- Reflective of the weakening economy, the labour market continues to soften. Over the December quarter, unemployment treaded higher to 5.1% from 4.8%. Meanwhile employment and total hours worked continue to decline.

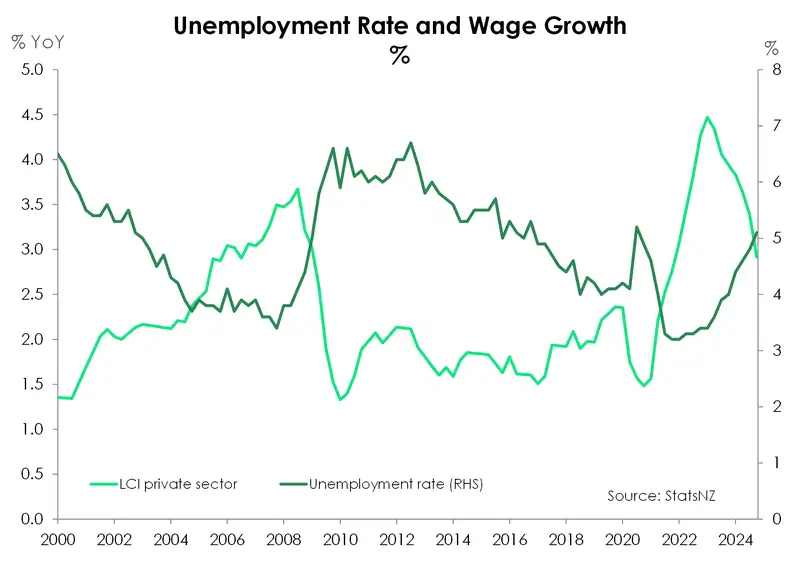

- We’re seeing more moderation in wage inflation albeit for a bit of a lift in average hourly earnings. The private LCI a measure of pure wage inflation has slowed to 2.9%, moving further – albeit slowly – away from the 4.5% peak. Weaker wage inflation should help drive an easing in domestic inflation.

- Labour market conditions are loosening in line with expectations. With each datapoint, a 50bp cut this month looks more and more concrete. We’re more focused on what is needed beyond February. We think a move to a 3% cash rate this year is needed. Why pause in restrictive territory? Why prolong the recovery?

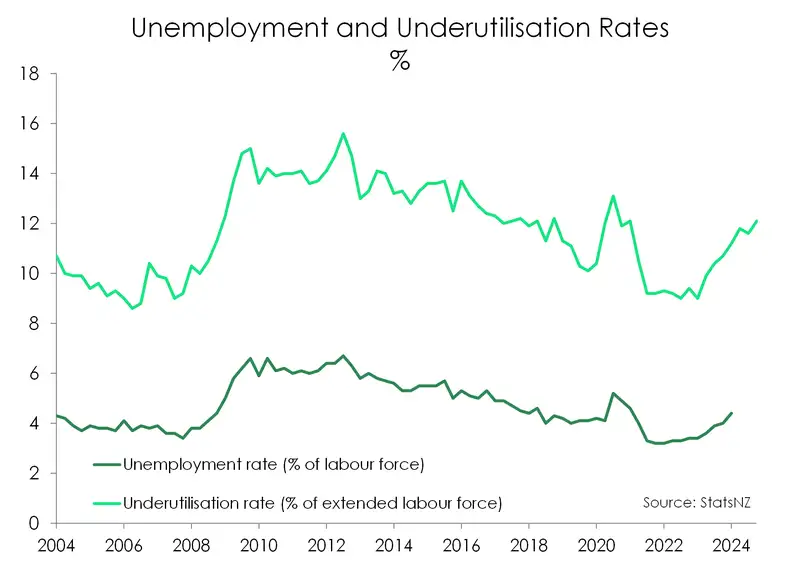

Today’s jobs report confirmed what we already knew. The Kiwi labour market continues to soften amid the backdrop of a very weak economy. In line with our expectation, the unemployment rate rose from 4.8% to 5.1% - the highest rate in four years. The labour force participation rate also continues to normalise from record high levels, falling to 71%. Workers are stepping away from the market as hiring appetite has slowed. The underutilisation rate – a better measure of slack in the market – lifted from an already high 11.6% to 12.1%. And the ongoing rise suggests that spare capacity within the broader market is growing. Measures beneath the umbrella term also moved higher with the underemployment rate – those working part-time and wanting more hours – rising from 4.0% to 4.8%.

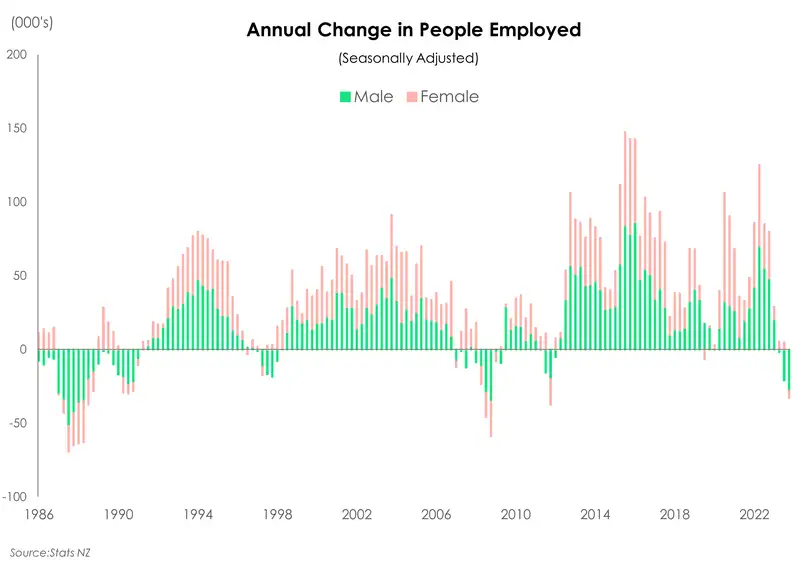

Looking deeper into the details reveals sobering weakness in the Kiwi jobs market. Worker demand continues to wane, with employment contracting 0.1% over the quarter, and down 1.1% over the year. It marks the second consecutive annual decline for employment growth and the deepest since the GFC. And men have borne the brunt of job losses in 2024. Of the 32k decline in employment, 85% were men. According to Stats NZ, employment losses were concentrated in male-dominated occupations – notably, technicians and trades workers, and machinery operators and drivers.

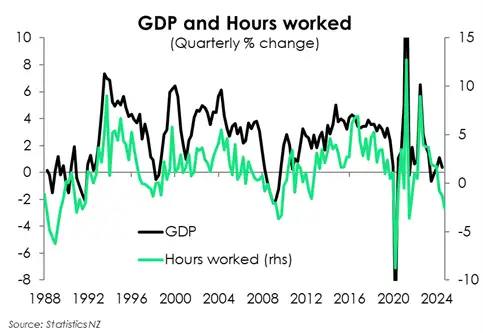

In another sign of weak labour demand, 2024 saw a shift in the quality of work. Even prior to the decline in employment, hours worked were already on the chopping block. The full-time workforce shrank 1.7% in 2024. Meanwhile, the part-time workforce expanded 1.5% over the year as 9,000 men took up part-time work. Needless to say, the cutback in full-time employment was a key influence of the decline in total hours worked.

The total number of hours worked have been in decline since March last year. With hours worked falling for four straight quarters, the annual print is far from pretty. Outside of the 2020/21 covid period, the number of hours worked recorded the deepest annual decline since 2009. In 2024, total hours worked fell 2.5%, reminiscent of the 3.3% slide in 2009. The cut back in hours and staff was an inevitable outcome for the labour market given the RBNZ’s delivery of aggressive rate hikes. And fewer hours is another warning sign of weak economic activity for the December quarter.

We are hopeful that a recovery in the second half of this year should help businesses avoid further significant cuts to head count. But should we not get the required rate relief from the Reserve Bank, the risk of further reductions only grows. It’s why we think the Reserve Bank will need to deliver more than they have signalled this year. When we last heard from them in November the RBNZ signalled that we’d see the OCR get to 3.5% this year and no lower until deep in 2027. That leaves conditions too restrictive, and we argue we need to get to 3% (neutral) this year. Especially with inflation already stabilising at 2%. Holding out for longer is just going to cause unnecessary and indeed avoidable damage to the labour market.

Wage inflation broadly cooling

On wages, the December quarter checkpoint provided a mixed read. The private labour cost index (LCI) – a measure of pure wage inflation – was steady at 0.6% over the quarter. Annually, the wage bill edged down to 2.9% from 3.4%. And the distribution of annual wage growth showed a lift in the proportion receiving no change in take-home pay, from 37% to 40%. Among the 60% of jobs that received a pay rise, the share of those that enjoyed more than a 5% increase is shrinking, from 27% to 21% - the smallest since the end of 2021. Instead, majority (24%) are facing pay increases of between 3% and 5%. It’s yet another clear sign of softening employment demand.

In contrast, the Quarterly Employment Survey (QES) showed some lingering heat in pay growth. Private sector average hourly earnings accelerated 1.4% over the quarter (from 1.1%) and 4.3% over the year (from 4%). The tick higher in the annual rate is notable, but the broader trend remains in decline. Given easing domestic price pressures amidst a weak economic backdrop, there’s reason to expect further slowdown in wage growth.

Staying ahead

While a 50bps cut from the RBNZ in February has long been expected by us and the market, today’s jobs data was still important. Today’s print was largely in line with the RBNZ’s projections and further supports more rate cuts. And we’re focused on what is needed beyond February. With the 2% target inflation rate virtually reached and core inflation also trending lower. The debate now centres on how far the RBNZ will cut the cash rate below 3.5%. The RBNZ track signals a long pause at 3.5%. We think a further 50bps is needed… with risk of more. Why pause in restrictive territory? Why prolong the recovery? Indeed, why muck around? Labour demand will remain weak for some time as the economic recovery takes some time. We see the unemployment rate peaking at around 5.3% in the first half of this year. At 5.1% we’re not too far from it now. Cooling net migration and lower labour force participation are likely to limit the lift in the unemployment rate. But it’s still a weak environment. And it's important for the RBNZ to set the conditions for recovery. They’ve already done more than enough to cool the economy and cool inflation.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.