- Kiwi economy is weak, because of aggressive monetary policy. Higher interest rates hurt. And the economy will struggle to grow this year. We continue to forecast an improvement in the outlook. But we’ve pushed out the timing of the turnaround.

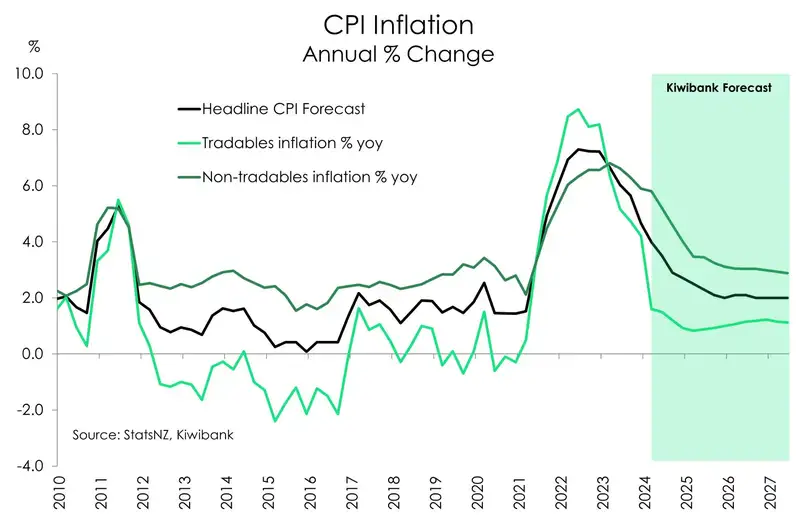

- It’s all about inflation. Kiwi inflation has fallen at pace, but the road to 2% is laden with frustrations. Home-grown inflation is proving persistent and problematic. However, the weak economy should ease price pressures. We forecast inflation below 3% by year-end.

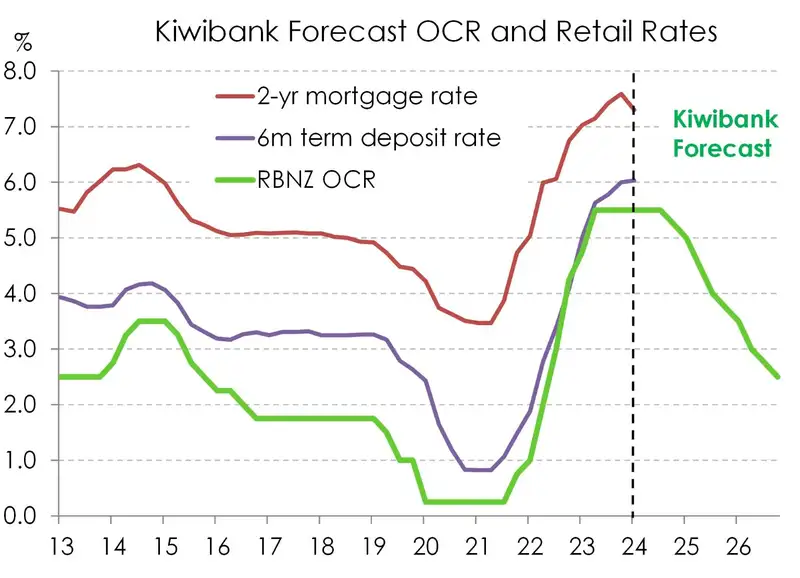

- If the economy, and inflation importantly, evolves as we expect, then we see the RBNZ delivering the first rate cut in November. We are cognisant that the risks are tilted toward a delayed kick-off. Regardless, we are confident that the next move in rates is down.

- On the ground, “survive ‘til ‘25” is the mantra we’re hearing. It’s a white-knuckle ride, but next year will be a better year. And it’s at the hands of the RBNZ.

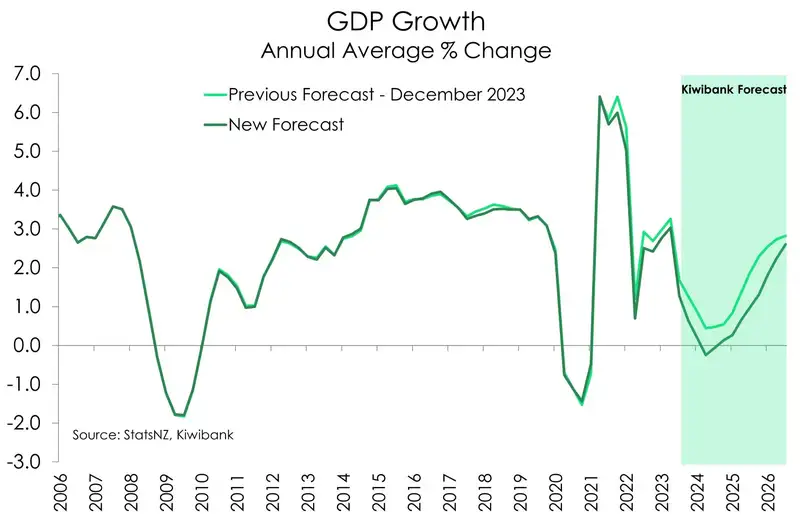

The Kiwi economy has clearly weakened since we last looked under the hood. Over the past 18 months, the economy has been at a standstill, recording a double-dip recession. And the forward-looking indicators point to an economy that will struggle to eke out much growth in 2024. We have downgraded our forecasts for the Kiwi economy. We now see the economy growing just 0.1% this year, down from an already soft 0.5%. The RBNZ has been among the most aggressive central banks in a quest to tame inflation. The “higher for longer” rates environment hurts. And the impact of restrictive monetary policy is undeniable.

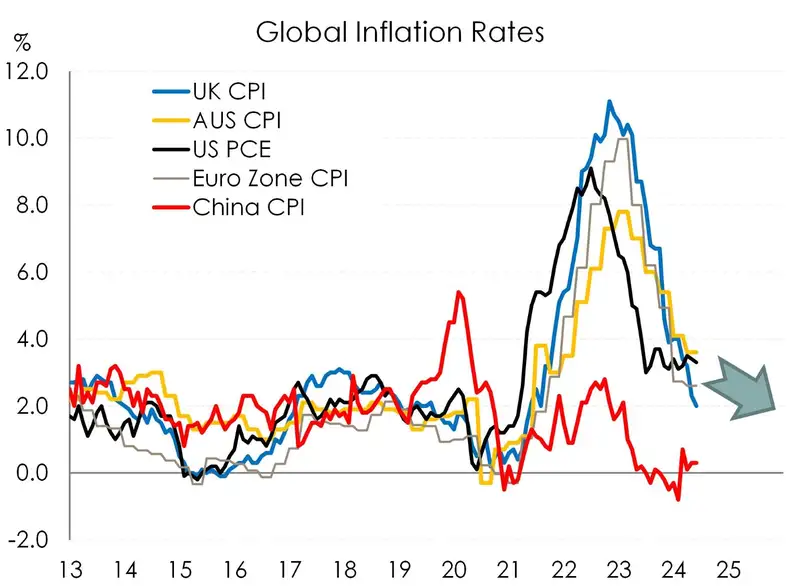

At the end of the day, it’s all about inflation. Kiwi inflation has fallen at pace from a 7.3% peak to 4%. We always knew that leg of the descent would be the easiest. A rapid deceleration in imported inflation has done most of the hard yards. It is the path back to 2% that is laden with frustrations. Home-grown inflation is proving persistent which is problematic. Rents, insurance costs, and council rates are all moving in the wrong direction. A slightly stimulatory fiscal pulse, in the near-term, isn’t helping either.

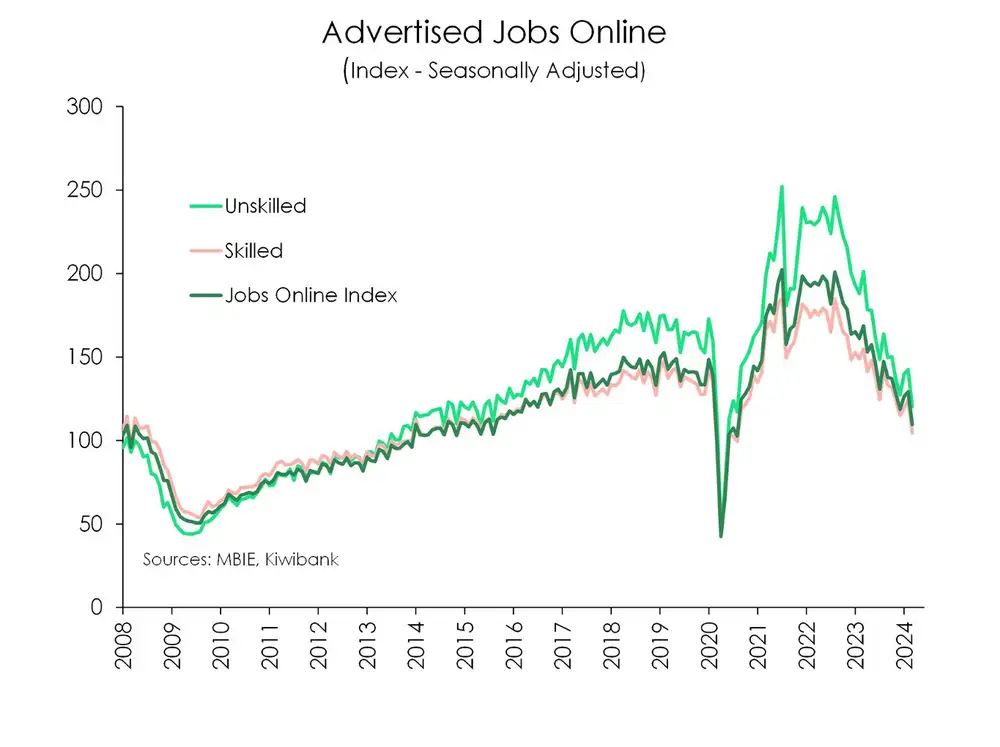

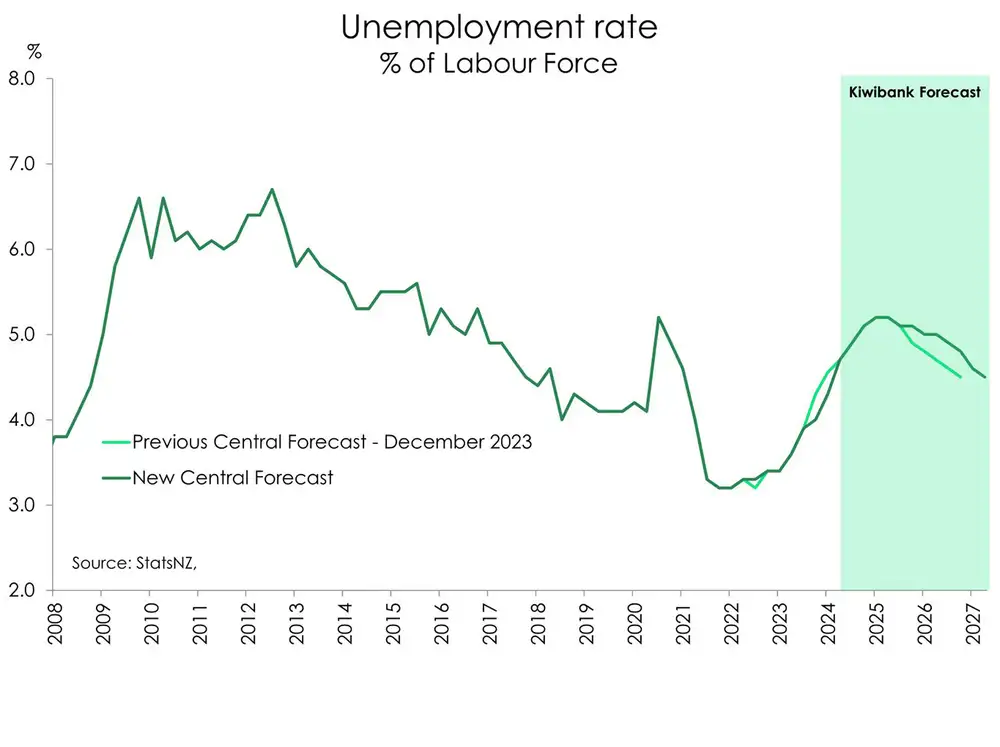

It will be a slower return to 2% from here. But aggressive tightening from the RBNZ is working. Current and expected weakness in the economy should quell domestic inflation pressures. The labour market is already responding as demand indicators soften. The unemployment rate has lifted off its lows, and we expect it to exceed 5% by the middle of next year. Wage growth is moving south and will ensure a sustainable return to target. We still forecast inflation falling back within the RBNZ’s 1-3% target band by the end of the year. It’s been a long time coming - three years above the target band, to be exact.

Where does this leave monetary policy? For now, the RBNZ are in a holding pattern. There’s no need for further tightening. The RBNZ’s heavy hand has hurt households and halted business investment. But it is too early to cut interest rates. Inflation remains outside the target band. And interest rates will remain restrictive for now. But we think the RBNZ will be able to ease policy earlier than they currently expect (second half of 2025). If the economy evolves as we expect, we forecast the first rate cut to come in November. The risks, however, are tilted toward a delayed kick-off. Regardless, we are confident that the next move in rates is down. We may be wrong on timing, but it’s the direction and magnitude of policy moves that’s important.

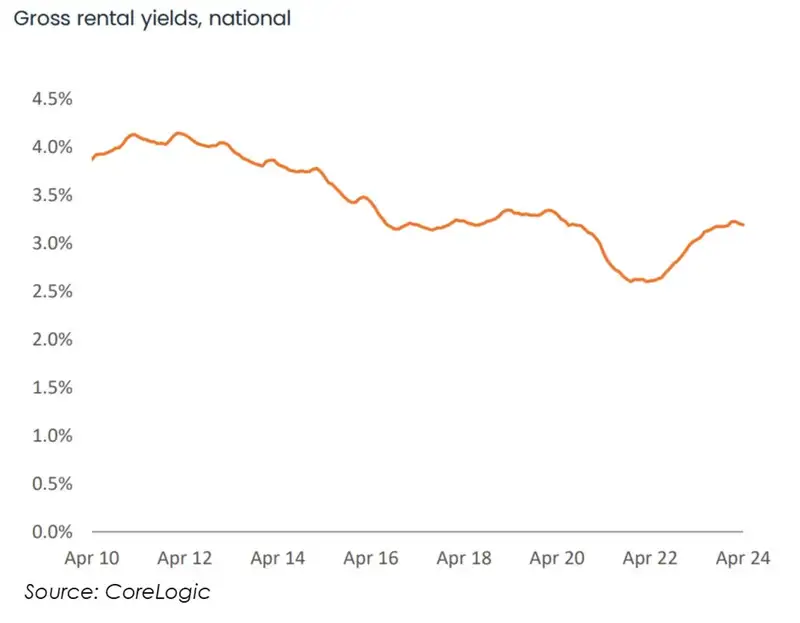

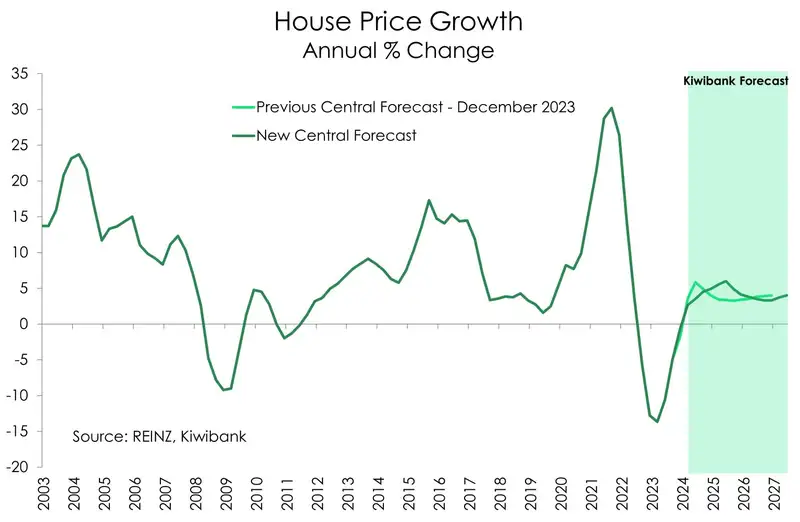

Rate cuts will be a breath of fresh air in a rather deflated economy. The housing market is also in need of rate relief. House prices have not performed as strongly as we had expected. Since the trough, prices are up just 2.3%. The expected pivot in monetary policy and tweaks to investor tax policy, should bolster demand. Rental yields are also strengthening, with rising rents and soft house prices. And investors should be enticed back to market. However, it is more a story for 2025. We’ve pushed out our forecast lift in house prices. It is not until next year that we see house price gains of around 5-6%.

2024 may be another lacklustre year for growth, but it’s always darkest before the dawn. And the good news is, dawn is approaching. We see the economic outlook improving into next year. Because 2025 will be the year of significant rate cuts.

We are privileged to meet many of Kiwibank’s business banking clients. And the anecdotes and insights we gain are invaluable. One client summed up our current situation perfectly:

We must survive until '25.

It’s a white-knuckle ride for many, but next year should be a better year. And it’s at the hands of the RBNZ.

Delayed economic take-off

2023 was a tough year. The Kiwi economy recorded a double-dip recession and growth averaged just 0.6% over the year. The state of the economy is weaker still on a per capita basis. Per capita output has been in decline for the last six quarters. Because at the same time our economy has slowed, migration has surged. There’s less of the economic pavlova to go around. Per capita output has declined nearly 4.3% since September 2022, deeper than the drop during the 2009/09 GFC. It surely ‘feels like’ a recession for the average Joe or Jane on the street.

The worst should be behind us. The outlook is better, but still soft. We’re not out of the woods yet. The forward-looking indicators point to lacklustre growth. Both consumer and business confidence continue to linger at recessionary levels, reflecting the challenging landscape. Consumption is anaemic, business investment is dragging along the floor, and trading activity is running backwards. According to NZIER’s business survey, firm’s experienced activity declined in 5 of the last 6 quarters. At the same time, investment intentions and business confidence remain in the red, despite bouncing momentarily post-election.

We have downgraded our near-term growth forecasts. We see the economy growing just 0.1% this year. That’s well below the long-term average of 2.5%. The RBNZ has the economy in a chokehold, and the pulse will only strengthen once interest rates are reduced. And the next chapter in monetary policy (rate cuts) is more likely to be a story for 2025. We’ve pushed out the timing of the turnaround.

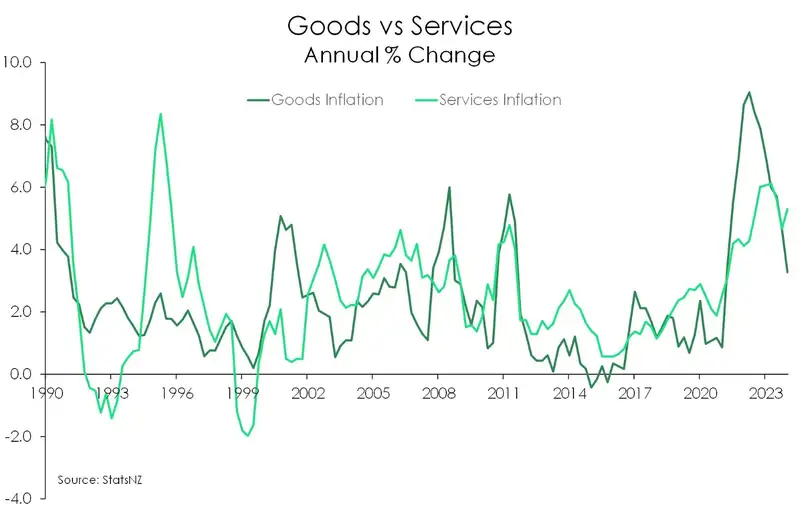

Sticky services delays disinflation

Kiwi inflation has eased over the last two years. Headline inflation has fallen steeply from the 7.3% peak in 2022, to 4% at the start of the year. That’s the easy part. And we have a rapid easing in imported prices to thank. The tricky task is returning inflation to the RBNZ’s target midpoint of 2%.

A successful and sustainable return largely depends on a further easing in domestic inflation. However, progress has been slow. Domestic inflation took longer to rise to its 6.8% peak, and will therefore take longer to normalise. At 5.8%, domestic inflation is still too hot. Services sector inflation, in particular, remains elevated. Demand rotated away from goods and toward services as the economy emerged from covid. Labour market tightness led to record-high wage growth and was another driver of services inflation.

Unlike goods inflation, it will take time for services inflation to recede. The RBNZ has smashed the interest rate sensitive parts of the inflation basket. But they’re less able to influence the parts that are less sensitive to interest rates. And those parts are under duress for other reasons.

Surging migration has pushed rents to the highest run rate since the 1990s, at 4.7%. It doesn’t help that residential building activity has cooled. Building activity is not keeping pace with population growth. Adding to housing related costs, insurance premiums have spiked following Cyclone Gabrielle and the severe weather events of 2023. Homeowners also face spiralling council rates, as debt-burdened councils face into embarrassing failures. Many councils have lifted rates by double-digits. A slightly stimulatory fiscal pulse, near-term, isn’t helping either.

It will be a slower return to 2% from here. But aggressive tightening from the RBNZ is working. We continue to forecast inflation falling below 3% this year. Weak growth and a looser labour market should ease domestic price pressures back towards 2%. It’s just going to take some time to flow through. We see inflation returning to the target midpoint by the end of 2025. It’s important to note that the RBNZ will need to start easing well before the actual return of inflation to 2%, or they’ll undershoot. Monetary policy works with a 12-to-24 month lag. So, policy today is aimed at the end of next year.

Looser labour markets

The labour market is beginning to show the weakness in the economy. It’s snowballing. The unemployment rate continues to move away from the record lows in 2021. Spare capacity in the market is building. In 2023, the loosening was primarily centred around a migration boost to labour supply. The borders were open, and migrants quickly began filling the void of long held vacancies. But, with record levels of net-migration, employment growth has started to fall below population growth, pushing up the unemployment rate. Now, a different narrative is in play. The labour market is weakening under the weight of a recession. Consumer demand has cooled, and so too has firms demand for labour. Firms are pumping out less output. And with less output, there’s less demand for an extra pair of hands. And unfortunately, we haven’t seen the end of it. Recessions tend to feel worse at the tail end. Because unemployment lags the broader economy by about 9 months. In a downturn, the labour market is the last shoe to drop. So, even with output starting to pick up into 2025, albeit off low levels, we still expect the unemployment rate will reach a 5.2% peak in the middle of next year.

It’s harsh, we know. But greater slack in the labour market cools domestic inflation, with softer wage growth. We’ve seen wage growth come down from the 4.5% peak last year. And as spare capacity builds, we should see wage pressures ease further. Currently, inflation (4%) is still running above the pace of wage growth (3.8%). But with a faster fall in generalised inflation, we expect wages to hold at a higher run-rate. That’s what we need to see a slow end to the cost-of-living crisis. Inflation needs to drop, as expected, to 2%, and wages should hold in the 3s. Households need it.

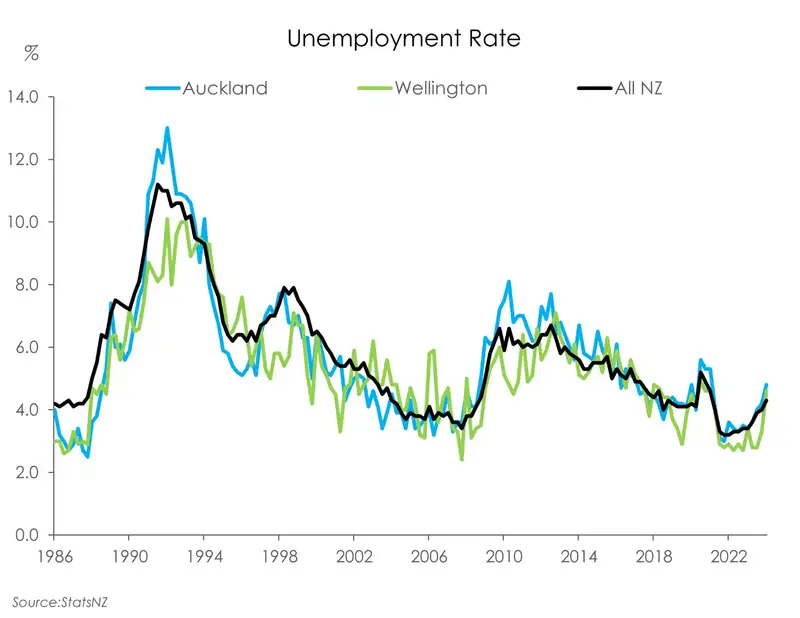

A look into Wellington’s labour market

What’s happening in the labour market across the regions will be of notable interest this year. Wellington is in focus, with all the public sector job cuts. As it stands, both Auckland and Wellington’s unemployment rates are higher than the nationwide rate. However, Wellington’s unemployment rate (4.6%) is yet to surpass Auckland’s (4.8%). Keeping in mind that the labour market lags the broader economy by about 9 months. And so, the job losses we’re hearing about now (or from earlier in the year) are yet to come through in the data.

Generally speaking, Wellington’s unemployment rate rarely deviates too far beyond that of Auckland’s. If we look back at the peak in unemployment during the GFC we see Auckland suffered much higher levels of unemployment than the national rate and more so than Wellington. Of course, things will unfold differently this time, given the concentration of the public sector job cuts in Wellington. It’s one to watch.

Investors are ready to pounce

The Kiwi housing market stabilised early in 2023, helped by booming migration. However, the market has struggled to gain direction since. It has been a sluggish start to 2024. Monthly house price movements have been modest in both directions. Sales are holding up above last year’s levels, but remain well below the long-term averages. It’s taking time, but confidence will return.

Come Spring, we should see investors re-enter with greater confidence. We are likely to see a rebound in investor activity as the changes to policy – including, reintroducing interest deductibility, reducing the Brightline test holding period, and easing the LVR restrictions – kick in.

An improvement in rental yields should also entice investors. Rental yields hit a trough of 2.6% in 2022. But the rise in rents has seen yields creep higher. Nationally, gross rental yields increased 3.2% in June, the highest since late 2020. Rental yields are still historically low, and need to better compensate for high mortgage rates (interest deductibility certainly helps). The attraction toward rental property will strengthen once interest rates have been cut.

House prices will also rise for the wrong reasons. Everything that is wrong with our housing market is due to a lack of supply. We need better infrastructure, more plots, more houses. And affordability will follow. Until then, the demand/supply imbalance will worsen. Pipelines are empty, with an ongoing decline in consents. But our population has grown to a team of 5.3mil. It’s déjà vu. Migration surges, and price rise. Because we fail to invest for the population we have… with little consideration for the population we will have.

Interest rates are the key driver of housing prices. And it is only once interest rates are reduced do we forecast a meaningful rise in house prices. We continue to call house price gains of ~6%, similar to our previous forecasting round. However, we have pushed out the timing recovery into 2025, around six months later than we initially thought.

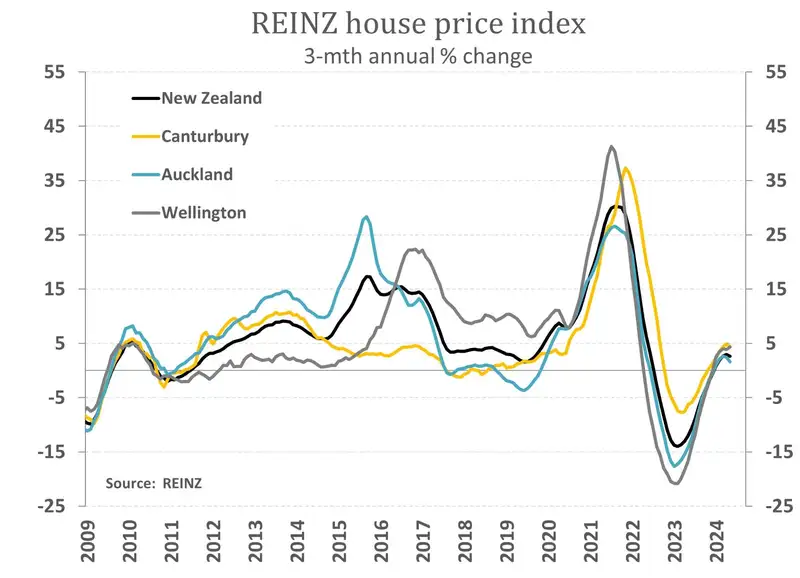

Much like the labour market, we’ll be closely monitoring divergences in the housing market across the regions. We’ve already observed some material differences across the regions. The two capitals, Auckland and Wellington suffered the most during the housing downturn, with price falls of about 23% and 25% respectively. While regions like Canterbury posted a materially shallower decline of 7.5%. Now in the slow recovery, regional divergences are emerging once again. House prices across Aotearoa have recovered 2.3% since the trough last year. Auckland’s recovery is more sluggish, with house prices up just 1.4% from the bottom. While Wellington and Canterbury have a bit more bounce in their step, with prices up over 4% from the trough. However, context is key. For the Windy Capital, house prices are still over 20% below the late-2021 peak. House prices in the Garden City, however, have clawed back to be just 4% below peak levels.

In the year ahead though, Wellingtonians will likely be weighing up the impact of significant job cuts in the public sector. That will have flow-on effects, possibly stalling Wellington’s recovery. Meanwhile, as the biggest beneficiary of the migration boom, Aucklanders will have to deal with a worsening housing shortage. But come rate cuts, the influx of migrants and rapid population growth might very well see a faster recovery for the Auckland housing market.

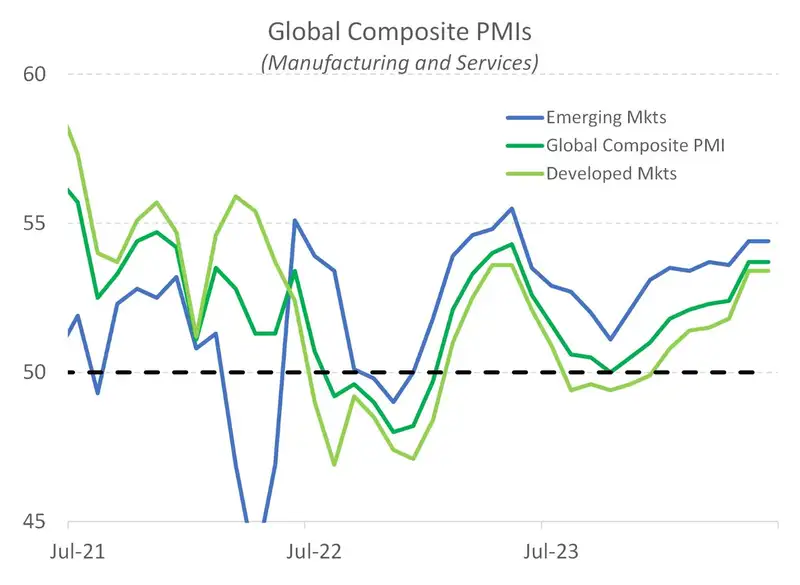

The Influential Global Outlook is positive

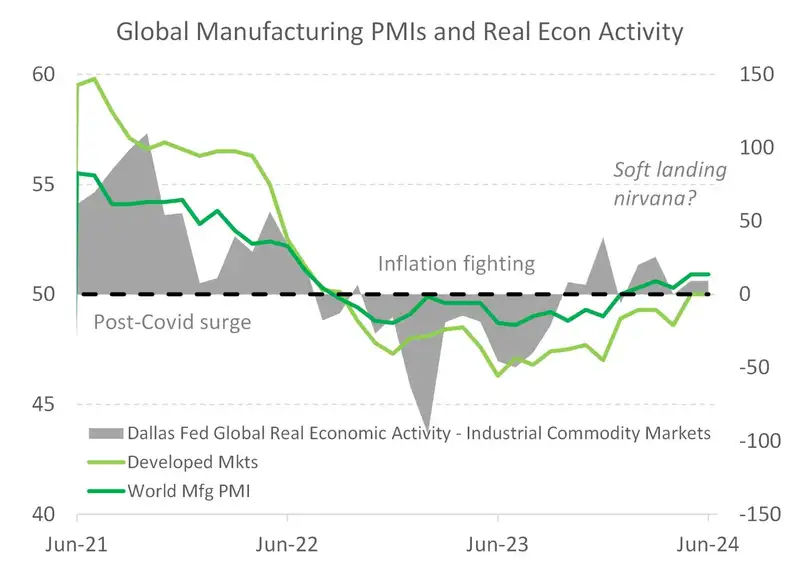

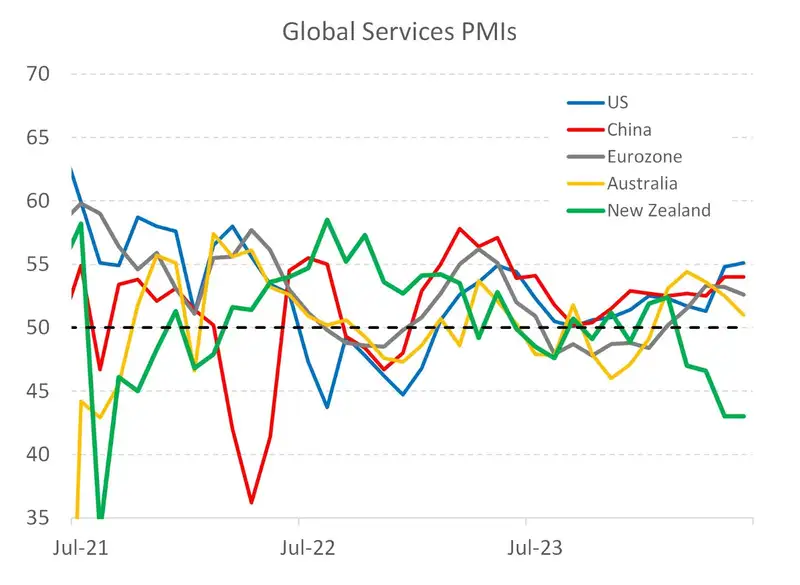

When we look at the Purchasing Managers Indices (PMIs) for manufacturing and services, we can see a broad-based improvement. Emerging markets are leading developed markets, and services are outperforming manufacturing. The good news is in the manufacturing powerhouses. The titans of manufacturing, including China, Japan, South Korea, US, and the UK have all moved out of the red (PMIs below 50, and contracting), and into the black (with PMIs above 50, and expanding). The major disappointment being Germany, and the Eurozone as a whole.

The chart above shows the developed markets manufacturing PMI hit 50 (breakeven) for the first time since September 2022. The uplift in the PMIs coincides with a clear improvement in global activity, as measured by the Dallas Fed’s global real economic activity (Kilian) index. Economic activity has been above trend for six of the last eight months. And as more and more central banks ease financial conditions, by cutting interest rates, growth should strengthen. With the European (ECB) and Canadian (BoC) central banks easing rates, after the Swedish (Riksbank) and Swiss National Bank, traders are looking to England (BoE) and the US (Fed) for cuts, later this year.

Embattled economies and falling inflation should enable most central banks to ease policy this year. And with that, our trading partner growth should improve into next year.

Our greatest strength is also our greatest weakness, and that’s our largest trading partner, China. The Chinese economy has struggled with “dimmer prospects” (IMF April’24). The property sector remains in a significant correction. “Without a comprehensive response to the troubled property sector, growth could falter, hurting trading partners (including NZ).” And a comprehensive response is in train. The Government has stepped in to buy unsold homes (via local governments) and relaxed mortgage rules in an attempt to arrest the decline. The powers in Beijing are targeting 5% growth, which will take some work, and stimulus. The Chinese Yuan has come under pressure, and is limiting the PBOC’s ability to cut rates. Rate cuts from the ECB, BoC, along with the Riksbank and SNB, will provide some room for the PBOC to move. PBOC rate cuts are expected in coming months.

One theme of the global rebalancing has been the rotation from goods back into services, and what that means for services inflation. The rotation is still underway, and services inflation remains a key consideration for central banks in (not) easing monetary policy. Interestingly, the performance of New Zealand’s manufacturing and services indices is disappointing, to put it politely. While other countries have seen a strong lift in services PMIs, New Zealand’s has dropped off a cliff.

The underperformance in Kiwi activity has been reflected in the Kiwi stock market, rates and to a lesser extent, currency.

Global growth is forecast by the IMF to remain below trend at 3.2%, for this year and next. Expected growth is similar to the actual growth recorded last year. We think there is some slight upside risk to next year’s forecast, but not this year. Survive ‘til 25. The good news is the resilience in foreign demand.

The IMF notes: The global economy remains remarkably resilient, with growth holding steady as inflation returns to target… Yet, despite many gloomy predictions, the world avoided a recession, the banking system proved largely resilient, and major emerging market economies did not suffer sudden stops. Moreover, the inflation surge—despite its severity and the associated cost-of living crisis—did not trigger uncontrolled wage-price spirals. Instead, almost as quickly as global inflation went up, it has been coming down. (World Economic Outlook Apr’24)

Inflation rates, globally, are falling back to target. And export prices out of China are falling. The tradables good and services within our inflation basket has fallen from over 8% to 1.6%, and will continue to fall below 1% into 2025. There’s a good chance we, once again, get some disinflation in parts. That’s helpful, but it’s only half the job.

“As inflation converges toward target levels and central banks pivot toward policy easing in many economies, a tightening of fiscal policies aimed at curbing high government debt, with higher taxes and lower government spending, is expected to weigh on growth.” (World Economic Outlook Apr’24)

Interest rates will hold, for now, and hopefully fall

The outlook for interest rates is becoming clearer, if only delayed. We have experienced a great deal of volatility in rates markets, with rate cut expectations being pushed back, but not out. Because the path for policy is ultimately pegged to the path of inflation.

Current wholesale rates have factored in a full 25bp rate cut in November, followed by a second in February. Thereafter, rates decline and imply a cash rate around 4% in early 2026. That’s 150bps of easing. We agree with the market’s pricing near term. But the market is light on cuts over the medium term. We expect 25bp cuts in November, February, and at every meeting until we get back towards neutral. Neutral is the Goldilocks rate, currently around 2.75-3%, that’s neither too hot or too cold.

Based on our view, the market is well priced until mid-2025, but under-priced thereafter. In our financial market update, Soft landing nirvana: ‘on a plain', we noted that:

“Bets on rate hikes have swung to rate cuts. If we look at the OIS (overnight index swap) curve, traders are placing some handsome bets on cuts to come as early as August (-26bps at 5.24%). And there is 66bps of cuts priced by November (at 4.84%). Our call is for the first 25bp cut to come in November, ahead of most commentators, and even we’re surprised at the speed at which cuts are expected… The cuts priced into July, and out to February, are likely to be pushed back… as the RBNZ under-delivers on over-priced cuts.” (Soft landing nirvana, March 2024)

Our expectations have come through, with fewer cuts priced near-term. But the next big move in rates is yet to come, and it will. It’s more a 2025 story. When the RBNZ start easing, whether it’s in November or February, or later, the big move in rates will be over 2025-26 as the terminal cash rate gets adjusted towards a neutral setting. The rates market will need to adjust to a 3% terminal rate, and that’s another 100bps of decline, or bull-steepening.

The Kiwi has regained flight, but still faces headwinds

The Kiwi has traded in a 58.1c to 63.2c range against the Greenback this year. And we’re smack in the middle at 61.2 now. The Kiwi has been propelled higher against the Euro, as the ECB started off their rate cutting cycle. We’ve seen a lift from 55c to 57c.

The Kiwi dollar has broadly outperformed our expectations. Because the RBNZ has maintained a relatively hawkish tone, compared to their central banking peers. Although we have also been surprised by the hawkish tone out of the Fed, as the US economy continues to outperform. We are still waiting for the Fed to lead the RBNZ.

As we noted in March: “If the Fed leads, then the Kiwi currency should hold up against the greenback, helping to ease imported inflation. We need that sort of help. It is only when the RBNZ comes into action that the Kiwi is likely to depreciate, helping exporters. Indeed, we see the Kiwi holding strong near term, before falling to 57c by year-end. It is only when the RBNZ comes into action that the Kiwi is likely to depreciate, helping exporters. Indeed, we see the Kiwi holding strong near term, before falling to 57c by year-end.” (Soft landing nirvana, March 2024)

We stick by our long-held forecast for the Kiwi flyer of 57c by year-end. Although the risk is clearly towards a postponement of that descent until 2025. Because the RBNZ may choose to hold well into 2025.

Near term, we think the Kiwi will remain elevated, as the RBNZ’s hawk-like feathers fly higher and shine brighter than their central banking peers. The stronger Kiwi flyer will assist with the inflation fight, and help importers.

Ultimately, we think the cooling in global demand and reduction in inflation pressures will weigh on the bird. But that may take many a month to see. It will be a volatile downward glidepath. It always is. But we expect the Kiwi to ultimately fall into a 55c-to-59c range in 2025. Basically, we expect to re-record the recent lows. The downward glidepath for the Kiwi flyer will eventually help our exporters, with tourism and agriculture in need of a boost.

Economic forecasts

Quarter* |

||||||||

|---|---|---|---|---|---|---|---|---|

|

Dec-23 (a) |

Jun-24 (f) |

Dec-24 (f) |

Jun-25 (f) |

Dec-25 (f) |

Jun-26 (f) |

Dec-26 (f) |

Jun-27 (f) |

|

|

GDP (Prodn, Real apc) Change from Dec'23 forecast (%pts) |

-0.3 |

-0.3 |

0.5 |

1.2 |

1.8 |

2.9 |

2.7 |

2.5 |

|

GDP (Prodn, Real aapc) Change from Dec'23 forecast (%pts) |

0.6 |

-0.2 |

0.1 |

0.5 |

1.2 |

2.2 |

2.8 |

2.6 |

|

CPI (% yoy) Change from Dec'23 forecast (%pts) |

4.7 |

3.5 |

2.7 |

2.3 |

2.0 |

2.1 |

2.0 |

2.0 |

|

Unemployment rate (%) Change from Dec'23 forecast (%pts) |

4.0 |

4.7 |

5.1 |

5.2

|

5.1

|

5.0 |

4.8 |

4.5 |

|

Wage Growth (pvt-sector LCI % yoy) Change from Dec'23 forecast (%pts) |

3.9 |

3.6 |

3.1 |

2.6

|

2.5

|

2.5 |

2.4 |

2.3 |

|

REINZ House Price Index (% yoy) Change from Dec'23 forecast (%pts) |

-0.7 |

3.5 |

4.9 |

6.0

|

3.8

|

3.3 |

3.7 |

4.2 |

* (a)= actual, (f)=forecast

Financial markets forecast

Quarter end |

||||||||

|---|---|---|---|---|---|---|---|---|

|

Dec-23 (a) |

Jun-24 (f) |

Dec-24 (f) |

Jun-25 (f) |

Dec-25 (f) |

Jun-26 (f) |

Dec-26 (f) |

Jun-27 (f) |

|

|

Official Cash Rate (%) |

5.50 |

5.50 |

5.25 |

4.50 |

3.75 |

3.00 |

2.50 |

2.50 |

|

2-year swap rate (%) |

4.64 |

4.65 |

4.00 |

3.40 |

3.00 |

2.75 |

2.70 |

2.70 |

|

5-yr swap rate (%) |

4.08 |

4.45 |

4.30 |

3.90 |

3.60 |

3.40 |

3.30 |

3.25 |

|

10-year swap rate (%) |

4.14 |

4.50 |

4.40 |

4.20 |

4.00 |

3.90 |

3.80 |

3.75 |

|

2s10s yield curve (basis points) |

-50 |

-15 |

40 |

80 |

100 |

115 |

110 |

105 |

|

NZD/USD exchange rate |

0.63 |

0.60 |

0.57 |

0.59 |

0.63 |

0.67 |

0.69 |

0.69 |

|

NZD/AUD exchange rate |

0.93 |

0.92 |

0.91 |

0.93 |

0.94 |

0.95 |

0.95 |

0.95 |

|

NZ TWI |

72.45 |

72.00 |

71.00 |

71.00 |

72.00 |

73.00 |

74.00 |

74.00 |

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.