Life under the traffic light system

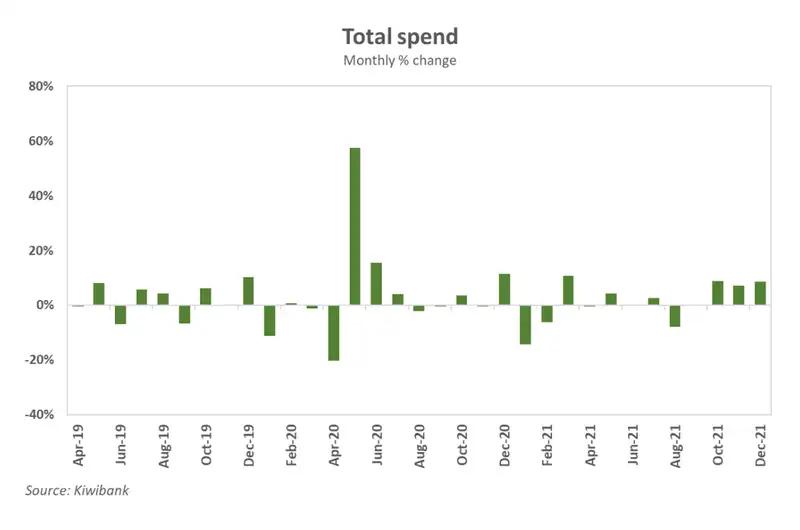

Kiwibank electronic card spend rebounded in the final quarter of 2021, rising 13%. The rise in spend was supported by Auckland moving out of a 90-day (level 4 and level 3) lockdown in mid-November. The data again confirms that demand is not destroyed by lockdowns, but is instead deferred.

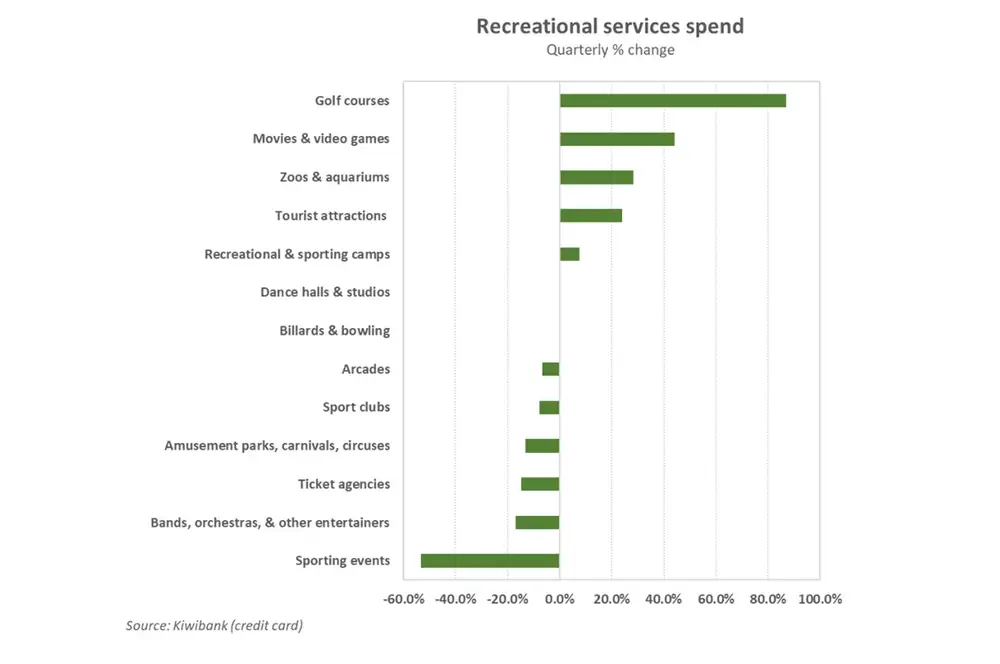

Spend on total services bounced back, rising 1.3% in the quarter. Restrictions under the new traffic light system are far more lenient, helping a recovery in the service industry. The transition to the new covid management system also coincided with the holiday season. The December quarter saw more trips to the zoo, movies and golf courses.

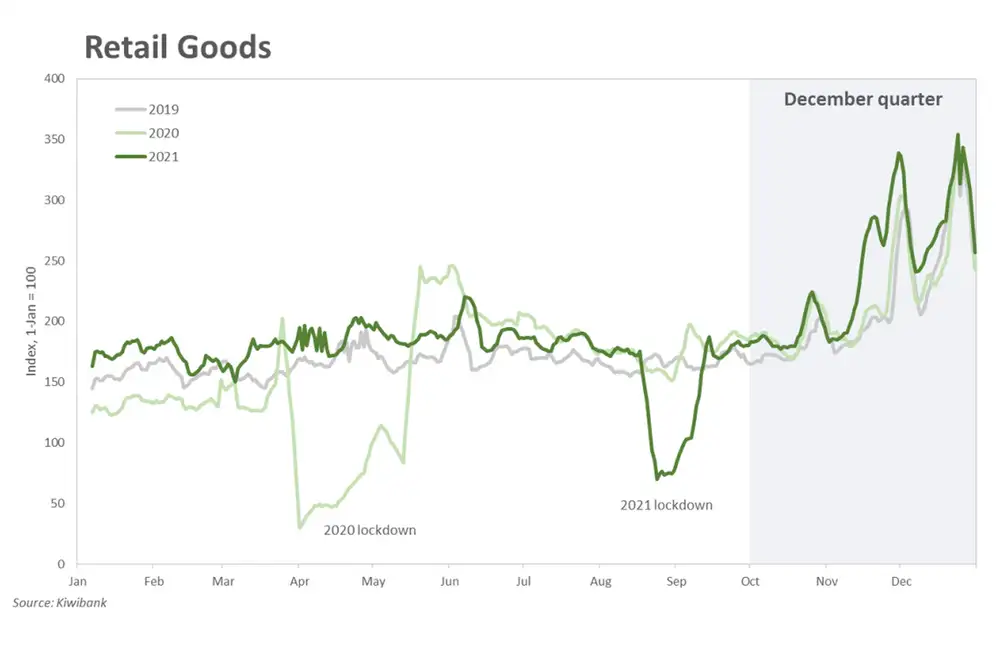

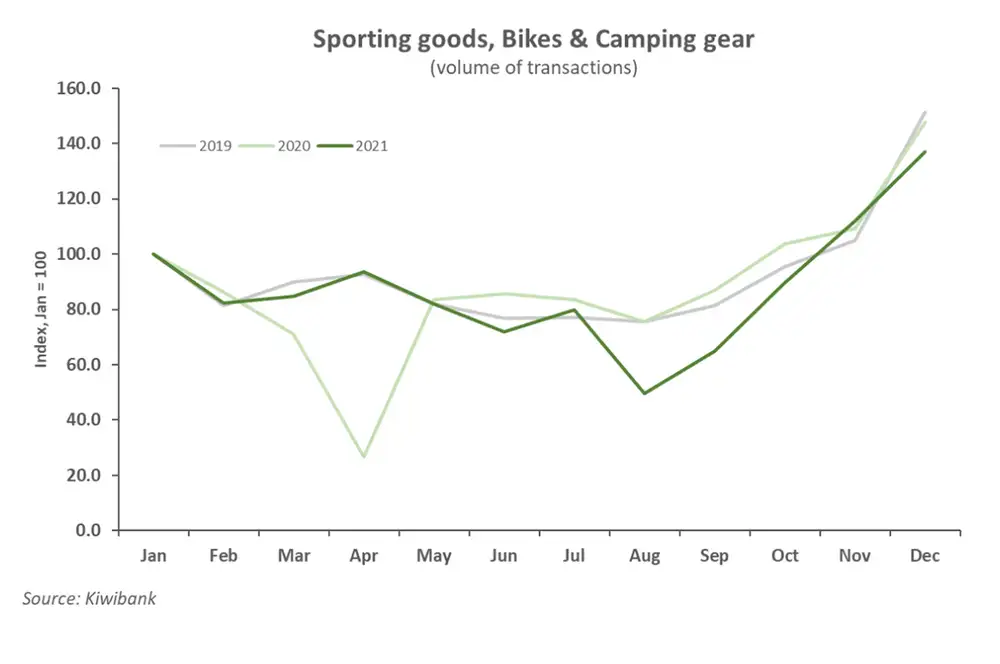

Shopping for Christmas presents and stocking fillers saw a seasonal rise in spend on retail goods. Bikes, surfboards and camping gear are usually the most popular given the summer holidays. The volume of transactions however fell short of the December average of the past two years. Fewer transactions reaffirm the difficulty to source stock while supply chains remain dislocated.

The new Traffic Light system comes with relatively more economic freedoms than the Alert Level system. But the limitations on people gatherings with the return to red puts pressure on retail, hospitality and entertainment. The 100-person limit will certainly see many conferences and concerts canned, which will flow through as a hit to spending. And the unprecedented speed at which Omicron spreads, may lead people to voluntarily lockdown. The recent spike in supermarket spend certainly suggests so.

Household consumption has been a key source of economic momentum since the recovery took shape. But interest rates are rising, broadening inflation is eroding real incomes and new lending is subject to stricter regulation. All these will challenge the resilience of household consumption, and the economy more broadly.

Back in recovery mode

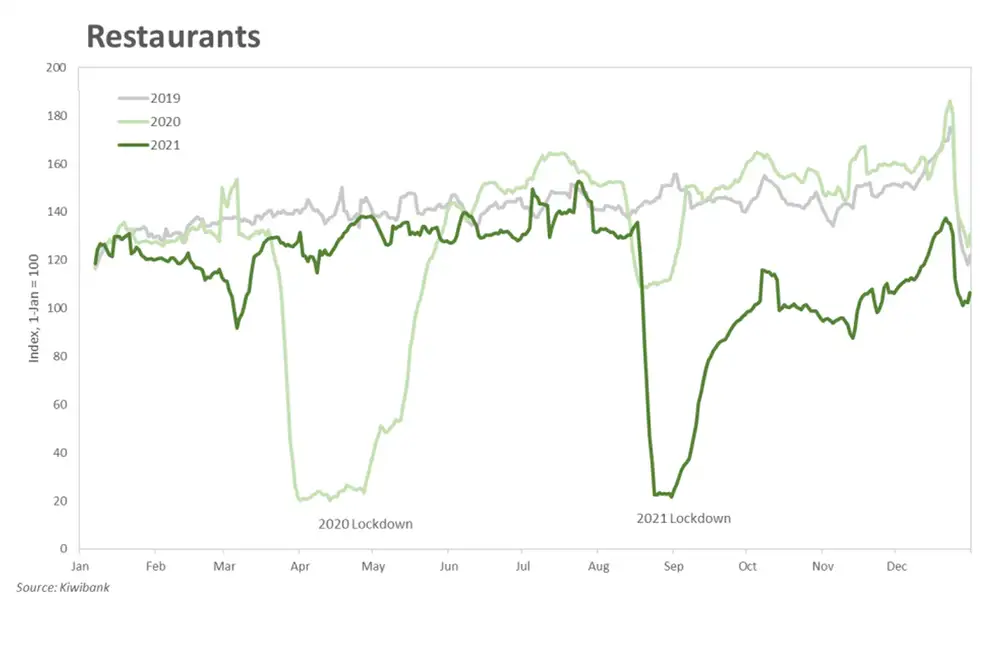

Kiwibank electronic card spend rose 13% in the final quarter of 2021, following a 2% fall in the September ‘Delta lockdown’ quarter. The rebound in spend was supported by Auckland moving out of level 3 lockdown in mid-November, after 90 days in level 4 and level 3 lockdown. The data again shows that demand is not destroyed by lockdowns, but is instead deferred. As Auckland’s service industry opened up, total services spend rose 1.3%.

The move into the new covid traffic light system also coincided with the holiday season. Restrictions under the traffic light system are far more lenient. And we saw spend on recreational services pick up strongly in the December quarter. More trips to the zoos and aquariums. The museums and movies were open for the latest showing. And golfers were back on the green. Many sport events and festivals however were canned in December, which explains the drop in spend among ticket agencies and in entertainment.

Testing out the new toys

Shopping for Christmas presents and stocking fillers saw a seasonal rise in spend on retail goods. And many of us managed to get the Christmas shopping done early, with November spend levels rivalling December. The US tradition of Black Friday seems to have firmly made its way to our shores. The December quarter also captured the Boxing Day spend up.

Bikes, surfboards and camping gear are usually the most popular given the summer holidays. The volume of transactions however fell short of the December average of the past two years. Fewer transactions reaffirm the difficulty in sourcing stock while supply chains remain dislocated.

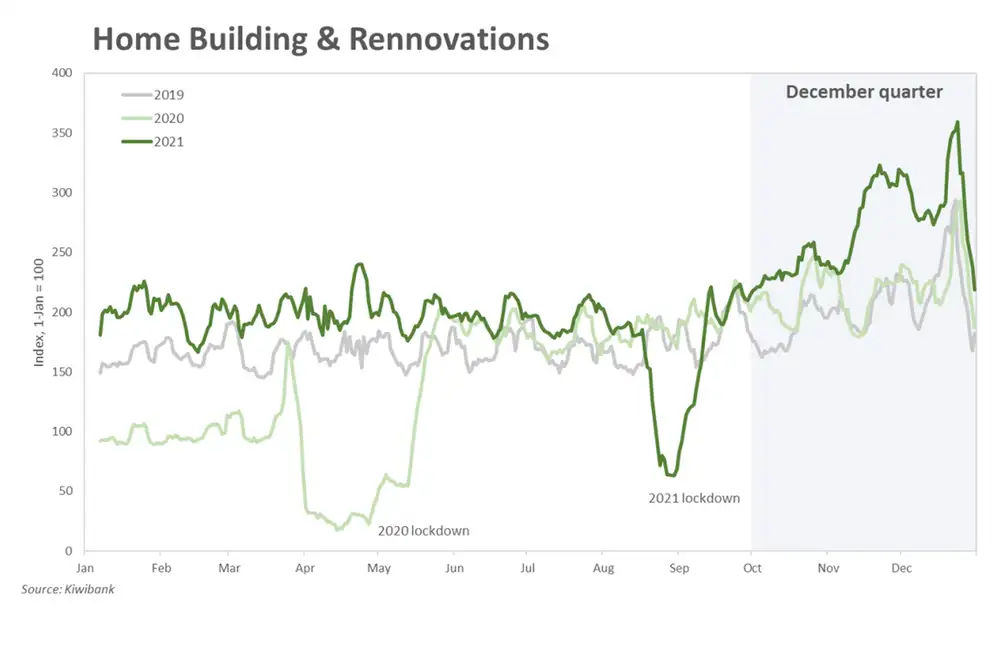

Spend on home building and renovations also picked up, as is usual in a December quarter. Time off work means more time in the backyard testing out the new tools.

Out and about in Aotearoa

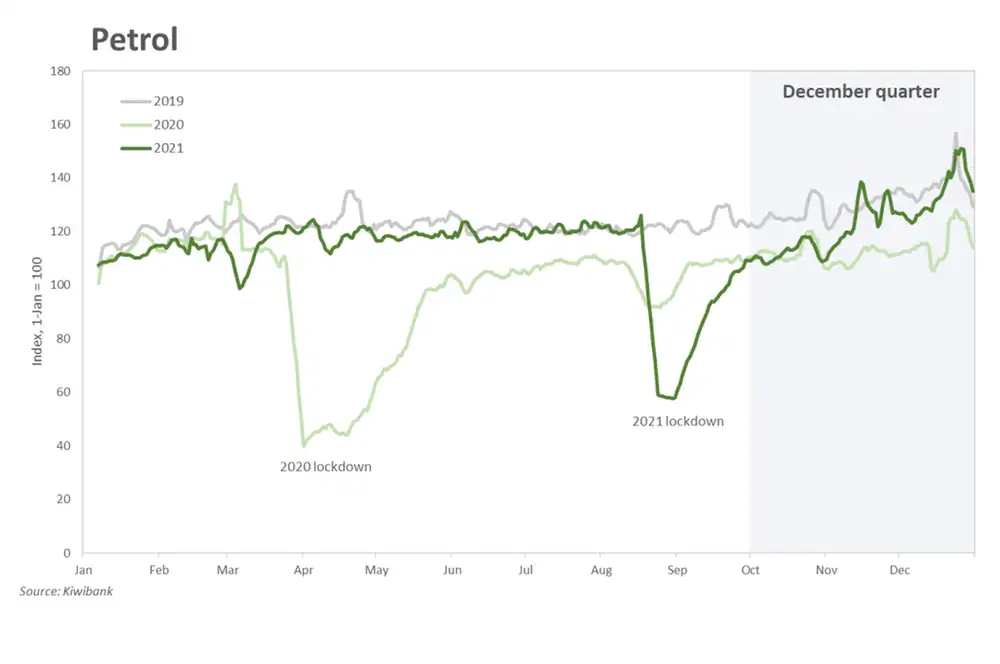

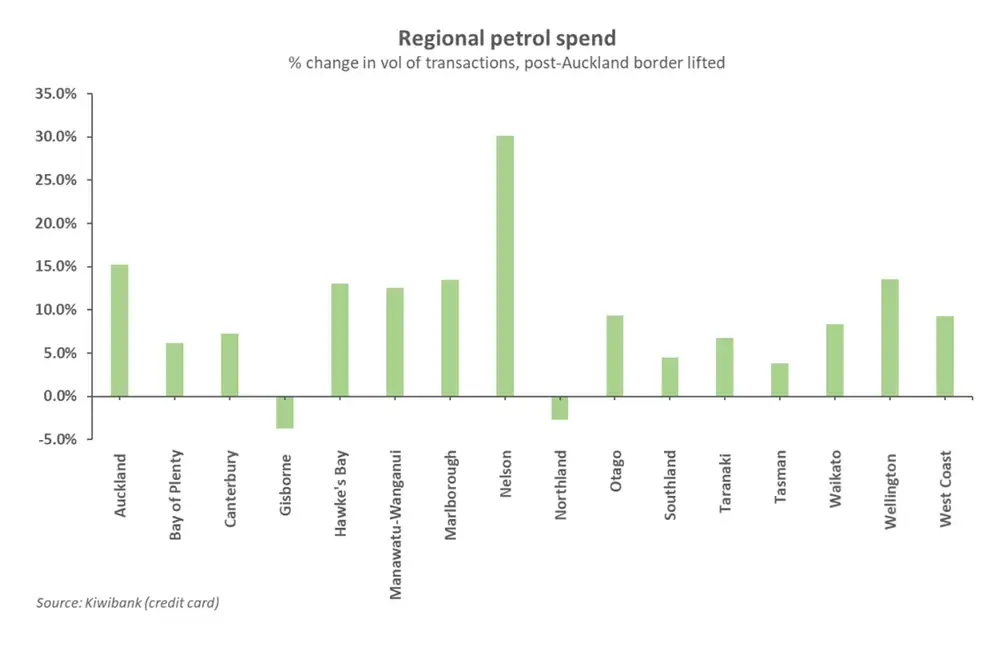

Spend on petrol steadily recovered as the economy reopened following the Delta lockdown. And spend was given a kick higher once the hard border around Auckland was lifted in mid-December. In the first two weeks following the border announcement, spend rose 12% compared to the week prior. After 120 days, Aucklanders were itching to escape the Big Smoke. The number of visits to the pump (credit card transactions) in Auckland jumped 15%.

Overall, the value of petrol spend rose 20% in the December quarter. There’s no doubt that the recent rise in petrol prices takes some of the blame for the pricier summer road trips. According to Stats NZ, the price of petrol is 30% higher than a year ago. Unfortunately, there’s little relief on the horizon. Geopolitical tensions have pushed global oil prices higher, and the we’re seeing the price at the pump uncomfortably close to $3/litre.

The return to Red

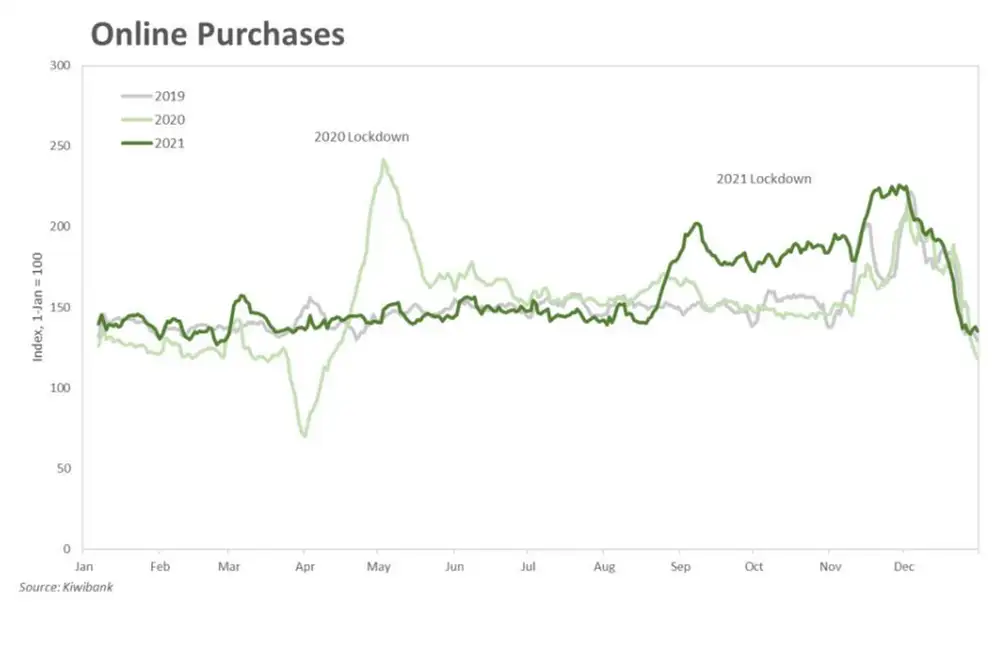

With Omicron in the community, NZ has moved into the Red light setting. The new Traffic Light system comes with relatively more economic freedoms than the Alert Level system, even at Red. The restrictions under Red are akin to Alert Level 2 – in theory, at least. In practice, the groundswell feeling can’t be more different. Perhaps spooked by the unprecedented speed at which Omicron can spread, people are understandably more cautious and staying put. Shelves at grocery stores were emptied as people stocked up, just in case they are required to isolate. It’s back to the bunkers, and (even) more online shopping. Spend at supermarkets and restaurants will be key in understanding consumer sentiment.

The limitations on people gatherings with the return to Red puts pressure on the retail, hospitality and entertainment industries. The 100-person limit will see many conferences and concerts canned, which will flow through as a hit to spending.

Household budgets under pressure

Price and wage growth mismatch

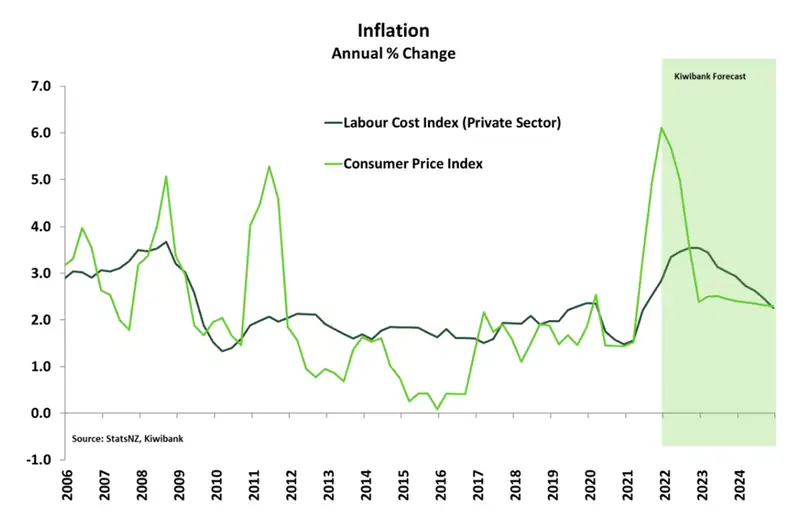

Covid has seen inflation spike to a 30-year high, and is yet to peak. Global supply chains remain clogged, energy prices – especially oil – continue to surge, and a weakening Kiwi dollar provides little offset. In an environment of strong demand, firms are able to relieve the cost burden by raising their prices. Cost-push inflation however should prove temporary. What’s more concerning is the growing strength in domestic inflation. Compared to a year ago, non-tradable (domestic) inflation is up 5.3%, the highest on record. Demand continues to outstrip supply in an overstimulated, capacity-constrained Kiwi economy. Domestically generated inflation has picked up the pace, and threatens to extend the current bout of high inflation.

Wage growth however just isn’t keeping up with the rapid rise in the cost of living. Wage inflation is on the rise and is expected to hit 3.5% by the end of 2022. But at 3.5%, wages are growing at a snail’s pace compared to an expected 6% rise in prices for goods and services. Kiwi households are seeing their real incomes erode. A hard-earned buck buys much less today. And a more expensive shopping trolley certainly eats into disposable income, making budgeting that much more difficult. With prices expected to continue rising in the near-term, households will be forced to shorten their shopping lists. Household consumption has been a key source of economic momentum since the recovery took shape. But rising prices, rising interest rates and new regulation will challenge the resilience of household consumption.

Higher and higher

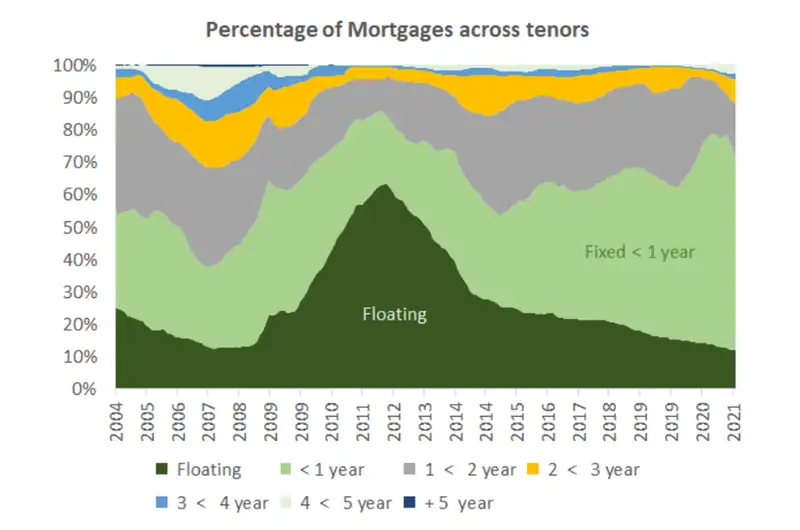

Rising interest rates will also squeeze discretionary spending. Inflation and employment continues to run well above the RBNZ’s targets. We’re expecting the RBNZ to lift the cash rate by 25bps at every opportunity it gets this year. At least another 150bps of hikes (to 2.5% by November) are in the pipeline. All mortgage rates will rise along with it. Most fixed mortgage rates will be 2-2.5%pts higher than the record lows seem early in the covid crisis. Sub-2% interest rates are a thing of the past.

And many households will be in the firing line. Households have taken on more debt and so are more sensitive to any increases in interest rates. Around 70% of outstanding mortgages are due to roll over this year. 70% of mortgagees will potentially face higher mortgage rates as their loan rolls over. Higher mortgage repayments also means households are left with less disposable income to spend.

New rules puts spending under scrutiny

New bank lending is now subject to stricter consumer credit legislation (CCCFA). There’s now greater onus on banks and lenders to ensure a prospective borrower is able to make repayments. The ‘responsible lending’ rules have been tightened. For households, the changes ultimately mean going through their expenses with a fine tooth comb.

For those in pursuit of a mortgage (or wishing to top up), they may be forced to cut back on spending to demonstrate a more prudent lifestyle. We may be past the days of the ‘Big Spender’. No more new pools, new furniture or new pets, all of which dominated 2020/21.

The new rules come at an awkward time. Small businesses need all the support it can get from consumers to make up for the weeks of inactivity during the Delta lockdown – the longest one yet.

Looking ahead, household consumption may post more modest growth in the months to come. And softening consumer demand would be a warning sign for economic growth, more broadly.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.