Consumer spend ramped up into the holiday period

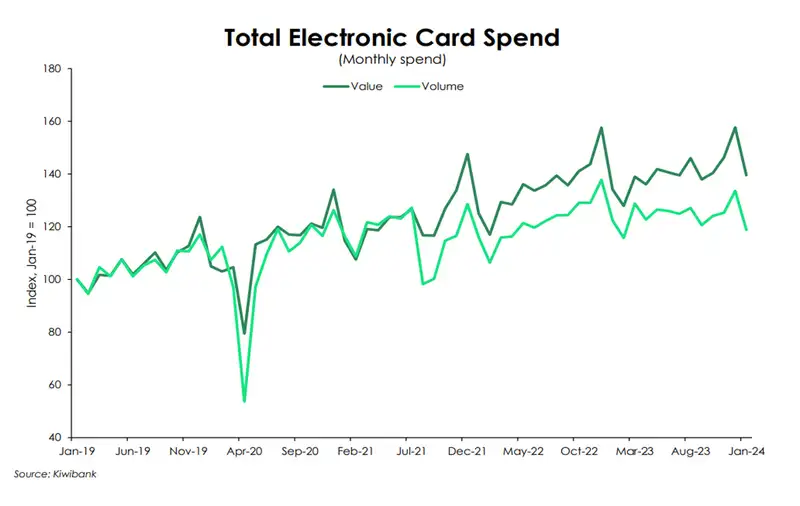

Kiwibank electronic card spend rose 5% over the December quarter. But 2023’s silly seasonal Santa spike was far more muted compared to previous years. Over the quarter, consumer spend was just 0.4% higher than 2022’s levels. And in the month of December, spend was unchanged. But given the (visible) hand of inflation, no change in the value of spend forewarns a decline in the volume of spend. Our data revealed exactly that.

The number of transactions were 3% fewer over December compared to 2022, and down 3.3% on the quarter. With high inflation and rising interest rates, Kiwi households were clearly more reluctant to spend in 2023. Such restraint continued into the festive season. And 2024 will likely be more of the same. January spend also looks to have been a weak month, with the typical lift in hospitality underperforming.

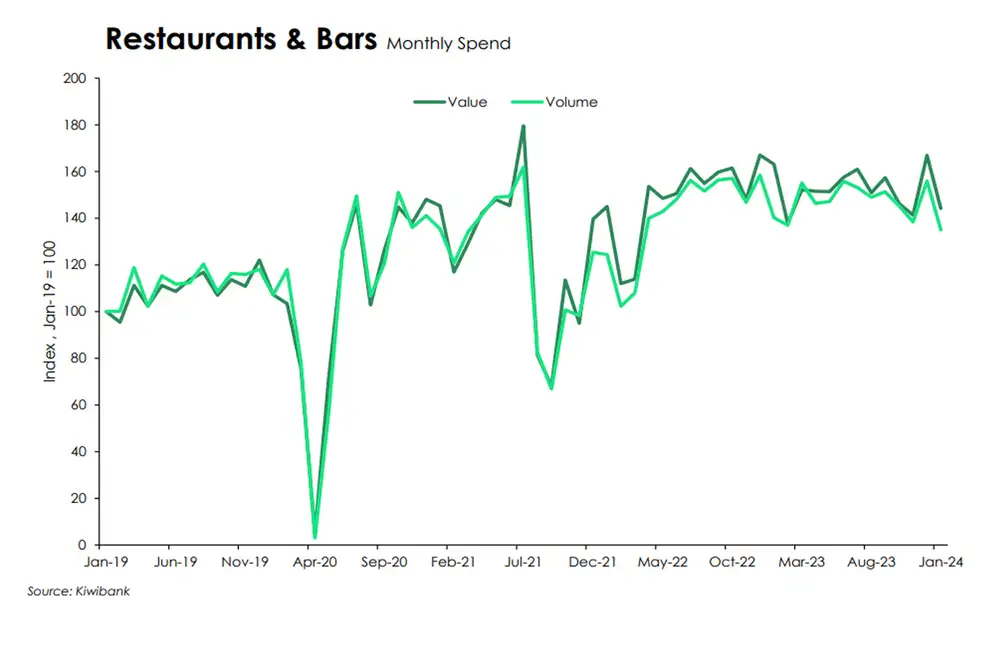

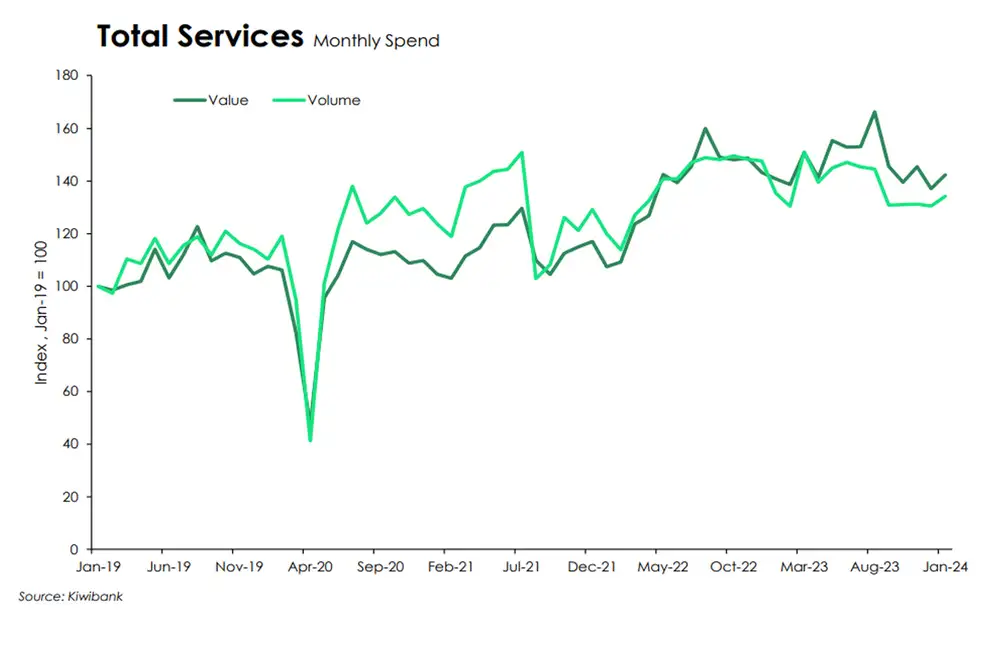

Spend on services underperformed over the holiday period. Dollars spent on hospitality, entertainment and recreation collectively declined 4.3%, meaning an even deeper decline in the volume of spend (12%!). It seemed that Kiwi opted to catch up over home-cooked meals and movie nights rather than nights-out – more visits to the local grocer (up 5.3%) and re-runs of Home Alone on Netflix (6.2% increase in home & online entertainment).

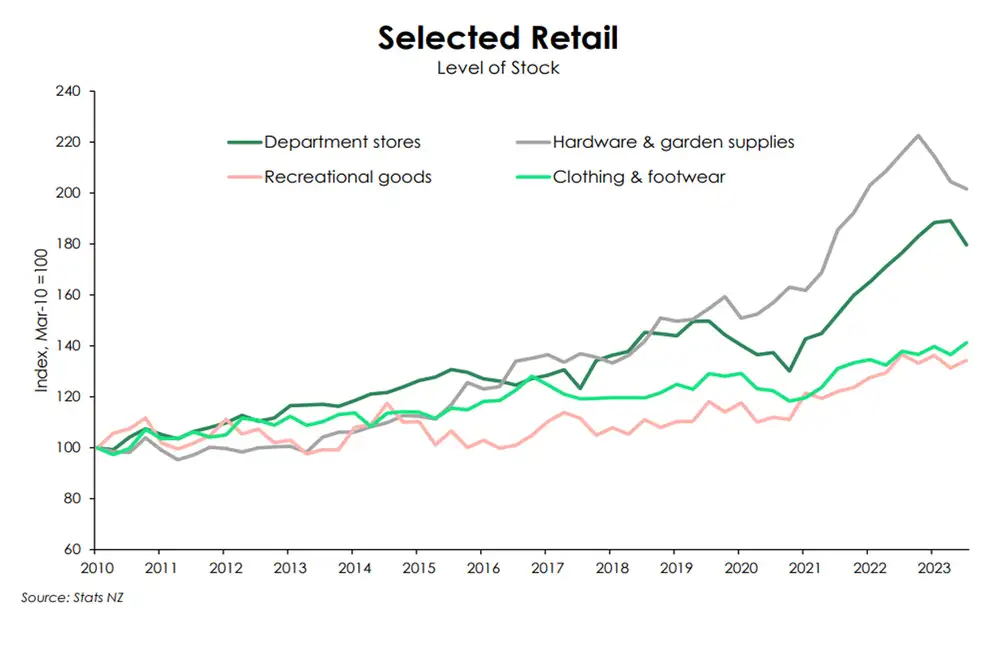

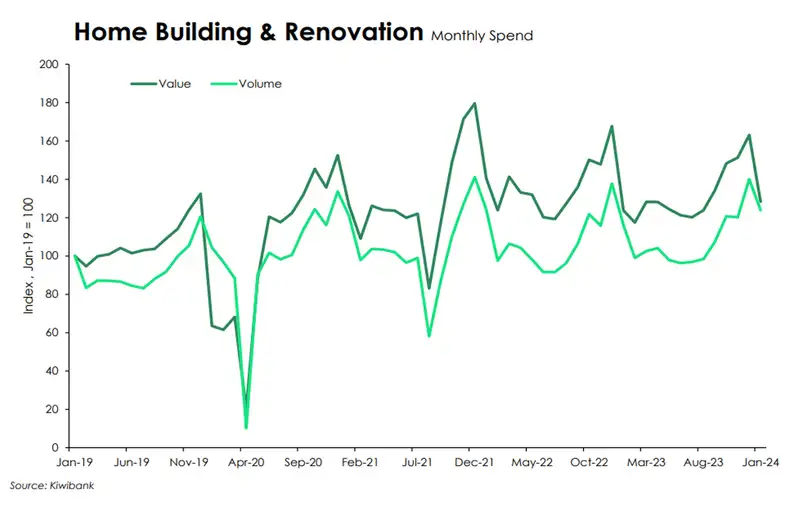

The summer holiday is also a time to bring out the tools to work on the house. And what better way than with new toys. Bucking the overall trend, the volume of hardware spend increased 1.6% from 2022, while the value of spend fell 0.6%. It may be that Kiwi opted for DIY of a smaller scale – patching up the fence, rather than a whole re-do. We also suspect heavy price discounting – due to overstocked shelves – was at play, which, evidently, Kiwi accepted.

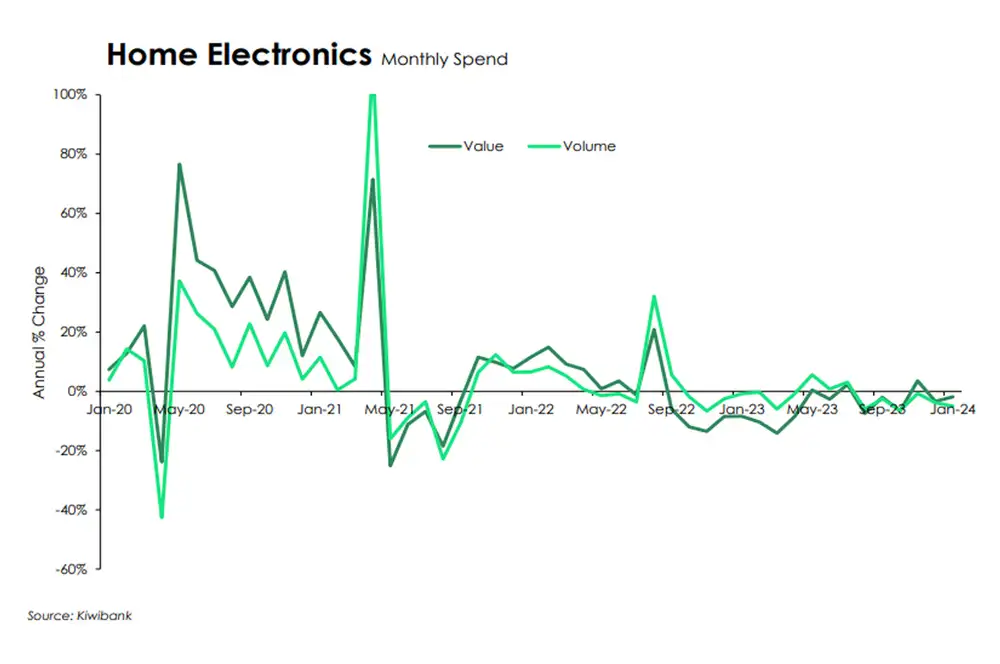

Discounting among other retail goods however may have been less appealing. For home electronics and clothing stores, the Black Friday deals and Boxing Day sales didn’t quite cut it in 2023. Both the value and volume of spend were below 2022’s spend. The smart TVs Kiwi bought in 2022 are still smart enough, and Chuck Taylor’s will forever be in style. There’s no need for an upgrade (yet).

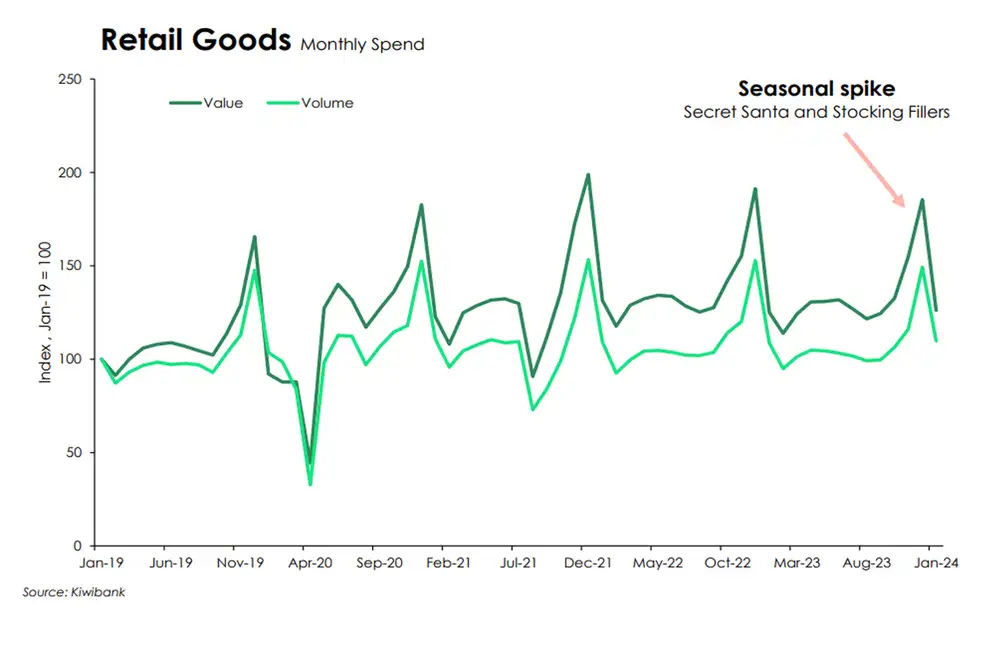

The value of spend on goods accelerated 12.5% over the December quarter. But the Black Friday deals and Boxing Day sales enticed fewer to checkout. The volume of spend is up just 2% from 2022’s levels, softer than the 5% growth recorded a year ago.

Clearly the exorbitant demand for all things pools and pizza ovens in 2020 has fizzled. Financial conditions have since tightened, and household disposable incomes are being squeezed. Consumer prices are high, interest rates are rising, and consumer confidence is subdued. As households cut back on spending, it’s discretionary items that are being culled from the budget.

The outlook for household spending remains broadly unchanged. Alongside still-high inflation and subdued consumer confidence, there’s plenty weighing on household consumption. However, the return of migrants offers a lifeline. Strong population growth should support aggregate consumption.

Battle of the anniversary weekends

Hospitality spend typically accelerates into the holiday period. But that wasn’t the case in 2023. Both the value and volume of spend at restaurants & bars declined more than 3% over the quarter. Cafés spend fared just a little better. Dollars spent are 1.8% more than 2022, but it’s largely a price effect. Because the volume of spend is down 2.3% compared to a year ago. Indeed, the December quarter inflation numbers showed a 0.7% rise in prices for restaurant meals and ready-to-eat food. Food prices may have been seasonally soft in the December quarter, but wage growth has been strong. According to Stats NZ, average hourly earnings within accommodation & food services rose 1.1% over Q4, up from 0.9%.

Weak hospitality spend looks to have continued into the start of 2024. The number of transactions made at restaurants & bars is still underperforming compared to 2023 (down 3.7%), but café spend is up 1.2%.

Our two biggest cities enjoyed their respective anniversary days in January, And it looks like Auckland can be crowned ‘Big Spender’ with a 6% lift in total spend volumes at restaurants, bars & cafes over the long weekend, compared to 2023. In contrast total spend volumes during Wellington anniversary weekend declined 3.2% compared to 2023 . Auckland’s Wynyard Quarter hosted the finale of the Red Bull Cliff Diving World Series which likely helped make a splash in spend over the long weekend. But a weak starting point must also be considered. Spend was likely held back in 2023, with the floods during the 2023 Auckland anniversary weekend.

After a run of double-digit growth, spend on services is slowing down. Spend declined 4.3%yoy from 2.3% - the first annual decline since the September 2020 quarter. And on an annual basis, the slide in the number of transactions is even deeper, down 5.2%. A softening in demand for services however is good news for sticky services inflation.

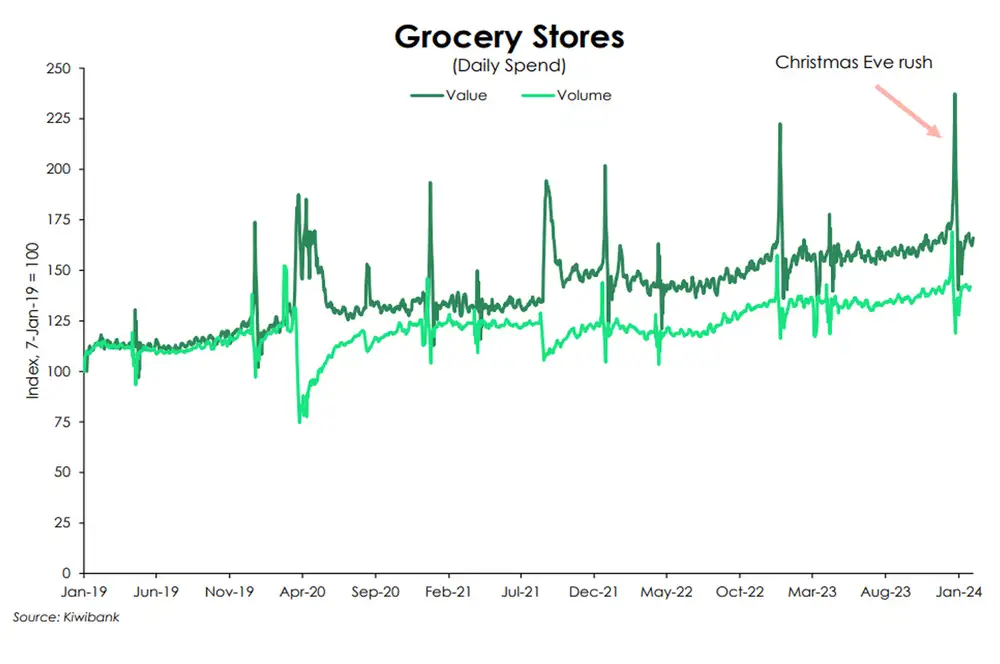

Potlucks & long lunches

As is typical, spend on all things food & drink jumped during the holiday period. Potlucks and long lunches meant busy kitchens and full pantries. In the month of December, the volume of spend played like this:

- A 5.4% rise at grocery stores, with December 23 & 24 together accounting for just under 10% of the month’s total purchases – the mad rush before the Christmas day close.

- A 6.2% rise on fruit and veg;

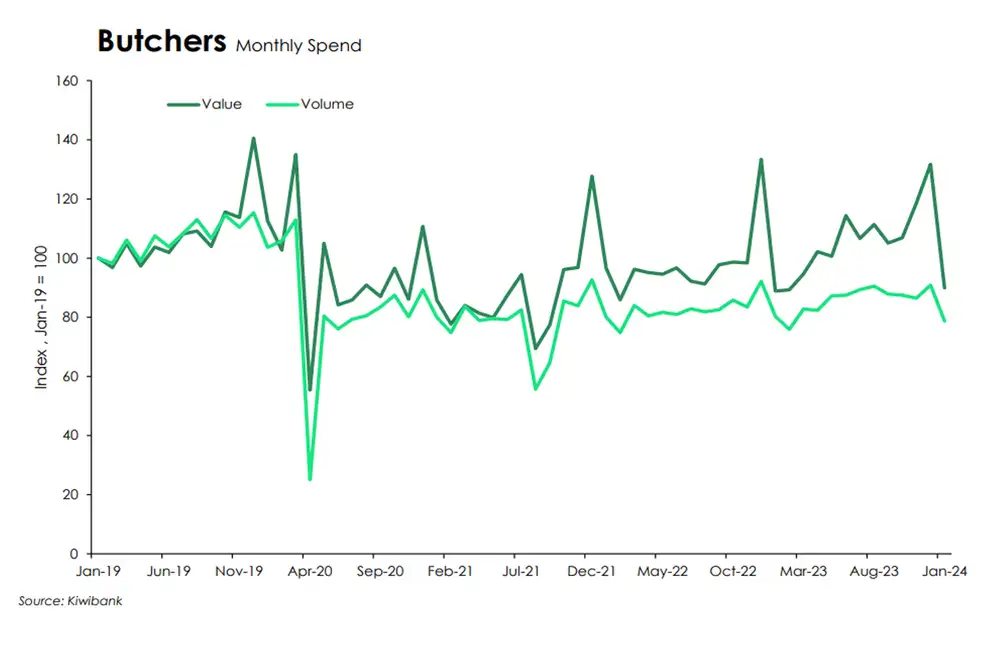

- A 5.1% lift at the local butcher. Meat prices have come under pressure as product, especially lamb and mutton, from across the Tasman, continues to flood overseas markets. The value of spend is down 1.2% from last year’s levels, despite the rise in volumes.

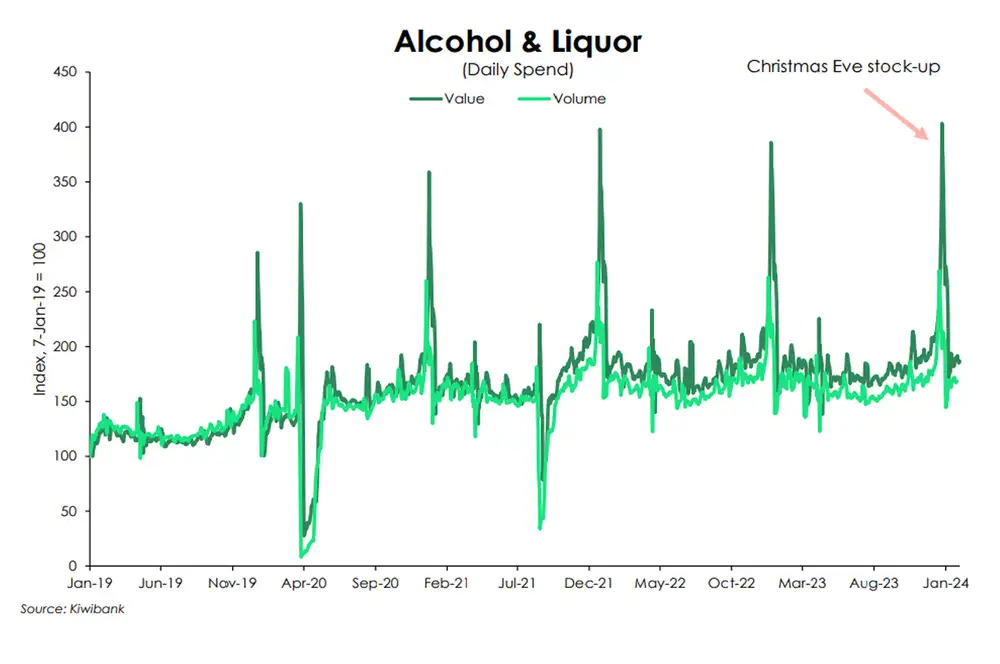

- A 28% increase in spend on alcohol & liquor.

Bargain hunting

Spam in inboxes, flyers in letterboxes, posters in storefronts – everywhere you looked, it seemed that retailers were offering bargains, discounts and deals. And with each year, sales seemed to be advertised earlier and earlier. For some, November’s Black Friday lasted a week, while Boxing Day sales began before we even cut into the Christmas ham. On top of that, the type of retail on sale was across the spectrum – from clothing to couches, electronics to ebikes, frisbees to fridges, and hammocks to hardware.

As we’ve signalled in previous reports, we have been expecting such price discounting. And it’s coming through hot and heavy. Retailers built up their stock during the pandemic. Inventory management pivoted from ‘Just in Time’ to ‘Just in Case’. Today, warehouses are full, and shelves are wellstocked. But this oversupply needs clearing. And how else to do so than by dropping the price. It’s Economics 101. While that’s not ideal for profitability, it is good news for inflation.

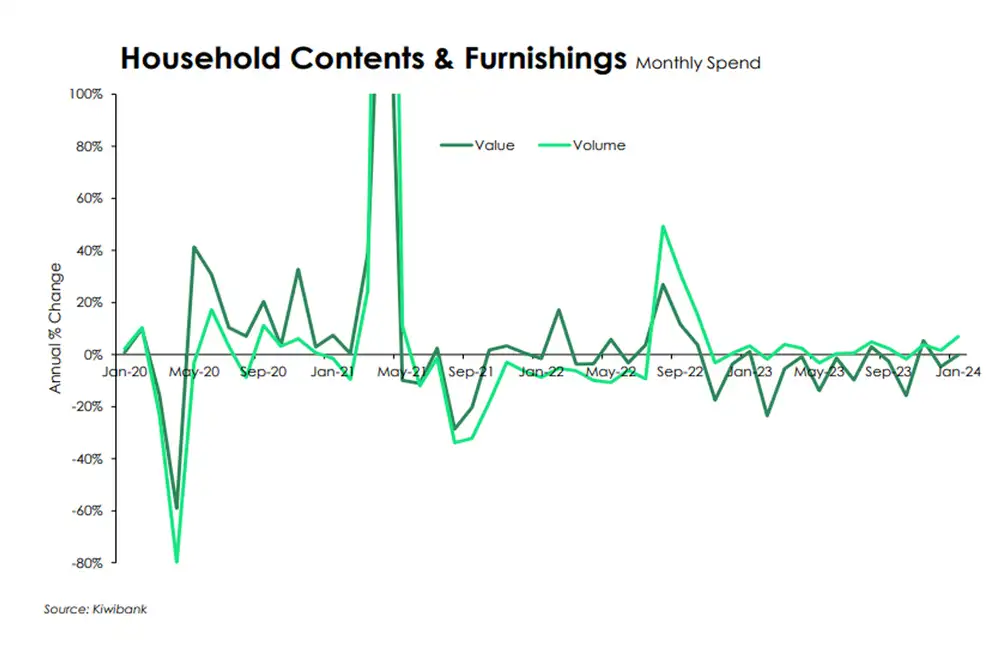

Some retail categories managed to record a rise in volumes as the value of spend fell. The number of transactions made on home contents & furnishings, for example, rose 1.3% compared to 2022’s levels while the value of spend declined 5%. A change in preferences may also explain the divergence between the value and volume of spend – passing up on the 4-seater sofa with a chaise, instead going for the 2-seater and a bean bag.

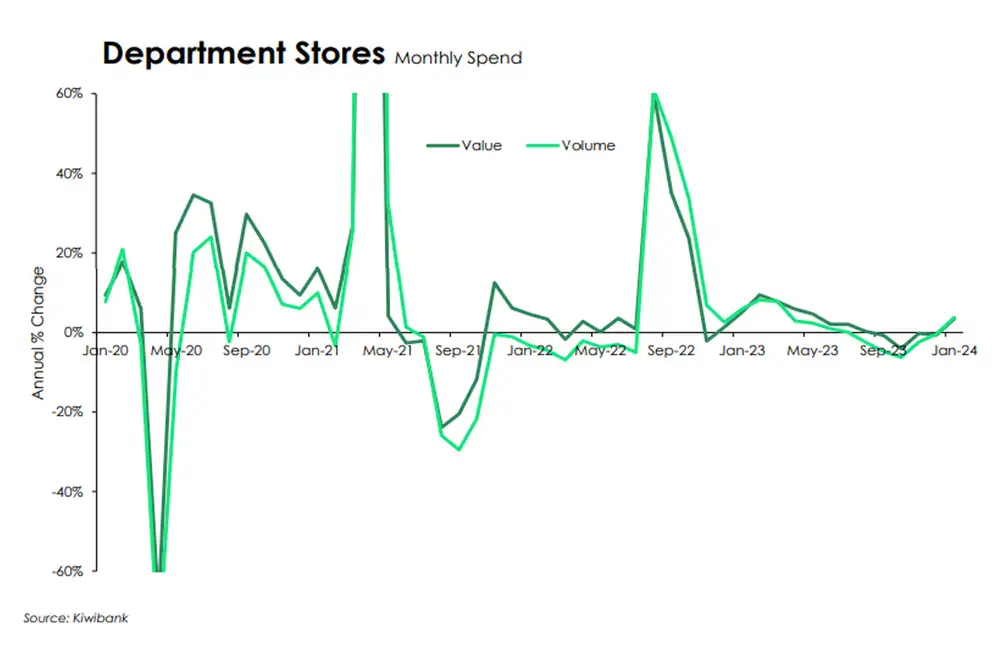

Other retail however recorded a drop in both value and volume of spend. Both the value and volume of clothing spend declined around 11% compared to a year ago. The 3% decline in the volume of spend at department stores was double the drop in dollars spent. Home electronics experienced the same, with a 1.8*% drop in values, and yet a 3.5% drop in volumes.

Overall, it’s no doubt that retail spend is struggling as household demand struggles amidst tight financial conditions.

Different series, same pattern: Restrained retail

Summer chores

There’s always something to build or repair around the home. And the summer holidays is a great time to get those chores done. Time off work means more time in the tool-shed.

Like home contents & furnishings, the volume of hardware spend accelerated near 2% from 2022, and yet the value of spend declined 0.6%. Again, price discounting due to an oversupply may be playing a role. It may also be that Kiwi are opting for a DIY job of a smaller scale – patching up the fence rather than a whole re-do.

Furry friends feel inflation too

It’s not just us feeling the impact of high inflation – but also our furry friends. Dollars spent on all things pets has accelerated over the past few years, while the volume of spend has largely tracked sideways.

Compared to 2022 levels, the value of spend at Vets, Doggy Daycare, Petcare etc is up almost 2%, while volumes have declined almost 4%.

Getting back to full strength

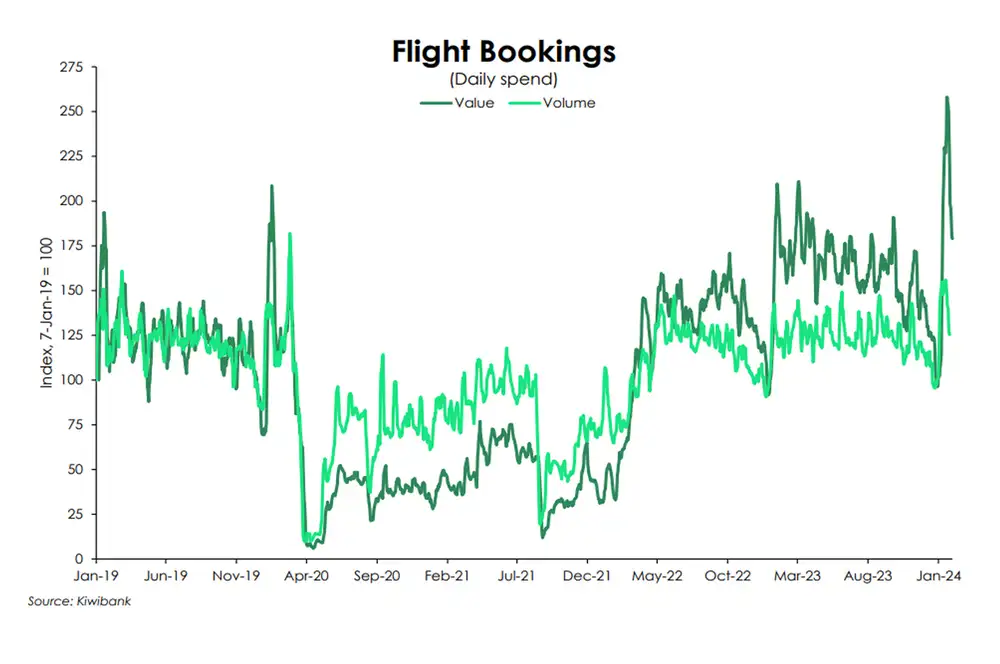

Since Covid-related border restrictions were relaxed in 2022, we have seen many Kiwi head offshore. The exodus was in part due to the pent-up desire of many young Kiwi to see the world. Demand for flight bookings however, appears to be stabilising. The volume of spend is up 7% on 2022’s levels. Base effects are in play as spend was largely in recovery mode in 20221/22. It took some time, but volumes have now returned to pre-pandemic levels. On the other side of the same coin, the total value of spend is up 5.4%yoy, much softer than Q3’s 12.5% jump. Prices for air travel appear to be normalising as capacity within the sector builds.

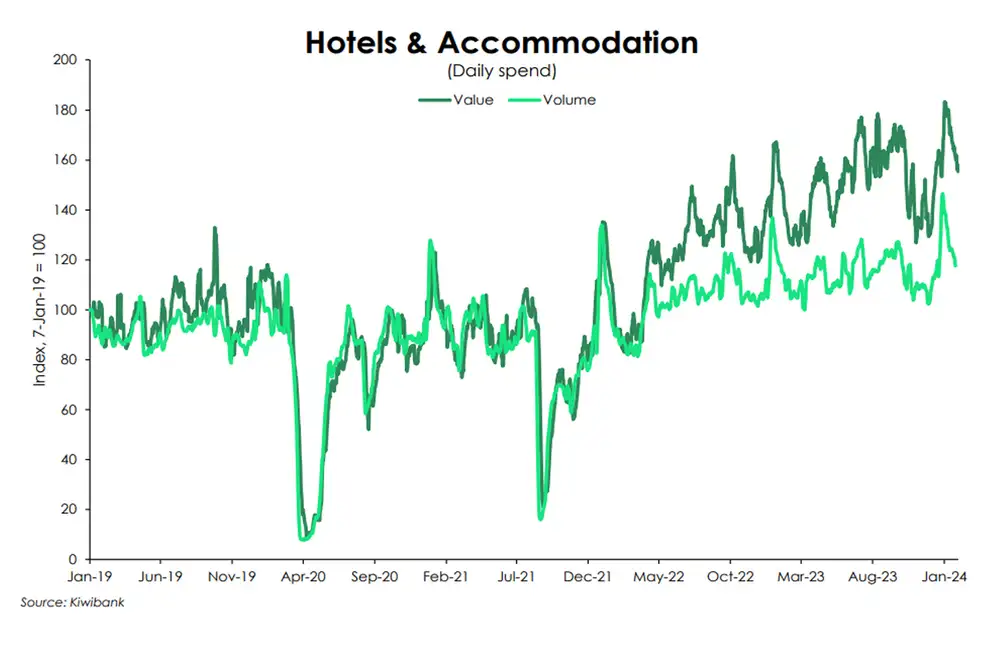

With the world back open, the surge in domestic tourism may have run its course. The volume of spend on hotels & accommodation appears to be flattening. At the same time, the total dollars spent is steadily increasing. The widening gap between the value and volume of spend suggests a rise in price. While domestic tourism may be softening, the return of overseas visitors is boosting demand.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.