- The tariff conflict is clouding the outlook for global growth. Central banks are treading carefully on further easing.

- In some good news, the Kiwi economy ended 2024 on a better note. Activity expanded 0.7% over the December quarter. It's the first step in our recovery. But there is still a long way to go.

- Construction has been one of the hardest-hit industries over the last two years. A stronger housing market will be essential to revitalise the industry. See our Chart of the Week for more.

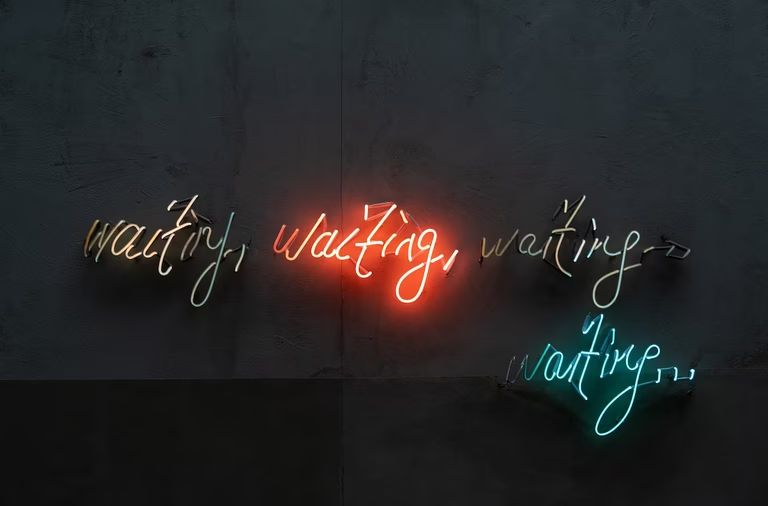

We’ve heard from several central banks recently. And it is becoming increasingly clear that policymakers are turning more cautious about further easing. The culprit for the change? The fast-moving, potentially disruptive, often confusing developments in US trade policy. The need for a careful, considered approach to cutting is appropriate given the turbulent global backdrop and still-uncertain effects on inflation and economic growth. As surmised perfectly by Bank of England Governor Andrew Bailey: “There’s a lot of economic uncertainty at the moment. We still think that interest rates are on a gradually declining path”. Policymakers are “still waiting to see what really does happen”. The Bank of Japan, who are swimming against the tide of central bank cutters, also highlighted concern over the implications of tariffs on global economic activity. And like its peers, the BoJ’s next move (hike) will be influenced by the fallout of US trade policy. The tariff conflict is clouding the outlook for global growth and risks a reacceleration of inflationary pressure. Policymakers are on guard.

Here at home, we saw some strong evidence of the Kiwi economy taking its first step into recovery at the end of last year. Economic activity lifted 0.7% over the December quarter (see our review). The December quarter was certainly an improvement from the steep 2.2% cumulative contraction in activity over the middle of 2024. And for the first time in two years, activity on a per capita (per person) basis lifted, up 0.4%. On an annual basis however, things are less rosy. Compared to December 2023, the economy is still 1.1% smaller, in aggregate, while output shrunk 2.2% on a per person basis.

Nonetheless, we’re acknowledging this as the first step in the economic recovery. Of the 16 measured industries, 11 posted a lift in activity over the quarter. And green shoots have emerged across the services and primary industries. Growth over the quarter was driven by an uptick in rental hiring and real estate, alongside an expected increase in retail trade and accommodation. According to Stats NZ, the summer tourism season saw higher spending from international visitors which flowed through to an increase activity across accommodation, hospitality and transport.

It must be noted, however, that there were still pockets of significant weakness in Q4’s report card. Construction alone took away 0.2%pts of growth, with a sizeable, but not unexpected, 3.1% decline in activity. (See our Chart of the Week for more). Meanwhile everything within the professional services landscape, from business services to public admin to media, continues to suffer under the weight of a deteriorating labour market.

Shifting our gaze from the rear-view to what’s ahead, the outlook is positive. The RBNZ has delivered 175bps of rate cuts since August, with more on the way. With each cut, the restrictiveness of the current environment eases. In time, this easing should translate into stronger economic activity. Trust the process. For now, with the cash rate still above estimates of neutral (~3%), demand and economic activity will remain slightly constrained in the near-term. But as we move closer to a neutral rate environment, we anticipate momentum to grow. The second half of this year should see a material lift in economic activity.

Financial Markets

The comments below were provided by Kiwibank traders. Trader comments may not reflect the view of the research team.

In rates, action was limited despite an improved risk backdrop & positive data

“An improved risk backdrop and data consistent with an economic recovery, albeit a patchy one, had limited impact on Kiwi rates. The 2yr swap rate remaining firmly in the middle of recent ranges.

The uneven recovery was in evidence throughout last week. Bright spots such as dairy and tourism were promptly blotted out by an overwhelmingly gloomy Westpac consumer confidence survey. In aggregate, however, NZ is officially growing with a genuine upside surprise to GDP promoting a small sell off. This was overshadowed by a subsequent weak Aussie unemployment print, seeing Kiwi rates dragged lower on the day.

In the short end however, the market has become marginally less convinced of the need for a 3rd 25bps OCR cut. For offshore players, receiving Kiwi no longer seems like such a no brainer as the NZ economy starts looking like less of an outlier. A series of on hold decisions from central banks last week also added to doubts that the RBNZ will continue to cut beyond May.

On Thursday, the FOMC left their policy rate unchanged and kicked the tariff question into touch, allaying fears of a comprehensive change in the outlook for the US economy. This kicked off a relief rally in US treasuries even though the dot plot showed that the committee expected higher inflation and slower growth.

With the week light on data, the potential timing of the 2032 syndication by the NZDM will be front of mind for NZ rates.” Matthew Crowder, Balance Sheet Manager – Treasury

In currencies, central banks wary of tariff outcomes

“Last week the Kiwi dollar traded higher for the majority of week. After opening at 0.5750, the Kiwi traded up to a high of 0.5831. Most of this move was on the back of a falling US dollar, as concerns about the US economy took hold in the earlier half of the week. But late in the week, following the Fed’s latest FOMC decision, where they kept rates on hold, and updated their ‘dot plot’ to indicate that they expect just 2 further cuts this year, the market reacted with positivity. Comments from Fed Chair, J Powell, saw the US dollar reverse some of its losses. Powell commented that he expects that the fallout from tariffs and potential trade wars should be transitory, and he also stated that he is not currently concerned about a recession in the US. The BoE and BoJ also had rate decisions, opting to stay on hold, and commented that there is a lot of uncertainty around tariffs which makes it difficult to forecast the outcomes. The Euro performed well against the US dollar last week, on the back of the German infrastructure and defence spending package worth EUR500billion that got across the line in Germany’s parliament mid-week. By the end of the week the Kiwi dollar was back where it started the week, at 0.5750. We think that there is potentially further upside for the Kiwi from here and are now broadly in a 0.5700 – 0.5850 range. Also, of note on the currency front, after opening the week at 0.9090, the NZDAUD cross managed a small rally up to 0.9162 on Thursday following the strong Kiwi GDP print, combined with the poor Aussie employment number. The NZDAUD cross was back to 0.9145 by the end of the week.” Mieneke Perniskie, Trader - Financial Markets.

Weekly Calendar

- Here at home, monthly filled jobs data is likely to show jobs growth flattening out after steep declines in the middle of 2024.

- Across the ditch, Aussie inflation data is in focus. The February report is likely to show headline inflation slowing to 2.4%yoy from 2.5% in January, led by softer prices of food and fuel. Core inflation gauges, while are trending higher, remain within the RBA's 2-3% target range. The data will be a key input in the RBA's April policy decision.

- The US Fed's preferred inflation gauge, PCE inflation, likely held at 0.3% in February, with price increases across goods, health care and financial services. Core PCE inflation is also expected to rise 0.3% over the month, faster than the pace consistent with the Fed's 2% target. PCE spending is expected to rebound 0.5% after January's 0.2% slide, potentially driven by front-loading spending ahead of tariffs.

- UK inflation is expected to have slowed slighted to 2.9% from 3%. Food and core goods prices however likely kept upward pressure on the headline rate, while services inflation, encouragingly, cooled over the month. Looking ahead, headline inflation is expected to rise in the near-term due to higher energy and administered prices.

- The Tokyo CPI report will likely show that the recent surge in food prices continues to filter through to other areas. Core inflation is expected to hold at 2.2%. Recent large pay increases should lift labour costs and add to inflation momentum. The report should strengthen the Bank of Japan's confidence that consumer price gains are becoming more secure around its 2% target.

See our Weekly Calendar for more data releases and economic events this week.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.