- Jerome Powell of the US Fed gave a dovish speech over the weekend. The time has come to adjust policy, and that means a rate cut in September. It looks like the Fed will finally join the RBNZ, ECB, BoE, BoC and others in cutting rates.

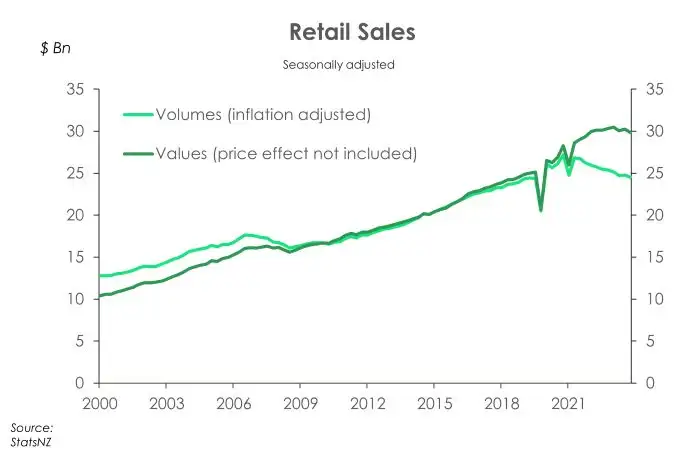

- Domestically things were quiet here last week bar for some housing and retail sales data. Neither of which were pretty. Retail sales were rather dire with a 1.2% contraction over the June quarter. The trade data comes as no surprise as we continue to hear the screams of retailors doing it tough.

- Our COTW looks at July’s REINZ housing data. House prices were down 0.33% over the month, and effectively flat over the year. And it was rather mixed across the regions. But we think it’s time to lift our heads and look to growth next year.

The time has come for policy to adjustUS Fed Chair Jerome Powell, Jackson Hole Symposium 2024

At the annual central banker gathering in Jackson Hole, US Fed Chair Powell gave possibly the clearest signal yet that the Fed will cut interest rates at its next (September) meeting. Entering the next stage of monetary policy has always been contingent on the Fed’s confidence in inflation sustainably returning to the 2% target. And now, their confidence has “grown”, with Powell acknowledging that the upside risks to inflation have diminished. Like the RBNZ, it has been a two-year long battle with inflation well above target. But at Jackson Hole, Powell declared victory.

Powell’s remarks on inflation were expected. But it was his emphasis on protecting the labour market that had financial market participants sitting up and paying attention. The US unemployment rate has been on an uptrend, most recently hitting 4.3% and triggering a recession indicator. Powell’s Jackson Hole appearance marked a shift in focus from inflation and toward employment - “We do not seek or welcome further cooling in labour market conditions…We will do everything we can to support a strong labour market as we make further progress toward price stability”. Reading between the lines, a 50bps cut is on the table, as the downside risks to employment have increased in their view.

As usual, Powell heralded their data-dependent approach going forward. “The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook and the balance of risks”. The August payrolls print will be pivotal in the ’25bp or 50bp’ debate as we near the September FOMC meeting. An exceptionally weak print will raise the likelihood of a big bang cut to begin the easing cycle.

Ultimately, the Fed’s confidence in beating inflation and its new quest in safeguarding the labour market to achieve a soft landing boosted investor sentiment. Equities rallied, bond yields tumbled, and the USD was dumped as the market looks to the cutting cycle.

Here at home, it is quiet on the data front. That said, we did see REINZ’s housing data and Stats NZ’s retail trade data last week. And it wasn’t pretty. House prices fell for the third consecutive month in July (see COTW). Meanwhile retail sales recorded a 1.2% contraction over the June quarter. And compared to last year, retail sales were down 3.5%. Spending was weak across the board, with eleven of the fifteen industries in decline. But most noticeably, spending was weak across discretionary items. Over the quarter, spend on electronics was down 6%, motor vehicles down 2.7%, and food and beverage services down 1.9%. Meanwhile, recreational goods, accommodation and clothing were all down over 4%. Overall, the retail trade data was consistent with another quarterly contraction in the economy (GDP). It’s no surprise, as we, and the RBNZ, have forecast another decline in June.

This week, we’ll see a range of monthly confidence surveys. And given that the survey period for these would have captured the RBNZ’s rate cut, and softer inflation outcomes, we may see an improvement in sentiment across businesses and consumers.

Building consents, out on Friday, will be another data point to watch. Especially after consents plummeted in June (falling 13.8%). Given such a large decline in one month we’ll likely see a bit of a bounce back in July. But unfortunately (god, save our housing shortage) is likely to remain weak, until the housing market improves. The story for 2025 is one of rapid rate cuts, the return of the investor, and the slow rebound in building (consents).

Financial Markets

The comments below were provided by Kiwibank traders. Trader comments may not reflect the view of the research team.

In rates, yields continue to recover from post RBNZ lows:

“Last week NZ yields continued to recover last week from the post RBNZ lows as profit takers lurked while worries about what might or might not be said at Jackson Hole added further support. The 2036 NZ Government bond syndication added pay side as buyers hedged their interest rate risk. Powell’s Jackson Hole speech all but confirmed an easing at the September meeting, the market noting the lack of the word gradual in the message, but any -50bp cut highly contingent of labour market weakness. US market pricing for FED cuts is of a similar magnitude to NZ i.e. -34bp of cuts priced into 18 Sept vs NZ -34bp priced into 9 October and 160-170bp of cuts by mid next year in both markets. Like the in sync’ed central bank aftermath of the covid hiking cycle the cutting cycle looks to be similarly synced amongst central banks (ex. RBA, BOJ). The parallels to the US often cited, and NZ daily wholesale moves certainly hitched to that wagon.

NZ data is scarce this week so focus will shift to offshore moves and the what the FED will kick off with while US PCE may/may not cement a -50bp cut. While middle east escalation may provide a small flight to safety bid. Aussie monthly CPI will be of fleeting interest to NZ given how out of sync the two economies are. It still feels expensive to hold received positions in the kiwi short end due to carry and roll (15bp 1yr, 9bp 2yr per month). The offset to this is the market was broadly right and RBNZ forecasts played catch up, it can be difficult to stand in the way of that momentum, more so as the market looks to the US for direction. There is the double RBNZ meeting argument doing the rounds for November, hence the -40 bp priced into that meeting (and the -34bp priced into October). There is offset to the downside/receive side flow, some of that depends on mortgage holder behaviour and by how exposures are spread across fixed terms.” Ross Weston, Head of Balance Sheet – Treasury.

In currencies, when the Fed speaks, we listen:

"When the Fed speaks, the rest of the financial world listens. As Jerome Powell all but confirmed the start of monetary easing in September over the weekend, the US Dollar and US Treasury yields declined – seeing NZDUSD breaking higher out of its longer term converging triangle patten and now testing an important reversal level around 0.6220/30 mark. With the Fed funds rate now likely a path lower, clues from other Fed officials at Jackson hole that the likely neutral level of 3% provided the market with some idea of the likely depth of the forthcoming US easing cycle. 3% may sound familiar as it is also the bottom of the current expected RBNZ OCR track from the recently updated MPS. So for keen followers of FX rates and in particular the performance of NZDUSD in coming weeks and months, for now the story is not about when the Fed starts its easing cycle, nor at what level both the RBNZ and Fed find the neutral level in cash rates – they look relatively the same at this point of time. The focus for markets now is simply is on the glide path. Is it a story of 25bp at each meeting, or every second meeting or perhaps even the possibility of larger, more urgent action? Time will tell and as the story unfolds, NZDUSD will be pushed and pulled with it. For now, we are keenly watching current levels around to determine whether NZDUSD has potentially shrugged off its downside risks from a technical perspective. In saying that, a lot has now played out in terms of the start of the global easing story and we still feel risk exists of renewed weakness in the Kiwi as local data continues come in soft. But as stated above, with interest rate expectations now coming into more alignment, deeper losses beyond the recent witnessed lows are now starting to recede somewhat." Hamish Wilkinson, Senior Dealer - Financial Markets.

Weekly Calendar

- Here at home, monthly indictor data are due out this week. On Wednesday, monthly jobs data will likely show another fall in the number of filled jobs over July. As has been the case recently, the June 0.1% fall may be (significantly) revised lower. ANZ business and consumer confidence (out Thursday and Friday, respectively) may show a lift in sentiment in August as the survey period captures the downside surprise in inflation as well as the RBNZ's 'surprise' cut and dovish pivot. Lastly, building consent data for July will be released on Friday. Building consents may bounce in July following the Matariki-impacted 14% drop in June. However, residential consents have been on a broad downtrend amidst tight financial conditions and a weak housing market.

- Across the Tasman, Aussie inflation data is in focus. Over July, headline inflation is expected to moderate to 3.4%yoy from 3.8%yoy. The recent fall in petrol prices as well as newly introduced cost of living rebates likely offset price gains elsewhere. The trimmed mean monthly indicators will be closely watched to gain a clearer picture of the underlying trend.

- July US PCE inflation data is due at the end of the week. Headline PCE inflation likely accelerated 0.2% over the month due largely to price gains in financial services as well as a slowdown in housing rent. Core PCE likely kept pace with June's 0.2% gain, with the annual rate climbing slightly to 2.7% from 2.6%. With the US labour market cooling, income growth is clearly slowing.

- The flash estimate of Euro-area inflation for August will be released this week. Headline inflation likely eased sharply from 2.6%yoy to 2.2%yoy. Favourable base effects - notably on energy - may see inflation fall below the European Central Bank's 2% target in the coming months. Core inflation, however, will likely remain elevated due to sticky services inflation. In August, core inflation likely slowed only slightly to 2.8% from 2.9%yoy. The persistent strength in core inflation will likely see the ECB moving cautiously forward with rate cuts.

- Tokyo inflation for August is due out this week. As desired by the Bank of Japan, the latest reading will likely show an acceleration in consumer price growth over the month. Tokyo CPI likely picked up to 2.3% in August from 2.2%. And core CPI (excluding fresh food) is expected to hold at 2.2%yoy. A hotter print will likely bolster speculation that the BoJ will hike rates again this year.

See our Weekly Calendar for more data releases and economic events this week.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.