Payback for the big holiday-fuelled surge in spending

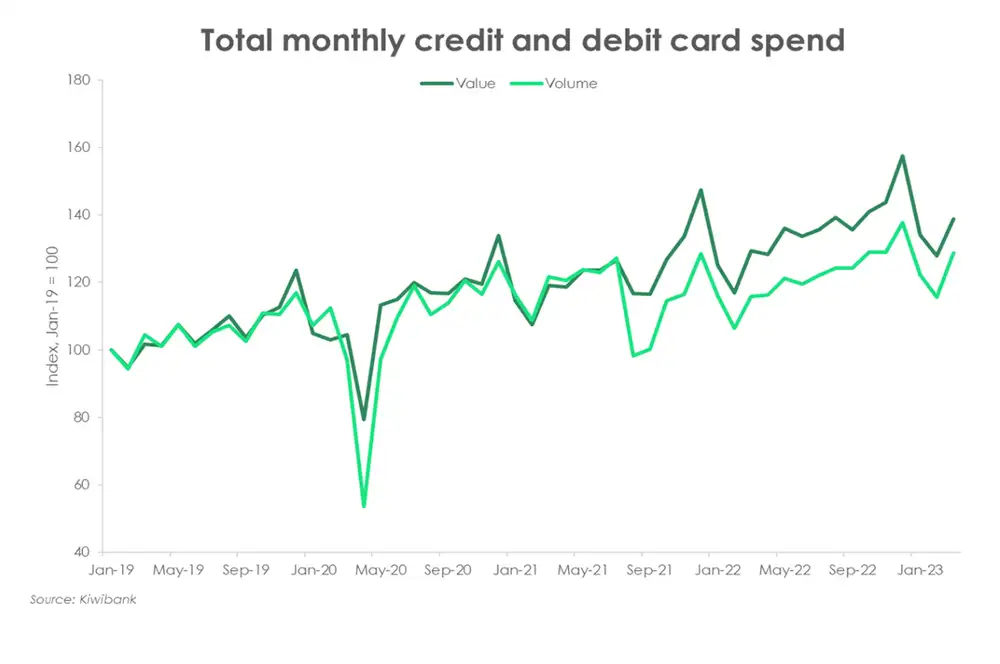

Kiwibank electronic card spend contracted 9% in the March quarter. It’s not a surprise to see soft spending to start the year. Over the December quarter, spend on all things food, retail and travel lifted 7.7%. Spending contracted in January and February, bringing down the entire quarter. Spend, however, began to rebound in March.

Inflated spending levels

Both the value and volume of spend are sitting above pre-covid levels. Historically low levels of unemployment continues to support households’ income, and in turn, consumption. Although, a growing Kiwibank customer base and a stronger preference for contactless payments in the covid era may also explain today’s inflated spending levels.

Household spending outlook

Nonetheless, the outlook for household spending remains the same. Households are faced with a tough trio of rising interest rates, elevated cost of living, and falling house prices. In an increasingly expensive environment, the appetite to spend weakens. A significant portion of mortgages are yet to roll onto current interest rates from the record low rates of 2020/21. Discretionary incomes will be squeezed and discretionary spending will be restrained as a result. A slowdown in consumption however is by central bank design. It’s needed to cool demand, restore balance in the economy, and ultimately, return inflation to target.

The detail

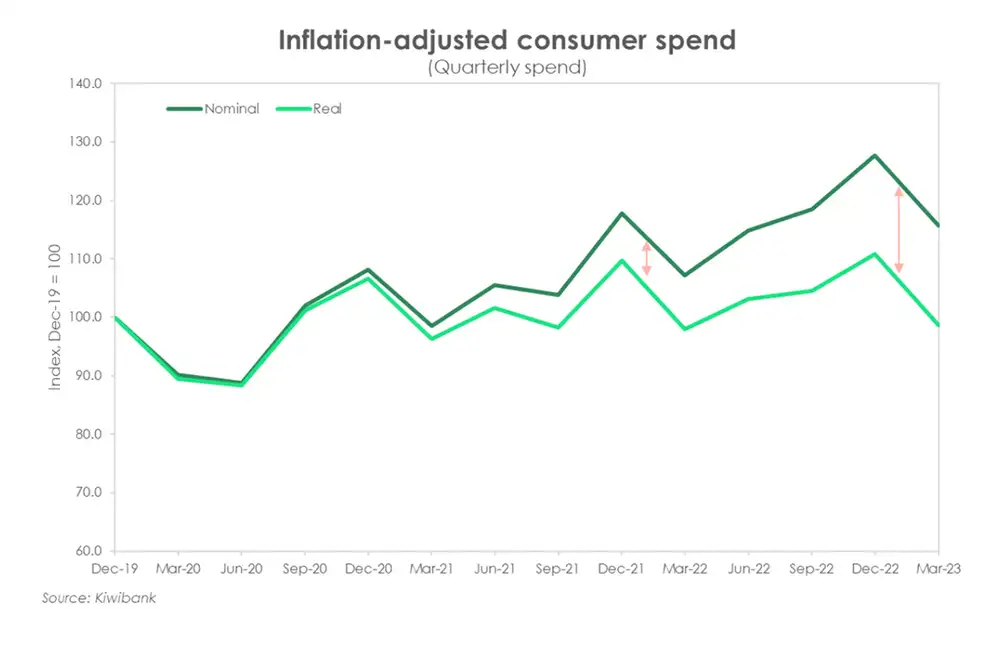

The rise in consumer prices continues to work behind the scenes, helping to limit the fall in the value of spend. But when adjusting for inflation, consumer spend fell by a greater magnitude, down 11%. The widening gap between nominal and real spend underscores the rapid rise in consumer prices.

Annual comparisons are complicated by last year’s Omicron outbreak. The growth in services spend is especially chunky, up 15.5% - off a very low base. The double-digit growth underscores the highly disruptive nature the covid restrictions had on the services industry.

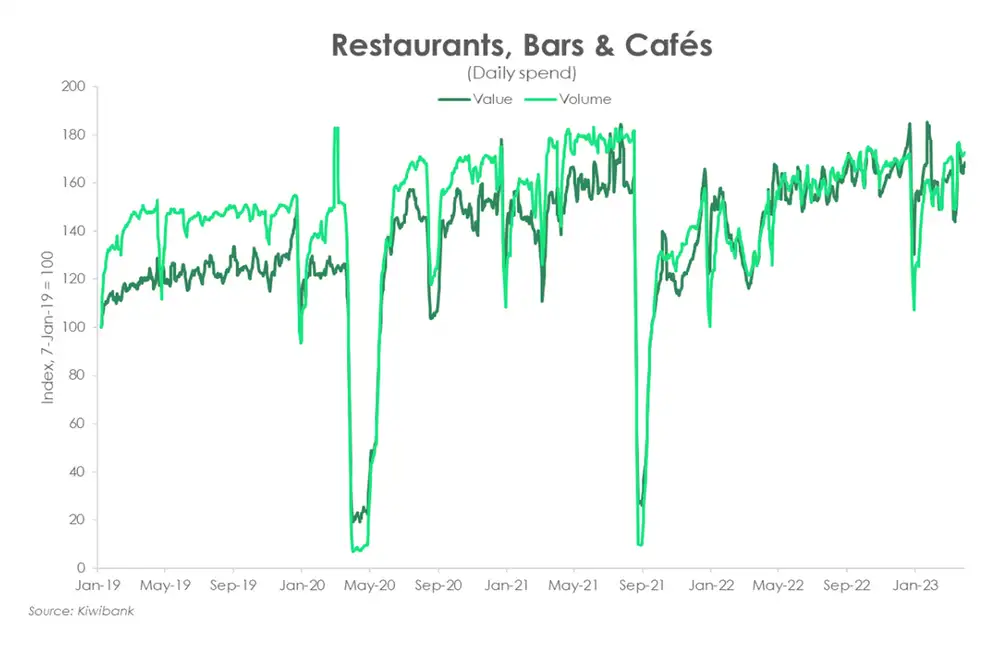

The March quarter marked the end of the festivities. The near 5% drop in the number of transactions made at restaurants, bars and cafés suggests less long lunches and more packed lunches.

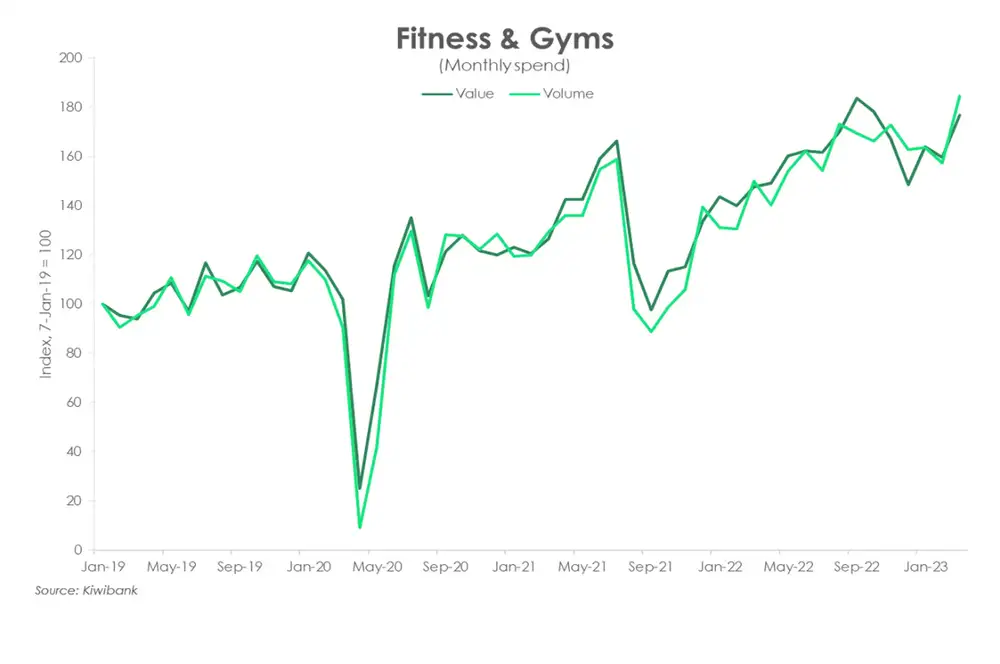

The March quarter also saw a typical 1.3% lift in the volume of spend on fitness services and gym memberships. After a few weeks of indulgence, it’s time to get started on those new year’s resolutions.

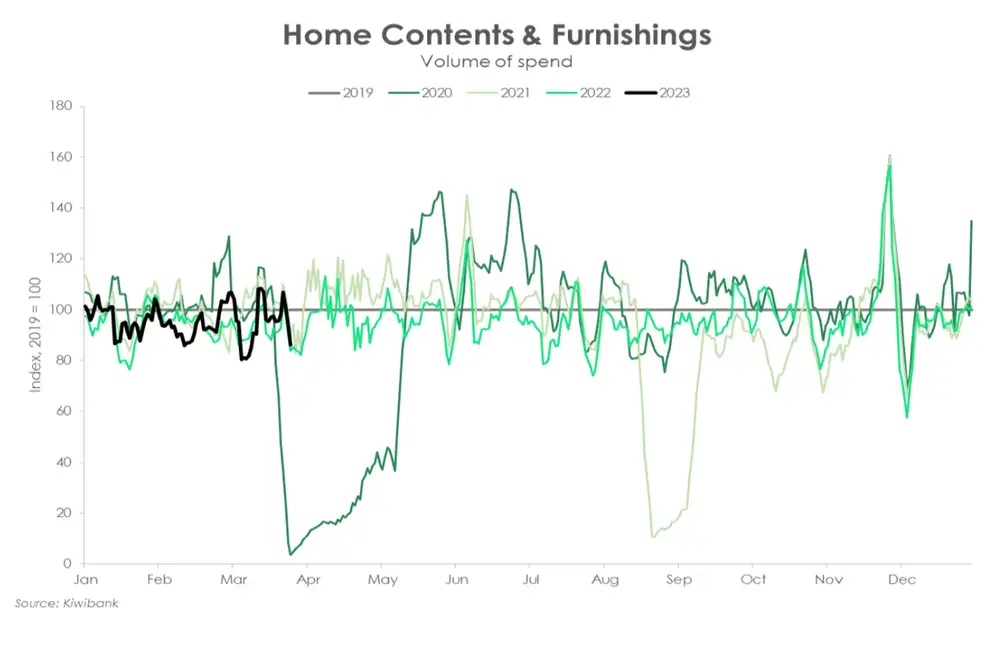

Housing-related spend continued to fall over the quarter. The average monthly volume of spend on home contents & furnishings now sits around 7% below pre-covid levels. Consumer confidence has weakened, credit is harder to get, and the housing market is in retreat. Households are just not in the mood to splash out on big-ticket items. Kiwi are spending less on the home and taking fewer trips to hardware stores.

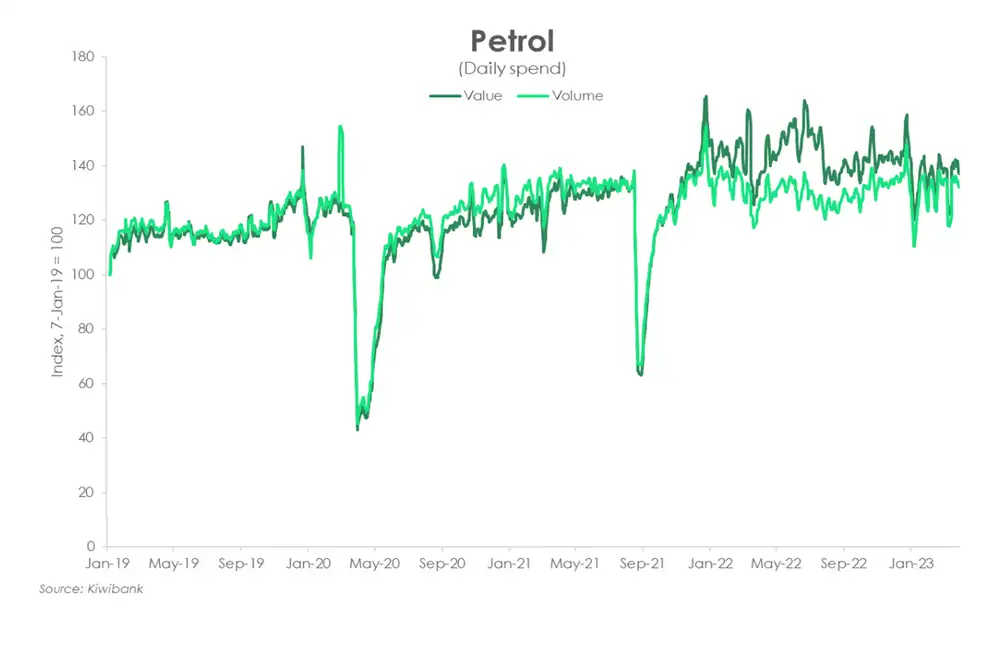

The value of petrol spend fell 8%, due to a combination of falling prices and fewer visits to the petrol station. Petrol consumption is weak. With relatively cheap public transport and working from home, Kiwi are opting for greener alternatives.

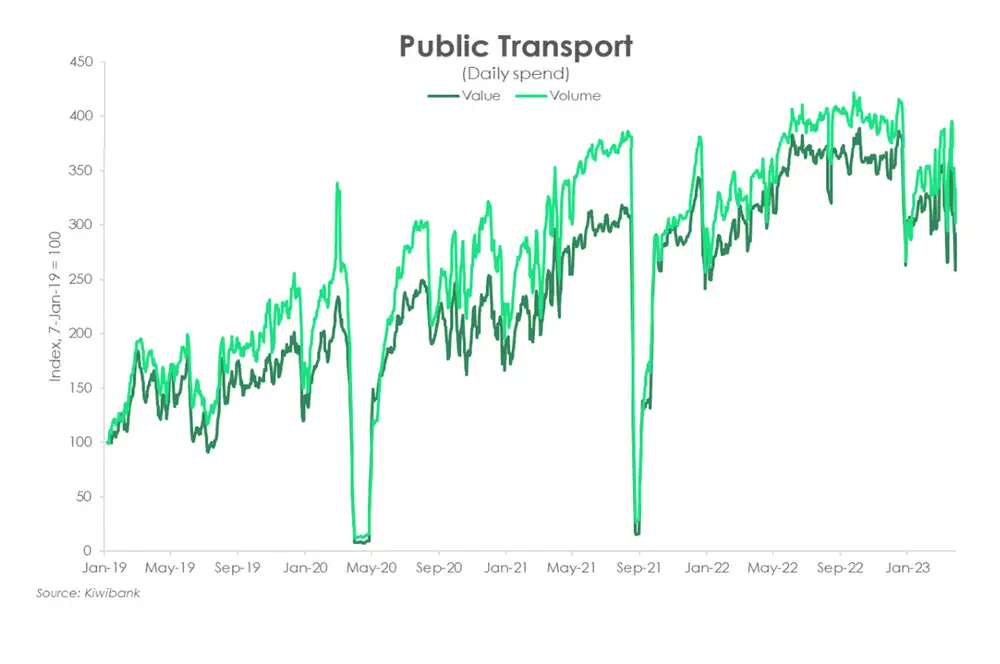

Over January and February, public transport spend was softer than usual. Compared to pre-holiday levels, the average monthly number of transactions was down over 15%. But March madness and the return to work/school saw a solid 10% rebound in the volume of spend – and a crammed commute.

Seasonally soft spend

Kiwibank electronic card spend contracted 9% in the March quarter. It’s not a surprise to see soft spending to start the year. It’s payback for the big holiday-fuelled surge in spending. Over the December quarter, spend on all things food, retail and travel lifted 7.7%. Spending contracted in January and February, bringing down the entire quarter. Spend, however, began to rebound in March.

On an annual basis, comparisons are complicated by last year’s Omicron outbreak. The outbreak saw the entire country return to the Red Covid-19 Traffic Light Setting. With those restrictions now relaxed, the total volume of transactions is up 8.4% on levels this time last year. The growth in services spend is especially chunky, up 15.5% - off a very low base. The double-digit growth underscores the highly disruptive nature the covid restrictions had on the services industry. The recovery continues.

A better comparison is that against pre-covid spending levels. And it appears that volumes are sitting high above 2019 levels. There are several reasons why this might be the case: Firstly, it may be evidence of a growing Kiwibank customer base. Secondly, the covid era has shifted preferences away from cash and toward contactless forms of payment – whether online or ‘tap and go’ style. And thirdly, households may be spending more simply because they can. Historically low levels of unemployment continues to support household incomes and in turn spending.

For the same reasons as above, the value of consumer spending is also sitting above pre-covid levels. An additional explanation is the rise in consumer prices. High inflation is helping to prop up the value of transactions. When adjusting for inflation, consumer spend fell by a greater magnitude, down 11%. The widening gap between nominal and real spend underscores the rapid rise in consumer prices.

Back to the grind

Over the December quarter, spend at restaurants, bars and cafés lifted 3%. Prepping for holiday parties and pot-luck dinners also drove up spending at grocery stores, butchers and fruit and veg stores.

But the March quarter marked the end of the festivities. The near 5% drop in the number of transactions made at restaurants, bars and cafés suggests fewer long lunches and more packed lunches.

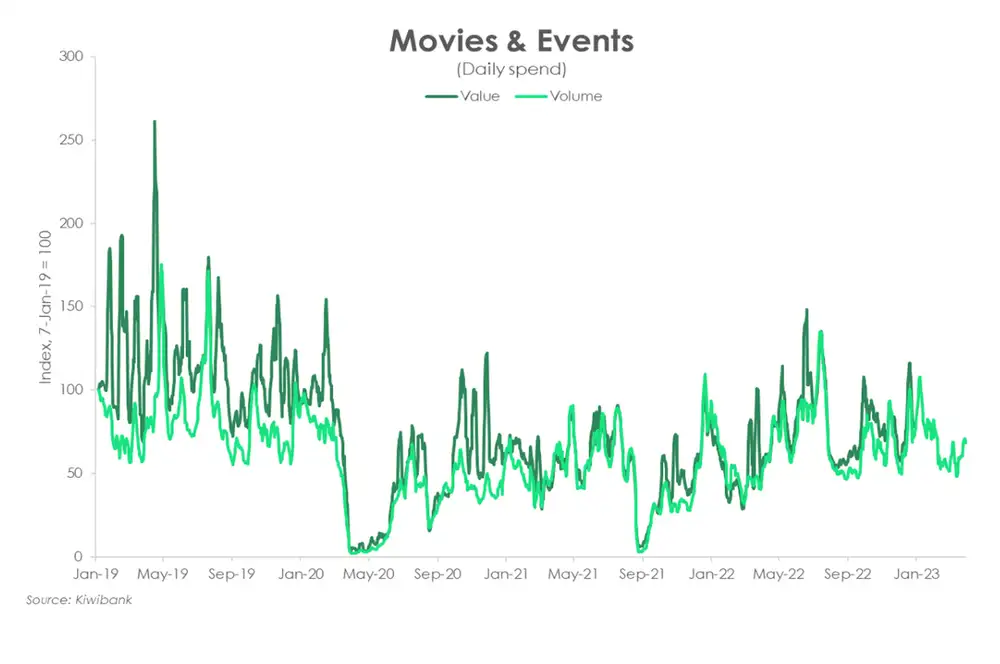

Entertainment spend fell 8.6% over the March quarter. Spend on sporting events was especially weak, down 10%. It’s the same case for movies and ticketing agencies. down 6%. Interestingly, spend at the cinemas has yet to return to its pre-covid levels. The pandemic propelled streaming services into popularity, everything from Neon to Netflix. Subdued cinema spending suggests that there’s a preference to watch the big stars on the small (home) screen instead.

The March quarter also saw a typical 1.3% lift in the volume of spend on fitness services and gym memberships. After a few weeks of indulgence, it’s time to get started on those new year’s resolutions.

Tourists to the rescue

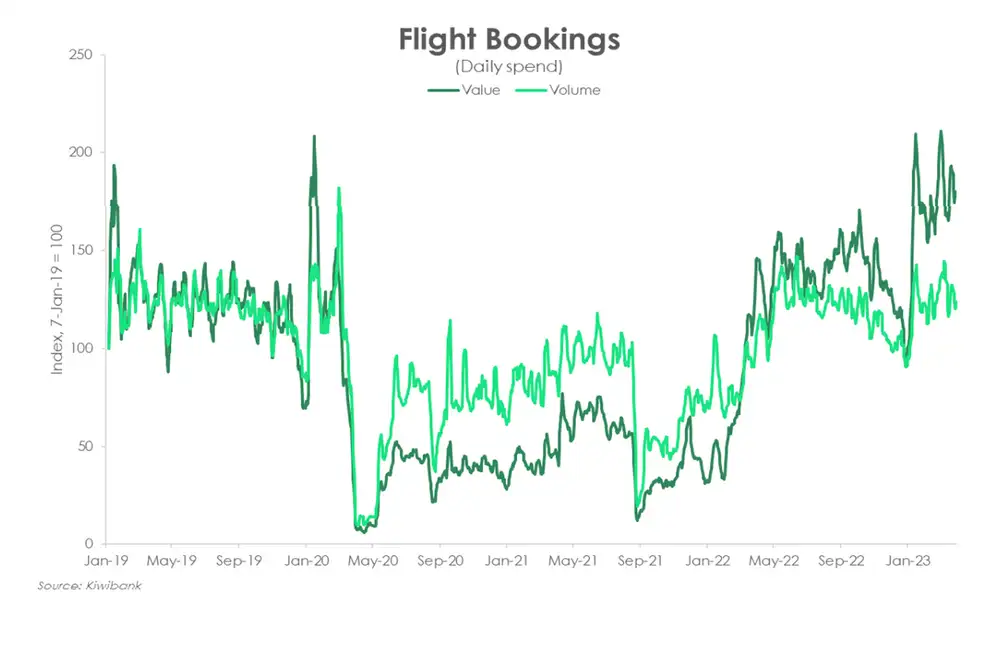

Spend on flight bookings has gradually recovered over the past two years. As we moved down the Covid-19 traffic light system in 2020/21, spend on flights began to tick up as Kiwi travelled the country, But the looser restrictions on Kiwi travellers (ie removal of MIQ) early last year gave spend a kick higher. Two years of a closed border had kept families apart, cancelled many overseas holidays, stalled plans of an OE, and hit pause on overseas careers. There was a lot of pent up demand to go beyond our four walls. And Kiwi appear to be doing just that. The growth in the value of spend has now outpaced the growth in the volume of spend. It suggests greater spend on (relatively more expensive) international flights.

With the world back open, the surge in domestic tourism may have run its course. Over the December quarter, a typically busy period for the tourism scene, spend on hotels & accommodation actually dropped 0.1%. Kiwi have explored their backyards to their hearts’ content for the past two years. But now, there’s a longing to check out sights abroad.

The good news is, overseas tourists are coming back. Visitor arrivals have risen steadily with the removal of border restrictions last year. Whether it’s our friends from across the Tasman or higher-spending travellers from the US, Canada or the UK – they’re all coming back. Arrivals are running at about 70-80% of the pre-Covid levels which means there is more upside to come. Tourism was once our biggest export industry, contributing 20% of total exports. That contribution has fallen to 2%. The return of tourists comes at an opportune time. Because the spend up of foreign dollars will help to offset the weakening demand by Kiwi consumers.

Finishing touches

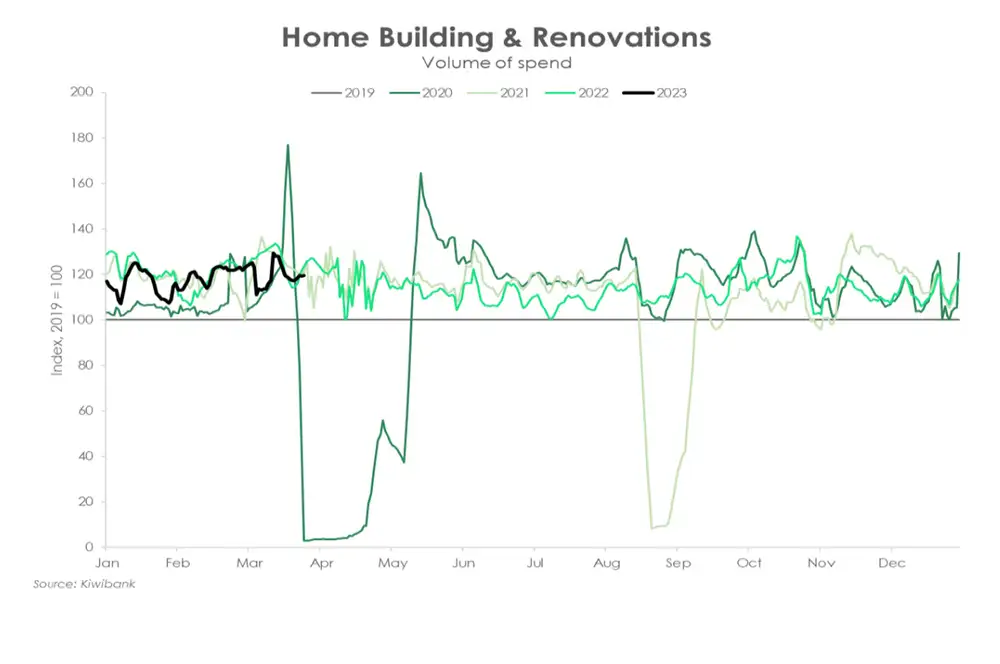

2020 will be remembered for the big spend up on all things housing. Kiwibank spending data supports the countless anecdotes of Kiwi DIYing, everything from renovating bathrooms to installing pools. And with the adoption of working from home, many sought to create a home office. There was fresh demand for office equipment.

But now Kiwi are fully decked out, and much has changed since 2020. For one, interest have risen and risen fast. In just 18 months, the official cash rate has gone from 0.25% to 5.25%. And last November’s supersized 75bps hike was issued with an instruction to Kiwi households: “Cool your jets” (RBNZ Governor Adrian Orr).

When it comes to housing, it looks like Kiwi might just be listening as related spend continues to fall – although the run up in rates and consumer prices is arguably more persuasive than the Governor’s words. The average monthly volume of spend on home contents & furnishings is sitting around 7% below pre-covid levels. Kiwi are also putting down the tools, with the average number of purchases on home build and reno over the March quarter down 11% since the November MPS. Compared to precovid levels, the volume of spend however remains elevated. There’s always something to build or repair around the home. And for many Kiwi households, the clean-up from the recent weather events will support this type of spend in the nearterm.

Coming to an end

The value of petrol spend fell 8.4% in the March quarter, a consequence of the drop in global oil prices at the beginning of the year. The decline in spend may also be a consequence of the fewer transactions made. Looking at volumes, it appears that Kiwi made fewer trips to the petrol station, down 5.7% from the previous quarter.

For much of the quarter, workplaces were running skeleton crews and classrooms were still empty. The bus/train/ferry stations were relatively quiet without the usual commuters. Over January and February, public transport spend was softer than usual. Compared to pre-holiday levels, the average monthly number of transactions was down over 15%. But March madness and the return to work/school saw a solid 10% rebound in the volume of spend – and a crammed commute.

Public transport has experienced a boost in demand following the Government’s move to subsidise fares back in April 2022. The cheaper alternative has been a popular choice of transport. The scheme has been extended once again through to the end of June. However, once the scheme ends, we could see petrol spend tick up as people return to their cars.

Of course, a cheaper alternative is to walk…down the hallway. Working from home is also a big factor reducing our petrol consumption. And the benefits are wide-ranging. A longer sleep-in, shorter commute, and a cleaner climate.

Tough times ahead

The outlook for consumer spending is weakening. Households face a tough trio of:

-

1Tahi

Rising living costs

Consumer prices have risen rapidly. And the price gains have been across the board, from food to fuel, and health to housing. Rising consumer prices eats into disposable income, making budgeting that much more difficult. Households are forced to tighten their belts and shorten their shopping lists.

-

2Rua

Rising interest rates

In the face of rising inflation, the RBNZ has been aggressively tightening monetary policy. The cash rate has gone from 0.25% to 5.25%. That’s a total of 500bps in the span of just 18 months. It’s the fastest tightening cycle in the OCR’s 24-year history The RBNZ is sticking to it’s pre-set path, which includes one more hike to 5.5%. The RBNZ intends to keep interest rates at these elevated levels in order to bring down inflation and temper price growth expectations. Disposable incomes will be squeezed by the higher rates. Especially for those households whose mortgages are due to be roll off the record-low rates of 2020/21 later this year.

-

3Toru

Falling house prices

The housing market continues in retreat. With all that’s been thrown at the market, house prices are now down around 15% from the November 2021 peak. We think the market is most of the way through its correction, but there’s still room for prices to fall further. We expect a peak-to-trough decline of ~20%. Housing, however, is the single largest form of wealth among Kiwi. And a cooling market adds another dampener to consumer spending. Falling house prices and tighter lending rules are not supportive of borrowing and spending.

In an increasingly expensive environment, the appetite to spend wanes. A slowdown in consumer spend however is by central bank design. Interest rates have been jacked up to cool demand, restore balance in the economy and ultimately, to return the inflation beast back to its cave.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.