- Kiwi consumer prices rose 0.4% over the June quarter, pulling down the annual rate to 3.3% from 4%. That's great news. But even better is the drop in core inflation, from 4.1% to 3.4%. We expect the downtrend to continue.

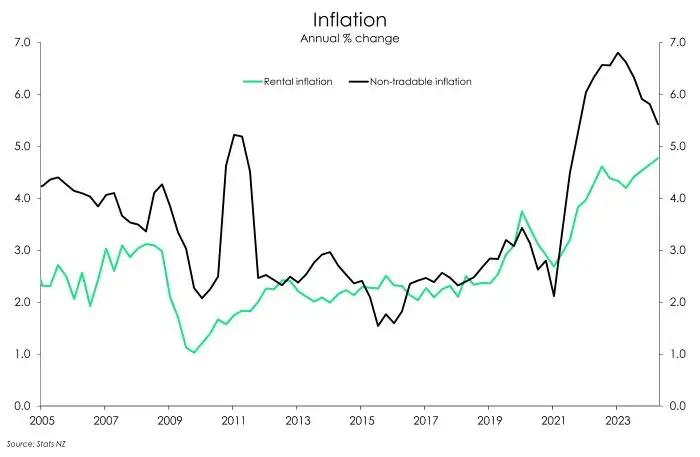

- Domestic inflation continues to moderate, albeit slowly. Rental inflation continues to run hot, and services inflation remains elevated. However, we suspect we're nearing a turning point as the economic backdrop deteriorates.

- Going forward, the path for policy is the path for inflation. We expect inflation to return to within the RBNZ’s 1-3% target by the September (third) quarter. It’s looking increasingly likely that the RBNZ will deliver rate relief by November. But prospects for an even earlier cut are rising.

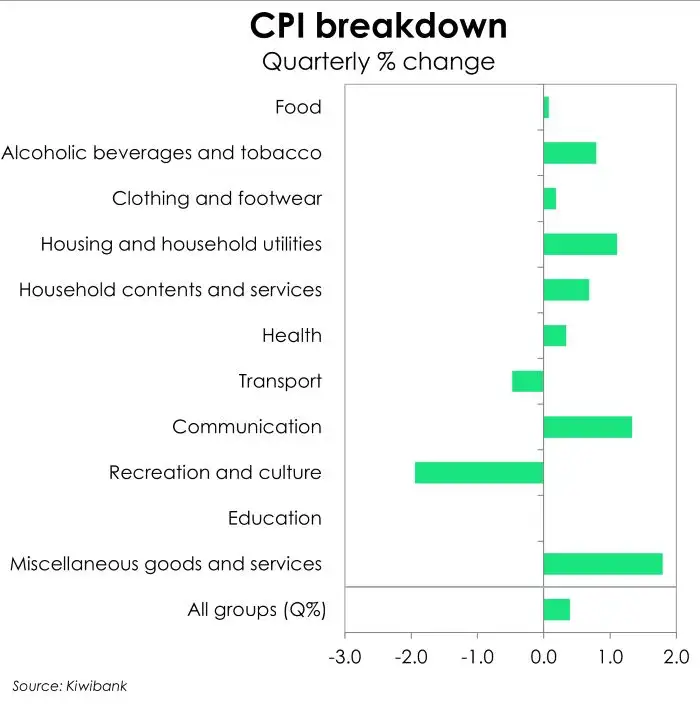

Today's inflation print came out below the RBNZ's forecast, again. It's important to understand the swing in numbers, to the softer side. Inflation is running at 3.3%, below our forecast 3.4%, and the 3.6% of the RBNZ. There is a lot happening beneath the surface. The core measure, which strips out volatile stuff we don't want included, fell from 4.1% to 3.4%. It's not far from the RBNZ's 1-to-3% target band. Unfortunately, domestically generated inflation remains a little hot, as imported inflation is nice and cooling. Imported inflation is down to just 0.3% from 1.6% last quarter, and a hefty peak of 8.7%. Domestic inflation remains heated at 5.4%, well above our forecast, and is down from a peak of 6.8%. Within the domestic price frustrations was a lift in rents (thanks to the migration boom) to 4.8%, a spike in insurance premiums to 14%, and elevated council rates at 9.6%. It's a triple whammy of price hikes, felt by most households. Whether you own or rent, you're hurting.

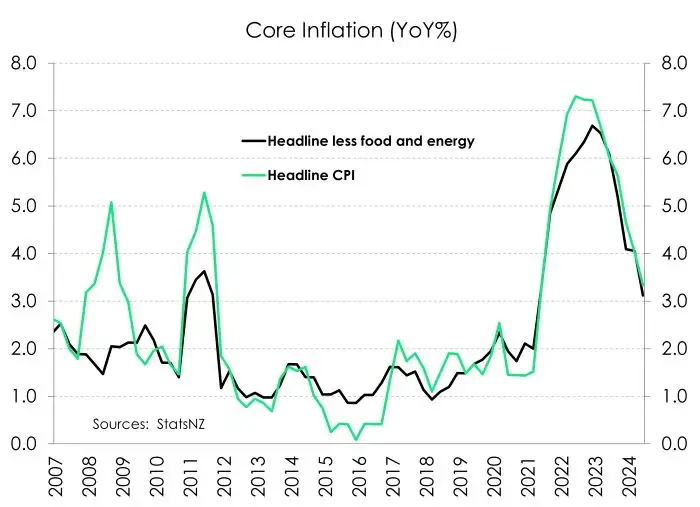

Kiwi consumer prices rose 0.4% over the June quarter. Over the year, inflation decelerated to 3.3% from 4%. The annual rate of inflation continues to moderate. That’s great news. Even better is the slowdown in core inflation. Stripping out the volatile price movements in food and energy prices, underlying inflation slowed from 4.1% to 3.4%. That’s a decent move lower.

We still think inflation is on track to fall below 3% in the current (September) quarter. And today’s progress on core inflation has us growing in confidence that the RBNZ’s 2% target will be achieved in 2025. Rate relief is on its way.

Domestic inflation still running hot

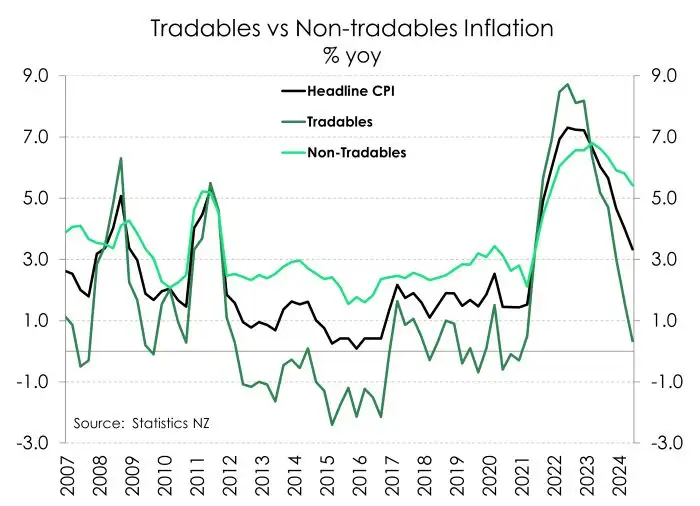

Imported deflation continues to do most of the work in bringing down the headline rate. And it was much softer than expected, with a decline of 0.5% over the quarter – the third consecutive quarterly decline. Over the year, imported inflation has fallen from 1.6% to 0.3%, and further away from the dizzying heights of 8-9%. Weakening imported inflation continues to do most of the leg work in bringing down the headline rate. That’s great. But momentum can be easily disrupted. We’re keeping an eye on the what’s happening abroad. Shipping rates have recently accelerated. It’s unlikely we will experience increases of the same magnitude as during Covid, but the move higher certainly does not help the inflation outlook.

The stubbornness in domestic inflation is yet to meaningfully let up. Domestic inflation was a little stronger than expected with a 0.9% gain over the quarter. Annually, non-tradables eased from 5.8% to 5.4%. Rental inflation (which makes up 9% of the CPI – the largest weight for a single item) is still running hot at 4.8% - the fastest pace since the late 90s. the ripple effects of migration continues to add upside pressure. Insurance costs are also up a whopping 14% over the year, while council rates are holding at 9.6%. However, looking at measures excluding these costs, we see a cooling in domestic price pressures. It give us confidence that non-tradables inflation, while slow, is on a downward trajectory.

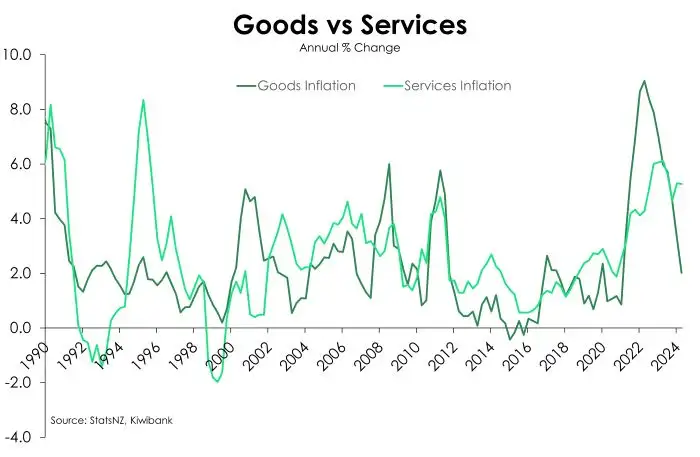

Services sector inflation, as a whole, was unchanged at 5.3%yoy. We suspect we are nearing a turning point in services inflation. Services inflation is closely aligned with wage growth. And the slowdown in wage growth as labour market pressure eases, point to an eventual slowdown in services.

Goods inflation on the other hand, continues to quickly decelerate. Over the year, good prices have lifted just 2%, widening the distance from the 9% peak. It follows the switch in demand away from goods and towards services as the economy exited covid – fewer new furniture (-5.6%yoy price decline) and more eating out (4.85%yoy price gain)

Core matters most

Perhaps some of the best news in the report came from the massive shunt lower for core measures of inflation. Stripping out volatile food and energy prices, underlying price pressures lifted just 0.3% over the June quarter. That’s a massive slowdown from the running pace of 0.9% over the previous two quarters. And with such a slowdown, the annual rate of core inflation eased to 3.4% after being stuck at 4.1% since December last year. It’s a very welcomed move confirming the underlying trend for inflation is down. And even better – moving closer to being below 3% in the coming months.

Basket breakdown

Over the June quarter, the same proportion of all items lifted in price at around 55%. However, more items recorded a decline in price, from 31% to 33% of all items. The shift points to generalised cooling in inflation pressures.

Driving the 0.5% rise in quarterly inflation was the rise in housing-related inflation, specifically rents. The ripple effects of the migration boom however adds upside pressure, when it comes to housing. Rental inflation however continues to creep higher, and is yet to turn. Over the quarter, rents accelerated 1.2%. And on an annual basis rents are running at around 4.8% (the highest since 1999) - well above the circa 3% pre-covid rates. Household utilities, including electricity prices climbed almost 3% over the quarter as is typical over the winter months. Home construction costs were up 0.9% over the quarter. Annually, construction costs have eased to 3%, a far cry from the pandemic peak of 18%.

The spike in insurance premiums is a result of a well-known spike in natural disasters, both here and abroad. And the spike in council fees is related, and exacerbated by decades of underinvestment in key infrastructure. Even StatsNZ's delivery of today's data was without a lockdown, due to water issues in their building... What is it with Wellington and water??? oh yeah, underinvestment and a lack of maintenance.

Food prices were soft over the quarter, up just 0.1%. Prices for fresh produce fell 6.6% but offset by the 1.1% rise in grocery food and 1.3% rise in restaurant meals. Over the year, food prices are up just 0.2%. That’s a big shift down from the double-digit highs of 2023 – pushed up by Cyclone Gabrielle.

Going the other way, prices for recreation and culture fell over the quarter. The group posted an almost 2% decline, led by a 4.5% decline in accommodation services and a 3.4% decline in recreational equipment – think games and toys (-12%) and pet-related products (-1.3).

Over the quarter, the transport group continues to show some deflation with prices for the group contracting 0.5%. It’s a move mostly characterised by an over 3% fall in passenger services (airfares) and a 2.3% fall in the purchase of vehicles. Though overall transport is still being held back by higher prices for petrol up 0.7% over the quarter and 14.7% over the year (low base effects are in play here). So much so that we did see a bit of reacceleration in the transport group over the year with transport up 3.5% from last quarter’s 2%.

The path for inflation is the path for policy

Today’s print reinforces the downward momentum in inflation we’ve seen to date. We’ve seen the headline rate fall from the 7s into the 6s, 5s, 4s, and now into the 3% range. Forward-looking indicators point to further moderation in price growth. Inflation is on track to return to pierce below 3% in the current (September) quarter, and (importantly) on its way to 2% in 2025. Along with a further loosening in the labour market, the RBNZ should be in a position to deliver a rate cut by Christmas. We are sticking with the first cut to come in November, for now. But prospects of an even earlier cut are rising. It all depends on the data.

Market reaction

Following a dovish tone from the RBNZ last week, wholesale interest rates have shunted lower. Prior to today’s report, market pricing implied 60bps of cuts by November, with the first 25bp cut in October. Wholesale interest rates are little moved following today's inflation print. Markets are still pricing the first cut in October, along with now 65bps of cuts by November.

We continue to highlight the overly optimistic market pricing for cuts near-term, but the lack of cuts longer-term. We agree with the need for the RBNZ to cut sooner. But we don’t think they will deliver (immediately). The cash rate, currently 5.5%, is unlikely to be cut before November. We think they need to see the September quarter inflation print (out mid-October). But the market already has more than a 50bp cut priced by November with the OIS strip at 4.85%. We forecast just a 25bp cut to 5.25%. Further out, the February meeting has over 100bps (4.48%). While we’re still forecasting 50bps to 5.0% by then. And by this time next year, the market has 154bps of cuts priced. Again, very optimistic – even though the economy desperately needs it.

But over the longer term, the market is still well short of our expectations. The terminal rate is sitting around 3.43%, well short of a return to neutral. Neutral is estimated to be around 2.5-to-3%. And we expect a move to 3.75% next year, and below 3% in 2026. If we’re right, there’s plenty of room for longer dated interest rates to fall. And fall they will.

Looking over at wholesale interest rates (swaps) and currencies, however, it seems that some of the underlying stubbornness in prices has seen an ever so slight lift in swap rates. The pivotal 2-year swap rate is up 4bps off the back of the inflation data release to 4.40%. The 2-year swap rate remains 30bps lower than around this time last week, and well down on the recent peaks over 5.2%. Meanwhile the Kiwi dollar has treaded slightly higher, now trading in the high 0.6060’s range, up from the low .0650’s prior to the release.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.