Beyond the March quarter, household consumption faces several headwinds as budgets are stretched thin by rising inflation, rising mortgage rates, falling house prices and recent revisions to regulation.

Post Auckland lockdown card spend

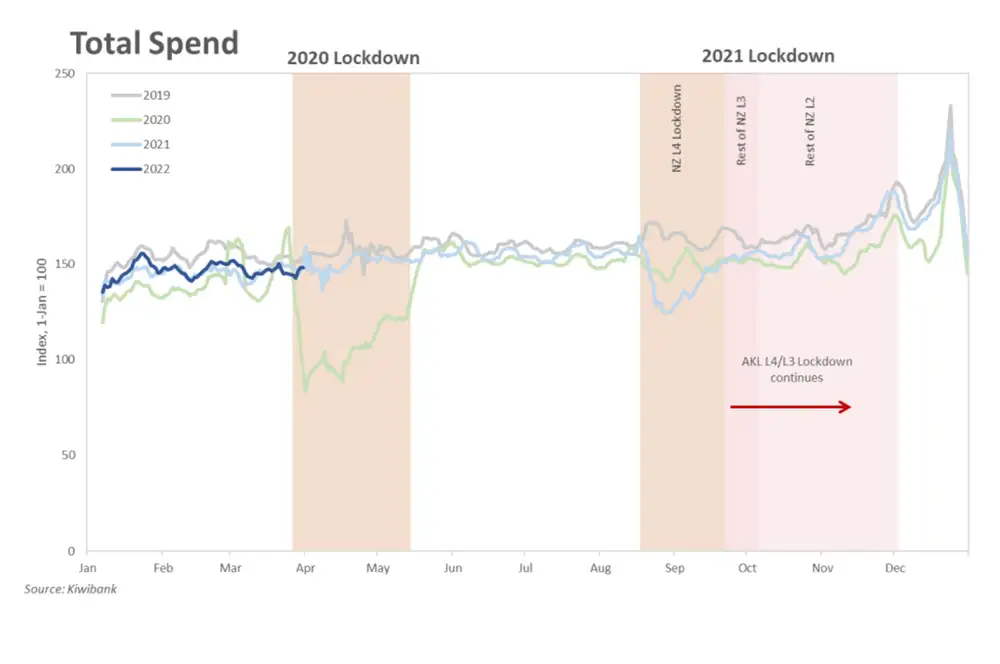

Kiwibank electronic card spend fell 9.1% in the first quarter of 2022. Spend over the March quarter is typically soft as it follows a surge over the holiday period. However, the March quarter this year was especially weak. It’s payback for the massive spend-up over the Dec-21 quarter as Auckland exited lockdown.

Weak spend

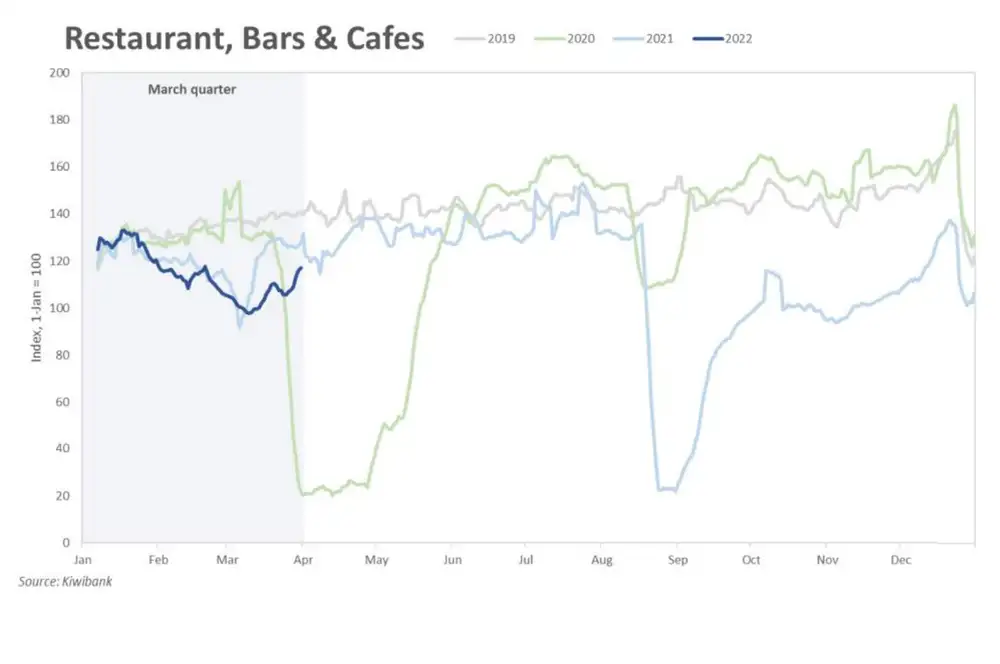

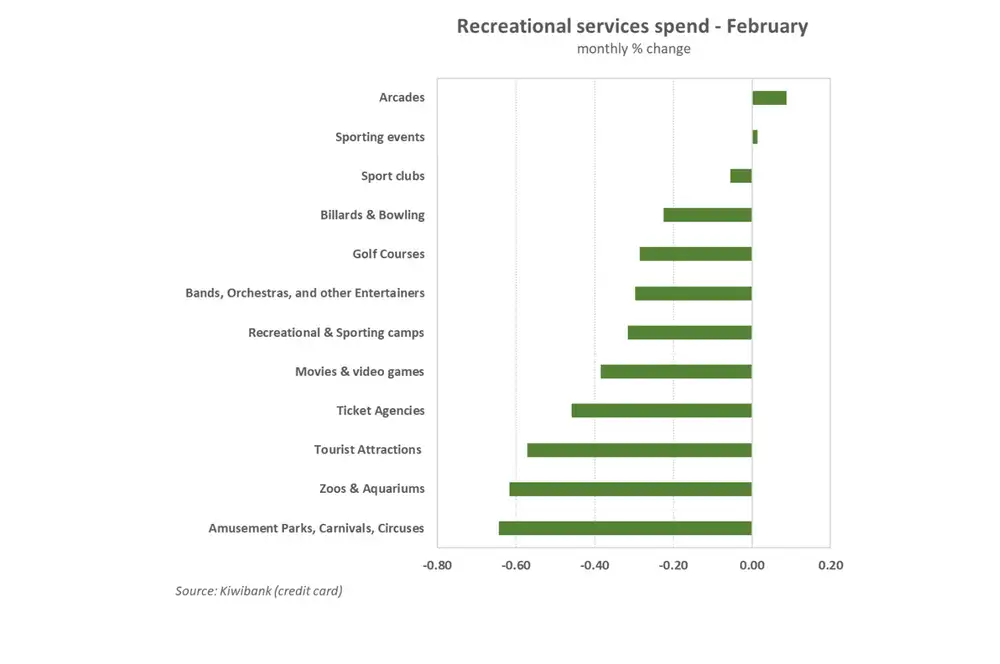

The Omicron outbreak, which dominated the first three months of 2022, also stands guilty for weak spend. Although, we have seen deeper declines in spending during previous outbreaks. Because restrictions under Red were far more lenient. Annually, total spend is up 8.7%. Hospitality and entertainment spend however continues to be disproportionately affected.

Lockdown pressure on supply chains

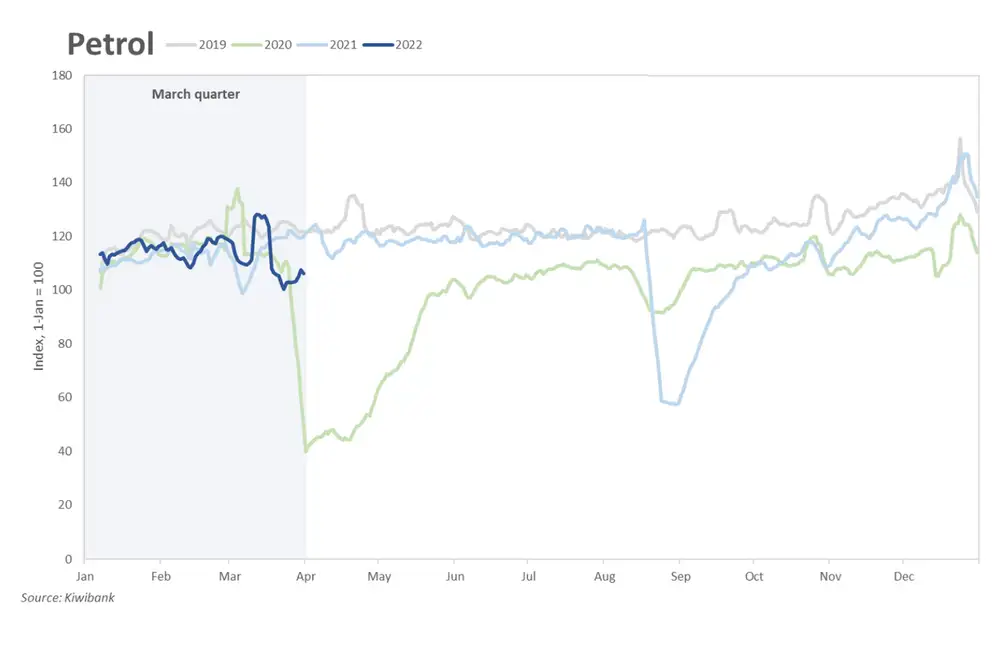

Spending may also have fared relatively better than expected due to inflation boosting the value of transactions. Petrol spend in particular was up 8% in the month of March as Russia’s invasion of Ukraine sent commodity prices spiralling higher. Unfortunately there’s little relief on the horizon as geopolitical tensions remain elevated and China faces its largest covid outbreak in two years. A locked down China adds pressure on already strained supply chains, exacerbating cost pressure.

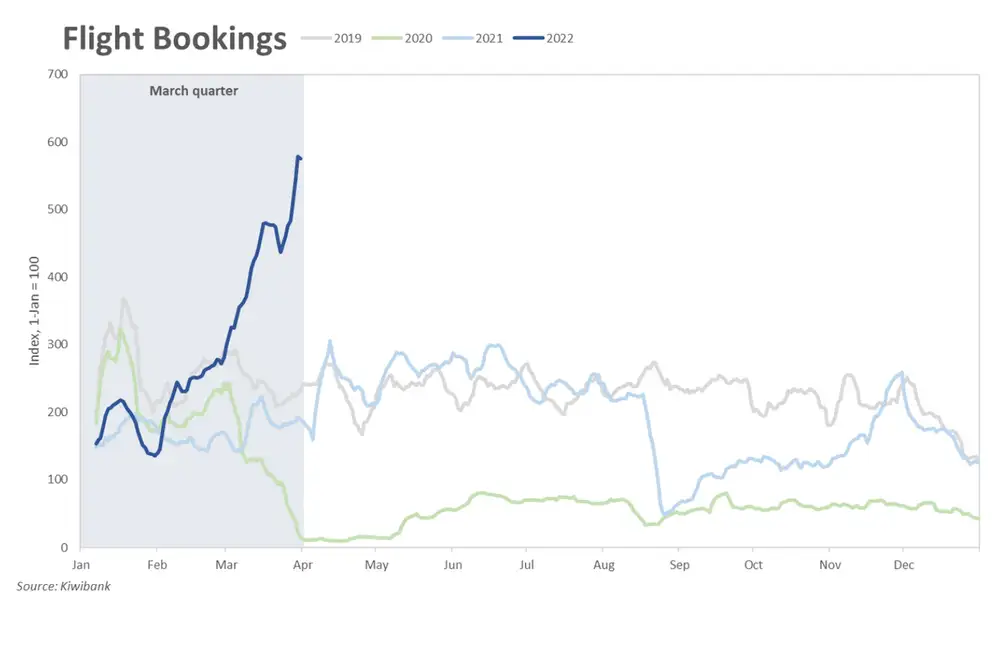

Seeking overseas travel

Flight bookings climbed a massive 80% over the quarter. There’s pent up demand to venture beyond our four walls. And the decision to leave has been made easier with the removal of MIQ. The ability to return home without the need to enter managed isolation may explain the sudden surge in bookings.

No more new pools, new furniture, or new pets

Housing-related spend is down 20% over the quarter. Seasonality and weak consumer confidence may explain the drop, but so too the revised consumer credit legislation. For those in pursuit of a mortgage (or wishing to top up), changes to the CCCFA mean cutting back on spending.

Household consumption

Household consumption has been a key source of economic momentum since the recovery took shape. But rising prices, rising interest rates and a housing market in retreat eat into household discretionary spending. And weaker consumption points to weaker economic growth.

It’s payback time

Kiwibank electronic card spend fell 9.1% in the first quarter of 2022. Spend over the March quarter is typically soft as it follows a seasonal surge over the holiday period. However, the March quarter this year was especially weak. It’s payback for the massive spend -up over the Dec -21 quarter as Auckland’s exit from lockdown coincided with the holiday period.

The Omicron outbreak which has dominated the first three months of 2022 also stands guilty for weak spend levels. Although the blow to spending was not as severe as seen during previous outbreaks. The 9.1% drop in spend is just 2%pts deeper than drop over the March 2021 quarter. The move to Red light came with fresh restrictions akin to Alert Level 2 which allowed for a greater range of activity, in aggregate. Despite Omicron being the largest outbreak, spending held up relatively well.

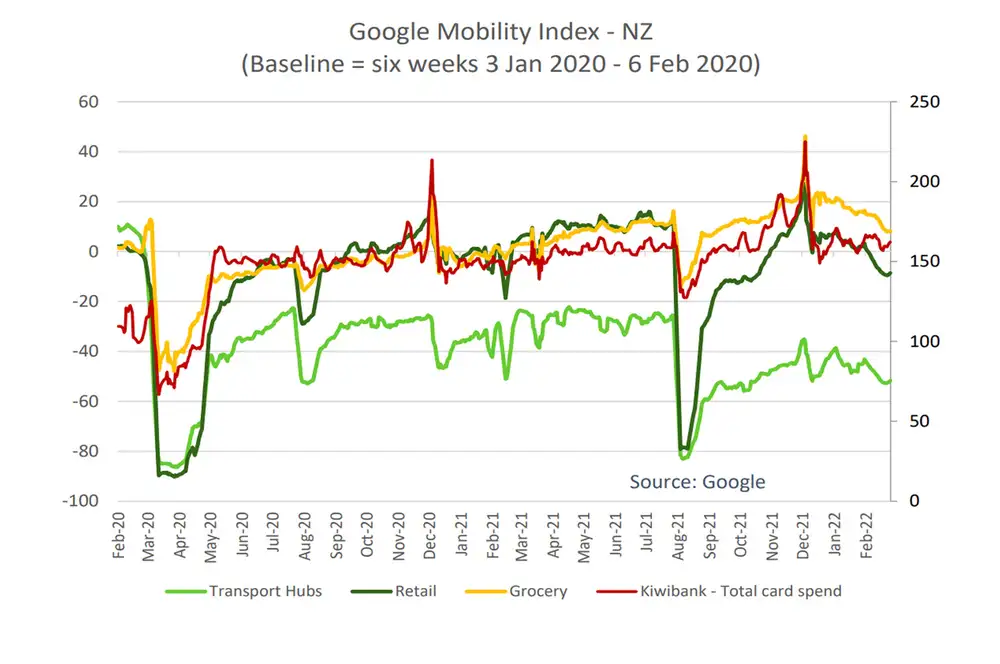

However, that’s the big picture. And the return to Red has had a disproportionate impact. As google mobility data suggests, retail foot traffic has once more waived and spending has followed suit. The deepest decline in spending was seen in high -contact services including retail, hospitality and entertainment.

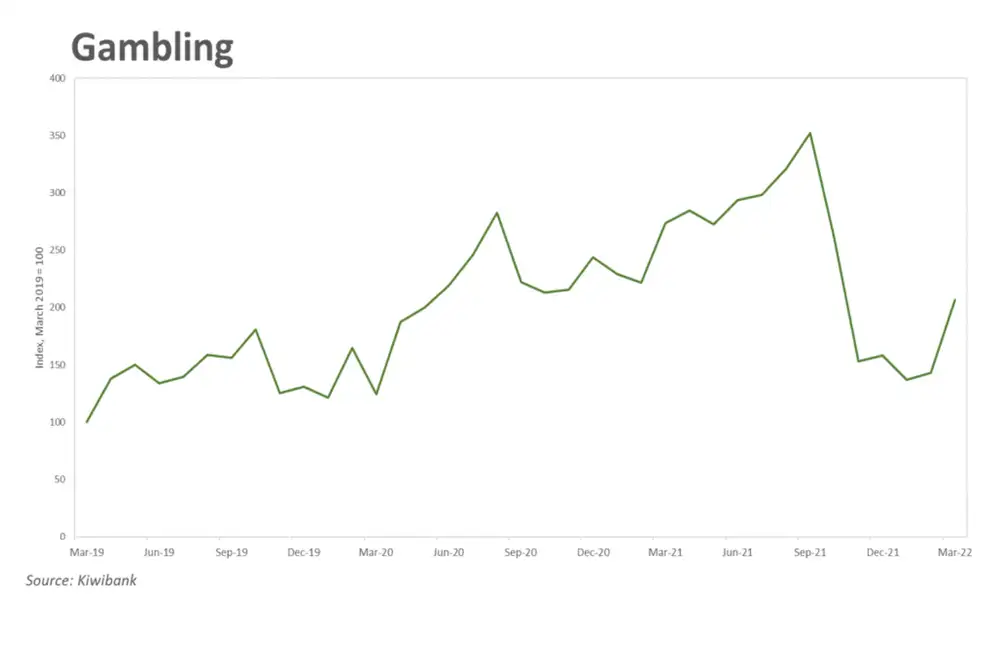

One bright spot is the gradual pull back in gambling spend from the spike seen during the March 2020 lockdown. While still sitting slightly above pre - pandemic levels, spend is down 30% from the March 2021 quarter. At the same time, spend on alternative forms of entertainment have picked up as the economy reopened.

Overall spend may also have fared relatively better than expected over the Omicron -riddled quarter due to inflation boosting the value of transactions.

High-contact services, highly vulnerable

Offshore -originated inflation

Russia’s invasion of Ukraine has disrupted supplies of oil, gas, and several other key commodities. Commodity prices spiralled higher. In early March, global oil prices breached US$120/barrel – the highest in almost a decade and a 60% jump from the beginning of the year. Local petrol prices were caught in the uptrend. With prices pushing past $3/litre, the value of petrol spend in March rose 8.4% compared to the month prior, and up 12.1% compared to a year ago.

In response to the energy price shock, the Government has reduced the fuel excise tax until mid -June and incentivised the use of public transport by halving fees and fares. However, as the conflict continues in Europe, petrol prices have climbed back toward and through $3/litre in some parts of the country.

Also adding upward pressure to oil prices is the recent lockdown of key industrial areas in China, as the country faces its largest outbreak in two years. Locking down the world’s factory will also exacerbate current supply chain disruptions and shipping costs, which had previously been showing tentative signs of recovery.

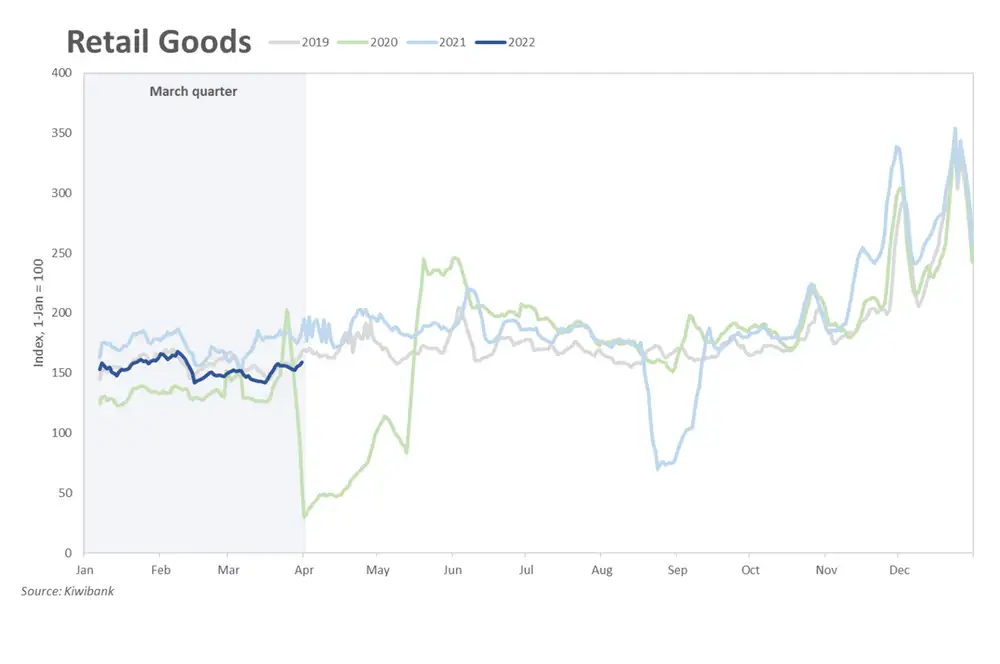

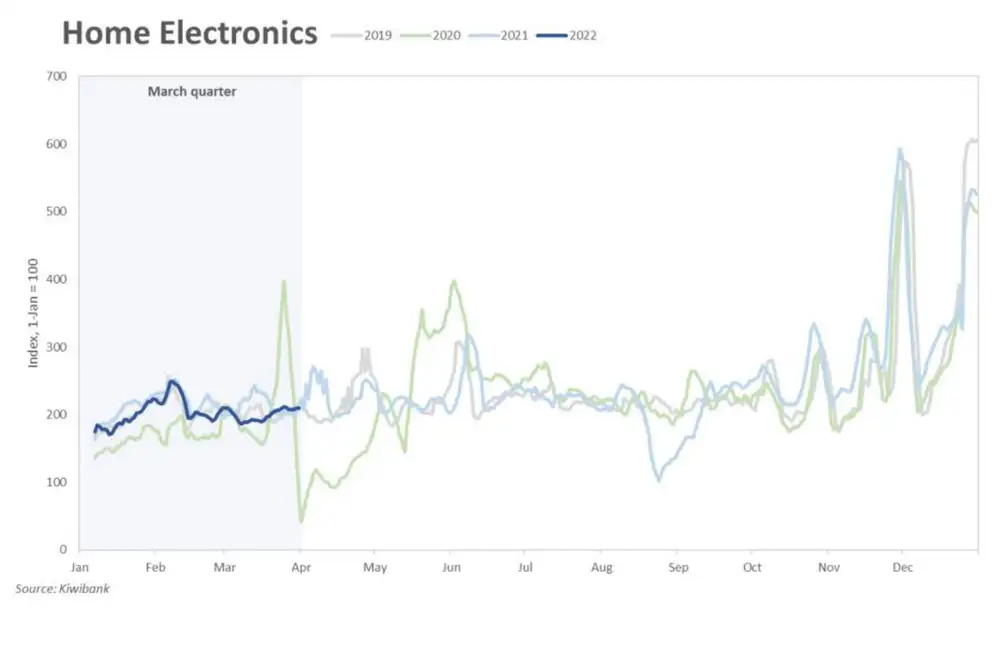

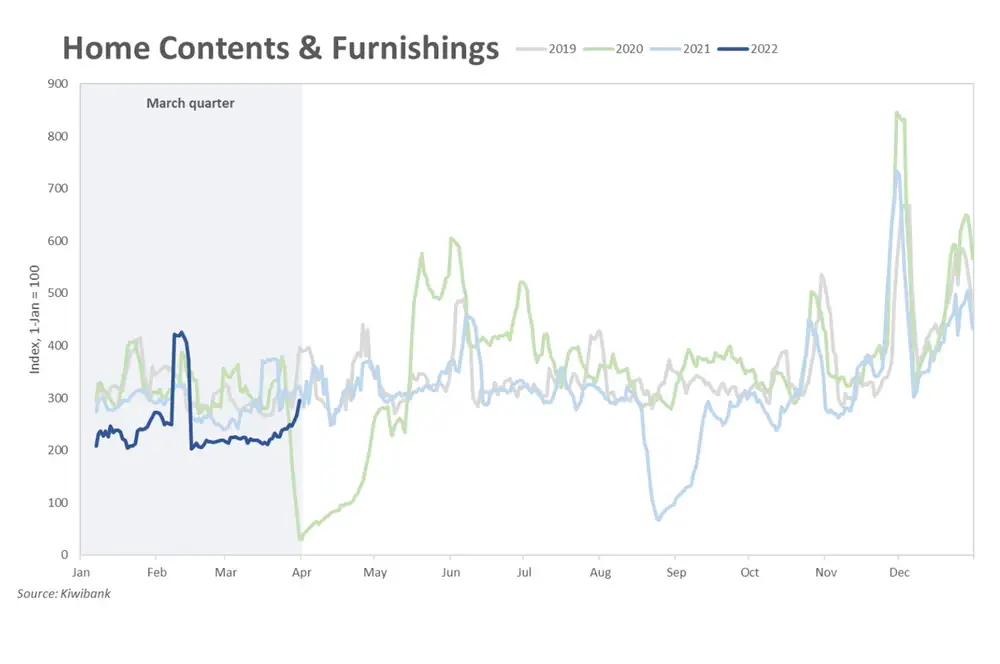

There’s demand for goods, but supply is harder to source in this covid - stricken environment. And our island nation is especially vulnerable being located at the bottom of the world. Spend on retail goods, including apparel, home contents & furnishing & hardware, are holding up so far. But we could see the value of spend rise as a consequence of elevated cost pressures.

Ready for take-off

With Omicron spreading like wildfire across the country, you’d think there would be little appetite for people to jump on a plane (aka a flying petri dish). However, the opposite has transpired. Flight bookings climbed a massive 80% over the quarter. The removal of MIQ for vaccinated Kiwi upon return is likely to explain the sudden surge in bookings. Two years of a closed border has kept families apart, cancelled many overseas holidays, stalled plans of an OE, and hit pause on overseas careers. There’s a lot of pent up demand to venture beyond our four walls. But now, the decision to leave has been made easier knowing that they can return without the need to enter managed isolation. As explained in our note (“A grand reopening of Aotearoa is likely to add to labour shortages this year”), we expect annual net migration outflows could reach 20,000 by the end of the year.

Webinar fatigue and feeling all ‘Zoomed out’ may also explain the jump in flight bookings. People may be choosing to attend conferences and network in person than opt for the digital alternative. With covid going from pandemic to endemic, people are learning to live with the virus which means leaving the hermit’s cave.

Perhaps more reflective of the current domestic tourism scene is the relatively weak spend at hotels and accommodation. Growth in this category appears to be slowing. Kiwi have explored their backyards to their hearts content for the past two years. But now, there’s a longing to check out sights abroad. With more people expected to leave than arrive this year, it’s hard to see domestic tourism spend experience another 2020 spend up. Overseas tourists are desperately needed to revive the sector. Hopefully we see our Aussie mates hit the slopes in the upcoming winter ski season.

Playing by new rules

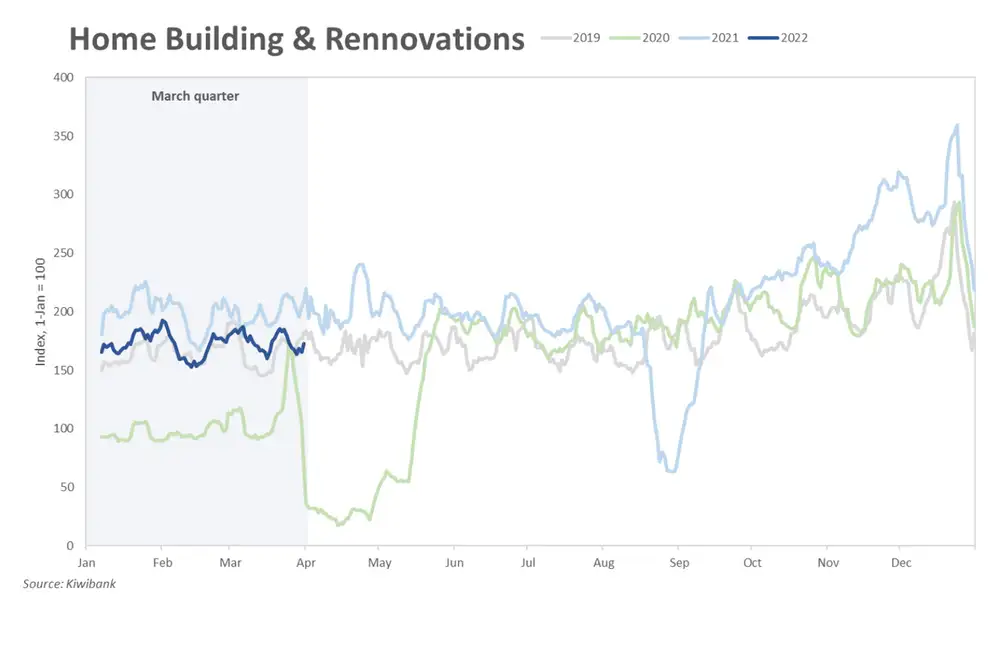

A rampant housing market has underpinned much of the strength in housing-related spending. However the market is cooling, and spend dropped 22% over the March quarter. Seasonality may explain the pullback. However several surveys over the March quarter revealed weakening consumer confidence as households face the Omicron outbreak, rising mortgage rates and rising inflation. Today’s climate is not ideal for splurging on big ticket items.

Another culprit for weak spend may be the stricter consumer credit legislation (CCCFA) that’s binding new bank lending. For households in pursuit of a mortgage (or wishing to top up), changes to the CCCFA ultimately mean cutting back on spending. No more new pools, new furniture, or new pets.

The new responsible lending rules have been hard to swallow. Given the backlash, the Govt has tweaked the rules so that going through past expenses with a fine tooth comb is no longer necessary. These changes are expected to come into effect by the second half of the year, at the earliest. We are unlikely to see a meaningful change in spend behaviour until then.

Outlook: Bye, bye Big Spender

Household consumption has been a key source of economic momentum since the recovery took shape. But rising prices, rising interest rates and a housing market in retreat eat into households’ discretionary spending. And weaker consumption points to weaker economic growth.

-

Price and wage growth mismatch

Inflation is at a 30-year high and a 7%+ peak looks increasingly likely by the day. But at 2.5%, wage growth is not keeping up with the rapid rise in living costs. Kiwi households are seeing their real incomes being eroded. A more expensive shopping trolley eats into disposable income, making budgeting that much more difficult. And inflation hurts more for those who don’t have as much wriggle room. Households on low or fixed incomes are disproportionately affected, as food and fuel typically make up a larger share of their budget. With prices expected to continue rising in the near-term, households will be forced to tighten their belts and shorten their shopping lists.

-

Rising rates

In the face of rising inflation, the RBNZ has hiked the cash rate to 1% in successive moves. And fixed mortgage rates have lifted in lockstep. We see another 150bps of hikes in the pipeline for the cash rate this year (to 2.5% by November). All mortgage rates have further to rise. Most rates will be 2-2.5%pts higher than the lows seen early in the covid crisis. A strong labour market however ensures households are still capable of making good on their mortgage and rent payments. But there’s little doubt that a more expensive bill will also squeeze discretionary spending.

-

Weaker wealth effect

Following unsustainably high house price growth last year, the housing market is now in full retreat. February marked the third consecutive month of house prices in decline. And we expect a cumulative 5% decline by the start of 2023. Housing, however, is the single largest form of wealth among Kiwi. Households also consume some of the capital gains generated in the good times in the form of mortgage top-ups or by downsizing and crystalising gains. But a cooling market, as is the case today, adds another dampener to consumer spending. Falling house prices and tighter lending rules are not supportive of borrowing and spending.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.