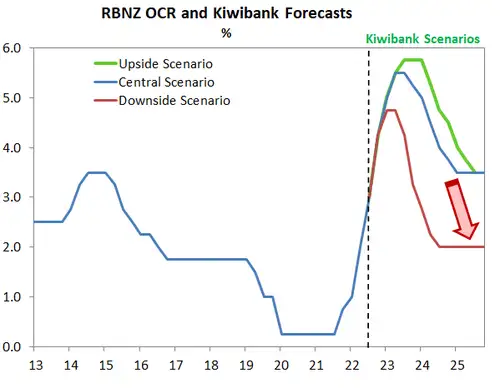

The RBNZ are hell-bent on forcing inflation back within its mandated 1-to-3%yoy target band. And fair enough, their credibility as an inflation-fighter is being tested. They expect the OCR to hit 5.5% in order to achieve the required economic slowdown.

We think a move beyond 5% is a step too far. What the RBNZ will do (hike to 5.5%), is beyond what we think the RBNZ should do. We place a much larger weight on the global slowdown, higher interest rates are effective, and Kiwi are feeling the pinch now.

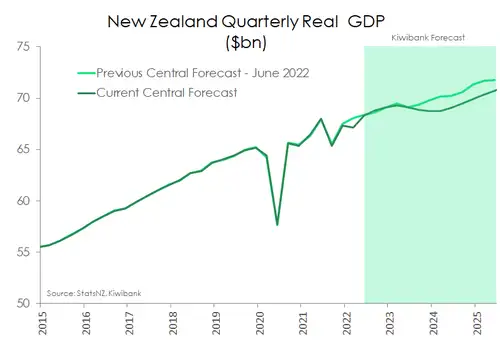

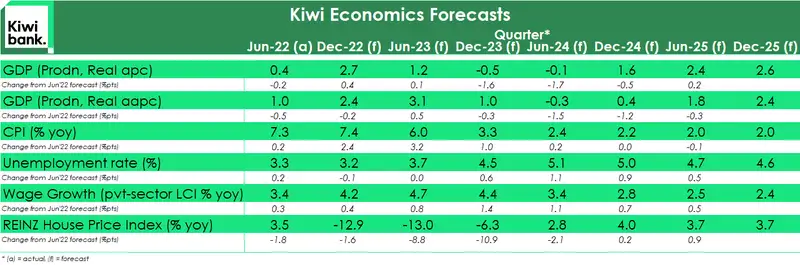

The outlook for the global economy is worsening, and so too is the outlook for the Kiwi economy. We’re likely to see a recession next year. We outlined the deteriorating global backdrop in our note titled: “Global growth is slowing, quickly, and will “feel like a recession in 2023.” Central banks may over-tighten in order to bring inflation under control. And our trading partner growth will be weaker as a result. Commodity prices are likely to ease further, and our terms of trade (export prices relative to import prices) is likely to decline – reinforcing the recessionary impulse domestically. We’re simply trading in a weaker world.

The weaker global backdrop suggests an easing in internationally sourced inflation. Shipping costs have been in decline for a while now. The speed at which we see an easing in global inflation, however, has frustrated central banks, including the RBNZ. There’s a desire to see weaker inflation, rather than forecast a reduction in price pressure – and be disappointed again (and again). Although we appear to be nearing an end to central bank tightening. Over the next 6 months we expect to see most major central banks (pivoting) hitting their terminal rates and pausing. Of course, the next move is an easing… and that’s a story for later in 2023.

Seemingly at odds with international developments, the RBNZ has upped the ante. Because domestically generated inflation continues to print on the high side of upwardly revised forecasts. It’s not good. Not only has the RBNZ hiked the cash rate 400bps, but they’re forecasting another 125bps to come. And these rate rises are coming at a time when bank funding costs are set to rise. We find ourselves factoring in what the RBNZ is doggedly determined to deliver, and it is likely to be too much. We’re worried about the impact on Kiwi households and businesses. The RBNZ’s forecast recession could easily turn into another economic accident. First there was too much easing, and now there is too much tightening.

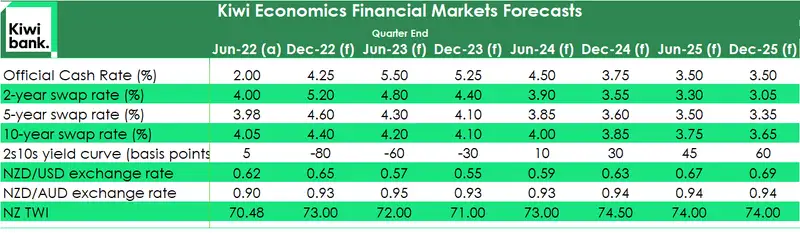

We believe we will see a peak in the cash rate at 5.5% in April next year. We would like to see the peak at 5% (or below). A peak at 5.5% (or below) will be interpreted by market traders as just that, a peak. Rates cuts will follow, eventually. We expect global interest rate markets to factor in a rate cutting cycle with greater conviction in 2023. And we expect the RBNZ will be in a position to begin easing financial conditions by the end of next year. We forecast RBNZ rate cuts to commence in November (if not earlier), taking the cash rate back down to 3.75% by the end of 2024. We see the risks skewed towards more rapid rate cuts.

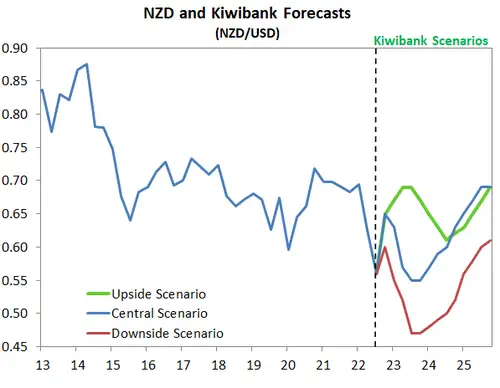

Near term, we see a helpful strengthening in the Kiwi dollar. Because the RBNZ is simply more aggressive on interest rate hikes, compared to the vast majority of central banks. Interest rate differentials are working in our favour, again. The little Kiwi flyer (NZD) is in an updraft. But it won’t last. As the world plunges into recession, and commodity prices decline, we will most likely see the Kiwi currency spiralling lower in a downdraft. Weaker global growth, softening risk sentiment, falling commodity prices, and interest rate cuts will see investors shun risk currencies – like the Kiwi dollar.

It’s an engineered recession

The RBNZ is openly engineering a recession. Much higher interest rates are being set to reduce demand (namely household consumption) to better meet constrained supply. That is, shifting to a better-balanced economy to return inflation to target. For households late to the property boom of 2021, rising mortgage rates means that debt servicing costs are set to more than double. Around 20% of mortgages are re-fixing heading into 2023, and another 50% over the coming year. Many mortgage holders will be moving from a 2-2.5% rate to 6-7%. That’s a few thousand dollars more in monthly mortgage payments. A triple threat of high living costs, rising interest rates and falling house prices will reduce households’ discretionary spending. We are starting to see a softening in spending already.

Our spending tracker showed a third of the categories we monitor dropped gdpin the volume of transactions made over the September quarter; and all were concentrated within discretionary spending. We expect this to continue.

Residential property investment is also under pressure. Construction has helped the economy power through the Covid lockdowns. But as residential construction quietens down, Kiwi economic activity will slow. The sheer weight of rising interest rates is set to push the economy into recession from the middle of next year. We are forecasting a three-quarter contraction in activity from the June quarter to leave the economy 0.7% smaller at the end of 2023.

An engineered recession is the consequence of getting inflation under control. And inflation is forecast to ease slowly from current rates of over 7%. The recent rally in the NZ dollar and cooling in global commodity prices will help lower the cost of imports. Like slowing an oil tanker from full speed, however, stickier domestic inflation will take longer to tame. Wage inflation, a major component of domestic inflation, has yet to peak. And inflation expectations remain stubbornly high. Complicating matters in the near term will be the expected end to temporary Government policy to tackle the cost-of-living crisis. The discounted fuel excise tax and half price public transport will end in January 2023. All-in-all, it will take until early 2024 for inflation to return to the RBNZ’s 1-3% target band. Inflation is unlikely to hit the 2% target midpoint until a full year later.

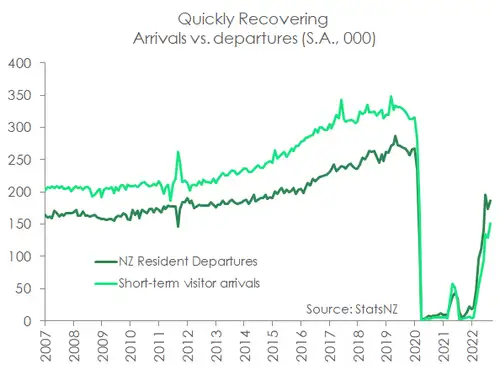

It’s not all doom and gloom. We are seeing the beginnings of a meaningful lift in net migration. The inflow of foreign migrants has accelerated in recent months. The much-needed uplift in the supply of labour will provide some relief for Kiwi businesses. We have heard the calls from Kiwi businesses across most industries crying out for workers. It appears those calls have been heard abroad. Unfortunately, there is no such thing as a free lunch. Increasing the working-age population with a steady inflow of migrants is a fountain of youth for an ageing Kiwi population. That’s great. But that said, we also get an increase in demand for just about everything. More people mean more houses, more infrastructure, more healthcare, more education, more, more, more. And we have failed as a nation to adequately respond to surging population growth in the past. Our ageing and underfunded infrastructure remains in deficit, we still have a shortage of housing across the country, and we still have major constraints in healthcare and education. Migration is a part of the answer, so too is educating Kiwi into the right roles. But the biggest challenge is funding the right physical investment with limited resources.

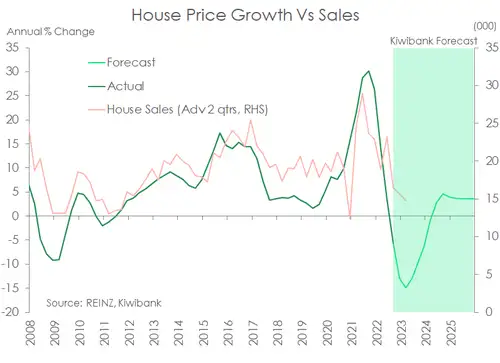

The housing market appears to have borne the brunt of the tightening in credit conditions to date. Sales activity has fallen sharply, and the supply of listed housing has risen to surpass pre-covid levels. Across Aotearoa, house prices were down housing 11%yoy in October and have fallen 12% from the peak. Prices have fallen back to levels seen at the start of 2021. Unfortunately, house price declines have further to run. The RBNZ’s desire to quickly hike the cash rate to 5.5%, with a 75bp move in February on the cards, has already seen mortgage rates take another leg higher. Higher mortgage rates will weigh on the market over summer. We are still expecting house prices to be 13% lower in the final quarter of 2022 compared to a year earlier. However, annual house price declines are expected to reach 15% in the first quarter of next year. The deeper fall now means our new forecast represents a 21% drop from peak to trough and take prices back to levels seen in late 2020.

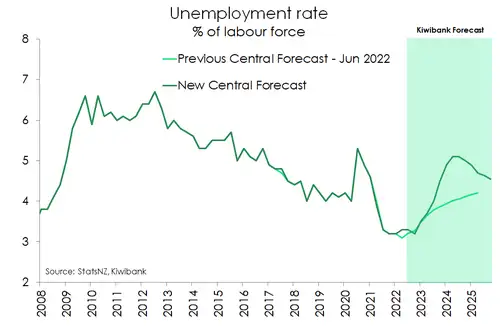

Fortunately, the labour market has softened the blow. House price falls would be far deeper if it wasn’t for the near record low unemployment rate (3.3%) and surge in wages. Wage inflation has yet to peak. Acute staff shortages has seen firms bid up wages to attract workers. And faced with sharply rising cost of living, workers are demanding pay hikes. Workers have also taken advantage of high demand by working longer hours and moving between employers. We are forecasting peak wage growth of 4.7%, as measured by the private sector labour cost index, in March 2023 before gradually receding.

But the forecast recession will see the labour market soften. As demand cools, so too will firms’ demand for labour. And the elevated cost of labour will reduce demand. The RBNZ needs to see employment return to maximum sustainable levels. Firms will also have more choice as net migration inflows return and help plug staff shortages. We are expecting the unemployment rate to track higher, and peak around 5.1% in 2024. The likely lift in unemployment is less severe when compared to past recessions.

An upside to NZ’s growth outlook is the return of tourists. As our drawbridge has been let down, we’ve seen an encouraging return of international visitors. Whether it’s our friends from across the Tasman or higher-spending travellers from the US, Canada and the UK, they’re all coming back. Pre-pandemic, tourism was our biggest export industry, contributing 20% of total exports. That contribution has fallen to 2%! And currently, international tourism spend is down over 90% on 2019 levels.

But after two summers without tourists, the sector is in for a busy one this year. The rebound in visitor arrivals should help drive a recovery in tourism and see the sector make a greater contribution to overall activity. And the return of tourists comes at a great time. Because the spend up of foreign dollars will help to offset the weakening demand by Kiwi consumers. However, like migration, the return of tourists is a double-edged sword. The ability of the tourism sector to service increased demand is questionable given the staff shortages plaguing the sector. The summer period is typically the peak in international tourism. And the sector may struggle to keep up. We may see more growth emanate from tourism (good), but also inflation pressure (not so good).

Interest rates may peak sooner, and the NZD will fall

Financial markets have experienced heightened volatility as traders confront rapidly rising interest rates, the likelihood of recession, and the inevitable ‘pivot’ in central bank actions. Over the last year, interest rates have risen at the fastest clip in decades, stock markets have struggled, and risk appetite has whipped around. Recently, the expectation of central banks reducing the pace of monetary tightening, especially the US Fed, has boosted confidence and risk appetite. We are not only contemplating the end of interest rate hikes, but we’re thinking about the beginning of interest rate cuts. Wholesale interest rates appear to be peaking, and we may have seen the top already. If we’re correct, central banks will hit their ‘terminal rates’ in coming months (not years). Interest rates are likely to be kept at restrictive levels well into 2023. Because central banks will want to see clear and present declines in prices before declaring any sort of victory over inflation. We think a recession is inevitable for large parts of the world, and we will most likely see rate cuts later in 2023 and into 2024.

There are two parts to our forecasts for financial markets. There’s a near-term tactical view – one of risk appetite relief. And there’s a strategic view – one of weakening risk appetite and recession.

Our tactical view involves the peaking of interest rates as central banks realise they have done enough. Risk appetite will improve (it already has), wholesale interest rates will peak (they may have already), and the US dollar retreats (as it has already). We expect these themes to remain in play as we kick off into 2023. The recent divergence of central banks will see a stronger Kiwi dollar in the near-term. The RBA was the first to switch from camp hawk to camp dove. Not far behind was the Bank of Canada, Bank of England and the European Central Bank. All have stepped down from the big bold hikes of 50bps or even more. And it looks like the US Fed is packing up its tent as well, after four consecutive 75bps hikes. The RBNZ however continues to let its hawkish flag fly. Another 125bps of hikes with a follow-up 75bp in February have been pencilled in. Interest rate differentials are working in our favour, again. Against the Greenback, the Kiwi appreciated close to 8% in November and 65USc looks within striking distance. The stark divergence between the Antipodean central banks will also keep the KiwiAussie cross elevated.

Our strategic view is much more pessimistic, and entails a sharp decline in wholesale interest rates, a bear market for equities, falling commodity prices, and a weakening Kiwi dollar. The outlook for the global economy is dimming. 2022 was the transition year as pandemic stimulus was unwound. But pushing interest rates higher, pushes economies closer to the cliff’s edge. A slowdown in US economic activity is the least that can be expected. The energy crisis unfolding across Europe means a recession is all but certain. The outlook for growth in Asia is also deteriorating as China – the powerhouse of the region – and its zero-covid policy are in for a messy divorce. The policy is causing huge disruption, and civil unrest. At some stage the severe impact on economic activity will force change. We will see the impact of slowing global growth in our terms of trade – the ratio of export prices to import prices, reflecting our purchasing power. Our terms of trade is currently at record highs, since records began in 1861. But what goes up, must come down. The risks around the global outlook mean we will likely see export prices falling relative to import prices. And as a driver of the Kiwi flyer, a declining terms of trade over 2023 puts the NZD under pressure.

In our central scenario (our core view), we see interest rates holding near current levels into 2023, and then declining over the year ahead. We expect central bank tightening to run its course over the next 6 months. Markets will position for the next move, of course, being rate cuts. The persistence of inflation, and the need for central banks to see a sharp deceleration in price pressure, is likely to mean cash rates may hold for a while. We suspect the tide is already turning, and central banks will be in a position to ease monetary policy by the end of 2023. We see wholesale rates declining over the year ahead. The 2-year swap rate is likely to start 2023 over 5%, but end the year around 4.4-4.5% (that’s a full 100bps off the recent highs). Interest rate curves are likely to remain deeply inverted, with long-end rates factoring in much lower growth and inflation rates. We are then likely to see a sharp bull-steepening in interest rate curves as rate cuts are ultimately delivered. We see the Kiwi 2s10s swap curve holding around -75bps (and possibly inverting further), before steepening up towards -30ps (as short-dated yields fall faster than longer-dated) as rate cuts are priced and delivered.

We have two alternative scenarios worth running through.

On the upside, inflation remains persistent and central banks tighten further than expected. We give a relatively lowprobability to the upside scenario of 20%. Interest rates rise further, and hold at higher levels for longer. The Kiwi currency appreciates under this scenario as the RBNZ is likely to deliver more than most. We would expect the cash rate to push to 5.75%, possibly higher. Under the upside scenario, we don’t believe central banks will stand by and let inflation run out of control for even longer. Even higher interest rates would be required, and ultimately bring about a reduction in demand. Interest rates would rise and flatten even further. The Kiwi currency would likely hit 69-70USc.

On the downside, weaker global growth and inflation come through quicker than anticipated. And central banks move to cut rates earlier than forecast. We assign a much higher probability of 40% to the downside risks. In the downside scenario, interest rates have well-and-truly already peaked, and we see a swift downshift over 2023. The cash rate is likely to peak at 4.75% - with a hike in February still likely. And then rate cuts come thick and fast from the middle of 2023. The Kiwi currency gets hammered in the worsening global recession. We would expect to see the Kiwi drop below 50USc to 47USc.

Given the balance of risks, with downside risks significantly outweighing upside risks, positioning for lower interest rates and a lower currency makes sense to us.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.