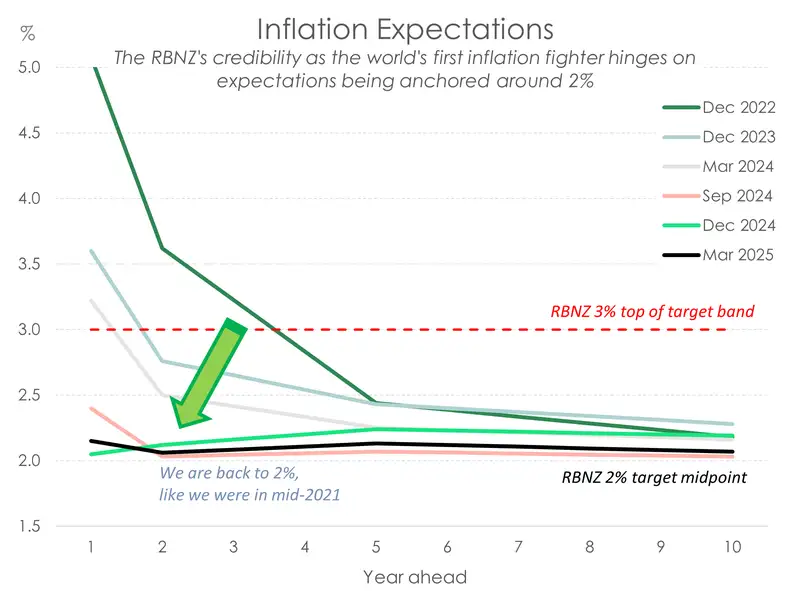

The latest RBNZ survey of inflation expectations showed expectations remain well-anchored at the RBNZ’S 2% sweet spot. All measures, bar the one-year-ahead measure, edged closer towards 2%. It’s great news and an incredibly important development. Expectations are key in price setting behaviour and therefore the inflation outlook. The higher our inflation expectations are, the higher we’ll push up prices, including wages. As history shows, expectations of inflation follow actual inflation and can be self-reinforcing.

So, the drop across expected measures were exactly what we and the RBNZ want to see. The all-important two-year ahead measure dropped 6bps to 2.06%. While further out, inflation expectations for the 5-year-ahead measure fell 11bps to 2.13%. Similarly, the 10-year ahead measure dropped 12bps to 2.07%.

Recent downward pressure on the NZD, along with higher petrol prices and ‘Trumpflation’ worries were likely behind the 10bps increase in the one-year ahead measure to 2.15%. Still, all measures remain well within the RBNZ’S comfort zone and confirms the stabilisation in inflation.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.