times of stress.

Support and Resistance levels: These are chart levels that appear to limit a currency’s price movement. A support level limits moves to the downside; a resistance level limits moves to the upside.

Terms of trade: The ratio of the prices at which a country sells its exports to the prices it pays for its imports. Put simply, terms of trade is a measure of a country’s purchasing power with the rest of the world. How many imports can be purchased per unit of exports – import bang per export buck. An increase in our terms of trade means New Zealand can purchase more import goods for the same quantity of exports. And a rising terms of trade lifts the incomes of exporters and the businesses and communities that support them.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.