Handbrake on consumer spending

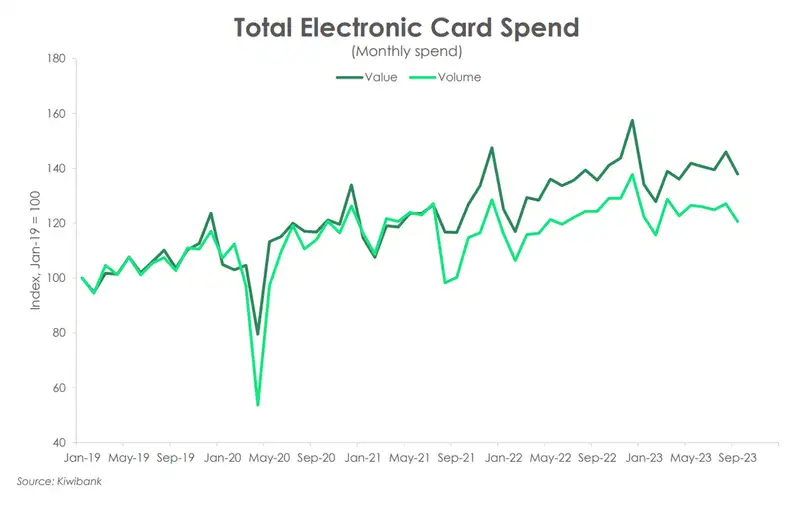

Kiwibank electronic card spend rose a soft 1.2% over the September quarter, softer than last quarter’s 4% increase. The handbrake on consumer spending is even clearer when comparing spend from a year earlier. Annual growth in household spending was just 3% - the smallest annual increase in two years.

The value of spend continues to sit high above pre-covid levels, for a few reasons:

- Historically low levels of unemployment continues to support household incomes and, in turn, consumption.

- Consumer prices continue to rise at an uncomfortably fast pace.

- A growing Kiwibank customer base, as well as a stronger preference for contactless payments in the covid era, may also explain today’s inflated spending levels.

Kiwi are spending more on their cards, but getting less

Stripping out the price effects, however, presents a more accurate account of today’s typical consumer. The apparent flattening in the volume of spend suggests that Kiwi consumers are increasingly reluctant to pull out their cards. In fact, Kiwi swiped, tapped or inserted their cards fewer times than last quarter. The volume of spend declined 0.7% over the September quarter. And compared to a year earlier, the number of transactions grew by just 0.5%. So Kiwi are spending more on their cards, but getting less. It’s part of the cost-of-living crisis…

Household consumption

The outlook for household spending remains broadly unchanged. Over the last year, most Kiwi mortgages rolled off the low rates of 2020/21. And 30% of our mortgages will soon jump aboard the ‘high rates’ train. Alongside still-high inflation and subdued consumer confidence, there’s plenty weighing on household consumption. It’s no surprise to see NZIER report the retail sector as the most pessimistic. However, the return of migrants offers a lifeline to retailers. The solid 2% population growth should support aggregate consumption. The upcoming festive season also typically sees a jump in spend which should help turn frowns upside down.

The highlights

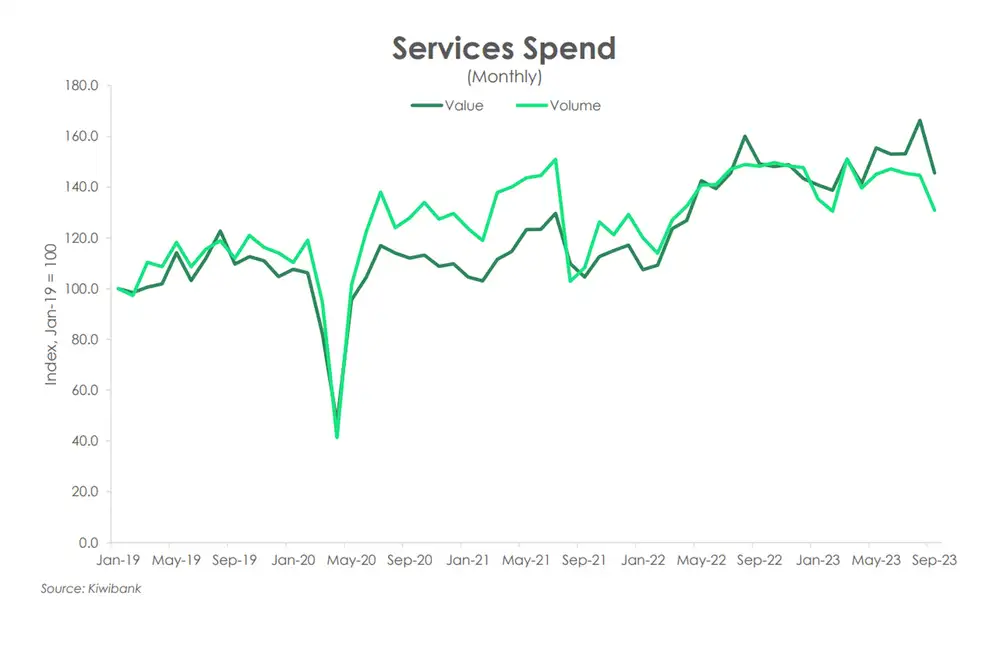

After a run of double-digit growth, spend on services is slowing down. Annual growth decelerated to just 2.3% from 10% over the September quarter. A softening in demand for services presents downside risk to the outlook for services inflation.

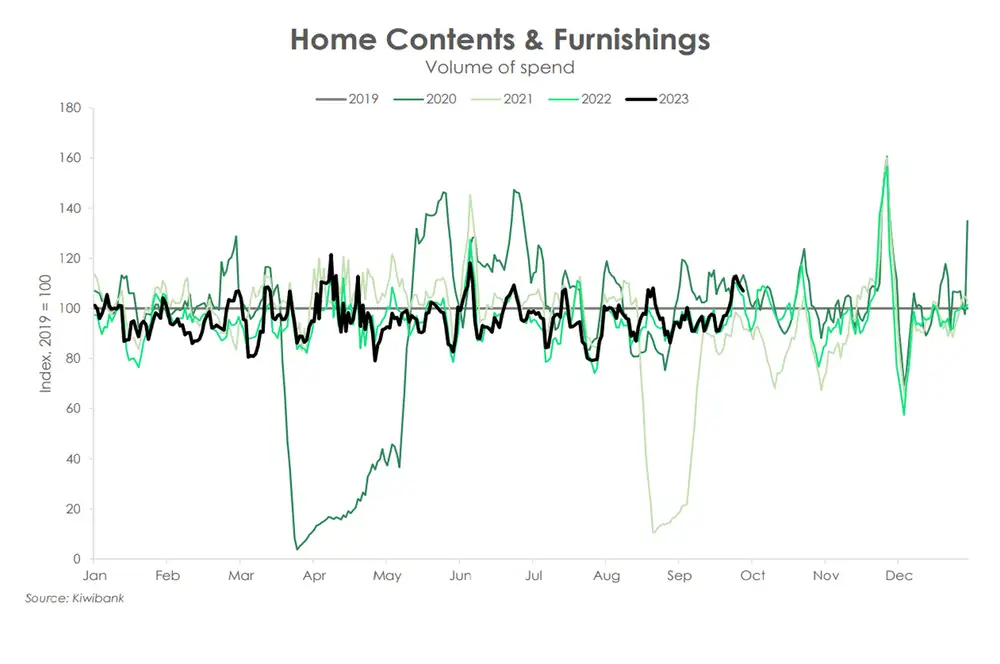

Non-essential goods also remain under pressure. Household incomes are being squeezed by tight financial conditions. There’s little appetite to splurge. The average number of purchases on home contents & furnishings is sitting around 5% below pre-covid levels.

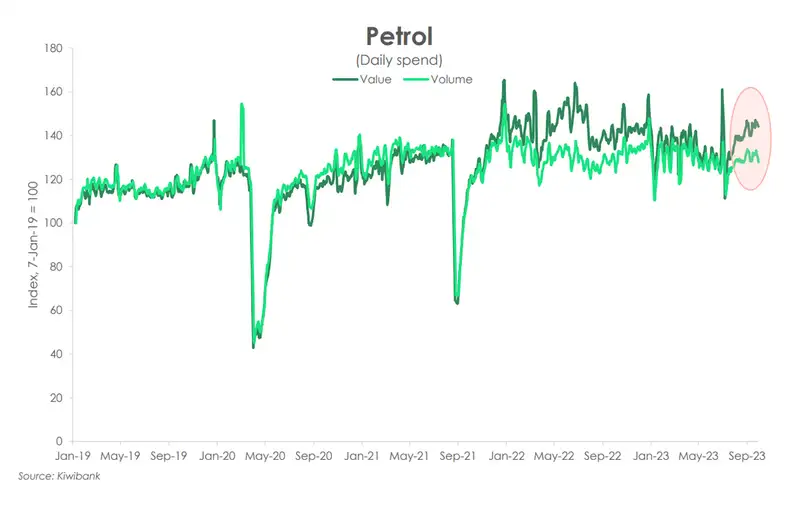

Once again, the value and volume of spend on petrol is diverging. Global oil prices rose over 30% in the last three months, with prices at the pump rising in tandem. However, as petrol prices rise, Kiwi are filling up the tank less. The value of spend rose 3%, while the volumes declined 0.6% over the quarter.

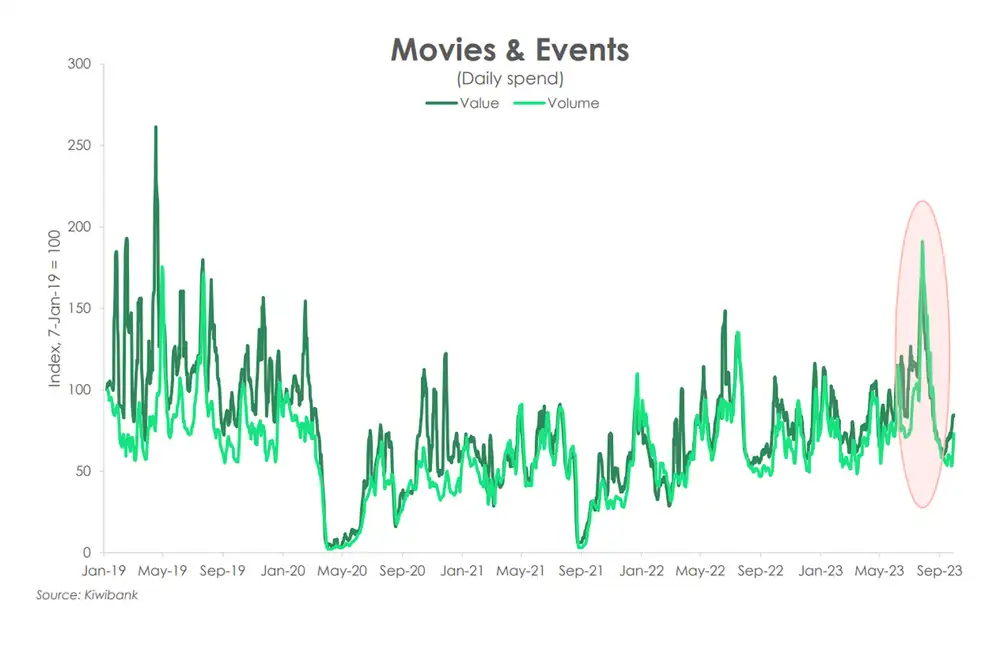

As Barbie and Oppenheimer battled it out for the Box Office Crown, spend at cinemas spiked. In the week of the double-feature release, spend jumped 57%.

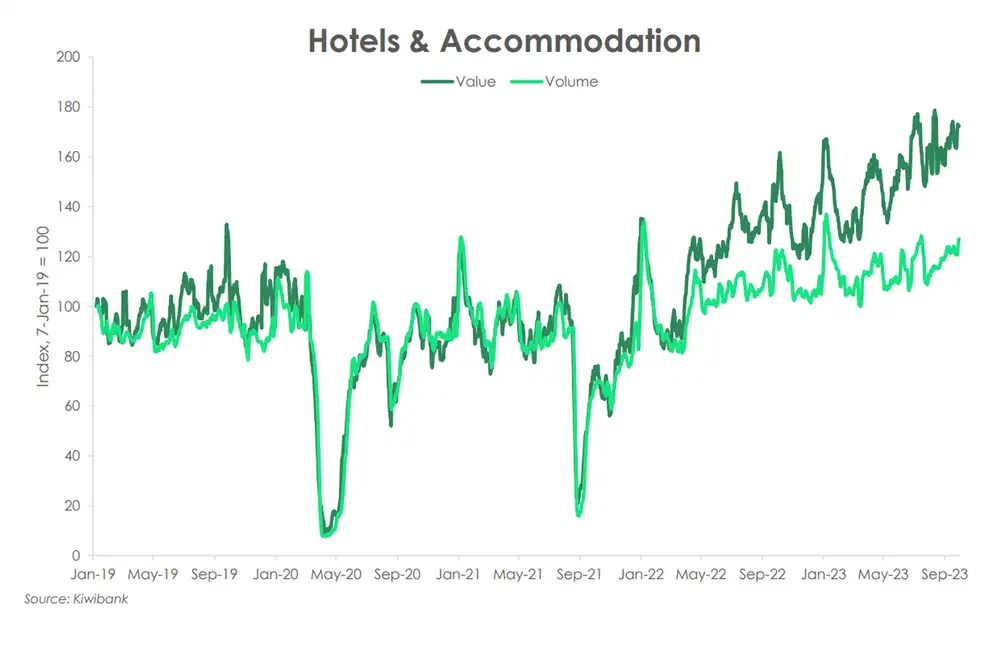

The return of overseas tourists boosted demand for our local operators, and in turn, prices. While volume of spend on hotels is flattening, the dollars spent is steadily increasing.

Spend on services is slowly softening

The value of services spend has enjoyed double-digit growth for the last year, as consumption rotated away from goods. However, demand for services may be waning. Compared to a year earlier, the value of spend increased by just 2.3% over the quarter.

The volume of spend is even more suggestive of a slowing in services spend. On a quarterly basis, the volume of spend declined almost 3%. And on an annual basis, the slide in the number of transactions is even deeper, down 5.2%.

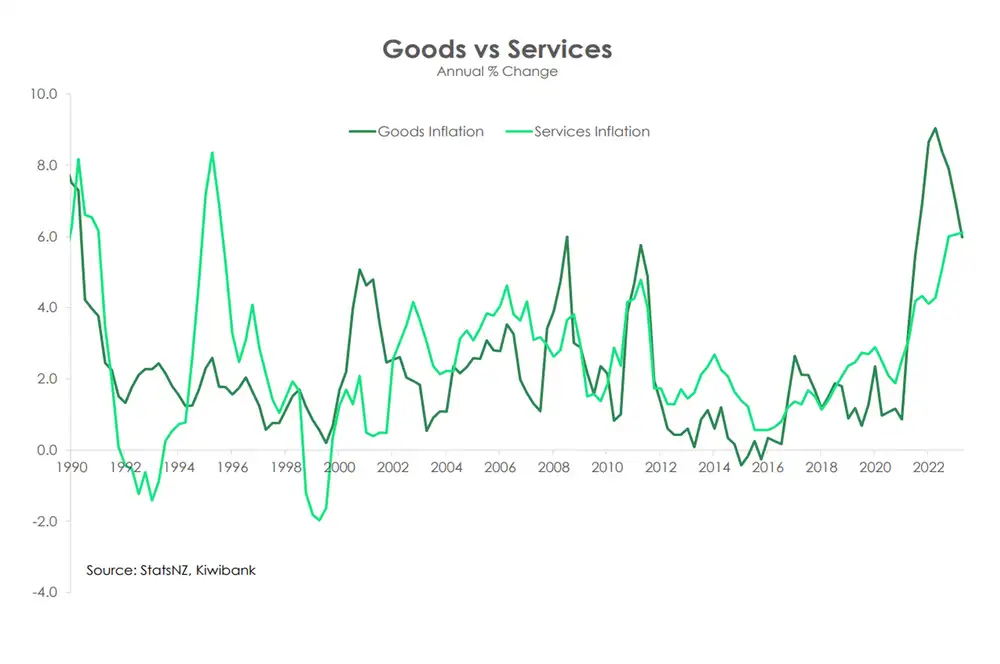

A slowdown in consumption presents (welcome) downside risk to the outlook for services inflation. Unlike goods inflation, the rate at which prices for services is rising continues to accelerate. Solid wage growth is one reason. The other is demand for services. And as the economy emerged from lockdown, demand for services was given a boost. However, today’s tight financial conditions will soon hit demand. Services inflation should be near peak levels.

Petrol back on the rise

The value of petrol spend lifted 3.4% in the September quarter, following last quarter’s 0.2% rise. Compared to last year, spend has declined 2.8%. A year ago, global oil prices spiked with the war in Ukraine and the continued disruption to supply changes. Global oil prices have fallen below last year’s levels. However, prices have recently been trending higher. In the three months to September, Brent crude oil gained over 30% and hit $97/barrel – a fresh high for the year. The re-acceleration in global oil prices has filtered down to prices at the pump. The value of spend has lifted as a result. At the same time, the 25c fuel excise tax has been re-applied. Yet another factor driving up the value of petrol spend.

Once again, we are seeing a divergence between the value and volume of spend. As petrol prices have increased, the volume of spend has declined. Compared to the June quarter, Kiwi visited the petrol stations 0.6% fewer times. However, that’s not necessarily being picked up by public transport spend. In fact, despite the return to full-price fares (for those 25years and above), both the value and volume of spend fell. Alongside higher petrol prices, some may be taking advantage of working from home.

Come on Barbie, let’s go…to the Movies

Since the pandemic hit, spend at movies and ticketing agencies has struggled to return to its 2019 levels. The pandemic propelled streaming services into popularity, from Neon to Netflix and everything in-between. Subdued cinema spending suggests that there’s a preference to watch the big stars on the small (home) screen instead. But the intrigue of pink cowboy hats and wide brim fedoras pulled people out of their pyjamas and back to the cinemas. As Barbie and Oppenheimer battled it out for the Box Office Crown, the volume of spend rose an atomic 57% in the first week of the double-feature release.

Spend has since fallen back below pre-covid levels. But another spike may be waiting in the wings. Taylor Swift’s Eras Tour is set to hit the big screen later this month. With no pit stop in Aotearoa, Kiwis will have to settle for the 2D version. The release of the concert doco may trigger another spike in spend at the movies. We’ll be on the lookout…

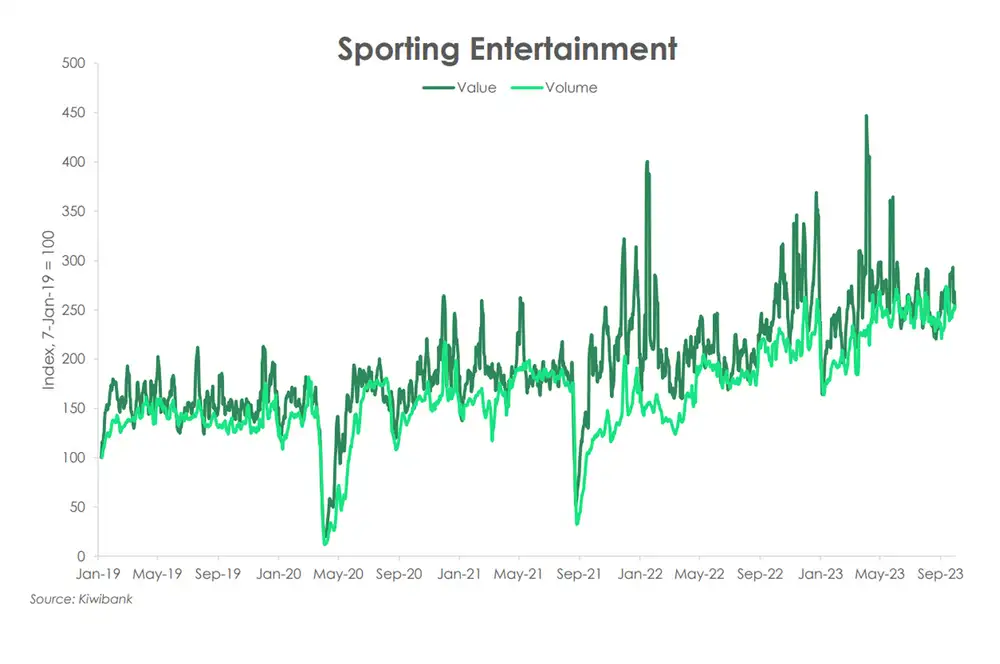

The FIFA women’s World Cup helped to kick spend on sport events higher. Compared to last year’s levels, both the value and volume of spend notched double-digit growth (19.8% and 27.4%, respectively). We saw a similar lift in spend in October/November last year during the Women’s Rugby World Cup. Despite the action on the football field, the hospo scene was relatively quiet (next slide) – from a domestic consumer perspective (our data does not include spend by international tourists). There was little sign of an out-of-the-ordinary rise in spend at restaurants, bars & cafés.

Coffee is a hard line

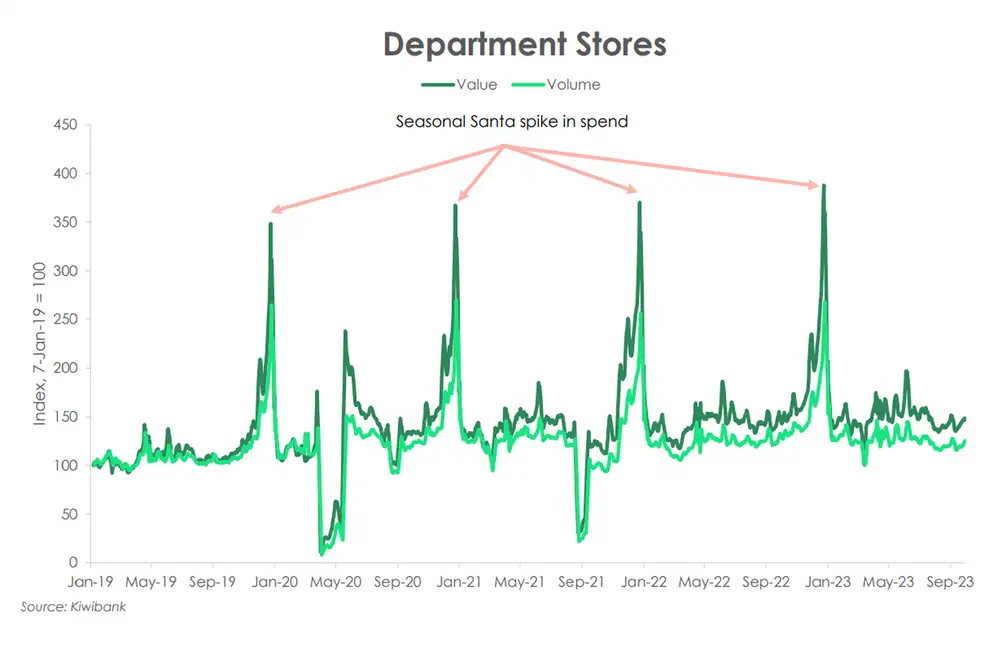

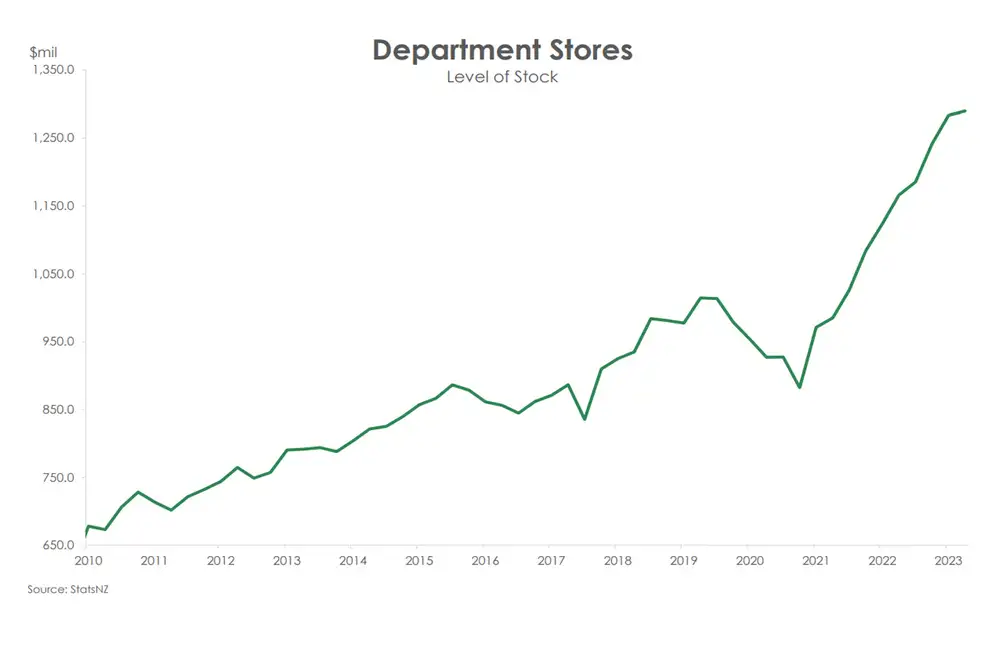

Spend at Department Stores is also coming under pressure. Compared to a year ago, the value of spend lifted just 0.5% as household demand pulled back. On an annual basis, the number of purchases contracted 2.4%. Retailers will be looking to the upcoming festive season for promise of greater activity. Spend typically spikes during the December quarter. However, there is reason to expect a smaller spike in dollars spent. Retailers built up their stock during the pandemic. Inventory management pivoted from ‘Just in Time’ to ‘Just in Case’. But as consumer demand weakens and stock needs to be cleared, we could be in for some discounting. And that’s good news for inflation.

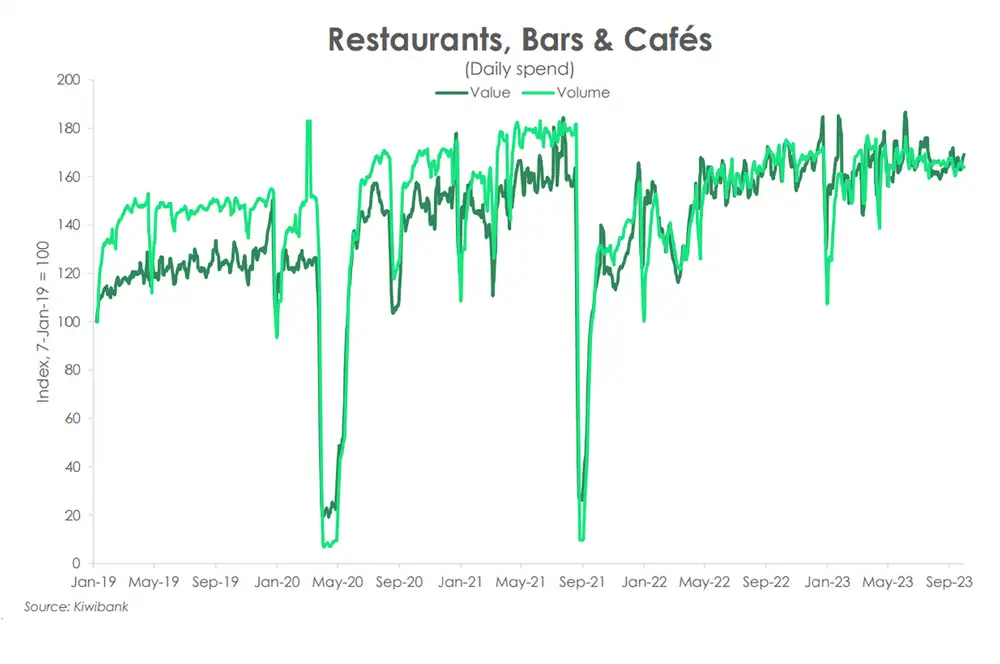

Household demand for big-ticket retail is clearly waning. But when it comes to a barista-made morning coffees or brunches over the weekend, demand is relatively more inelastic (less price-sensitive). Despite higher prices at restaurant, bars & cafés, the value and volume of spend have moved in tandem. Compared to last year’s levels, the value of spend was up 3.5% while volumes recorded a 1% lift.

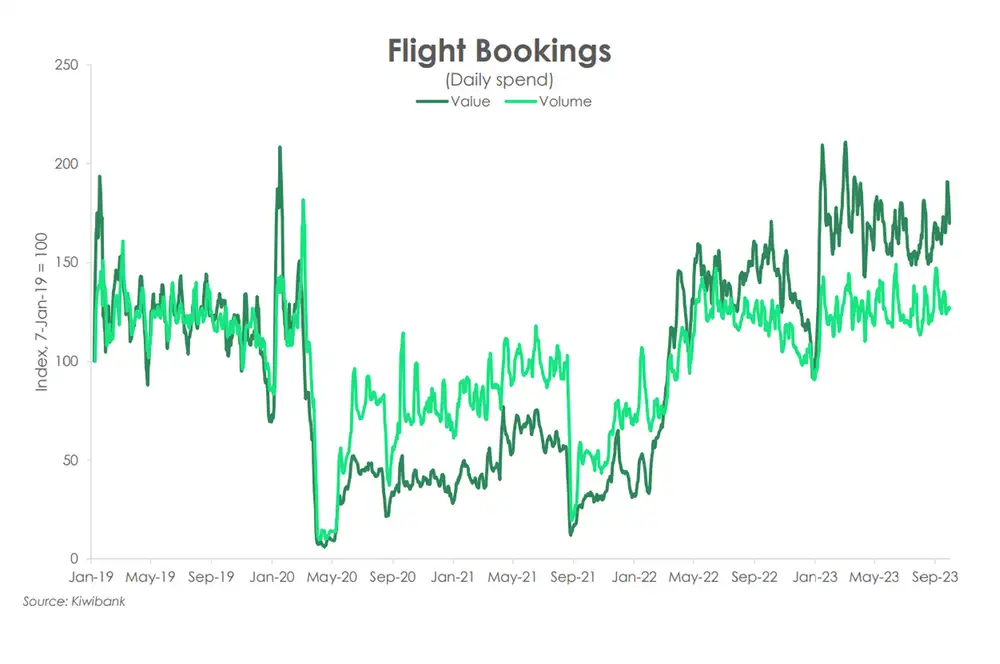

Returning overseas tourists

Since Covid-related border restrictions were relaxed in 2022, we have seen many Kiwi head offshore. The exodus was in part due to the pent-up desire of many young Kiwi to see the world. Demand for flight bookings however, appears to be stabilising. The volume of spend eased to 2.5% on last year’s levels – softer than previous double-digit growth rates. Despite the lift in transactions, the total value of spend decline 2.6%. It appears that prices appear to be normalising as capacity among airlines builds.

With the world back open, the surge in domestic tourism may have run its course. The volume of spend on hotels & accommodation appears to be flattening. At the same time, the total dollars spent is steadily increasing. The widening gap between the value and volume of spend suggests a rise in price. While domestic tourism may be softening, the return of overseas visitors is boosting demand. The cost of a Ferg Burger in Queenstown or rolling in a Zorb in Rotorua may be a bit more expensive than when the borders were shut.

Sticking to DIY

Since September 2022, the average volume of home contents & furnishings spend has sat below pre-covid levels. Clearly the exorbitant demand for all things pools and pizza ovens in 2020 has fizzled. Financial conditions have since tightened, and household disposable incomes are being squeezed. Consumer prices are high, interest rates are rising, and consumer confidence is subdued. As households cut back on spending, it’s discretionary items that are being culled from the budget. Compared to last year, spend on home goods is down 4%. And the average number of purchases is 5% below pre-covid levels.

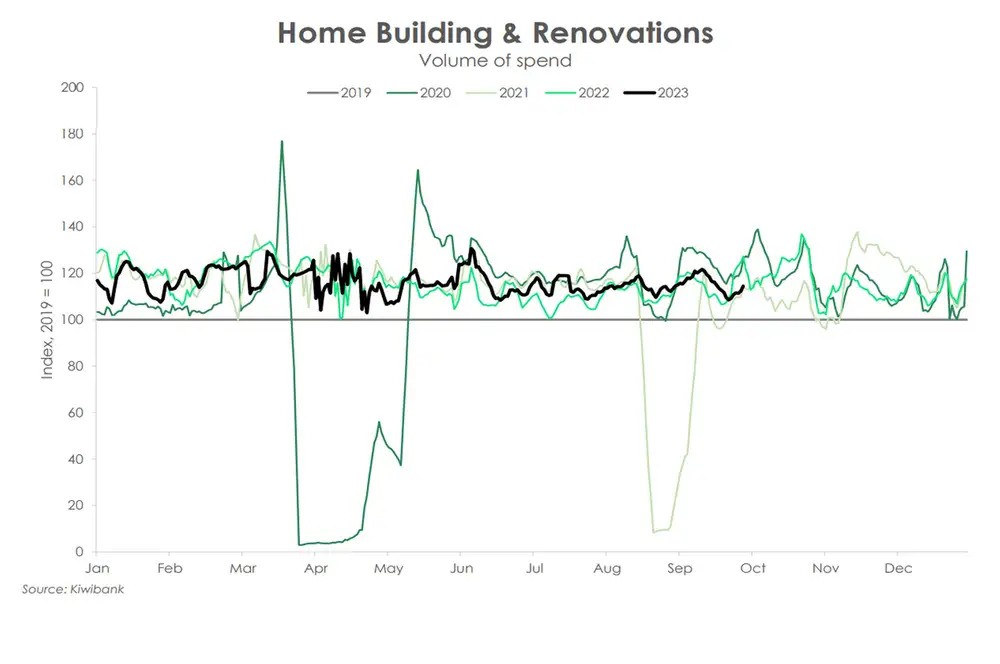

Kiwi however aren’t letting go of the tools, just yet. The average number of purchases relating to home build and reno is sitting over 10% above 2019 levels. There’s always something to build or repair around the home. And for many households, the clean-up from the weather events earlier this year will continue to support this type of spend, in the near-term.

Spend on home electronics also remains well above pre-pandemic levels. With the adoption of working from home, many have sought to create a home office. There was, and will continue to be, demand for office equipment as hybrid working has become the norm for many workplaces.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.