- Pay rises are running above inflation. The cost-of-living crisis is coming to an end, slowly. It may not feel like it, yet, but inflation has eased, and will ease further.

- The RBNZ engineered a long, harsh recession to get inflation back to 2%. And we're close... very close. At 2.2%, inflation has fallen from a rapid peak of 7.3%.

- The RBNZ can declare victory in the war on inflation.

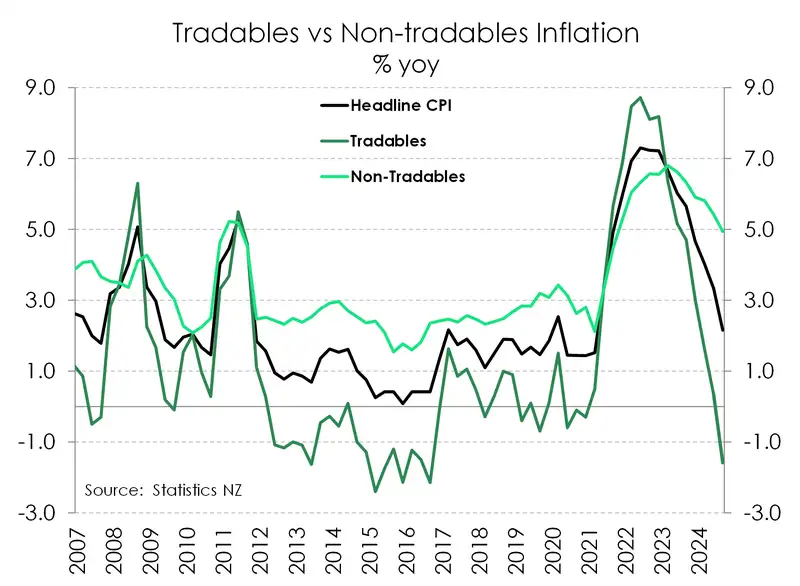

- There is more disinflationary pressure in the pipeline as the economy continues to operate below its productive capacity. Tradables is the reason we have returned to 2%. And the eventual normalisation in domestic price pressures is why we see 2% sustained in the medium-term. It’s the two phases of 2%. Phase 1, imported. Phase 2, domestic.

- The light at the end of the tunnel is burning brighter. Cost pressures are easing. Great news for businesses and households, and interest rate relief is coming thick and fast. Policy settings are still restrictive, but more interest rate cuts are coming. We expect another 50bp cut in Nov. Falling inflation, and falling interest rates will help household budgets, and business opex.

The good news - deflationary pressures are becoming more broad based. There were more goods and services recording declines in prices. And there were fewer goods and services recording hikes in prices.

The bad news - there's still some very chunky prices hikes in council rates and insurance premiums to pay. The $5 fee for prescriptions also hurt.

The expected news – the inflation beast is back in its box. Earlier this year, we had forecast inflation falling back within the RBNZ’s 1-3% target band in the September quarter – that’s happened. But our initial forecast was for 2.8%, not 2.2%, given the persistent strength in domestic inflation. So not only has inflation been put back in its box, it’s a lot closer to 2%. And we still have more deflationary pressure in the pipeline. It’s good news.

The risk in the near-term is inflation undershooting 2%. The RBNZ has begun relaxing interest rate settings. But a cash rate of 4.75% is still restrictive. If domestic inflation normalises faster than expected, then we will likely see inflation falling into the lower-end of the RBNZ’s target band. And that opens the door to further large reductions in the cash rate.

The two phases of 2%

The first phase is the deflation of prices for imported goods. Known as tradables inflation, imported prices are falling, and are DOWN -1.6% over the year. Imported prices peaked at a whopping 8.7%, and have fallen swiftly with the decline in global inflation rates. In line with our forecast, tradable inflation fell 0.2% over the quarter – the fourth consecutive quarterly decline. Weakening imported inflation has done most of the leg work in wrangling inflation back within the band. That’s great. But momentum can be easily disrupted. We’re keeping an eye on the what’s happening abroad. Oil prices in October spiked as the Middle East conflict escalated.

The second phase is the deflating of domestic prices. Domestic inflation is a slow-moving beast. The good news is that it is moving in the right direction (south). The quarterly 1.3% gain was slightly softer than expected. Non-tradables prices have eased from 5.4% to 4.9% on an annual basis, and is some distance from the 6.8% peak. It’s the first time since September 2021, domestic inflation is sitting below 5%. That said, domestic inflation is still sitting high above the long-term average (~3%). Rental inflation (which makes up 9% of the CPI) let off a bit of steam. The 0.9% increase over the quarter saw the annual rate slowing to 4.5% from what may be the peak in the series at 4.8%. Home construction costs were also very weak, lifting only 0.1% in the quarter and easing to 2.5% from 3%. Stats NZ attributes the weakness to lower prices for materials (eg. timber) as well as labour costs with surveyed businesses citing increased competition and price-matching over the quarter.

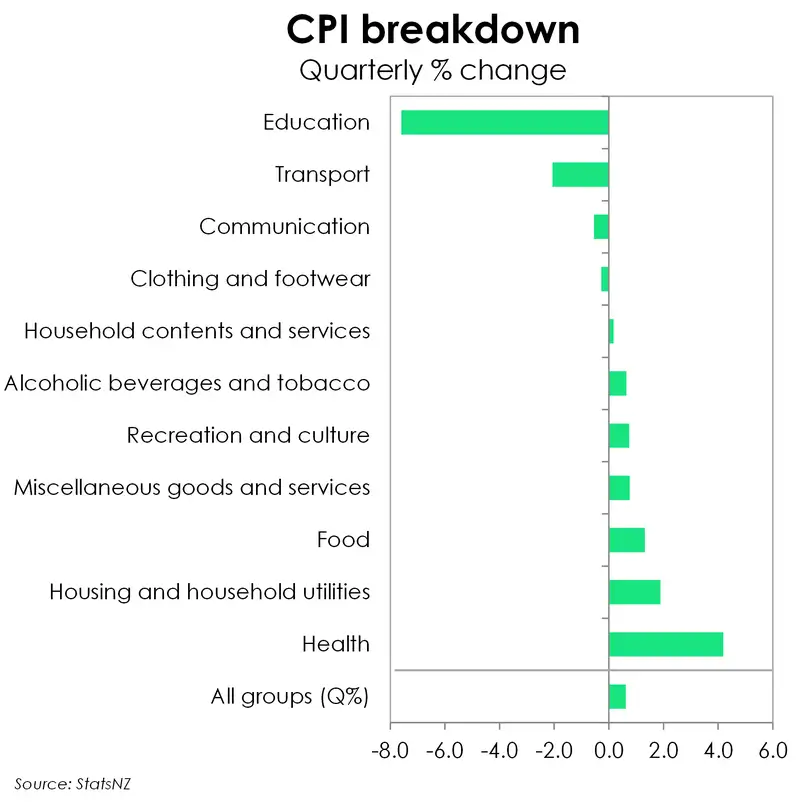

Another source of homegrown frustration was the health group, rising 4.2% over the quarter. The large quarterly increase is in part due to the 17% increase in pharmaceutical products which follows the reintroduction of the $5 prescription payment (into effect 1 July 2024). But it’s artificial strength. Because if we exclude temporary idiosyncrasies like these, we’d likely see an even weaker non-tradables print. Underlying domestic price pressures are clearly weakening.

Services sector inflation, as a whole, dropped to 4.5% after being stuck at 5.3% for the first half of the year. This marks the beginning of the correction lower. Services inflation is closely aligned with wage growth. And the slowdown in wage growth as labour market pressure eases, point to an eventual slowdown in services.

Indeed, there is more disinflationary pressure in the pipeline as the economy continues to operate below its productive capacity. Tradables is the reason we have returned to 2%. And the eventual normalisation in domestic price pressures is why we see 2% sustained in the medium-term. It’s the two phases of 2%.

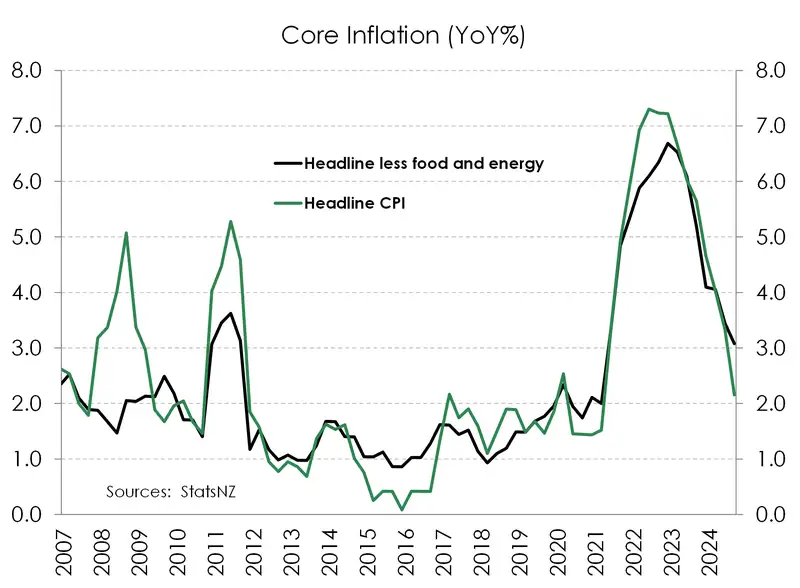

Core matters most

Various measures of core inflation also maintained its downward trajectory. Stripping out volatile food and energy prices, underlying price pressures lifted 1%. Annually, core inflation is now just skimming the top-end of the RBNZ’s 1-3% target band at 3.1%. It’s a very welcome move confirming the underlying trend for inflation is down. And even better – moving closer to being below 3% in the coming months.

Basket breakdown

Over the September quarter, fewer items in the CPI basket recorded an increase in price (from 56% to 53%) while more items either recorded no change in price (from 12% to 14%) or declined in price (from 32.7% to 33.4%) and compared to a year ago, a far larger proportion of the basket is recorded price declines – from 29% to 33.%. The shift points to generalised cooling in inflation pressures.

There are lots of moving parts. A few of the notable price movements include:

- The 12.2% increase in council rates, which accounted for 51% of the overall 0.6% increase in consumer prices

- The 17% increase in pharmaceutical products

- The 6.5% decrease in petrol prices, which removed 0.3%pts from the headline quarterly inflation rate.

- The 22.8% decline in early childhood education, as part of the Government’s FamilyBoost scheme.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.