Business confidence climbing with cuts

Modal to play video

Episode five is all about Kiwi business. According to NZIER’s latest survey, business confidence has markedly improved. In the September quarter, only a (seasonally adjusted) net 5% of businesses expect economic conditions to deteriorate in the coming months – a much smaller proportion than the net 40% in the prior quarter. The improvement is an emphatic sigh of relief from Kiwi businesses.

There is light at the end of the tunnel. But it’s still some distance away until we’re out of the shadows. According to Kiwi businesses, it is still a challenge to navigate the current economic environment. Experienced activity levels actually deteriorated, with more firms reporting a decline in trading activity over the quarter. There’s real risk see yet another quarter of the Kiwi economy running backwards.

Policy settings have been too restrictive for too long. But now that the cutting cycle has begun, businesses are lifting their heads and looking to next year. To keep up confidence, the RBNZ now needs to deliver.

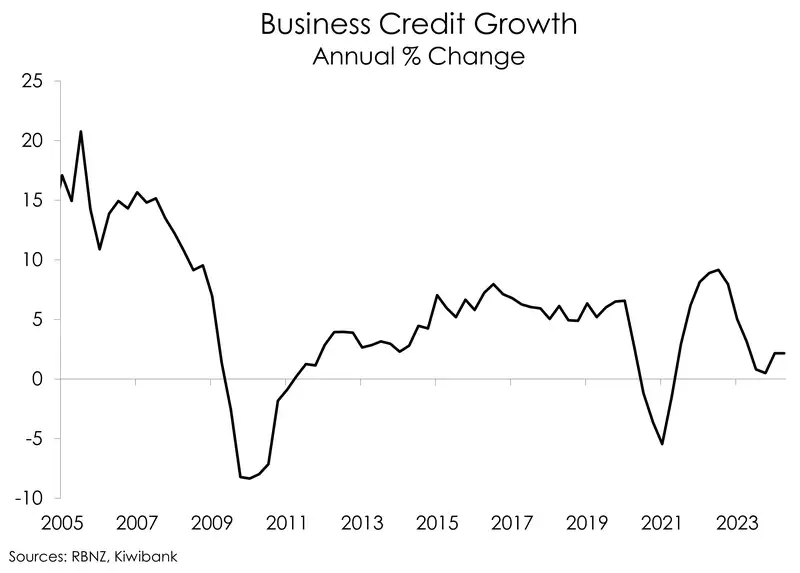

The real highlight of episode five is our chat with Kiwibank’s Chief Customer Officer – Business, Elliot Smith. Elliot runs us through how Kiwibank has performed over the last few turbulent years, and discusses the current business lending environment. Business credit grew just 2.2% in the 2024 financial year. The appetite for credit among businesses remains subdued, running well below the long-term average of 6%. Credit growth continues to be weighted down by below-trend economic growth and tight financial conditions. However, we expect an improvement over the forecast horizon as the RBNZ delivers rate relief. We expect business credit to accelerate from the second half of next year. By then, interest rates should be meaningfully lower than current levels, providing a boost to business confidence and in turn activity.

Stay tuned: In the next episode, we run through the RBNZ’s October policy decision and how financial markets reacted.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.