- The fallout of a nationwide lockdown led to the sharpest recession in NZ history. Fortunately, the 2020 recession was short lived. Unprecedented policy stimulus has fired up the economy, which is now facing acute capacity pressures and a shortage of workers as the economy struggles to keep up with demand.

- The intense heat of the recovery radiates out from a rampant housing market, a consistent story across all regions.

- But regional economies can’t stay scorching forever. The RBNZ is set to start hiking the cash rate in August – which had been an accelerant of the current recovery.

From one extreme to another

Over the last year the Kiwi economy has gone from one extreme to another. The fallout of a nationwide lockdown led to the sharpest recession in NZ history. Fortunately, the 2020 recession was short lived. Unprecedented policy stimulus has fired up the economy, which is now facing acute capacity pressures and a shortage of workers. The story playing out in the data at the national level is being repeated across all regions.

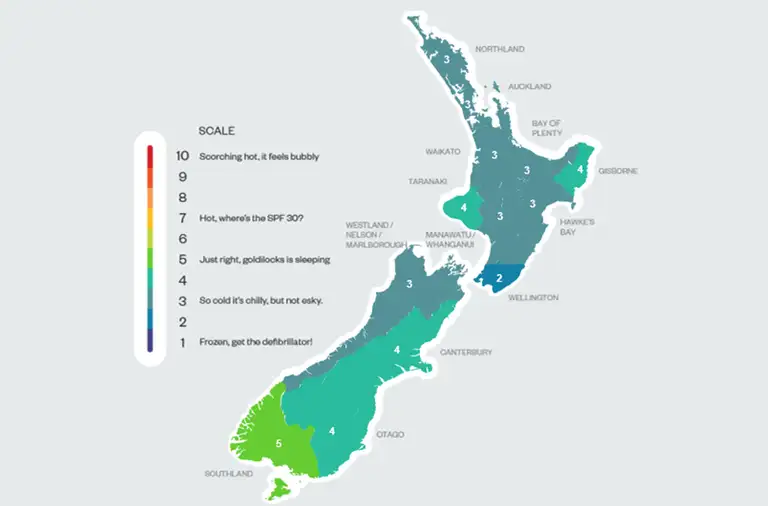

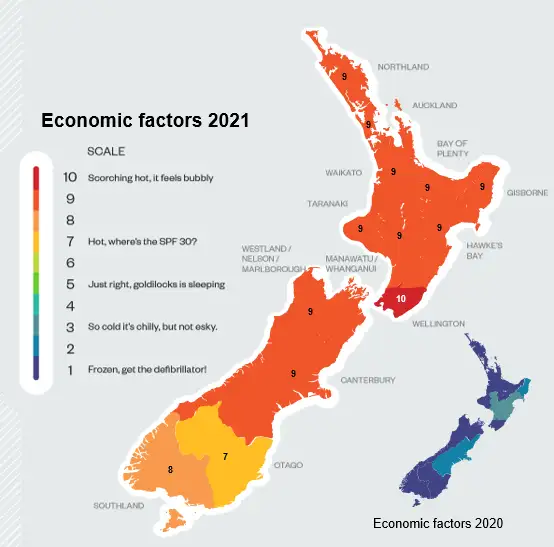

The economic temperature is sweltering, everywhere

All but one region recorded a score of at least 8 out of 10. A complete 180 from the same time last year, with nothing above 3 in the immediate aftermath of the pandemic. Leading the regions this year was Wellington, scoring an imperfect 10. But it was a close race with ten regions bunched up just behind on a score of 9 – including the rest of the North Island, Canterbury, the West Coast and the top of the South Island. But such high regional scores are far from perfect. The rapid rebound in activity has caught many off guard. Supply-side disruptions and an acute shortage of workers in many industries, point to production delays and rising inflation. An ideal score is more of a goldilocks zone between 5-and-7. You don’t want to be served porridge stone cold, or hot enough to burn.

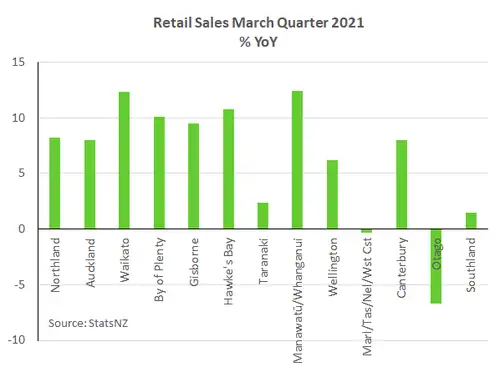

At the other end of a very narrow spectrum, the Otago region scored the lowest at 7, but up from a flatlined 1 last year. Otago has been hit more than most by the closed border and a deflated trans-Tasman travel bubble. The world-famous Queenstown-Lakes district has felt the absence of international tourists, with weaker retail sales and employment in the region. But domestic tourism, elevated export prices, and a buoyant housing market are all helping to cushion the blow.

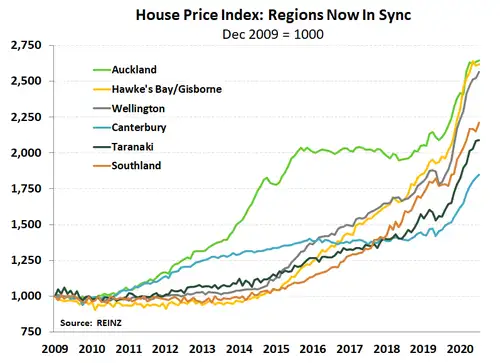

It starts with housing

The radiant heat generated by NZ’s current recovery emanates from the housing market. A universal hot spot. And the heat from the housing market is spreading to other areas of the economy, such as construction and retail sales. The stimulus employed to fight the fallout of last year’s level four lockdown was quick to fire-up the housing market. The Government’s wage subsidy protected businesses, jobs, and incomes, giving households the confidence to make major investment decisions such as housing. And the RBNZ’s lightening quick response to crush interest rates led to record low mortgage rates. The move slashed debt servicing costs and allowed households to make larger offers to secure homes.

There isn’t a single part of Aotearoa that isn’t experiencing a bubbly housing market. Sales shot up out of lockdown, well above pre-covid levels. But despite the quick return, property sales have been constrained by a distinct lack of listed property. And any property new to market doesn’t tend to hang around for long. Constrained supply with such demand means only one thing. Astronomical house price growth. And nowhere is more consistent with this narrative than the lower North Island.

The Whanganui/Manawatū, Hawke’s Bay and Wellington regions are experiencing levels of house price growth (30%+) that makes policymakers nervous. Markets such as Canterbury and Taranaki, which both experienced an extended period of slumber, have sprung out of bed. Over the last decade Canterbury experienced a building boom in the wake of devastating earthquakes. The region stood out with ample housing supply, modest house price growth and rent rises. Demand now looks to have well and truly caught up. In June house prices in Canterbury were up 26% on the year, and 35% higher than five years ago – just to illustrate the intensity of recent market movements. The bottom of the South Island recorded the slowest rate of house price growth. But the 24% rise in Southland could hardly be called a snail’s pace.

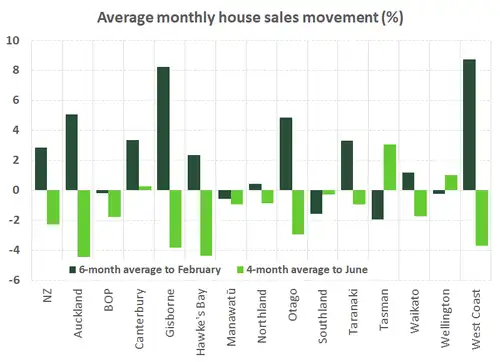

The housing market has set the tone for a heady recovery. But it will also set the tone in the regions in the months ahead. Activity and the rate of house price growth looks set to cool. Changes in Government policy since the start of 2021 have led to a slowdown in sales activity (see chart below). The tightening in loan-to-value ratio (LVR) restriction, and the removal of interest payments as a tax-deductible expense has perturbed investors.

However, the housing market hasn’t softened as quickly as many expected, and house price growth across the regions will peak much higher than we had thought. Nevertheless, there are other factors set to cool the market. We are seeing the ramp up in new housing supply at the same time a closed border is limiting population growth. Also, mortgage rates are starting to rise as the RBNZ looks to normalise policy settings.

North vs South

Some unfamiliar with New Zealand (or world geography) often think our country is one long, narrow stretch of land. But due to the pandemic restrictions, the divide between the North and South Islands couldn’t be more stark. Our famers, orchardists and lumberjacks in the North are enjoying record-high commodity prices for all our homegrown goods. Down South, our umbrella-hat wearing tour guides are still doing it tough with the closed border and a popped trans-Tasman travel bubble.

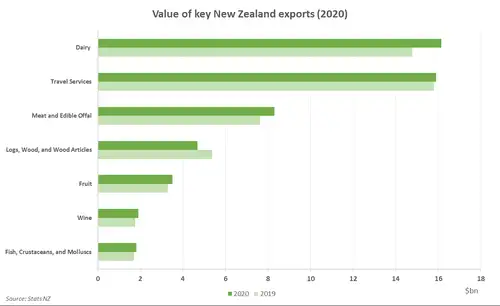

Our agricultural commodity prices have been on a tear, pushed higher by strong offshore demand. Our key Asian markets (especially China) handled Covid well and were able to get their economies back up and running relatively quickly. Demand for our products has proven resilient throughout the pandemic. Dairy regained pole position last year as the top export earner, overtaking tourism once the border closed. As our Dairy Queen region, the Waikato economy has been well supported by the strong dairy prices. However, such heights have recently been tested with wholemilk powder prices on a downtrend for the past four Global Dairy Trade auctions. Nonetheless, ANZ’s commodity price index sees dairy prices 35% higher than a year ago, and prices falls at this time of year are not unusual as northern hemisphere supply swells. The Canterbury region too has benefited from strong meat prices, and woodland country - Northland - is seeing strong demand for logs from China which is pushing up forestry prices. Shipping delays however weighs on export volumes. The same story is unfolding for horticulture. The Hawke’s Bay economy is being supported by favourable kiwifruit and apple prices, but labour shortages and shipping disruptions are making it more challenging to get fruit to market.

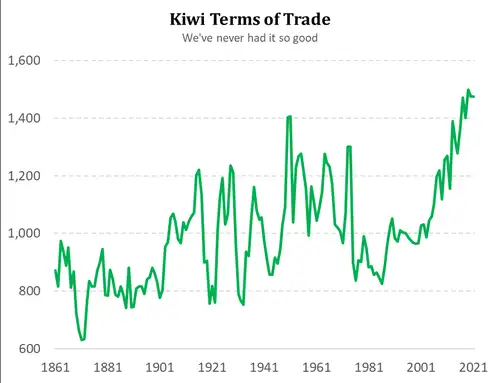

Strong commodity prices have pushed our terms of trade to record-high levels, supporting export earnings. But the global supply chain disruptions threaten the strength of our purchasing power. There is significant cost pressure mounting at the ports, driving import prices higher. Given we don’t expect these price pressures to abate anytime soon, there’s downside risk to our terms of trade.

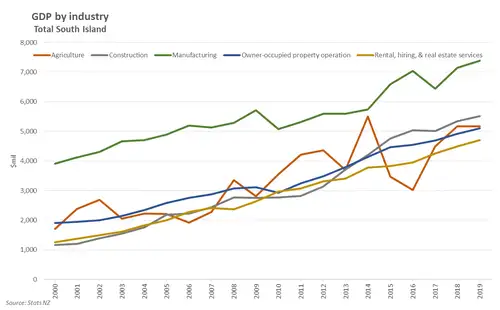

t’s a red-hot 9 across the board for our commodity-driven regional economies. But the business climate cools the further south we travel. Because agriculture makes up a smaller portion of output among the South Island regional economies, Canterbury aside. And with only a pointy tower, some beaches and RotoVegas to show for in the North, overseas tourism is concentrated in the South.

But the closed border means these regions are hurting disproportionately more from the lack of international tourists. With overseas travel off the cards, these regions have done well to attract domestic tourists. And Kiwi travellers have happily opened their wallets. But retail sales and employment in Otago and the West Coast remains soft, exposing a ‘foreign currency’ hole. Also, the housing markets in these regions have not seen similar growth as in other parts of the country, which has supported spending elsewhere.

Until our border reopens to those international tourists with blank cheques in hand, we expect these regions to remain at the bottom of the leaderboard.

Smooth sailing for the City of Sails

Despite facing headwinds in the form of covid scares and snap lockdowns, it’s been smooth sailing for the City of Sails. Businesses and households have adapted, and economic activity has continued largely uninterrupted. With no change to alert levels for the past four or so months, the CBD is seeing more life and a healthy return of workers to the office. Retail sales and employment were solid for the nation’s powerhouse. Of course, underpinning consumer spending has been the red-hot housing market. Median house prices are up 25%yoy, sitting at $1.15mil – a new record for Auckland.

The Auckland economy has fired up since last year, but a score of 9 highlights the economy is near boiling point, facing issues around capacity. A trip down to the waterfront, and it’s clear – the Ports of Auckland have never been busier. Shipping containers are stacked high, with cranes operating left, right and centre. The congestion in Auckland has even led to containers being diverted to other ports – Timaru, Whangarei, Tauranga – to keep freight volumes moving. And similar to the rest of the country, Auckland is facing a severe skilled labour shortage across numerous industries. Building and construction are in hot demand. But many of our clients are experiencing great difficulty in hiring across many industries. IT, finance and other professionals are hard to come by. The ongoing material and labour shortages hamper future growth.

The packet of Jaffas looks to be spilling over, with some ending up in the neighbouring cities. Northland real estate is booming with “…Aucklanders are moving north & investors are chasing better yields” Lorraine Wetzell, Mobile Mortgage Manager, Auckland. And in the Waikato “…businesses are relocating from Auckland for cheaper land, better workforce, lower wages, less travel time.” Eddie Stocks, Regional Manager, Waikato Business Banking.

Regional employment is set to take-off

Regional employment growth looked soft at the start of the year but is set to take-off. Employment growth was the weakest measure within our regional indexes. On an annual basis, most regions outside the main centres of Auckland, Wellington and Christchurch recorded falls in employment in the March quarter. Otago, Southland, and Taranaki recorded the largest falls in employment growth over the period.

However, employment growth is already accelerating according to recent business sentiment surveys. Hiring intentions have bounded back. And we expect to see improvements in employment across the regions when June quarter labour market data is released. In fact, labour demand is so strong at present, according to firms, that labour shortages are a key constraint for many. “Hospitality and some trade sectors are struggling to obtain quality staff members to operate at full efficiency.” Caitlin Osmond, Commercial Manager, Wellington.

A closed border has not just blocked tourists, but also non-New Zealanders looking to live and work in Aotearoa. Staff shortages mean that firms are competing for staff in a small pool of candidates. Rising wages growth, and inflation are the expected consequence. As are production delays: “Labour supply is very short, with most of my portfolio reporting big capacity issues and they are now starting to turn down forward work.” Nick Hosking, Commercial Growth Manager, on Gisborne.

The feel good (or bad) factor

Again, we asked our Kiwibank business banking and mortgage manager colleagues to get a sense of the regions at the coalface. Here is what they said:

Northland’s business climate feels a balmy 8

“Very prosperous for those in industries such as construction, engineering, forestry & transport. Professional services (lawyers, accountants & valuers) are very busy, delays in services is a pain point for some of our business customers. Real estate is booming - Aucklanders are moving north & investors are chasing better yields. Shortage of rentals available in some suburbs. There is a labour skills shortage across all industries.” Daniel Heswall, Commercial Associate, Northland

In Auckland the fire is still burning a 9

“Stock is low, Buyers are high. Buyers can be tripping over themselves waiting to view a home. When making offer still getting multi offers happening. Sale prices above valuation top range still. Although my investor customer has quietened down, I haven't heard them selling invest properties. This would suggest returning Kiwi want the home for themselves, adding fuel to property prices. The sizzling heat appears to be out but there's still fire.” Lorraine Wetzell, Mobile Mortgage Manager, Auckland

The Waikato is humming an 8

“Humming! We have businesses relocating from Auckland for cheaper land, better workforce, lower wages, less travel time. There are many infrastructure projects, both public and private. And we know that the cows are going to help farmers with great dairy prices next year!” Eddie Stocks, Regional Manager, Waikato Business Banking

“Overall the Waikato market seemed unaffected, certainly the amount of investors in the market reduced to a minimum almost overnight following the announcement/introduction of the new rules, however they were quickly replaced by first home buyers and existing home owners looking to sell and upgrade their owner-occupied property.” Craig Wrigley, Mobile Mortgage Manager

The Bay of Plenty feels a supply disrupted 7

“The local BOP economy appears to be ticking along quite strongly with businesses bouncing back strongly post Covid-19 lockdown. Building levels are at record levels with labour along with supply chain issues being the biggest headaches to this progress.” Andrew Long, Property Finance Analyst, Tauranga

“There is a severe shortage of housing and prices are mental. Before lockdown last year, you could buy a nice house in an average suburb for $7 -800,000 in Tauranga. Now those houses are $1m - $1.5m. Existing homeowners are afraid to sell for fear of being unable to secure their next home in time. Everything being sold at auction makes the process even harder for people. Pre-approved customers are coming back after missing out on houses wanting higher loan amounts to give them more chance.” Donna Neville, Mobile Mortgage Manager

Gisborne is “red hot in all areas”, scoring an 8

“Gisborne is basically red hot in all areas. Gisborne has undergone massive investment in the last three years across a number of primary sectors. Investment in kiwifruit into the region is very noticeable due to the cheaper land cost within close proximity to town and a large contingent of Bay of Plenty growers taking license into the region on the back of selling orchards in the bay at record highs. This coupled with major extensions to the port, and 5-year forestry contracts has seen a good spread of industries perform well for the last two financial years. Housing stock/prices are under major pressure and show no signs of slowing down with house prices doubling in the last two years. Labour supply is very short, with most of my portfolio reporting big capacity issues and they are now starting to turn down forward work. If you had some spare cash to invest this place has plenty of pace left in it for the foreseeable future.” Nick Hosking, Commercial Growth Manager.

‘The bay’ (Hawke’s Bay) feels a buoyant 6-8

“Virus containment has enabled our business economy to return to 'normal' levels, with some sectors (e.g. construction / trades) with a pipeline that even Kelly Slater would be envious of. Horticultural labour remains tight especially at seasonal peaks. Has the property market finally run out of puff after a "Kiwi" like phenomenal performance? Maybe / Maybe not. The Bay remains pretty buoyant” Garth Duncan, Senior Commercial Manager, Hawke’s Bay

“Residential construction activity in the bay is very active (supported by low interest rates and strong house price gains). Building consents are running at record levels, with no sign of let-up in this space over the next 12-18 months. Major commercial construction firms (MCL Construction, Gemco, Stead construction) all have a number of projects on and forward pipeline work of 12-24m. But there remains pressure around building supplies and labour. With regards to rural, horticulture and forestry, labour shortages remain a concern. Crop sizes are significantly down due to labour shortages, meaning a lot of fruit has been left to rot. However, orchardists are benefiting from healthy prices for apples. Forestry owners too have benefited from strong export prices, with log prices increasing 20% in last 6 months. Farmers have also been buoyed by recent turnaround in sheep and beef prices.” Karl Trafford, Commercial Manager, Hawke’s Bay

Growing pains make Taranaki feel like a 7

“There is an optimistic outlook for the region. The local economy has performed above expectations since lockdown but skills shortages, particularly in construction and youth unemployment remain as key challenges. Expectations are that this will improve on the back of key investment areas like trade training. Within the business community spirits are high however the common theme is that now is not the time to sit on our hands and the opportunities need to be created.” Jayden Devonshire, Commercial Manager, Taranaki

Whanganui/Manawatū

“Taumarunui has experienced (in the Ruapehu region) has experienced a huge growth in house price and capital growth - some of the highest in the country. Going from a decade ago where houses could literally stay years on the market well priced properties (but far higher than they were then) are going in a matter of weeks.” Angela Bycroft, Team Leader, Taumarunui

Although Wellington feels like an 8

“Construction continues to be strong in Wellington region, with the likes of Transmission Gully and Peka Peka to Otaki nearing completion. Hospitality and some trade sectors are struggling to obtain quality staff members to operate at full efficiency. The housing market continues to be strong in Wellington, albeit a bit of cool off in the first home buyer and investor market evident.” Caitlin Osmond, Commercial Manager, Wellington

Blenheim and Nelson

“There is not enough stock on the market and no land opening up for construction, so it’s a sellers’ market. The outlook remains strong over the next few months given short supply of housing and plenty of cashed up buyers around. There’s been no obvious changes from what I understand following the Government’s recent tax changes. Landlords are still retaining their properties, however not purchasing anymore.” Stephen Wilson, Bank Manager, Nelson

Christchurch feels a sweltering 8 or 9

“General sentiment is extremely positive, supported by a red-hot housing market, continuing commercial development (will we ever get a stadium...?), and consumer demand fuelling everything. Post-Covid performances are generally very strong (retail and hospo excluded), with no signs of deteriorating. Hospo remains difficult, but has weathered the immediate Covid impacts ok. The biggest challenge continues to be numbers visiting the CBD. Stock procurement (ie offshore) is becoming a shambles, with price rises everywhere as a result. Shipping seems to be the next biggest hurdle. Labour market for Christchurch is tight, with wage pressure seeming to be escalating. There's business (and plenty of it) out there for those who are well capitalised, staffed appropriately, and with the desire to go and get it.” Brad Macdonald, Commercial Manager, Christchurch

Outside tourism, Otago feels like an 8

“Lots of new businesses setting up. SME a big part of the local economy. Lots focused around the booming building and rapidly growing population. Wanaka is one of the fastest growing regions in NZ.” Lindsey Turner, Retail Branch Team leader, Wanaka

“The housing market is smoking hot‼! If the borders open, it will go crazy. Since it’s winter, listings are currently short. So it will be interesting to see what happens come spring/summer.” Leon Prytherch, Bank Manager, Queenstown

Kiwibank’s Regional Score

Kiwibank’s Regional Score summarises seven economic indicators in 13 regions (see map on the front page). Included in the scores are: population growth, retail sales, employment, house price index, house sales, building consents, and the light-traffic index. To combine these different measures (e.g. number of people with the values of retail sales) we take annual growth rates of each measure. Growth rates are then standardised relative to their average rate of growth – as some data seem to move to their own beat. We then combine the indicators for each region by taking the average of the various measures. Finally, we convert each average into a score from 1-10 by fitting the data to a normal distribution with a mean of 0.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.