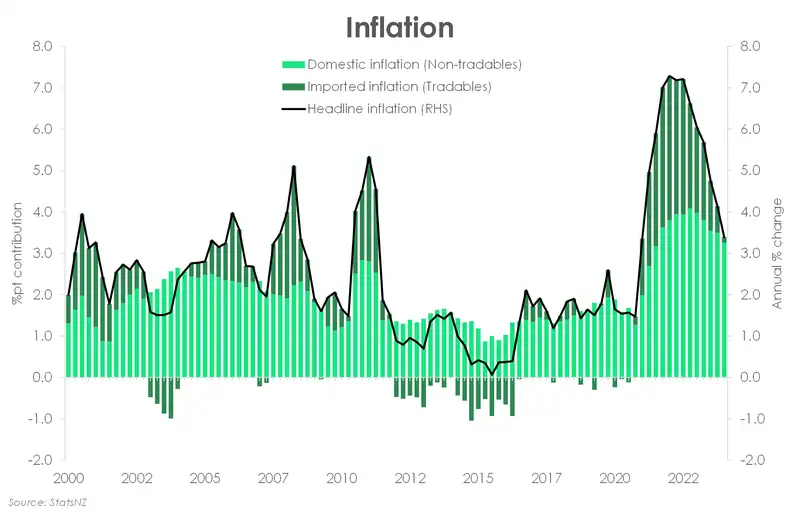

Earlier this year, we forecast inflation falling back within the RBNZ’s 1-3% target band in the September quarter – but only just (2.8%) given the persistent strength in domestic inflation. While that remains the case, we now see inflation falling closer to the midpoint of the target band. Because recent monthly price data have shown that strong downward momentum in imported inflation continues. Falling petrol prices leads the way.

A fast deceleration in imported prices has done most of the hard yards in bringing down headline inflation from the 7,3% peak back to the 2% target. Domestic inflation, in contrast, is a slow-moving beast. But it is now moving in the right direction (south). And the good news is, the return to 2% inflation will be sustained by the eventual normalisation in domestic price pressures. It’s the two phases of 2%.

More important than the headline print, is the underlying trend in consumer price growth. Core measures of inflation strip out the items within the CPI basket vulnerable to volatile price movements – food, energy, utilities. Core inflation has been trending lower since hitting the 6.7% peak in December 2022. Core inflation currently sits at 3.4%, and we may see it fall back within the target band as well.

The path for inflation from here, is the path for policy. Wednesday’s update should be further confirmation that inflation continues to move in the right direction. And faster than we initially anticipated. Forward-looking activity and pricing indicators point to further moderation in price growth. We may not have to wait until next year to see the RBNZ’s 2% inflation target achieved.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.