- With a relatively quiet week at home, our eyes were on offshore developments. The US payrolls was the major release out over the week. But another soft Aussie GDP print also got its fair share of time in the spotlight.

- Domestically we have seen more partial indicators ahead of next week’s GDP release. And it’s with pain in our hearts (and little surprise) that we saw construction post another chunky decline over the September quarter.

- Our COTW takes a look into what’s been happening across commercial property over the past couple of years. Just like the housing market, commercial property has not been immune to the harsh economic climate brought about by the RBNZ. But shifts in demand have also played a role in the downturn, with some sectors doing it tougher than others.

The major event over the weekend was the release of the US non-farm payrolls. The print was mixed, with stronger than expected employment and wage growth coinciding with a higher unemployment rate. 227k jobs were added over November, exceeding the number of jobs added over the past two months. And wages lifted another 0.4% over the month, to be up 4% over the year. But the unemployment rate lifted unexpectedly from 4.1% to 4.2% with a lower-than-expected participation rate. The latest employment numbers were positive enough to calm fears around a recession… but weak enough to bolster bets of further Fed rate cuts.

In other news, our neighbours down under, who are yet to begin cutting rates, saw economic activity falter against expectations again. The Aussie economy grew 0.3% over the September quarter. But on a per capita basis, activity fell 0.3%. It marks the seventh quarter of consecutive declines in GDP per capita. And the Aussie’s are pretty much on par with our per capita recession in NZ. The good news at least, is that the growing weakness of the Aussie economy bolsters the case for RBA cuts early in 2025.

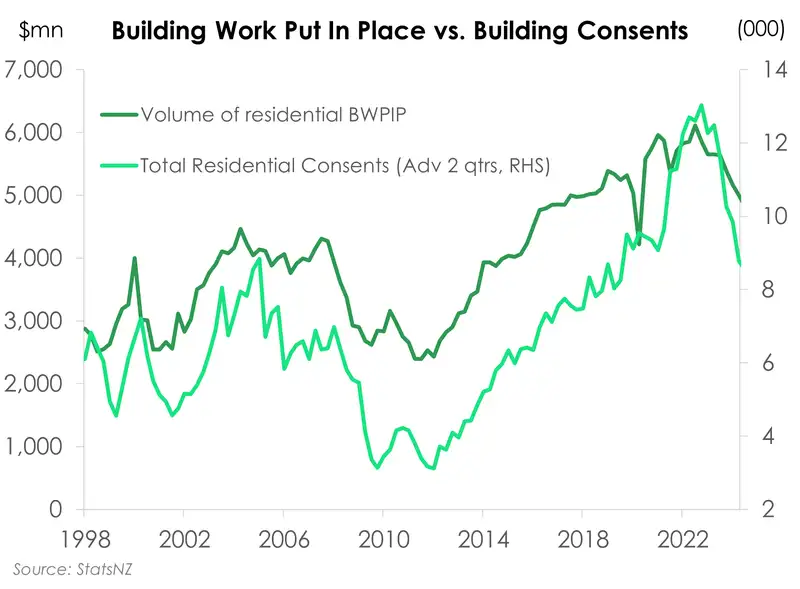

Speaking of economic growth, here at home, more partial indicators have been rolling out ahead of next week’s Kiwi GDP release. Last week, the major domestic headline was the 3.2% fall in construction activity over the September quarter. It was quite the shock against the much smaller 0.3% decline that had been expected. But at the same time is little surprising given the sluggish state of the housing market and ongoing falling consents. Lower house prices, still-high construction costs, and a still high-interest rate environment is seeing major pullbacks in construction. Along with a lot of downsizing across construction businesses with construction jobs having made up just under a quarter of total job losses in the past year. Building activity has recorded a fifth consecutive quarterly decline. And there were falls across both the residential and non-residential space. Going forward, the outlook for construction is going to be determined by the recovery in the housing market. And with interest rates falling now, we expect the housing market to make gains into next year.

Financial Markets

The comments below were provided by Kiwibank traders. Trader comments may not reflect the view of the research team.

In rates, the weight of offshore moves dominates.

“Kiwi yields ground lower last week under the weight of offshore moves. This time the US moves weren’t the major driver, a much weaker Aussie GDP the main catalyst. That data miss not enough to price in anything of note for tomorrows RBA meeting, there are -2bp of cuts priced into tomorrow’s meeting and a -25bp cut not priced until April 2025 from September 2025 pre-release. There were nerves most of the week on the US employment report for a backdrop of what the FED will do at next week’s FOMC meeting, those nerves shift to watching this week’s monthly CPI release on Thursday NZT. The US market erring on the side of a -25bp cut, with -18bp priced pre-employment data release and firming to -22bp post release.

What does it all mean for Kiwi rates? A good dose in inter and intraday volatility. The direction has clearly been lower in yields, with tenors > 1 year through recent lows. This has seen both payers and receivers emerge, receivers on a cross-market basis and payers on an outright basis although at the shorter end of the curve. Expect this kind of volatility to continue, with what feels like an upside bias given receive side flows will start to abate as we roll into year end. That bias further cemented by accounts reducing negative accruing received positions over the break, mortgage paying as holders rush to refix, and kiwi high frequency data continuing to show signs of life (electronic cards and PMI this week).” Ross Weston, Head of Balance Sheet – Treasury.

In currencies, the USD saw renewed strength.

“Geopolitical factors and a mixed bag US employment print on Friday that reaffirmed expectations of 25bp rate cut at next week’s final FOMC meeting for the year, bought with it a period of renewed strength for the US Dollar. Opening this morning around the 0.5830 level, NZDUSD saw a decline of 1.50% across the past week – and now lining up a retest of the recent November low at 0.5797. With offshore economic events including US CPI, and interest rate decisions from the RBA, BOC and ECB all set to dominate headlines this week, the NZ Dollar’s near-term outlook remains largely driven by offshore influences. Last week’s surprisingly soft 3Q GDP reading out of Australia has bought Tuesday’s RBA meeting squarely into the minds of traders. As the RBA largely bucked the trend of other major central banks with its steady as it goes monetary cycle, long CFTC speculative futures positioning in the AUD have built to levels not seen since 2017. This positioning, largely driven on an expectation of a reversal of the negative interest rate carry in the AUD seen across the past few years as the RBA held cash rates at levels below many of its peers now looks to be put to the test. Should the RBA provide any form of dovish hints in tomorrow’s meeting that a potentially slowing Australian economy may be enough to see the commencement of rate easing from as early as February next year, then the aforementioned AUD positioning build-up will be in the markets spotlights. From a Kiwi perspective, the adjustment of positioning post last week’s Australian growth numbers release has seen NZDAUD punch back above 91 cents, whilst at the same time, the softening economic outlook for Australasia as whole also helped contribute to the overall decline in NZDUSD. Indirectly, Tuesday’s RBA event will be important for the NZ Dollar. In another reminder of the political uncertainty likely to impact markets for at least the first half of 2025 as the incoming Trump presidency deploys its America First policies, last week’s USD strength was also heavily influenced by a threat of tariffs on BRICS nations should they continue a policy approach to reduce US Dollar’s global reserve status. This week we release our updated quarterly FX Tactical in which we will also provide a broader 2025 outlook. Calling currency movements and directions over a sustained period based on interest rate differentials alone is always somewhat of a tricky task - throw in the uncertainty of what social media post might arrive day to day from the US President elect, the challenge becomes even greater. But it’s a challenge we are up for! Stay tuned over the week ahead… ” Hamish Wilkinson, Senior Dealer - Financial Markets.

The Week Ahead

- Here at home, more partial GDP data are due out, including manufacturing activity. Electronic card transaction data will also be released. This high-frequency measure is showing tentative signs of recovery in household consumption. We may see a lift in spend over November helped by the Black Friday sales and tax cuts.

- Across the ditch, the RBA will announce its final policy decision for the year. The cash rate is expected to remain unchanged at 4.35%. Since the last meeting, key officials have signalled little urgency to cut interest rates. Inflation has fallen back within the 2-3% target band, but largely due to govt cost of living subsidies. Underlying inflation pressure remains strong. And the minutes of the November meeting noted that the RBA wants to see more than one good quarterly inflation print. The labour market remains tight, with job growth while slowing is still positive. The case for rate cuts is not yet strong enough. In saying that, the weak September quarter GDP growth print may soften the RBA's hawkish tone on Tuesday.

- The main economic event this week is the November US CPI report. Inflation is becoming benign in the US. In October, consumer prices rose just 0,2%. And in November, market consensus is for a 0.3% increase over the month. Core inflation is the focus. And the November update may show disinflation in core prices stalling. Shelter inflation is expected to fall, but offset by a rise in prices for other core goods and services - keeping the annual rate at 3.3%.

- Sticking with central banks, the ECB is expected to cut interest rates for a fourth time this year. The overall tone of the statement and following press conference, fronted by President Christine Lagarde, will likely lean dovish. Since the last cut in October, the outlook for growth and inflation has deteriorated, which the new forecasts should reflect.

See our Weekly Calendarfor more data releases and economic events this week.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.