- The IMF released its latest World Economic Outlook which celebrated the end of the global fight against inflation. Even better is the resilience of the global economy throughout the disinflation process.

- Downside risks are rising and now dominate the global economic outlook. Between geopolitical risks and a deeper slowdown in China, there is plenty reason for policymakers to remain vigilant.

- RBNZ Governor Adrian Orr was on the newswires last week. The key takeaway was two words: “more incremental”. Our Chart of the Week breaks down what this means.

“The global battle against inflation is almost won”, according to the IMF’s latest World Economic Outlook. Global headline inflation is forecast to fall to 3.5% by the end of 2025, from an average of 5.8% in 2024 and the 9.4% peak in 2022. It’s great news. Even better is the resilience of the global economy throughout the disinflation process. We’ve managed to avoid a global recession altogether. But now the IMF warns of rising downside risks.

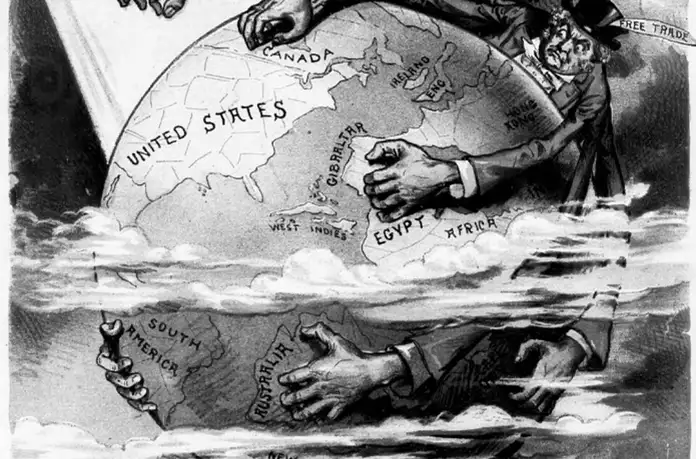

While the global decline in inflation is a major milestone, downside risks are rising and now dominate the outlook: an escalation in regional conflicts, monetary policy remaining tight for too long, a possible resurgence of financial market volatility with adverse effects on sovereign debt markets, a deeper growth slowdown in China, and the continued ratcheting up of protectionist policies.IMF World Economic Outlook, October 2024

The IMF made no change to its global growth forecasts. The global economy is still expected to grow 3.2% this year and next, which the IMF describes as “stable yet underwhelming”. Beneath the headline, the US was the only advanced economy to see an upgrade to its growth outlook due to robust consumer spending. In the IMF’s eyes, the so-called ‘soft-landing’ sought by the US Federal Reserve, has largely been achieved. Growth projections for emerging market powerhouses like India and Brazil were also upgraded. However, growth for the second largest economy, China, was dialled back. The collapse of the Chinese property market and subdued consumer confidence sees China’s economic growth slowing from 5.2% last year to 4.8% this year and 4.5% in 2025. That’s not good news for us. A severe slowdown in China hits us directly through our trade with Asia and volatility in financial markets. But our exposure to a Chinese slowdown is compounded by our links with Australia. Australia is our second largest trading partner. And any Chinese-led slowdown in Australia is likely to spill over to New Zealand. Australia exports materials used for construction in China. And China is Australia’s largest trading partner.

So, what about Aotearoa? The IMF’s outlook is largely unchanged with economic growth climbing back to ~2% in 2025. But the starting point is softer. The IMF now projects 2024 to record flat growth, down from a forecast of 1%. In per capita terms, we know that economic growth has been worse than the GFC. And on the global scale, the IMF puts us down among the worst in the world. It’s a result of aggressive monetary policy tightening which has driven our economy into recession. But now that the RBNZ has closed the chapter on rate hikes, the outlook is improving. Inflation is back within the band and rate cuts are coming through thick and fast. But hold your horses, RBNZ Governor Adrian Orr signalled more “incremental” moves on the way down in a speech last week (see Chart of the Week). Nonetheless, 2025 should be the year we climb out of recession.

Financial Markets

The comments below were provided by Kiwibank traders. Trader comments may not reflect the view of the research team.

In rates, nerves (and yields) are high ahead of the US election

“The Kiwi rates markets is in a nervous skittery phase ahead of the US election next week. That uncertainty added to by the NZ Employment report due November 6th at the same time the US election result is due. US markets appear to be running with a higher yield as a victory by either would lead to higher inflation and a larger deficit. However, for the rest of the world that base themselves on US market moves the outlook is less certain, as tariffs could create a deflationary environment, and deeper cutting cycles outside the US to offset. In summary, the only certainty is uncertainty and under that environment it feels like rate positions are being neutralised until the picture is clear, that creates volatility and unusual market movements.

NZ OIS still has -56bp of cuts priced into November, with most commentators pricing in another -50bp in February (-100bp priced into February). The extra -6bp of cuts into November a reflection of underwhelming NZ data, NZ employment report (5% RBNZ forecast Unemployment rate) and the 3 month break till the RBNZ next meet in February 2025. The steepening of the NZ curve stalled a little last week, although the more NZ cuts now less later coupled with the higher global yields may underpin that steepening for a little longer. Mortgage fixing remains short dated, although looking at the wholesale forward curve the 1 and 2 year swaps are nearly the same in 3 months’ time. In addition, post January it is unlikely -50bp cuts stay the normal suggestive of a slightly longer mortgage fixing cycle is waiting in the wings.

In short, NZ mid/long curve direction is being driven by offshore with US jobs report at weeks end overshadowed by US poll watching. The NZ short end remains anchored by domestic rate expectations that won’t become clearer until November 6th is out of the way.” Ross Weston, Head of Balance Sheet – Treasury.

In currencies, the Kiwi falls to the 0.5900 levels

“With the US dollar staging a comeback as a safe haven in an uncertain world, also driven by US yields which generally continue to increase, the Greenback has outperformed most currencies globally. And finally the Kiwi has fallen from its 0.6050 support perch and has traded to a low of 0.5958. This came during a week where there was little in the way of economic data, so market participants focused instead on the upcoming US election, and what this may mean for the US economy from a longer term perspective. US yields continued to increase last week, with big Fed cuts now considered to be off the table given the relative strength of the US economic performance. Also the uncertainty around the US election, but the potential for big fiscal spending with either candidate, is driving longer dated yields up. The week ahead in the lead up to the election could see more of this rhetoric. We have US non-farm payrolls on Friday and this is more likely to disappoint traders, following the previous bumper print, and the disruptions from hurricanes that have probably seen a pull back on new jobs added. All in all, a week more likely to contribute to US dollar strength than not. Now the Kiwi was had a dip lower into the 0.5950 territory, we may see a bit of a relief rally. But given we have been calling for a lower Kiwi dollar for some time now, the current level makes more sense to us on a fundamental level. The interest rate differential is finally starting to show through in the Kiwi dollar. NZDAUD is the next Kiwi cross that we see downside potential for. After being painted into the 0.9000/0.9100 level for some time, Aussie CPI this week could be a catalyst for the NZDAUD cross to head into the 0.8900 levels.” Mieneke Perniskie, Trader - Financial Markets.

The Week Ahead

- On the domestic data calendar, there are a few key high-frequency indicator releases this week. The September filled jobs number may show a modest decline. The August 0.2% lift may also be revised down, as has been the recent trend. The ANZ business confidence survey for October will likely show a further improvement in sentiment following the RBNZ's latest 50bp rate cut. However, the confidence boost has been underpinned by expectation of further rate cuts, as activity remains down on last year's levels. Finally, a fall in building consents is expected over September. However, the downtrend in consents appears to be flattening off, and will likely remain at current levels before recovering in the second half of 2025.

- Across the Tasman, the September quarter inflation report is due out this Wednesday. Headline CPI inflation likely slowed from 3.8% to 3%, the top of the RBA's 2-3% target band. Monthly readings have shown lower oil prices over the quarter as well as the cost-of-living subsidies weighing on price gains. A substantial fall in the trimmed mean measure of inflation, from 3.9% to 3.5% is also expected as monthly prints have signalled.

- In the US, September quarter GDP is expected to rise 3% over the quarter, keeping pace with Q2 growth. Growth continues to be underpinned by household consumption and non-residential investment. Consumer spending is expected to grow 3.2%, up from 2.9%. Business investment in equipment is also expected to contribute positively to growth, despite election uncertainty. The September PCE report is also due out and will likely show an acceleration in consumer price growth. Headline PCE likely rose 0.2% over the month, up from 0.1%, and core inflation increasing 0.3% from 0.1%. To round out the week for US data releases is the payrolls report for the weather-disrupted October month. Following September's blowout report of 254k jobs, the pace of job growth likely slowed to a 120k gain. Cyclical forces are also at play, with job growth likely weak in manufacturing and business services. The unemployment rate is expected to remain at 4.1%. The report is a key release ahead of the November FOMC meeting.

- The euro-area economy likely expanded over the September quarter, with GDP increasing 0.2%, keeping pace with Q2 growth. Real incomes are rising as inflation has fallen below 2%, which should fuel a recovery in the services sector. Lower interest rates should also help boost household consumption. However, risks to Q3 GDP are skewed to the downside given recent weak business surveys. The flash CPI inflation print for the monetary union is also due out this week. As the base effects of last year's spike in fuel prices recedes, the headline inflation rate is expected to tick higher. In September, annual inflation likely accelerated to 1.9% from 1.7%. Core inflation however likely fell from 2.7% to 2.6%.

- The Bank of Japan meets this week, but no change to policy is expected. The target rate is likely to remain unchanged at 0.25%. After a historic hike in July, the BoJ is waiting for a further strengthening in core inflation before tightening policy. Risks of overshooting the 2% inflation target however are building as wage and price growth remain strong and the recent depreciation in the Japanese yen.

See our Weekly Calendar for more data releases and economic events this week.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.