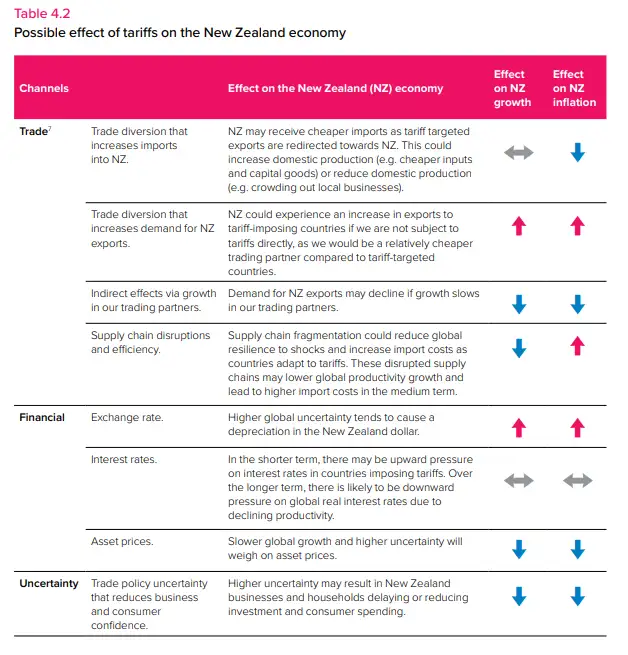

Beyond the RBNZ's rate cut and updated forecasts, their special topic on the implications of global tariffs on Aotearoa certainly grabbed our attention. It's become a key issue in many of the conversations we're having with businesses and clients, and it's undoubtedly a challenging one to address. Our usual response centres around the fact that it's still too early to draw firm conclusions. But as history reminds us, tariffs and trade wars are negative for economic growth and carry inflationary implications. At present, the trajectory of rising tariffs is leaning toward a higher near-term inflation outlook, domestically. Particularly given the weakness of the Kiwi dollar against the strength of the USD. However, with the landscape constantly evolving, the timing and magnitude of further changes remain uncertain, and the true impact is yet to be realized. But we thought the RBNZ visually summed up the possibilities quite nicely in the table below.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.