A change in focus from covid cases to covid vaccines has boosted confidence. The upside risks to growth have strengthened. A switch in focus from rate cuts to rate hikes, has redefined markets. Interest rates are rising, silencing incessant talk of negative rates.

Roaring Twenties 2.0?

It’s been over a year since the covid pandemic began. And we’ve gone from counting covid cases to counting covid vaccines. It’s an important shift. The vaccine rollout is the biggest in history, and brings with it a hope of returning to something more normal. Nearly 2 billion doses have so far been administered. And the success in managing Covid has allowed a resumption of economic activity after many months of hibernation. The global recovery has begun, and impressively so. The release of pent-up demand was much stronger than anticipated, and businesses and households have adapted to a new way of working. The working from home movement that swept the world is here to stay, and the trend toward digitisation has been accelerated.

Underpinning the global recovery has been the extraordinary fiscal and monetary policy support. There’s no doubt that swift policy action worldwide prevented far worse outcomes. Monetary policy was quick to relieve stresses building in financial markets. Interest rates were slashed, liquidity injected, and billions of assets purchased. Monetary policy has proven so effective in some economies that central banks have begun to lay the tracks for the pathway back to normal - Bank of Canada, Bank of England and most recently ours truly, the Reserve Bank of New Zealand. But the lead star in the recovery has been Government support. Over $16 trillion has been spent in global fiscal support, through business loan provisions, wage support and cash hand- outs. The US$6 trillion in total spending in the US is a gamechanger for the outlook of the world’s largest economy.

The IMF has once again upgraded its forecasts. Global growth over 2021 is projected to be 6% (a 0.5%pt upgrade), following a 3.3% estimated contraction last year, far smaller than the -5.2% decline initially feared. And the good times keep on rolling. Global growth over 2022 has been upwardly revised to 4.4% (a 0.2%pt upgrade). Basically, a smaller fall and stronger, vaccine-powered recovery. 2020 was the year of the virus, 2021 the year of the vaccine, and we’ve circled 2022 as the year we’ll see more freedom in international travel - at least in stages.

From the IMF’s new forecasts, we are on the cusp of the strongest surge in global growth in decades. Could we see the return of the Roaring Twenties - cloche hat, pocket watches and all? And just like in the 1920s, there is pent-up demand, infrastructure projects in the pipeline and growing spare capacity. The debate has certainly shifted from risks of deflation to risks of rampant inflation. Central banks would much rather fight inflation than deflation, and are well equipped to turn course if needed.

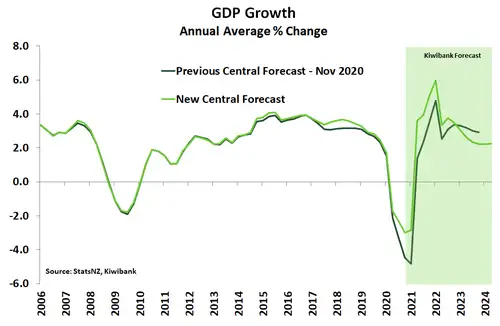

The economy is expected to howl along

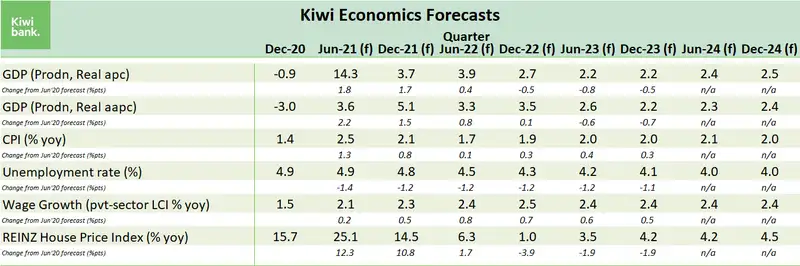

Despite economic activity falling 1%qoq in the final quarter of last year, the economy may just avoid a technical recession (two quarters of falling GDP) at the start of 2021. But the recovery in activity is far from even. Tourism and education are industries that continue to suffer from a closed border. Fortunately, the travel bubble with Australia should ease some of the pain felt among tourist operators.

In contrast, record low mortgage rates and an extensive housing shortage has given the construction sector a backlog of work. So much so, capacity constraints are ever present. For the export sector high and resilient commodity prices have supported incomes. On top of this, fiscal policy will continue to support the economy this year. Growth is expected to take off.

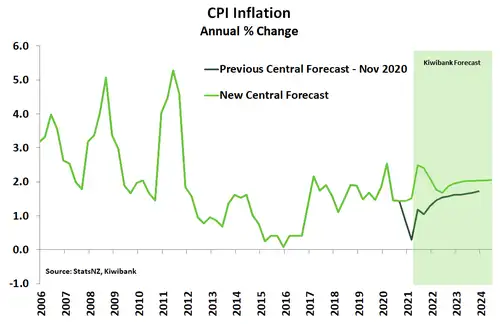

Mass disruption to global supply chains has marked out the covid crisis from others. For instance, the global move to remote working, and stimulus driven spending has caught many semiconductor manufacturers on the hop. And microchips are used in almost anything that needs electricity, intensifying shortages further up the supply chain. In addition, the jump in the demand for, well everything, has led to a surge in global shipping costs. Locally, clogged ports over the summer added long delays for goods and materials that were in high demand. In response firms are having to pass rising costs onto consumers.

CPI inflation is set to jump above the RBNZ’s 2% target mid-point in the June quarter. In part due to the passthrough of rising costs, but also the impact of base effects of a fall in prices during lockdown. Like other central banks, the RBNZ is not concerned with a near term jump in inflation. Supply chain disruption is expected to be temporary; the RB will look through it. And looking through inflation, current aggregate spare capacity is projected to be used up quickly this year. As a result, non-tradables (domestic inflation pressure) will see inflation move quickly back to the RBNZ 2% target midpoint. The RBNZ will be moved to act, and in our view start to hike the OCR from May next year.

Net migration and the border…

A key assumption underlying our forecasts is the timing of NZ’s border reopening. That is, reopening to the more usual two-way flow of tourists, students, migrants, and entrepreneurs. And reopening is linked to the successful rollout of covid vaccines. The Government is aiming to have all those over the age of 16 (who wants a vaccine) to be fully vaccinated by the end of the year. It’s presumed that the border can then reopen soon thereafter. We certainly hope the current vaccine plan is achieved. However, even six months out the current plan seems overly ambitious. Already supply uncertainty of the Pfizer vaccine has knocked the start of the rollout to the general public back to the end of July. But a successful vaccine programme doesn’t just rely on supply. Just as important is vaccine demand. Experts in the US indicate that for herd immunity to be achieved between 70% and 85% of a population needs to be fully vaccinated. At high levels of immunisation, the chain of transmission can be adequately disrupted to avoid the alarming surges in covid cases that can overwhelm the health system.

The experience internationally so far has proven that achieving high rates of immunisation quickly is no easy feat. In the US and Israel (two countries that went early and went hard) there was an initial surge in vaccine take up. Those who wanted a shot, rushed to get one. However, after an initial flurry of shots, vaccination rates have fallen sharply (see chart for US below), pushing out the time when the goal of herd immunity is reached. Caution, fear and outright anti-vaxxers are harder to overcome. We may experience similar behaviour here in Aotearoa.

Then there is the trickier question around vaccinating those under 16. As a result, we still think that any move on the border, outside regional bubbles, will take longer to achieve than early 2022. Our view is that opening the border will occur around the middle of next year. Moreover, it looks more likely that any reopening will be done piecemeal rather than just swinging the doors wide-open. For non-citizens, travel to NZ may be conditional on full vaccination. A condition that will be biased toward those from developed nations, countries with the resources to capture the lion’s share of vaccines to date.

The opening of our border and its timing is a key driver of our net migration forecast – which in turn is a key driver of NZ’s population growth. Importantly, net migration is the difference between long-term arrivals and departures (both immigrants and returning Kiwi). The recent migration boom was due to a surge in immigrant arrivals coinciding with a sharp fall in the outflow of NZ citizens and residents.

As we have already published in our latest housing market note, net migration is expected to gradually rise over 2021. “Because the quarantine-free travel bubble with Australia makes it easier to move across the Tasman. And the travel bubble is set to open more capacity in managed isolation facilities.” Once our border begins to open next year net migration should rise rapidly before settling at an annual level of around 30,000 people. This is half of the run rate we had seen pre-covid. And is in part due to the expectation of the adoption of a more restrictive immigration policy. The Government has tasked the Productivity Commission to undertake an inquiry into immigration settings. The corollary being more restrictive immigration policy settings lie ahead. Moreover, as was mentioned above any reopening will initially advantage migrant arrivals from developed economies. In 2019 migrant arrivals from China, India, South Africa, and the Philippines made up almost 40% of the 125,000 non-NZ long-term arrivals. Arrivals from these countries may be slower to recover as vaccine rollout takes longer than in rich countries.

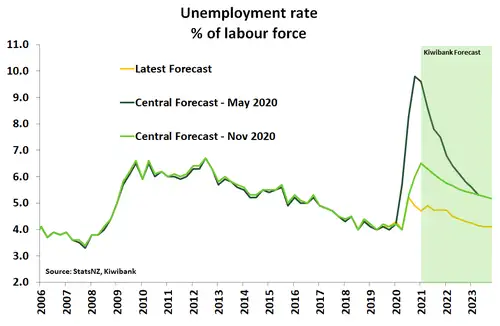

…are fundamental to labour and housing

The outlook for net migration has implications for both the labour and housing markets. The labour market has continued to defy predictions, with the unemployment rate falling to 4.7% in the March quarter. The labour market is consistent with the remarkable resilience of the NZ economy to last year’s covid disruption. Successive forecast rounds have seen unemployment rate forecasts slashed (see chart below). This time around is no exception. We believe the unemployment rate has already peaked in the current cycle at 5.2%. The improved outlook for the economy and restricted growth in the labour supply (due to a closed border) should see the unemployment rate trend lower over the next three years. Wage growth will get a bump in the June quarter following the hike in the minimum wage to $20/hr. Beyond the June quarter, increased competition for a slower growing pool of workers will see wage growth return to the highs hit just before covid disrupted the market.

National house price growth is tipped to peak at around 25%yoy in the current quarter. House price growth should fall quickly thereafter. Recent policy changes, such as the tax treatment of interest payments for investors and tighter LVRs, are already taking some of the heat out of the market. Also, the closed border has provided a rare opportunity to tackle NZ’s massive housing shortage, which we estimate to be almost 70,000 homes. Population growth has fallen rapidly at a time new home building has reached levels last seen in the 70s. Recent building consent issuance indicates high rates of construction will continue for some time – assuming we have the builders to do the work. The current housing shortfall may disappear in the coming few years with net migration remaining low. The additional supply should also add further downward pressure on house prices.

Heed the hawks, hikes are coming

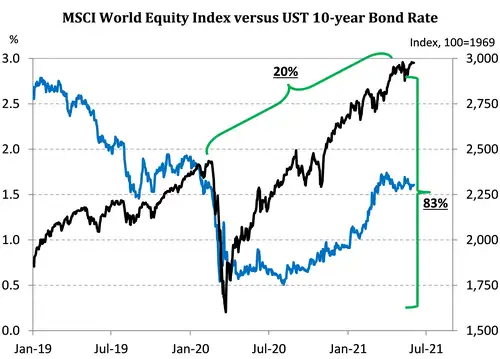

Financial markets, globally, have recovered well. Monetary policy has (finally) been supported by record amounts of fiscal policy. Developed market equities have been on a tear, and interest rates have risen. Equities are up over 80% since the Covid induced lows. Investors who managed to hold on during the Covid meltdown, have seen their equity portfolios rise at least 20%. And earnings are surprising on the upside.

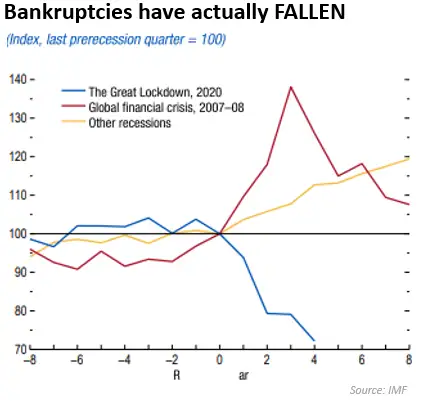

Importantly, bankruptcies globally, have FALLEN. We simply haven’t experienced the pain and scarring of a ‘normal’ recession. And it has been the fiscal side of the equation that has helped the most. Wages subsidies and measures to support business have softened the blow.

One of our favourite quotes from the last 10-years, refers to the lack of fiscal involvement. “The persistence of low inflation and

low interest rates is not a surprise when, as has been true in fact, the low interest rates fail to generate substantial fiscal expansion [and thus aggregate demand expansion]." Christopher Sims. Indeed, we would be in a very different world if Governments chose to invest, rather than fight for austerity. We may not have had Brexit, Grexit, and threats of Frexit or who’s Nexit. Times have changed, but major threats remain. Populism is a symptom of widening inequality. And inequality has worsened with Covid. But Government’s, in the developed world, have awoken.

It is much easier for a Government to spend during a health crisis, to save lives, than it is to bail out Wall Street banks (2008). But many governments are using the crisis to right the wrongs of the past, and invest in the future. It is the injection of investment spending that is strengthening the medium term outlook. And New Zealand has done its share, but should be doing much more.

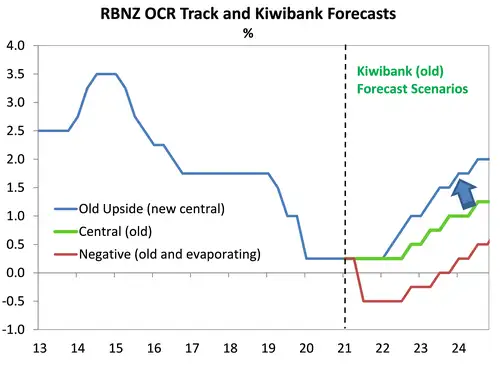

Last week’s super blood moon coincided with the RBNZ’s monetary policy statement. And there was plenty of howling. The Governor came out, hackles up, and warned of rate hikes (not cuts). The statement was much more hawkish (or wolverine-ish) than we had anticipated. And we think it was about 6 months too early. Nevertheless, we have a central bank actively howling about interest rate hikes, and soon.

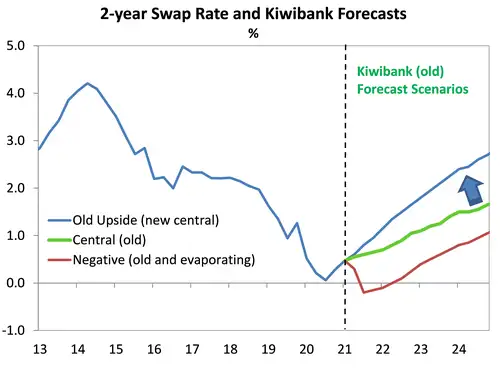

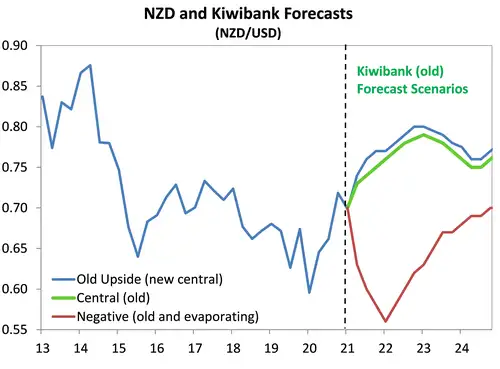

We have moved up our UPside scenario, and rates are on a higher trajectory. The rates markets and currency have moved in lock step with our forecasts to date. But now we expect to see a higher, more assertive, flight path.

There is little doubt that the RBNZ’s assertive message was a shot across the bows for indebted households and property investors. The Governor made clear the need to look beyond the record low interest rates of today. The RBNZ’s comments have pushed wholesale swap rates higher. And the pressure on banks is now to increase 2-to-5-year fixed rates on mortgages.

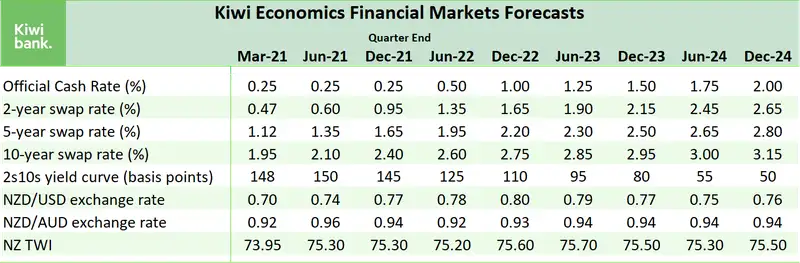

Kiwi 2-year and 5-year swap rates (the rates banks use to hedge 2-year and 5-year fixed mortgage rates) started 2021 at just 0.265% and 0.60% respectively. Both rates have risen, as expected, to 0.57% and 1.29% respectively. Such moves will likely be translated into higher mortgage rates, in time. As intended by the RBNZ (but not the RBA).

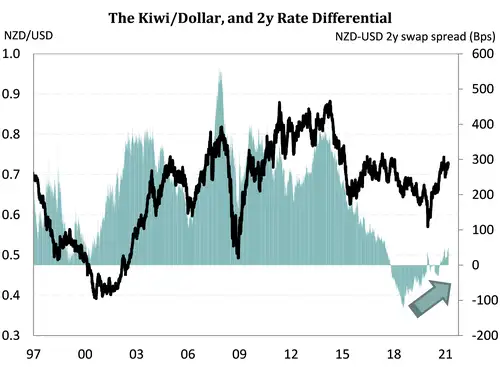

The RBNZ’s stance sticks out on the global stage. And interest rate differentials are a key driver of the Kiwi currency. We have upgraded our Kiwi dollar forecast, a little, as a result of the more assertive RBNZ OCR trajectory. Our forecast of 75c by year-end 2021, has been uplifted to 77c.

Although our forecast flight path for the Kiwi looks like the flight path of a Boeing 747, we remind readers that the Kiwi is an aerial acrobat. There will be plenty of aerial manoeuvres over the year ahead. Volatility is to be expected, and embraced.

In December we said: “You have to be completely unhinged to pretend to predict where the Kiwi flyer will go from here. But we’d say higher still next year. Let’s say 0.75c by December 2021. We have great unconviction in our forecast. So realistically, the Kiwi could end next year anywhere between 50c and 90c.”

Like the RBNZ, we have become “more confident” and unhinged. We take our 75c call and add 2c to 77c, with a touch more conviction.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.