The economy contracted 3.1% on a per capita basis

None of this will surprise the many households struggling under the weight of high inflation, the rise in interest rates, and the fall in house prices. Businesses are also suffering under the weight reduced profitability and weaker consumer demand.

Yes, there is light at the end of the tunnel, but only (if) when the RBNZ takes their foot off the brake. Today’s numbers support our call for RBNZ rate cuts to commence in November.

It’s official. The Kiwi economy is in recession again

Following the September quarter’s 0.3% contraction:

- the Kiwi economy contracted another 0.1% over the December quarter.

- The economy shrank 0.4% over the second half of 2023.

And don’t forget about the cumulative 0.7% contraction and recession we had over Dec22-March 23.

Aotearoa has, as we have coined it, gone through a double dip recession. The heavy hand of the Reserve Bank has hurt households and businesses.

Restrictive monetary policy is clearly working

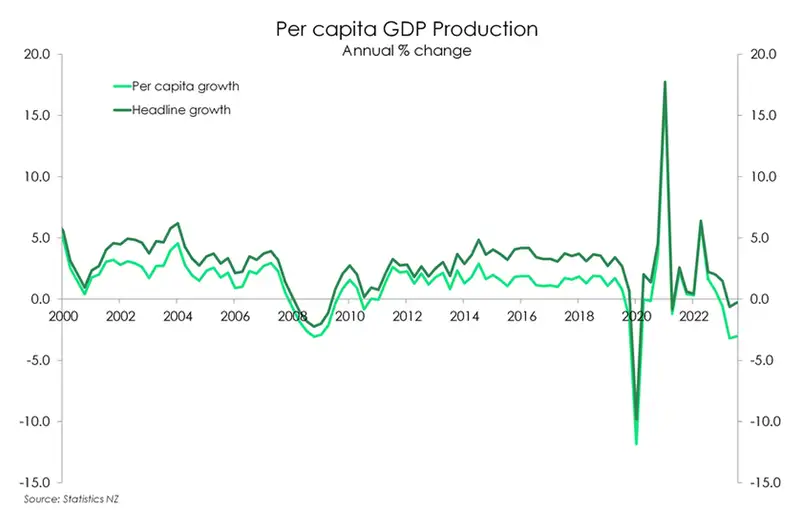

In fact, more than they had expected. The RBNZ expected a flat print, just narrowly averting a recession. But here we are again, in a technical recession. Compared to a year ago, economic output declined 0.3%, and a massive -3.1% per head.

The headline rate isn’t pretty. And against a backdrop of rapid population growth, it’s even uglier on a per capita (per person) basis. Over December, GDP per capita basis contracted a further 0.7% following Q3’s downwardly revised 1.1% contraction. And compared to a year ago GDP per capita is down 3.1%.

It must be noted, the weakness we’re seeing and feeling is all by RBNZ design. The RBNZ needs to restrain the economy in their fight against the inflation beast. And today they got that. Well, they got more than that. So long as interest rates remain elevated, the outlook for the majority of this year is for more subdued growth. There is a silver lining though. Today’s report adds more evidence to the RBNZ that they have well and truly done enough to get inflation down to 2%.

And today’s print adds to our view that the RBNZ will be in a position to deliver rate cuts from November. Once interest rate settings are relaxed, confidence among households and businesses should build and the economy should regain momentum. 2024 will be a better year than 2023, well that’s not hard. And 2025 should be a better year than 2024, with some rate cuts.

The Breakdown

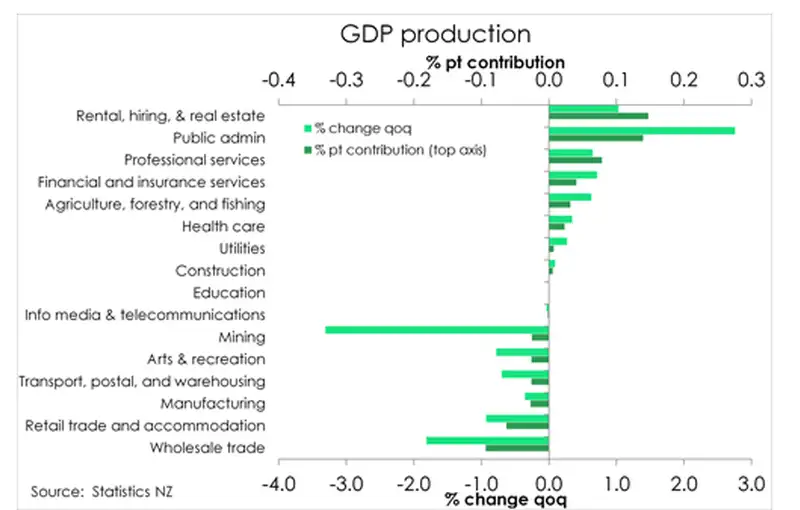

At a high level, the underlying contributors to today’s GDP numbers are nothing new. Services continue to battle to remain shiny as they have been for the past couple of quarters. But as high interest rates continue to weigh on activity, they’re certainly beginning to lose their lustre. Meanwhile the primary industry continues to find its ground in the aftermath of last year’s severe weather events as well as slowing global demand. The real pain point in the economy is the goods-producing sector. Both the services and primary industries managed a 0.3% lift over the quarter. While the goods producing industry contracted 0.1%. But taking a closer look at the details, it was a bit of a mixed bag, with some big pockets of weakness. The main one of course being the 1.8% decline in wholesale trade over the December quarter. Closely followed by the 0.9% fall in retail trade and accommodation. It’s no surprise to see these two industries lead the decline. Preliminary data from Stats NZ had already shown a 1.9% decline in retail sales volumes over the quarter and a 4.1% decline over the year. Arts and recreation also posted a 0.8%qoq decline. International tourism typically peaks in the December quarter. But judging by today’s report, it appears to have been a rather lacklustre season.

Another pain point is the ongoing decline in manufacturing down 0.4% over the quarter and 3.7% compared to last year. But again, this came as no shock to us. Manufacturing has seen annual declines since the beginning of 2022 while weak PMIs and shrinking manufacturing sales volumes have long dominated the headlines.

It's also worth mentioning the staggering 3.6% decline in mining. Though it’s fall did not have as heavy of an impact on the quarterly aggregate output as those mentioned above. And within the primary sector itself was outweighed by the 0.7% lift in the agri space.

On the flip side, there were also some pockets of strength in today’s report. Primarily in the rental hiring and real estate group which managed a 1% lift over the quarter thanks to the effects of our surging net migration and a warming housing market. And with activity indicators picking up in the housing market we continue to see the strength in the rental hiring and real estate group to be a theme for 2024. That should also breathe some life into the construction industry which managed a soft 0.1% over December.

The public admin sector also got a pleasant yet unsurprising lift in activity off the back of last year’s general election. But bear in mind, with government spending cuts on the horizon, the public admin space may be in for some downside surprises in the year ahead.

A soft year of spending

On the other side of the same coin, expenditure GDP was slightly stronger, recording flat (no) growth over the quarter. It follows an upwardly revised 0.4% decline (from -0.7%) in the September quarter.

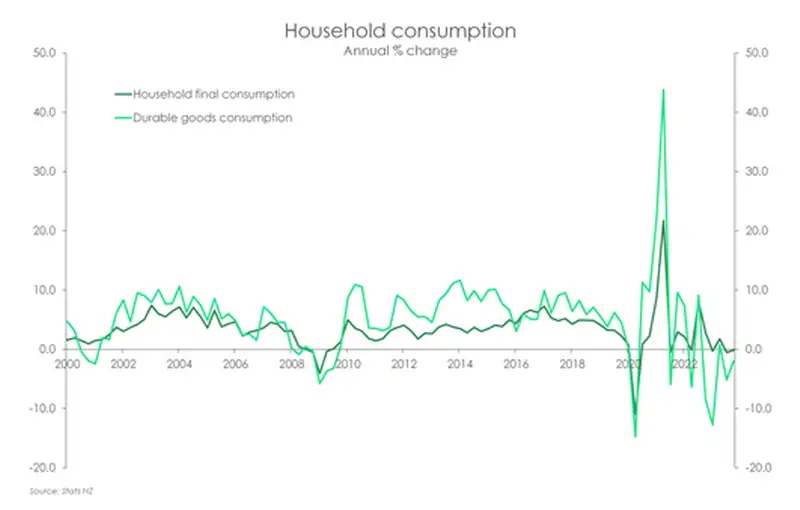

Household consumption was surprisingly strong, growing 0.5% over the quarter. Despite retail trade on the production side notching a 1.1%qoq decline, private consumption of durable goods lifted 0.6%qoq. However, it follows a big 3.4% decline in September. So a technical bounce back may partly explain Q4’s gain. Compared to a year prior, household consumption is down 0.2% and durables down a massive 2%. And that’s despite rapid population growth.

Migrants are arriving at a time when the economic undercurrents are soft. High inflation, steep interest rates and weak house price growth are all weighing on consumption.

Businesses investment also picked up in the quarter, growing 0.6% following a near 5% decline in Q3. But like household consumption, business investment is down almost 2% compared to a year ago. Investment in plant and machinery has taken a large hit, down 13%yoy.

It comes as no surprise with several business surveys having pointed to weak investment intentions over 2023. Similarly, the downtrend in building consents has seen a 3.7% decline in residential buildings compared to a year prior. Overall gross fixed capital formation is down 2.4%yoy. Business confidence has improved in recent months, but it is yet to translate into a lift in activity.

The worst should be over

With the December quarter GDP numbers now behind us, we can finally wave goodbye to 2023. It was a tough and awkward year to say the least. High interest rates and still-high inflation, floods, cyclones, escalating geo-political tensions, and recessions…long story short, it was a bad time. But we survived. And now it’s all about the outlook.

The good news is the worst should be over. Though we still expect 2024 to be a year of low growth so long as high interest rates remain. Policy settings are still aggressively tight. And a softening global backdrop doesn’t help either. But the turning point is on the horizon.

2024 may not be the year of growth but it is the year of central bank rate cutting. Offshore central banks like the Fed are likely to beat us to it but their move to lower rates will help boost global demand and in turn feed through onto our export volumes.

Here at home, it shouldn’t be too much longer before the RBNZ can cut rates themselves. We’re pencilling in November. And expect to see growth pick up into 2025 as rate cuts are delivered and stimulate domestic demand. For now, the theme remains. Survive ‘til 25.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.