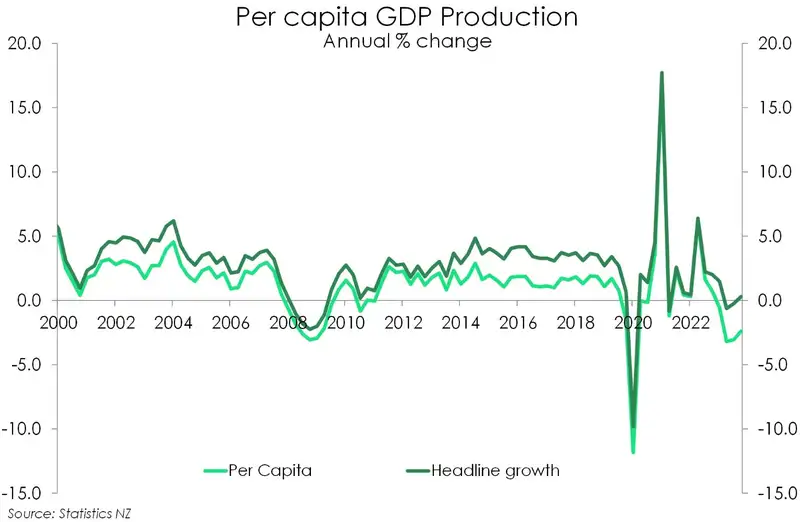

- Strong population growth is supporting aggregate output. But on a per person basis, economic output declined for the sixth straight quarter. Compared to a year ago, per capita GDP is down 2.4%.

- Forward-looking indicators suggest that the June quarter will be a soft one for economic activity. Beyond, we expect that the Kiwi economy will struggle to eke out further growth this year. Policy settings are restrictive. High interest rates hurt.

The Kiwi economy expanded 0.2% over the March quarter. It follows the technical recession over the second half of 2024. We may officially be out of recession, but the economy remains in a soft state.

Yes, the headline number is a better result than we had expected (-0.1%). And comes exactly in line (not above) the RBNZ’s forecast. But the economy remains very weak. Only half (8) of the 16 industries recorded gains. Construction, manufacturing and business services recorded chunky declines, as expected. That’s not good at all. The shift in consumer spending was also on display. We saw a decline in big ticket imports and a rise in low value imports. Households are clearly hurting and being forced to substitute away from large purchases and luxury goods, in order to meet the growing cost of essentials. Households are cutting back, and so are businesses. Weak investment intentions are being felt with a 1.3% pull back on investment across the economy. While business investment alone contracted 0.5% over the March quarter.

The heavy hand of the RBNZ is still hurting households and businesses. Restrictive monetary policy clearly continues to work. Squeezing out demand, effectively lowering inflation, but strangling growth at the same time. And the evidence of that was evident in today’s report.

On a per capita (per head basis) the economy declined 0.3% over the March quarter alone. That’s the 6th quarter in a row of consecutive declines. And compared to this time last year output on a per person basis is down 2.4%. So we’re still hanging around GFC levels when it comes to per person output.

Today’s confirmation of a weak economy proves that restrictive monetary policy is working. We are confident that the next move for rates is down. Picking the exact timing of those cuts is a little more difficult. And hinges on inflation playing ball. But by our forecasts, inflation is still set to fall back within the RBNZ 1-3% target band by the September (third) quarter. We’ll see that data in mid-October, and hopefully receive confirmation of inflation back within the RBNZ’s band then. And from there rate cuts could come as early as November.

A post-mortem of the Kiwi economy

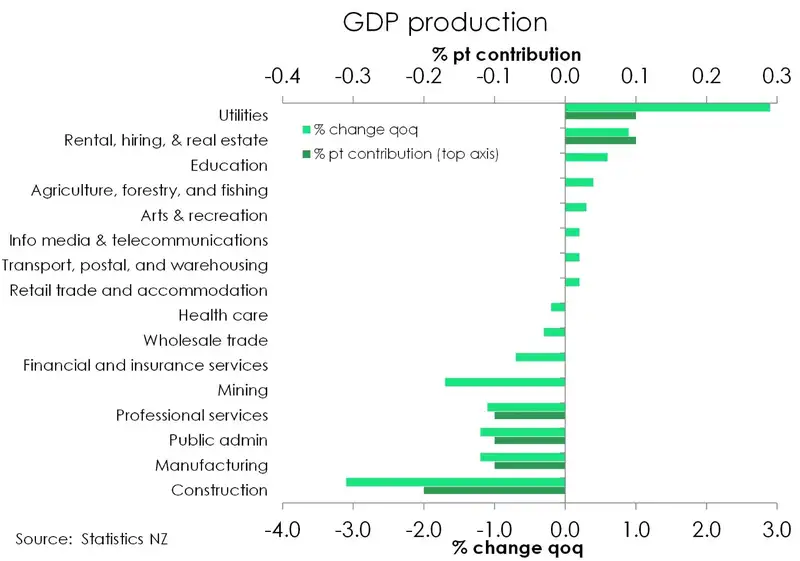

Today’s report showed many areas of weakness across the Kiwi economy with half of the measured industries posting declines. However, the biggest drag on the economy continues to come from the goods producing industries. All up the industry contracted a solid 1.3% over the quarter and took away nearly a quarter of a percentage point to the economy’s total growth. And it would have been worse had the electricity, gas, water and waste services did not lift a sizeable 2.9% thanks to strength in electricity generation over the quarter. That however, has little to do with demand or the strength of the economy. Construction on the other hand does.

Down 3.1% over the quarter, construction came out even weaker than we had expected. That’s by no means a surprise given the ongoing falls in building consents and weak data that’s come from the sector. Not to mention that today’s numbers also showed a 3.7% decline in investment for residential buildings and a 1.7% decline in non-residential building over the quarter. A soft housing market and tough financial conditions clearly continues to weigh on construction work. And going forward, we expect more of the same. Rapid population growth as well as changes in government policy, including the reintroduction of interest deductibility, may soon see an improvement across the housing market, and flow through to construction. But each day it’s looking more and more likely that we’ll need a rate cut before we see any meaningful improvements in the industry.

Following that path, manufacturing also performed worse than we had expected, with a 1.2% contraction over the quarter. And over the year manufacturing contracted 4.9% - marking the 9th consecutive annual decline for the industry. A 3.3% rise in food & beverage manufacturing - attributed to a rise in dairy exports - helped cushion the blow to manufacturing which would have otherwise been hit harder.

Similarly, a lift in dairy exports also provided some relief to the primary producing industry with the agri space lifting 0.8% over the quarter. Despite a slowing global economy, we have seen a general theme of strength and resilience across developed economies. And it seems that’s starting to come through with rising exports. All up, however the primary producing industry only managed a 0.2% over the quarter as a 1.7% quarterly fall in mining dragged down the sector.

The services were more of a mixed bag but ultimately fell, led by weakness across business services. As expected, retail trade and accommodation managed to eke out some growth this quarter (0.2%). Though breaking it down it was solely accommodation that contributed to the lift. Retail trade declined 0.1% over the quarter. Accommodation on the other hand lifted 0.8%. More clearly however retail sales continues to be weak. Under the weight of high interest rates and the high cost of living, Kiwi are tightening their belts. And it seems any spending is being done online and from offshore. Imports of low value goods was up a massive 20% alone this quarter. Perhaps the rise of Temu is upon us.

Turning to another point of strength was the 0.9% lift in the rental hiring and real estate sector. Despite high interest rates still weighing on the housing market it seems that net-migration effects are starting to play a role here. Elsewhere, business services declined 1.1% over the quarter, public admin and safety declined 1.2% and arts and rec fell 0.1%. The government spending and job cuts is likely playing a role here. But beyond that it’s all a product of weakening demand and pull backs from households and businesses.

Decline in durables continues

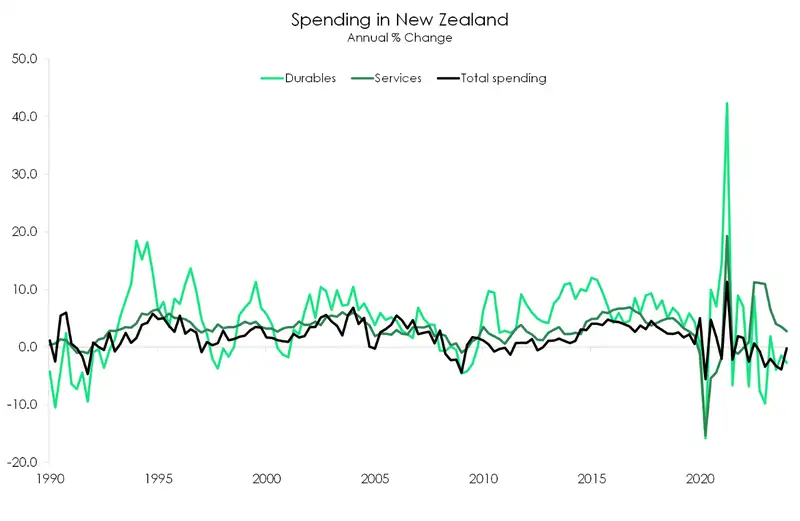

On the other side of the same coin, expenditure GDP lifted 0.1% over the quarter following a flat finish to 2023. Private household consumption increased 1.6% over the quarter – a much stronger print than the 0.4% that the RBNZ had pencilled in. However, the 1.6% lift should be read with caution. Covid has disrupted seasonal patterns of expenditure, creating challenges for StatsNZ’s modelling. Instead, a new series of household consumption was provided. Household consumption - excluding spend by Kiwi overseas and including overseas visitors - increased 0.8% over the quarter. And the rotation away from goods and towards services continues. Mimicking the decline in retail trade on the production side, consumption of durable goods declined 1.3% over the quarter. On an annual basis, durables spend declined 2.7% which marks the third-consecutive contraction. Households are reining in their big-ticket spending as tight financial conditions weigh on wallets. Consumption on services however accelerated at the start of 2024, with a 0.5% increase. However, on an annual basis, spend on services is broadly in decline. That’s goods news, and points to some moderation in services sector inflation in the coming quarters.

Compared to a year ago, household spending in NZ declined for the sixth-straight quarter, down 0.2%. High inflation, steep interest rates and weak house price growth are weighing on consumption. But strong population growth is providing support. The ongoing recovery in tourism likely also helped lift consumption over the quarter.

Beyond households, business investment was weak with a 0.5% decline over the quarter. Compared to a year ago, the decline in investment continued and deepened with a near-4% fall. Investment in plant and machinery has taken a large hit, down 11.6%yoy. It comes as no surprise with several business surveys having pointed to weak investment intentions over 2023. Similarly, the downtrend in building consents has seen a 5.4% decline in residential buildings compared to a year prior. Overall gross fixed capital formation is down 4.4%

What’s to come?

With the March quarter now behind us, the next question is what’s in store for the rest of 2024. When it comes to lagged GDP data, it’s always the outlook which is most important. Unfortunately, the outlook for the rest of the year is for more of the same. Forward-looking indicators suggest that the June quarter will likely be a soft one for economic activity. Beyond, the Kiwi economy will struggle to eke out further growth this year. Policy settings are still aggressively tight. And a soft global backdrop doesn’t help either. The pulse for the Kiwi economy will only strengthen when interest rates are cut. But that turning point is on the horizon. We’re beginning to see more central banks start to relax interest rates. And we don’t think the RBNZ will be far behind from when they are able to do the same. We’re pencilling in November. And expect to see growth pick up into 2025 as rate cuts deliver a needed breath of life into the economy. For now, however it’s about holding on until 2025.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.