- From thoughts of rate hikes to delivered rate cuts, it’s been a topsy turvy year. But we’re putting 2024 behind us and looking to 2025. It should be a better year. Especially the second half of the year.

- The RBNZ’s laser focus on inflation should broaden out, with the inflation beast tamed at 2%. And with more interest rate cuts on the way, we see the economy recovering from recession in 2025. Along with gains in the housing market.

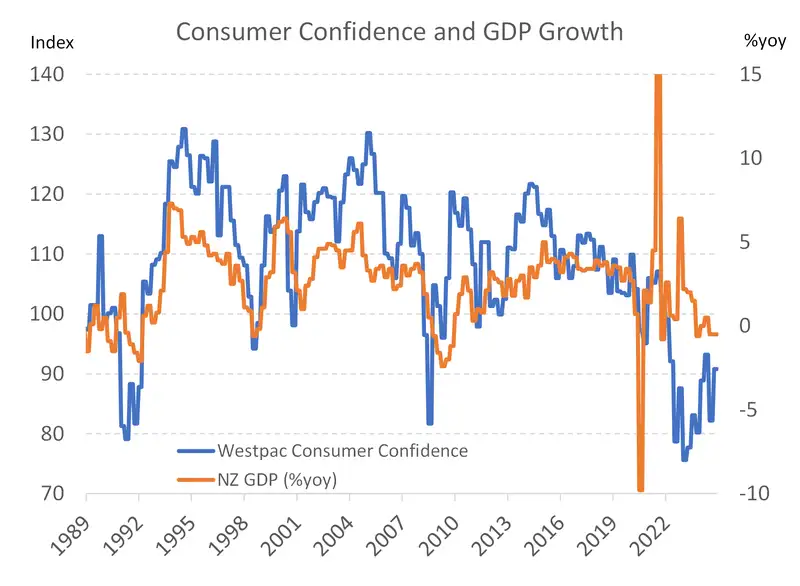

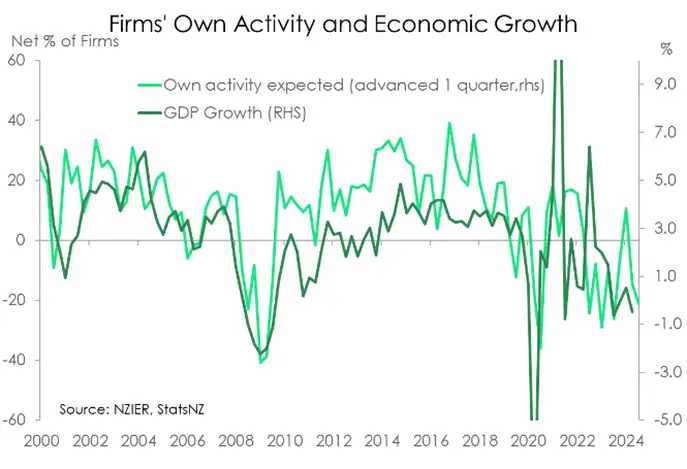

- It’s a confidence game. It’s all about confidence. And we expect the lift in confidence to persist, and eventually feed into activity, profitability, hiring and investment. We’re more confident in the recovery.

We are privileged to meet many of Kiwibank’s business banking clients. And the anecdotes and insights we gain are invaluable. Early in the (2024) year, one client summed up the feeling among businesses perfectly: “We must survive until 25”. And although we delivered an optimistic outlook, stating that interest rates would fall and we will recover in 2025, there was resistance. We often heard, “thanks for the optimistic view, miles out, but here's what we’re facing now…” and we’d hear a list of problems from rising costs, deteriorating profitability (too many firms were losing money), to evaporating order books. We were in a long and painful recession. We still are, technically. But we’re putting a stake in the ground, now, arguing the 2-year recession is over. It won’t be a V-shaped recovery, but it will be a recovery. Business owners have lifted their heads. Because talk of rate cuts became reality. They’re tangible.

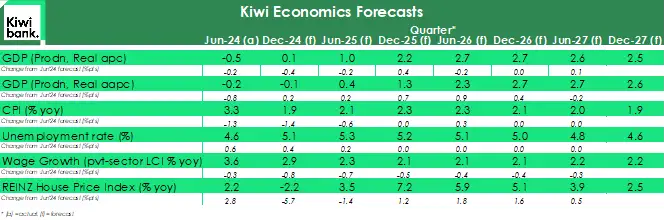

So pick a path. Many businesses, still struggling, will consider themselves lucky (although luck has little to do with it) to be ‘alive in 25’. But there is a growing chorus of business owners looking to ‘thrive in 25’. Costs are becoming more manageable for many (not all), profitability is improving as a result, and expectations of growth are lifting. If we were to describe the economy in one year’s time we’d (like to) say: the economy has grown about 2%, inflation is a touch below 2%, house prices are up 6%, the unemployment rate has fallen from its 5.3% peak, and investment is picking up into 2026. So yeah, we’re recovering, and 2026 will be a better year. Just as 2025 was a better year than 2024.

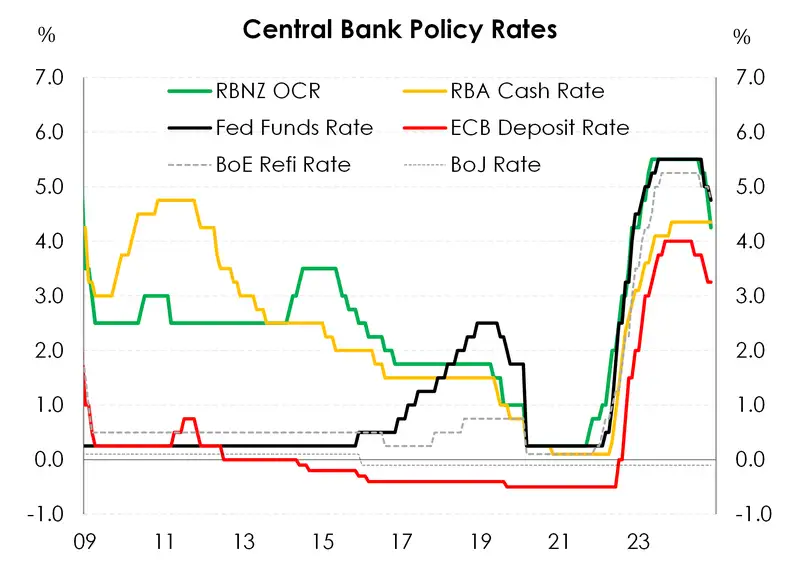

It's the cutting of the cash rate that’s critical to the cultivated climb out of recession.

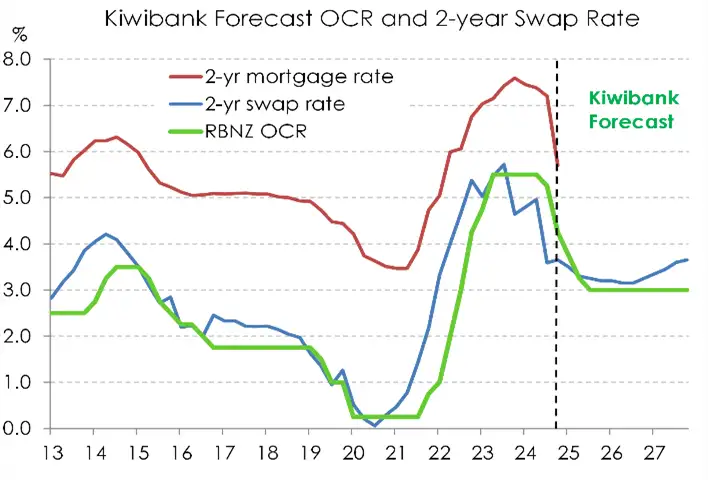

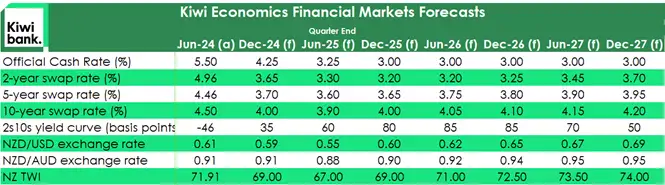

There’s some beautiful symmetry to our rates outlook. We’ve seen 125bps of easing thus far, and we forecast another 125bps to come. A cash rate of 3% is our forecast terminal rate, where policy settings are neither stimulating nor restraining growth. The continued cutting cycle is justified by a stabilisation in inflation around 2%. Although we see greater risks to the downside, that necessitates further policy easing. Indeed, we forecast a decline in home grown inflation. Wage growth too is moving south as the labour market loosens.

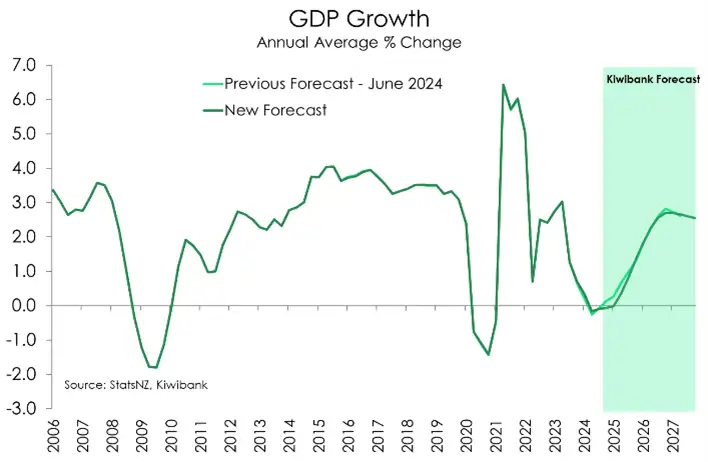

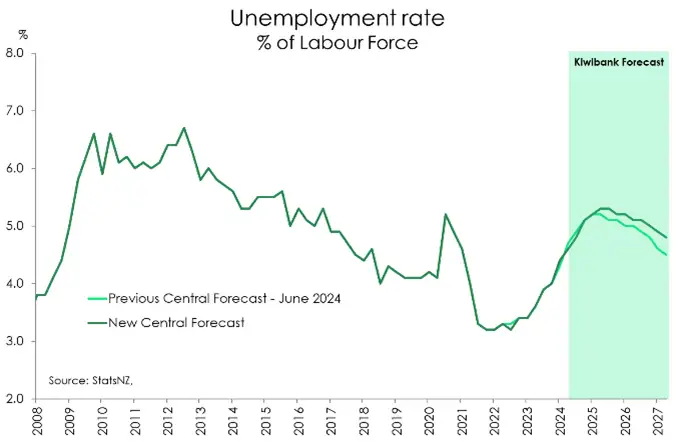

As interest rates fall, growth will gain momentum. Business and consumer confidence are improving with the rate cuts delivered and expected. Activity should lift from here. We forecast the economy growing 2.2% by the end of 2025, up from flat growth in 2024. In 2026 and beyond, the economy returns to more normal levels of growth of about 2.6% per annum. The labour market, however, is expected to deteriorate further. Labour demand lags the broader economic cycle. The unemployment rate is expected to continue climbing to a peak of 5.3% in the middle of 2025. From there, it is a slow descent as the economy recovers.

2025 will be a year of two halves. The first half will be a bumpy ride with glimpses of growth. And the second half will see an uplift in activity that will spring to life into 2026.

For more on our outlook, loaded with pretty charts, see below.

It's all about confidence, and we’re confident

Confidence has been hit, hard, during the recession.

Household confidence has been in the doldrums for a long time and was hit by four foul frustrating forces.

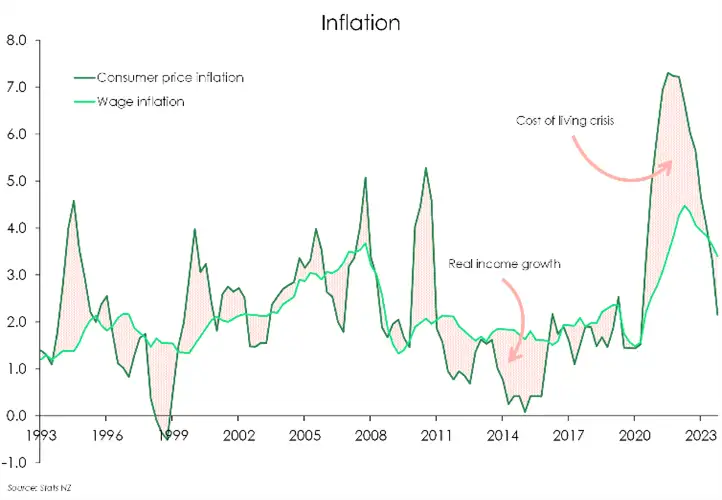

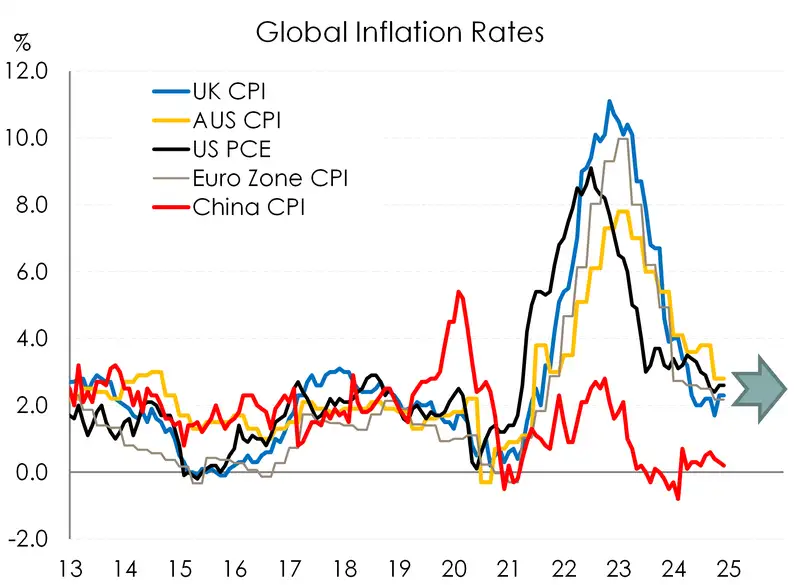

Firstly, confidence was hit by the cost-of-living crisis. Inflation rates rose well above wage rates, squeezing household budgets. But that’s ending. Now that inflation has dropped to 2.2%, and will ease further, households are a few pay rises away from some “real” income growth. It will take time to be felt. But it’s a nice tailwind.

Secondly, confidence was hit by higher interest rates. The RBNZ’s heavy handed hikes were designed to hinder household demand (spending) and pull down inflation. Well now we’re getting some quick cuts to soften the blow.

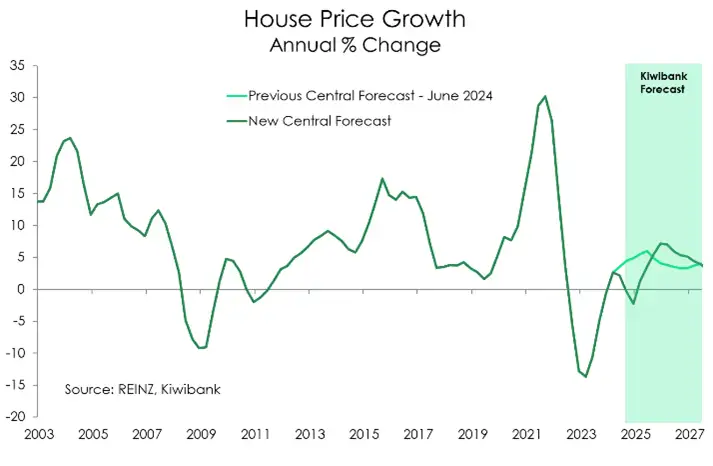

Thirdly, house prices fell 18% from the peak in 2021 to the trough in 2023. And for homeowners and investors, the wealth effect hurt. If we’re right, things will turn around.

And finally, confidence has been hit more recently by fears of job losses. Most pronounced in the capital, with public sectors cutbacks, consumers are more worried about their own jobs. The unemployment rate is forecast to lift to 5.3%, from 4.8% now, and a bottom of 3.2%. But if we’re right on the outlook, the unemployment rate should start to fall in the second half of next year… slowly returning into the 4s as we progress in 2026.

A year of two halves

It’s not just households feeling good about next year. Businesses are too. Business confidence, according to NZIER, has markedly improved. In the September quarter, only a net 5% of firms expected a deterioration in general economic conditions over the coming months. Confidence spiked 35pts following the RBNZ’s first cut in August. And since then, we’ve had another 100bps of cuts. Activity has yet to turn, however, with high-frequency data mixed at best. The fall in retail trade looks to have found a bottom, but the downturn in construction is deepening. Business investment and hiring intentions remains subdued, understandably. The macroenvironment is weak. There’s no appetite to expand – yet. A net 21% of firms still expect a decline in activity near-term. Below-trend growth lies ahead – in the first half of 2025.

But 2025 will be a year of two halves. The second half should see economic growth build momentum. The RBNZ has delivered more easing than previously expected. And we expect a faster turnaround. We forecast the economy to grow by 2.2% in 2025 – up from virtually flat growth in 2024, and stronger than our previous estimate of 1.8%. In 2026 and beyond, the economy should return to more normal levels of growth of about 2.6% per annum.

Hiring grinding to a halt

While the economic recovery should soon take place, we expect further weakness to the labour market. Because the labour market often lags the broader economic cycle by about 9 months. The past two years of recession are now weighing on the jobs market. We still have a bit more pain to see in the jobs market. Because excess capacity is still building.

Previously, a migration-driven boost to labour supply helped take the heat out of the labour market. At the same time, employment growth was cooling, but still positive. Now, labour demand is adjusting to the recent weakness in the economy. Hiring has come to a halt in many industries, as firms downsize. Our forecasts for the labour market are little changed. And we continue to forecast a recovery into 2026.

Inflation beast slayed and back in its cave

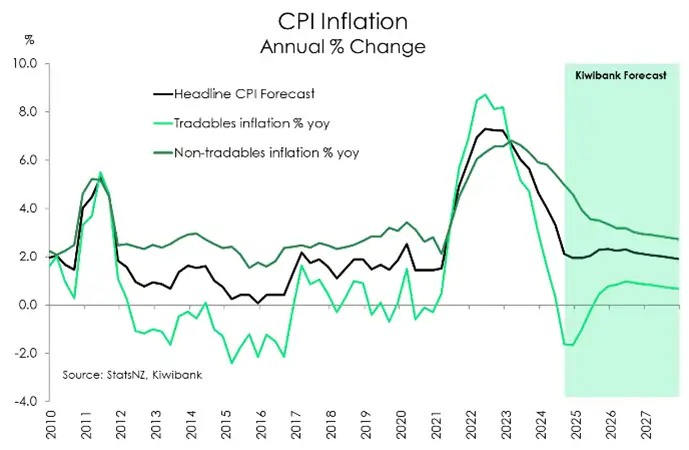

As forecast, inflation returned to the RBNZ’s 1-3% target band in the September quarter of this year. It was a long time coming – three years above 3% to be exact, with a 7.3% peak. But now at 2.2%, inflation is close to the RBNZ’s target midpoint. Through a lot of pain, aggressive rate hikes have slain the inflation beast.

The fall from the 7.3% peak is largely due to a rapid cooling in imported prices. In fact, we are now importing deflation, with imported prices down -1.6%. The inflation we have left, is home grown. And for inflation to remain at 2%, domestic prices need to ease further. Unlike the steep drop in tradable inflation from the 8.7% peak, non-tradable inflation has fallen just 1.9%pts from its 6.8% peak.

The good news is that domestic inflation, while slow, is moving in the right direction. Many hot spots have begun to ease. Rental inflation has fallen to 4.5% from 4.8%, with rents on new tenancies signalling a further cooling. Strength in council rates and insurance costs should cool in time.

Services inflation more broadly shows encouraging downward momentum as the labour market weakens. Because services inflation is closely aligned with wage growth, which is cooling. We’ve seen wage growth come down from the 4.5% peak last year. And we expect the downtrend to continue to around 2.2%, holding slightly above consumer price inflation.

Overall, there is more disinflationary pressure in the pipeline as the economy operates below its productive capacity. We forecast inflation hovering around the RBNZ’s 2% target midpoint over the forecast horizon, with downside risk.

Hopeful for housing

The expected recovery in the housing market should also boost confidence. It’s been a long time coming. In fact, not a lot has changed in housing since our last update. Here’s what we said last time:

“The Kiwi housing market stabilised early in 2023, helped by booming migration. However, the market has struggled to gain direction since. It has been a sluggish start to 2024. Monthly house price movements have been modest in both directions. Sales are holding up above last year’s levels, but remain well below the long-term averages. It’s taking time, but confidence will return.”

That still holds true today. 2024 has been a sluggish year for the housing market. House prices have virtually traded sideways in the past 18 months. Nonetheless, we maintain our long-held forecast of ~6% house price growth next year.

Falling interest rates is one tailwind for the housing market. The return of the investor is another. First-home buyers remain active participants in the market. Atypically, more bank lending is going to first home buyers than investors. However, we are seeing and hearing of a lift in investor activity, off a very low base. We expect this segment of the market to be more involved next year. Beyond lower interest rates, changes to investor policy – including the reintroduction of interest deductibility, reduction of the Brightline test holding period, and an easing in LVR restrictions – lowers the hurdle for investors. An improvement in rental yields should also entice investors back. While rental inflation has started to ease, rental yields have lifted and remain at around 3.9%. As term deposit rates decline, rental yields will become more attractive to investors.

Before any panic sets in about the return of investors, we must note that investors get an unreasonable amount of blame for New Zealand’s housing affordability. In reality, Kiwi housing affordability stems from one issue alone - a lack of supply. And we need the return of investors and developers if we’re going to tackle the issue at its heart.

Perfect symmetry. 125bps gone, 125bps to come

There’s some beautiful symmetry to our rates outlook. We’ve seen 125bps of easing thus far, and we forecast another 125bps to come.

That’s not fully priced in wholesale markets, and we expect a speedier delivery than that forecast by the RBNZ. We forecast another 50bp cut in February, from 4.25% to 3.75%, followed by a 25bp cut in April. The RBNZ may pause in May at 3.5%, but we expect another two 25bp cuts to 3% in 2025. The RBNZ forecast a perplexing pause at 3.5% well into 2026, and only get the cash rate down to 3% by the end of 2027. Why wait? They shouldn’t. For more on our interest rate forecasts, please see: “'Alive: in 25' or 'thrive in 25'? Here’s our interest rate forecasts.”

The case for more cuts: An upside scenario

2% inflation is within point blank range. In fact, risks are now tilted toward inflation undershooting the RBNZ’s target midpoint. A rate below 1.5% is still within the RBNZ’s 1-3% target band, but the alarm bells at the monetary headquarters will start to ring. Deflation is a different beast altogether, and one even harder to correct. The RBNZ’s reaction function to rising inflation is clearly understood – simply hike rates, theoretically to no end. But as we learnt during the GFC and covid, generating inflation may require a more creative approach, using other tools in the toolbox.

It’s not hard to imagine a world where imported prices continue to decline while domestic inflation normalises at a faster pace. We may be underestimating the impact of growing labour market slack. In such a scenario, headline inflation will likely fall to the lower end of the target band. The RBNZ will have to respond with further and deeper rate cuts. More stimulatory policy settings will be needed, with the cash rate falling below 3%. Lower interest rates should fuel the housing market, leading to a faster appreciation in house prices. Growing equity should bolster consumer confidence and in turn household consumption. Ultimately, more easing from the RBNZ should result in stronger economic growth (circa 3%) over the medium-term.

The influential global outlook is positive, albeit political

As always, the global outlook will play a big role in shaping Aotearoa’s course. Pushing politics and tensions aside, the global outlook is positive. Inflation for most major countries has converged closer to central bank targets.

As central banks have won the world war on inflation, most have pivoted policy. The RBNZ is not alone. Other heavy-hitters, including the US Federal Reserve, European Central Bank, Bank of England and Bank of Canada, have also commenced cutting rates this year. Global interest rates are falling and should fuel the global recovery next year. And as a small open economy, that’s important. Stronger trading partner growth will support the Kiwi recovery.

Based on the IMF’s forecasts, global growth is expected to remain below trend at 3.2% for both 2024 and 2025. It’s little changed from previous forecasts. But we think there is some upside risk. The IMF had downgraded US growth projections in 2025 off the back of a cooling labour market and tighter fiscal policy. However, these forecasts were finalised in October, prior to the US election outcome. We know that former President Donald Trump will return to the White House. But we don’t know the impacts of a Trump 2.0 presidency. At the outset, his proposed policies have been deemed as pro-growth and pro US business. So, we may see some upside in growth out of the US. And a stronger US economy would mean a stronger global economy.

Where things get complicated and confusing is when we try to map out the implications for the broader economy. Because there are threats of trade tariffs to consider. Financial markets are taking the bet that tariffs will be inflationary, especially if imposed at levels around ~20%, as has been floated. Another school of thought is the opposite – that is, tariffs may in fact be deflationary. Tariffs raise the barrier for goods to enter a country. Under the Trump regime, piles of (Chinese) exports destined for the US may need to be diverted elsewhere. For example, we may see more Chinese EVs rolling down Kiwi streets, at a discount.

Another key risk is the ongoing woes of the Chinese economy – our largest trading partner. Growth in China remains weak, falling short of their ambitious goal of 5%. The crisis in the property market continues, weakening consumer confidence and weighing on demand. Fiscal measures have been taken, but a material impact is yet to be seen. IMF’s forecasts of the Chinese economy were marginally improved for 2024 and 2025 off the back of stronger export growth. However, the developing tariff situation adds downside risk to these projections.

Tariffs and conflicts: A downside scenario

A downside scenario is one of stagflation – high inflation and low growth. Rising geopolitical tensions are a significant risk to the outlook, with implications for the macroenvironment. Our downside scenario assumes a global shock that leads to a reacceleration in international inflation. This may be characterised by tariffs imposed by the US as proposed by US President-elect Donald Trump, an escalation in the Middle East conflict or other black swan event. Against this background, import prices will likely spike and, by consequence, our terms of trade will deteriorate. The exchange rate will also weaken as a result. A reacceleration in imported inflation will likely see headline inflation breaking back out of the RBNZ’s 1-3% target band. High inflation will necessitate restrictive monetary policy for longer. The RBNZ will have to keep the cash rate above neutral. Economic growth will likely deteriorate, falling back into recession, and lead to a deeper deterioration in the labour market. High interest rates and rising unemployment will weigh on the housing market.

The Kiwi can fall further

The Kiwi currency has a big influence on our small, open economy. And we expect to see some relief for exporters.

Interest rate differentials can tell you everything you need to know. The attractiveness of the Kiwi has collapsed, with the RBNZ cutting well below the US Fed’s funds rate and the RBA’s cash rate. Interest rate differentials are working against the Kiwi, and will continue to do so well into 2025.

If we put our previous forecasts under the microscope, the RBNZ has cut in line with our thinking … and we’ve been the most vocal in support of aggressive easing to reflate us out of recession. On the other side, the Fed has cut by less than we expected, and the RBA hasn’t even started yet. Both the Fed and RBA have surprised us on the slower to move, die from boredom, side of the ledger.

The RBNZ will cut another 50bp cut in February, and another 25bp in either April or May. That’s fine. That’s priced. But it’s the inevitable move to 3% that’s not priced. And if we’re right, we’ll see the Kiwi currency crumble towards 55 cents. And it may be a year of two halves, with the Kiwi climbing in the second half. Stronger global growth means a stronger Kiwi. But for now, the focus is on the likely fall in the Kiwi near term. The weaker Kiwi is a double-edged sword. It is good for exporters, as their goods and services are cheaper to foreigners. And New Zealand effectively goes on sale for foreign tourists. That’s a net benefit for the economy. The partial offset is the added expense for importers. The decline in imported inflation has been helpful, but a falling Kiwi currency will add to importer invoices. Overall, we see the decline in the Kiwi as helping in the recovery.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.