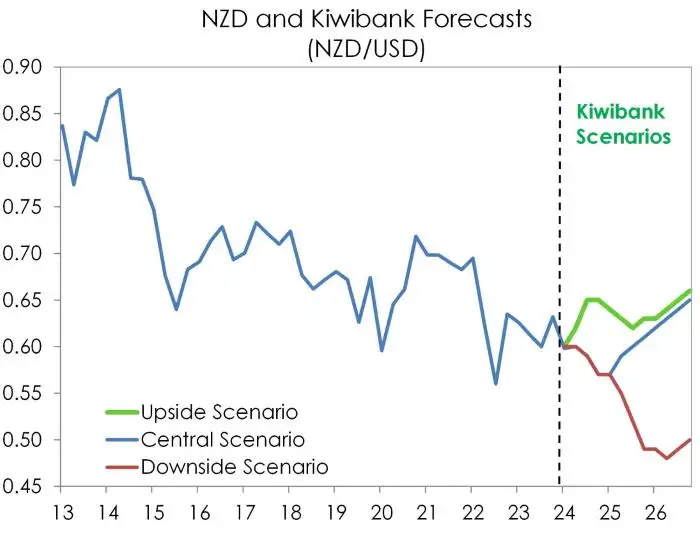

Since our FX Tactical in April, the Kiwi dollar has broadly outperformed our expectations. We had expected the Kiwi to be trading in closer proximity to a 57-59c range, with the clear deterioration in the economy. But the Kiwi is currently trading around 61c. For traders, it’s all about interest rate differentials. Not even the weak economic data of late has spurred much (sustained) price action. Instead, it’s inflation prints and central bank statements that set the trajectory of exchange rates. And the relatively hawkish tone of the RBNZ continues to support the Kiwi dollar. Although we have also been surprised by the hawkish tone out of the Fed, as the US economy continues to outperform. We are still waiting for the Fed to lead the RBNZ.

As we noted in March: “If the Fed leads, then the Kiwi currency should hold up against the greenback, helping to ease imported inflation. We need that sort of help. It is only when the RBNZ comes into action that the Kiwi is likely to depreciate, helping exporters. Indeed, we see the Kiwi holding strong near term, before falling to 57c by year-end. It is only when the RBNZ comes into action that the Kiwi is likely to depreciate, helping exporters. Indeed, we see the Kiwi holding strong near term, before falling to 57c by year-end.” (Soft landing nirvana, March 2024).

The Kiwi may have regained flight, but it still faces the same headwinds. We stick with our long-held forecast for the Kiwi flyer of 57c by year-end. Although the risk is towards a postponement of that descent until 2025. Because the RBNZ may choose to hold into 2025.

Near-term, we think the Kiwi will remain elevated, as the RBNZ’s hawk-like feathers fly higher and shine brighter than their central banking peers. The stronger Kiwi flyer will assist with the inflation fight, and help importers.

Ultimately, we think the cooling in global demand and reduction in inflation pressures will weigh on the bird. But that may take many-a-month to see. It will be a volatile downward glidepath. It always is. But we expect the Kiwi to ultimately fall into a 55c-to-59c range in 2025. Basically, we expect to re-record the recent lows. The downward glidepath for the Kiwi flyer will eventually help our exporters, with tourism and agriculture in need of a boost.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.