Rise in spend

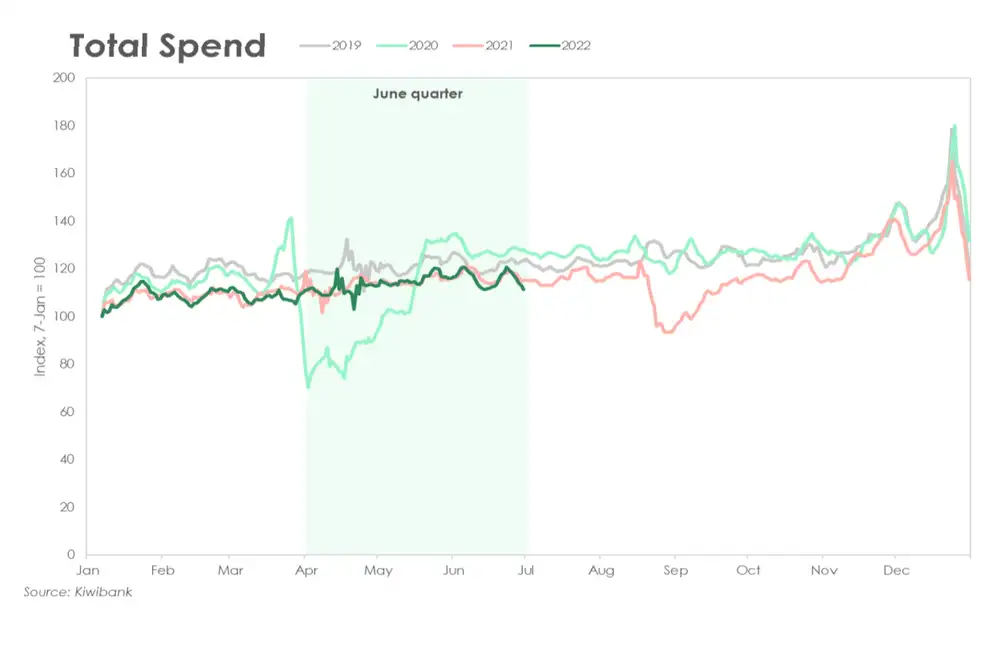

Kiwibank electronic card spend rebounded in the June quarter, rising 7.1%. The rise in spend was supported by the move into the Orange Covid traffic light setting, just in time for the Easter holidays. Hospitality spend was especially strong as vaxxed Kiwi were out and about.

Volume of transactions

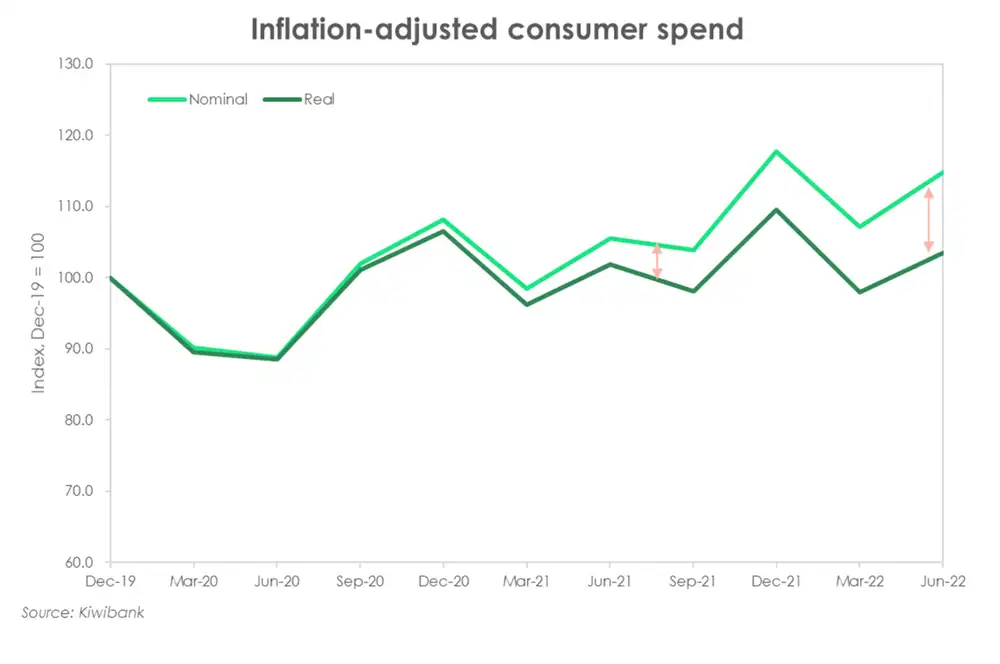

We suspect inflation was running at around 1.4% in the June quarter. The rise in consumer prices is boosting the value of transactions. The number of times Kiwi tap, swipe and insert their cards, however, is slowing. Kiwibank credit card data shows that the growth in dollars spent is outpacing the growth in the volume of transactions made.

Petrol prices remain elevated

But the subtle upward trend in petrol spend suggests that Kiwi are making fewer trips to the petrol station. Instead, Kiwi are opting for the cheaper public transport alternative. Despite ‘half-price fares’, public transport spend is steeply rising.

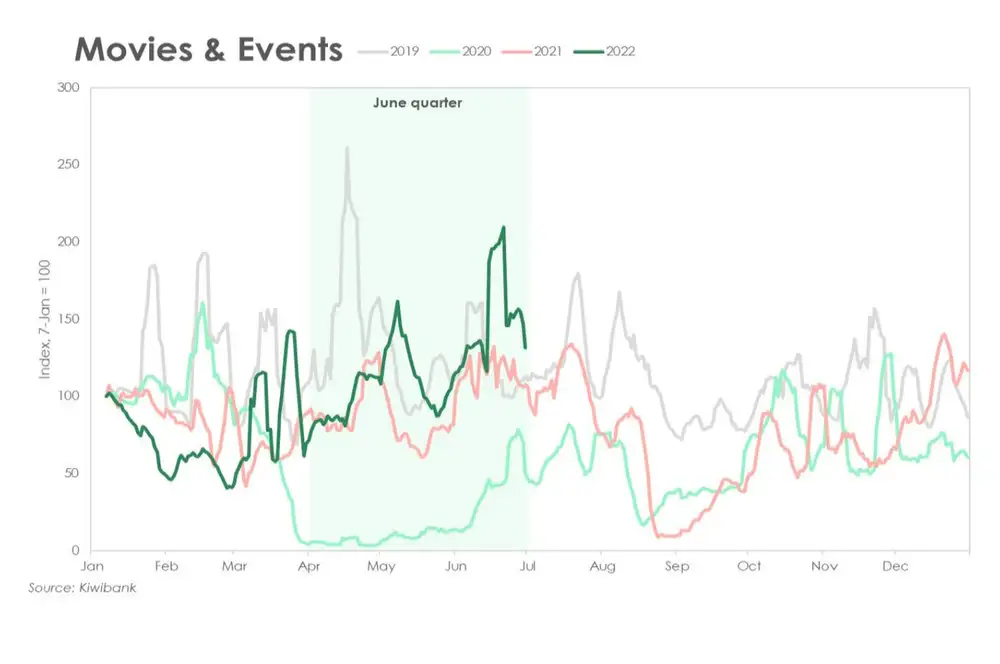

We’re back to handshakes and headbanging

Entertainment spend rose 61% over the June quarter. Despite covid still in the community, we’re learning to live with the virus. Concerts and (in-person) conferences are back on. We’re re-connecting IRL, and it’s good to see more international gigs coming back to NZ. And the return of Maverick (Top Gun) to the big screen is bringing cinemas back to life.

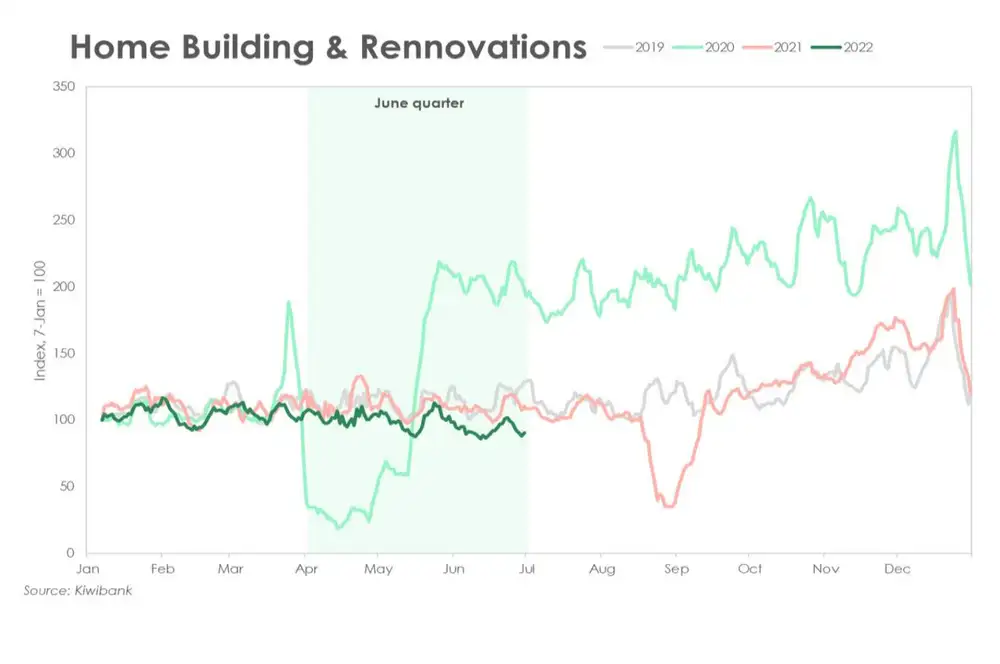

Kiwi are spending less on the home

Housing-related spend is down 1.5% over the quarter. Consumer confidence has hit record lows, credit is harder to get, and the housing market is in a sustained funk. Households are just not in the mood to splash out on big-ticket items.

Household spending

Household consumption has been a key source of economic momentum since the recovery took shape. But rising prices, rising interest rates and a housing market in retreat eat into household discretionary spending.

Artificially high

Kiwibank electronic card spend rose 7.1% in the June quarter, following the -9% decline over the Omicron-riddled March quarter. The rebound in spend was supported by the move into the Orange covid traffic light system. The step down to Orange came just in time for the cluster of public holidays between April and June. Hospitality spend was especially strong (next slide).

The rise in consumer prices however is also working behind the scenes, propping up the value of transactions. Adjusting for inflation, consumer spend rose by a lesser degree, up 5.7%. The widening gap between nominal and real spend underscores the rapid rise in consumer prices.

The slower rise in real spend may also suggest that Kiwi are tightening their purse strings. Indeed, the growth in dollars spent is outpacing the growth in the volume of transactions. Compared to a year ago, the value of Kiwibank credit card transactions is up by 6.1%. The number of transactions however is down 5.2%. Kiwi are tapping, swiping and inserting their cards fewer times.

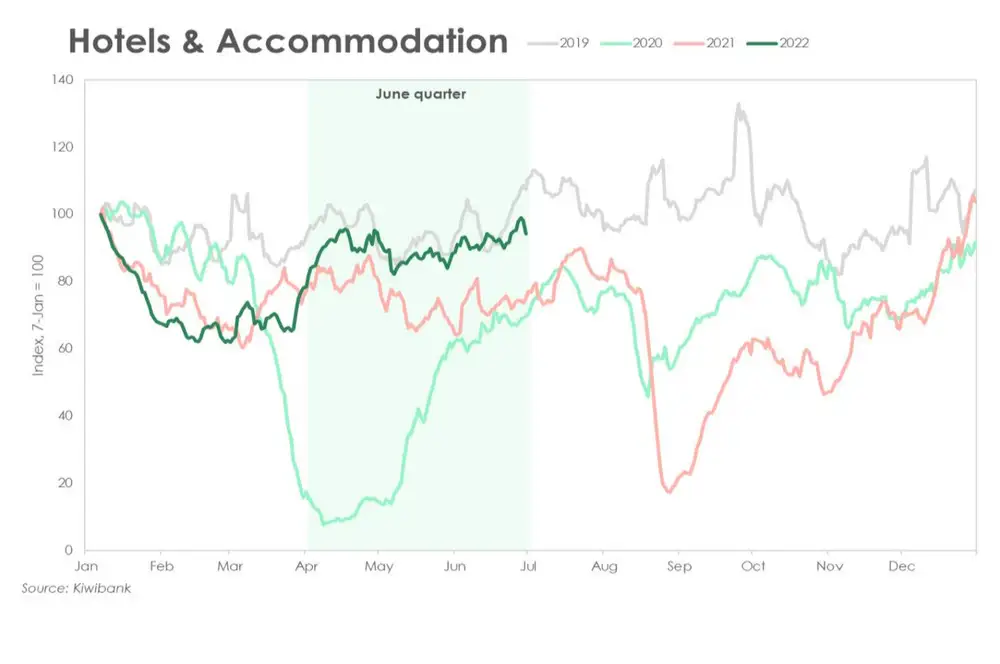

The movies need Maverick

The Omicron outbreak had a disproportionate impact on hospitality spend. But as cases peaked and restrictions were relaxed, spend lifted 19% over the June quarter. The move to Orange came just in time for the cluster of holidays between April and June. Between Easter and our inaugural Matariki public holiday, there were plenty of reasons for (vaxxed) Kiwi to be out and about. Restaurant spend rose 16%, and hotel & accommodation spend rose 24% with Kiwi packing for a night (or two) away.

Entertainment spend was given a kick higher over the June quarter. Despite covid still in the community, we’re learning to live with the virus. Concerts and (in-person) conferences are back on. It’s good to see clients in the flesh and more international acts coming back to NZ. We’re back to handshakes and headbanging. And the return of Maverick to the big screen is bringing cinemas back to life. Spend at the movies and ticketing agencies rose 24.5% in the month of June alone.

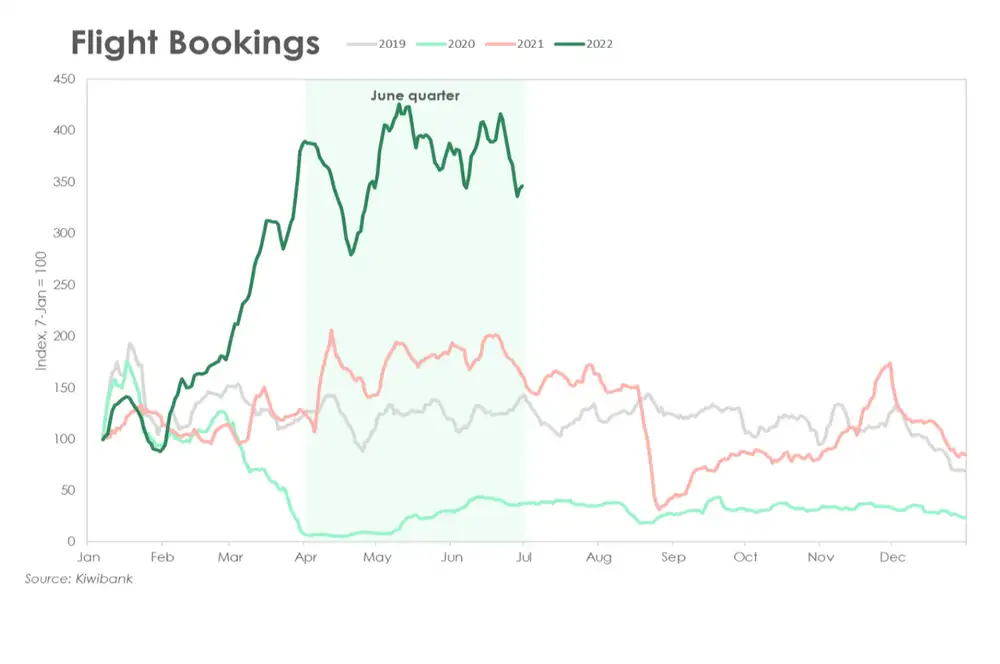

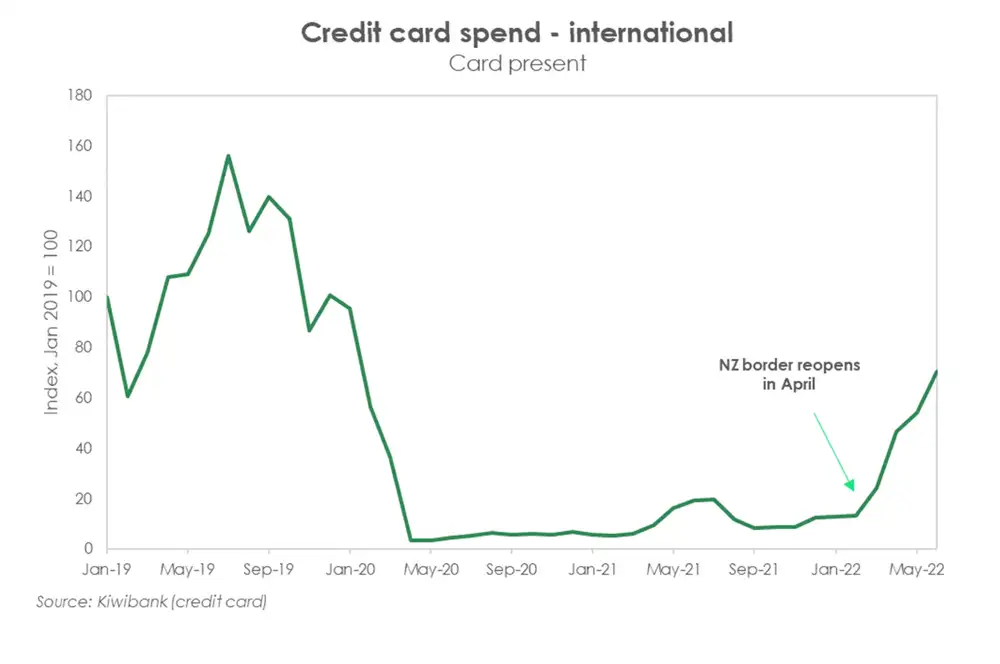

Kiwi embrace travelling once again

From updating the carpet during covid, to carpe diem after lockdown. Kiwi are seizing the day and travelling again. Flight booking spend continued to rise over the June quarter. Compared to a year ago, spend is up 107.4%.

A decent chunk appears to be on international travel too. Card present spend offshore is well on its way back to pre-covid levels.

However, some of the international bookings will be one-way. We continue to expect a growing net migration outflow heading into the end of the year.

The emergence of a second strain of omicron poses a risk to domestic travel spending.

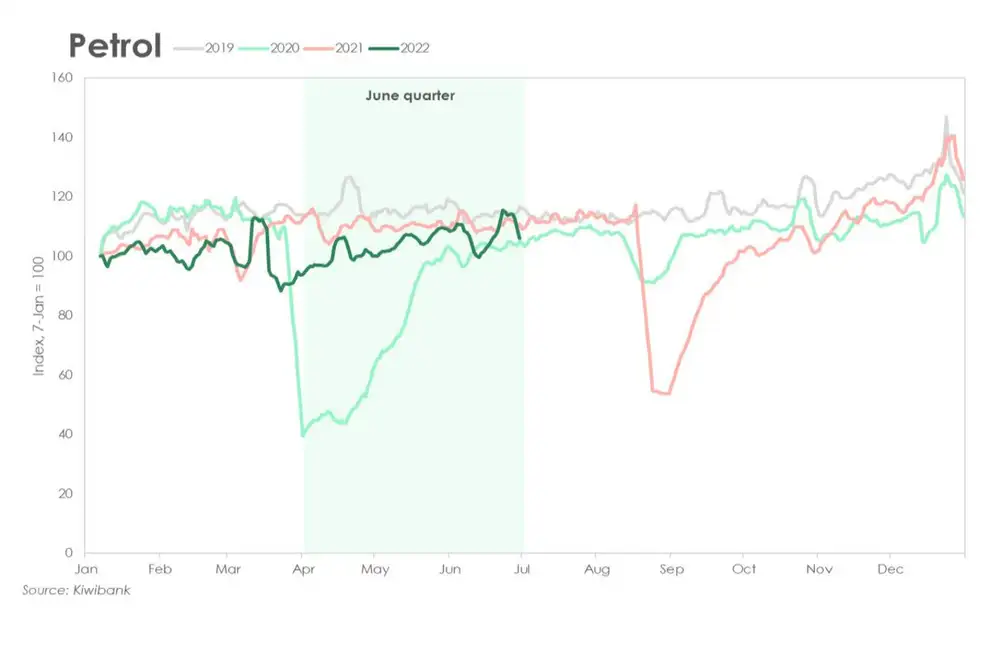

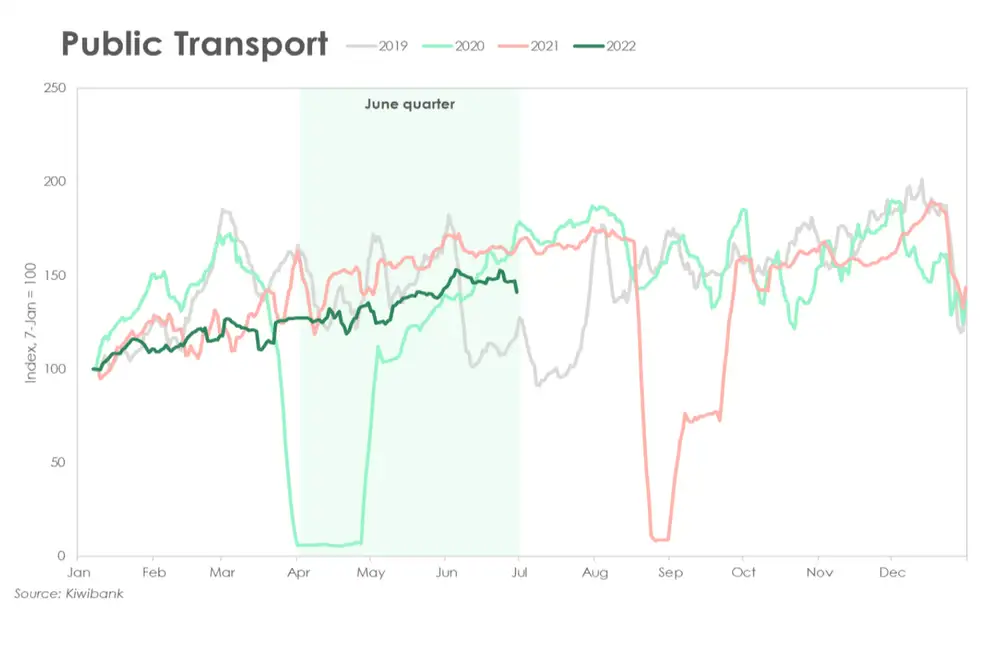

Substitution play

Petrol prices across Aotearoa remain at elevated levels. But the subtle upward trend in petrol spend suggests that Kiwi are fuelling up less. Kiwibank credit card data supports our supposition. Compared to the previous quarter, the number of visits to the petrol station is down 7.5%

Instead, Kiwi are opting to catch the bus, train or ferry as a way to get around. Public transport spend is steeply rising. And that’s despite the government’s half price discount on public transport fares.

Spend on petrol rose 5.6% (credit and debit) in the June quarter. Public transport, however, jumped 20.5%. Clearly, there’s a substitution trade in play. Given the sky-high petrol prices, many Kiwi look to be taking advantage of the cheaper alternative – textbook economic behaviour.

Spending less on the house

Consumer confidence has hit record lows, credit is harder to get, and the housing market is in a sustained funk. Households are just not in the mood to splash out on big-ticket items.

Also, with the border open and covid restrictions eased, consumers are now redirecting spending outward and on services.

Kiwibank’s own spending data revealed a 1.5% fall in housing-related spending in the June quarter.

In particular, spending on hardware was 5% down in the quarter. Supply shortages of key building supplies are also likely to be playing a role here.

At present, inflation is particularly strong on anything building related. Therefore, the volume of spending on hardware must have taken an even larger tumble in the June quarter.

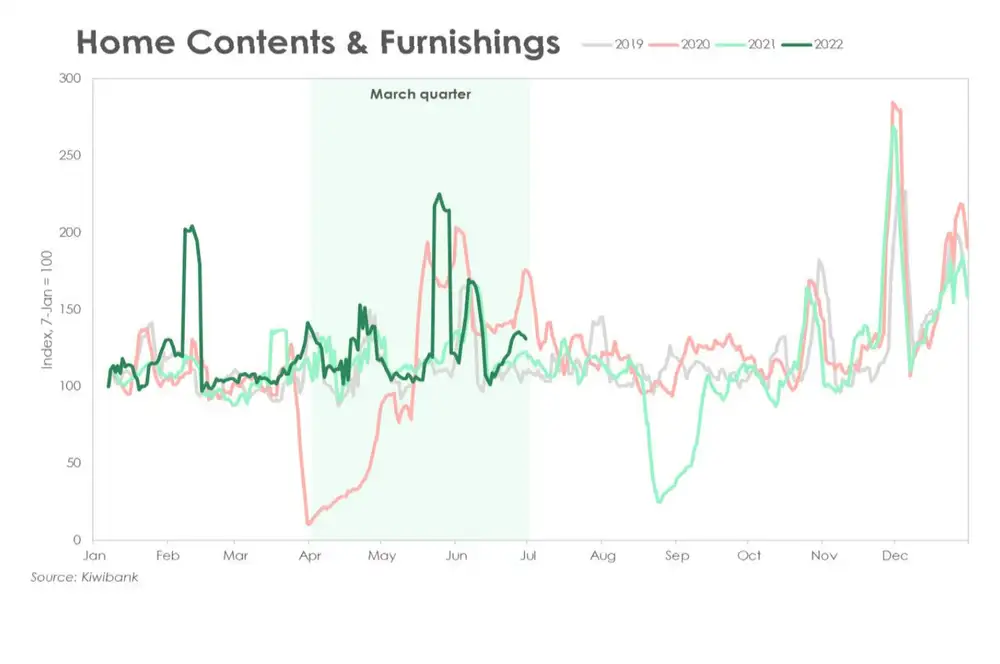

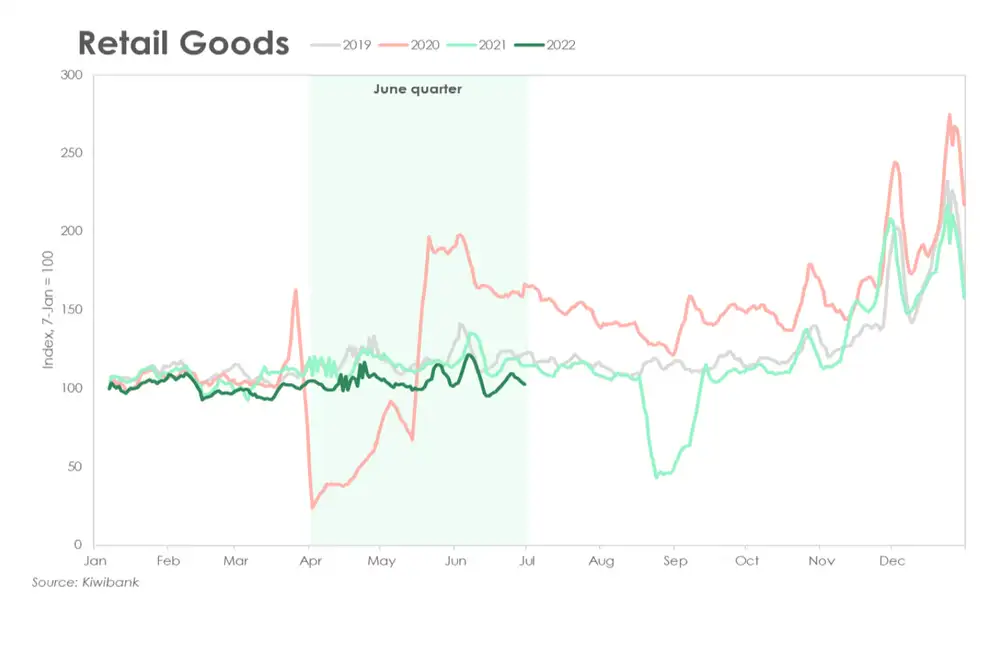

Winter is coming

Spend on retail goods rose 5.9% in the quarter. There was a pop higher in spend at department stores and on clothing and footwear in midJune. As we enter the winter season, Kiwi are gearing up for the colder weather.

Retail spend is holding up for now. But consumer confidence is weakening. Rising mortgage rates and rising living costs are claiming bigger and bigger chunks of household budgets. There’s less appetite to spend up large.

With household demand cooling, retailers may be in for some tough times ahead. Especially for those within the non-essential retail space.

Mourning morning coffees

Household consumption has been a key source of economic momentum since the recovery took shape. But rising prices, rising interest rates and a housing market in retreat are all stretching households budgets thin. A tight labour market is protecting household incomes, but a pullback in discretionary spend would be unsurprising.

-

1Tahi

Rising living costs

Inflation is likely to have lifted further in the June quarter, peaking at an annual rate of 7%. Consumer prices have risen rapidly. And the price gains have been across the board, from food to fuel, and health to housing. Rising consumer prices eats into disposable income, making budgeting that much more difficulty. With prices expected to continue rising in the near term, households will be forced to tighten their belts and shorten their shopping lists.

-

2Rua

Rising rates

In the face of rising inflation, the RBNZ has been aggressively tightening monetary policy. The cash rate has been lifted by 175bp in the span of just eight months, going from 0.25% to 2%. We see the RBNZ hiking another four times this year to a peak cash rate of 3.50%. All mortgage rates have further to rise. Most rates will be 2, 2.5%pts higher than the lows seen early in the covid crisis. A strong labour market however ensures that households are still capable of making good on their mortgage and rent payments. But there’s little doubt that a more expensive bill is also squeezing discretionary spending.

-

3Toru

Falling house prices

Following unsustainably high house price growth last year, the housing market is now in full retreat. With all that’s been thrown at the market, house prices are now down 6% from the November peak. And we expect a cumulative 10% decline by the end of the year. Housing, however, is the single largest form of wealth among Kiwi. But a cooling market, as is the case today, adds another dampener to consumer spending. Falling house prices and tighter lending rules are not supportive of borrowing and spending

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.