The cost-of-living crisis at an end

Modal to play video

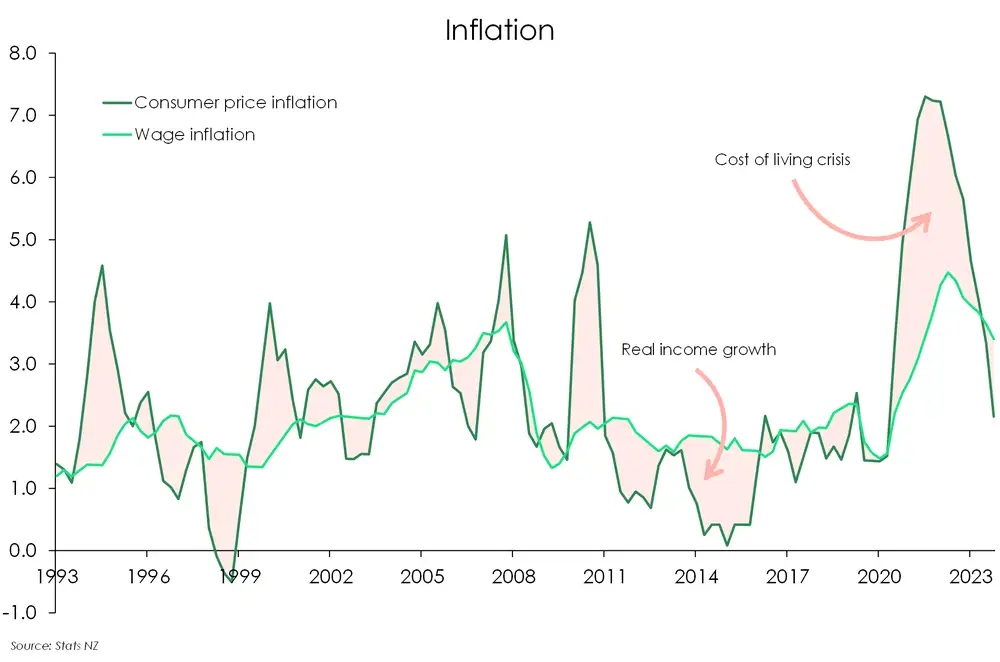

The cost-of-living crisis has dominated headlines and emerged with the cost of everyday essentials rising at a faster pace than household incomes. And for the last three years, that has been the case in New Zealand, with some households disproportionately impacted. Unfortunately, households on lower incomes are hardest hit. Food and fuel – both of which have seen the largest increases in price – make up a larger share of low-income household budgets. And these households typically don’t have much wriggle room.

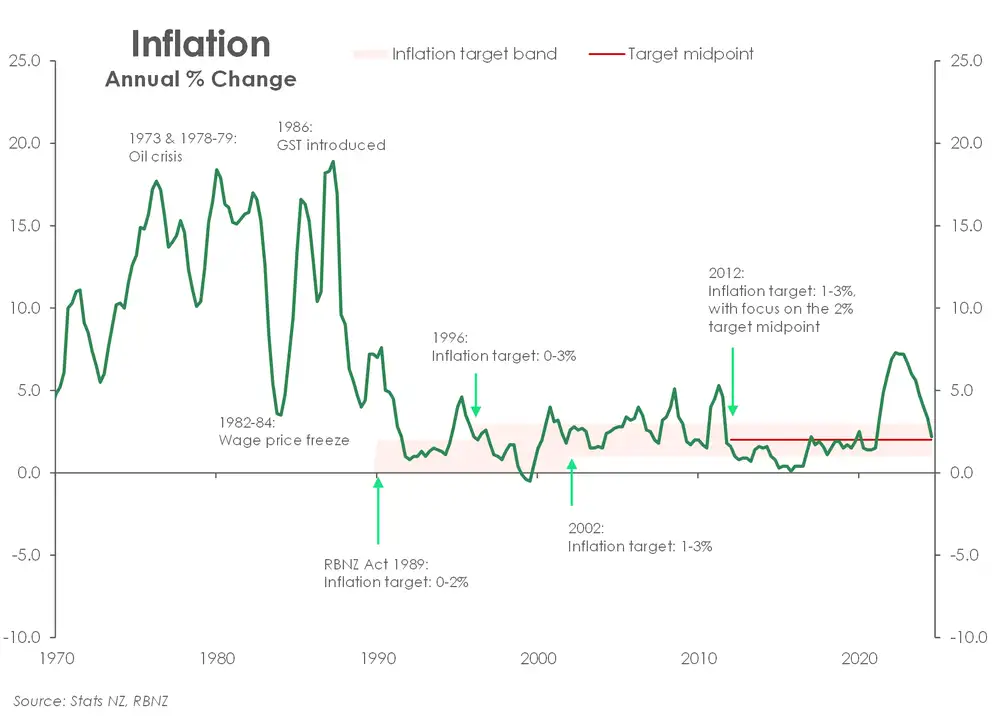

But now, pay rises are beginning to run above inflation. Inflation has fallen back below 3%. It’s been a long time coming – more than three years to be exact. Tradables (imported inflation) is the reason inflation has returned to 2%. And the eventual normalisation in domestic price pressures is why we see 2% sustained in the medium-term. It’s the two phases of 2%. Phase 1, imported. Phase 2, domestic.

The cost-of-living crisis is coming to an end, slowly. It may not feel like it yet, but inflation has eased, and will ease further. Falling interest rates and rising house prices in 2025 should also bring much needed relief to some Kiwi households. But meaningful improvements will like time some time

Stay tuned: In the next episode, we take a deep dive into the differences between the Antipodean economies. OZ vs NZ – how does the economic scorecard hold up?

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.