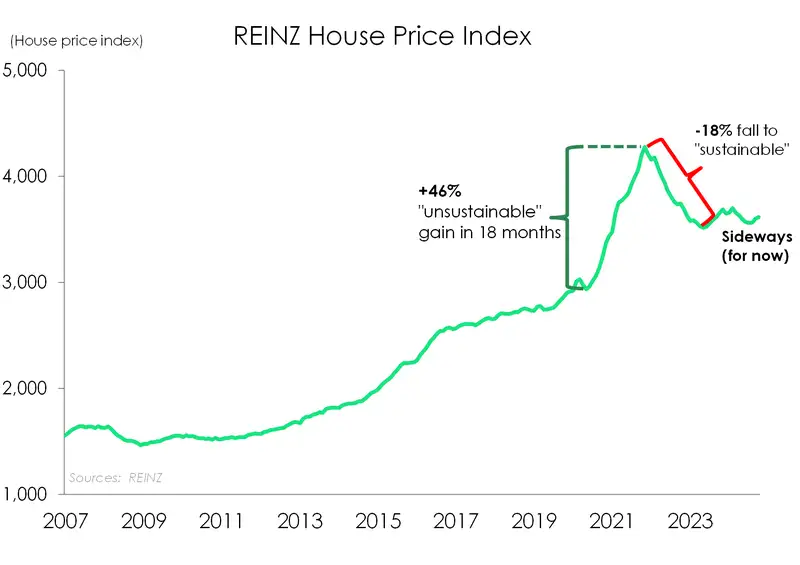

- The Kiwi housing market is stumbling sideways. Yes, there was an unsustainable 46% surge out of Covid. Yes, the RBNZ orchestrated an 18% correction back to more sustainable levels. But over the last 18 months, house prices have gone nowhere. That will change, next year. Interest rate cuts will fuel confidence. And confidence will generate activity.

- Investors have been hunted by policymakers, both from the last Government and RBNZ. Interest rate deductibility, Brightline tests, and laser focussed LVR restrictions have all targeted investors. Precisely what we don’t need with a chronic housing shortage. But now, the hunted will become the hunters.

- We have put a stake in the ground, claiming the two recessions (the RBNZ said we had to have) have ended. And it’s the RBNZ’s policy tack that has ended it. Interest rates are the biggest driver of house prices. Swift interest rate cuts are feeding through fast. And investors no longer need to worry about the Brightline test or interest deductibility. With the rise in rental yields, investors should return to the market.

- Hunters will seek opportunities in a ‘buyers’ market. The true test will come now, over the warmer months.

“Peel me off this Velcro seat and get me moving…” Greenday

The Kiwi housing market is still struggling to regain its footing, as house prices have staggered sideways. The REINZ data for October showed another small step in the right direction, lifting 0.5% over the month. That’s the third consecutive monthly gain. BUT, house prices are still down on last year, falling 1.1%yoy. The median national house price lifted to $795,000, but remains well below the November 2021 peak of $925,000.

We’ve seen extreme volatility in house prices. The correction that started in November 2022, and lasted 18 months to May 2023, recorded an 18% decline (with price falls recorded in 15 of the 18 months). The RBNZ induced correction followed “unsustainable” gains over 2020-21, with an eyewatering 46% spike in 18 months. And here we are, recovering without conviction (yet).

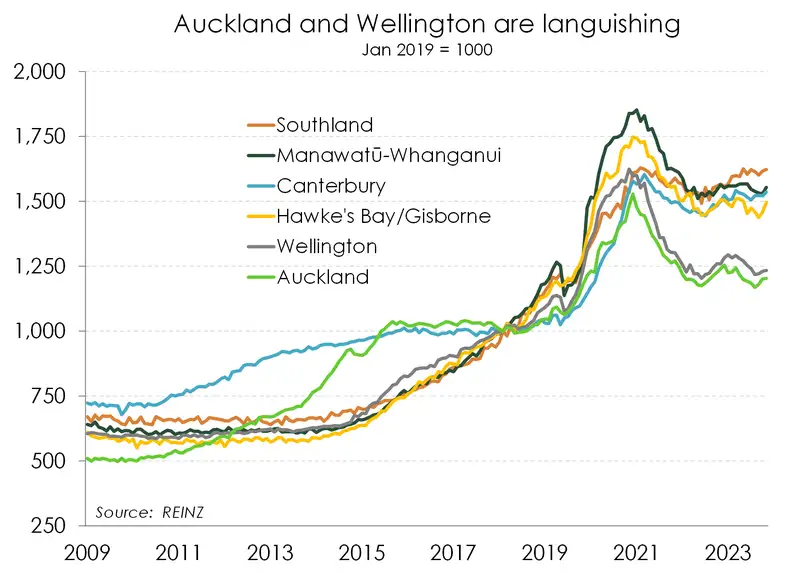

The REINZ data was rather mixed across the regions. Auckland underperformed, recording a small 0.2% gain on the month, to be down 3% over the year. Excluding Auckland, Kiwi property prices were up 0.66% on the month, and close to flat (-0.13%) over the year. But the pain is also being felt in the capital. House prices in Wellywood inched higher, up 0.3%, to be down 2% over the year. The rest of the North Island remained soft. There were further declines in Northland (-0.44%mom, -1.8%yoy), and Taranaki (-2.3%mom, -1.75%yoy). And despite some monthly gains in the Waikato (+1.1%mom, -0.1%yoy), the Hawke’s Bay (2.6%mom, -0.7%yoy) and the Manawatū (+1.5%mom, -0.6%yoy), house prices are lower than they were last year.

The South Island continues to outperform the North, with some solid gains in Canterbury (+0.94%mom, +2.4%yoy), and Otago (+0.5%mom, +3%yoy). And Southland continues to break higher ground, up 0.4% in the month, 3.5% over the year. Southland has been the strongest performing region for the last 12 months, followed by Canterbury.

Are we the waiting

“Starry nights, city lights comin' down over me. Skyscrapers, stargazers in my head. Are we? We are. Are we? We are the waiting unknown…” Greenday

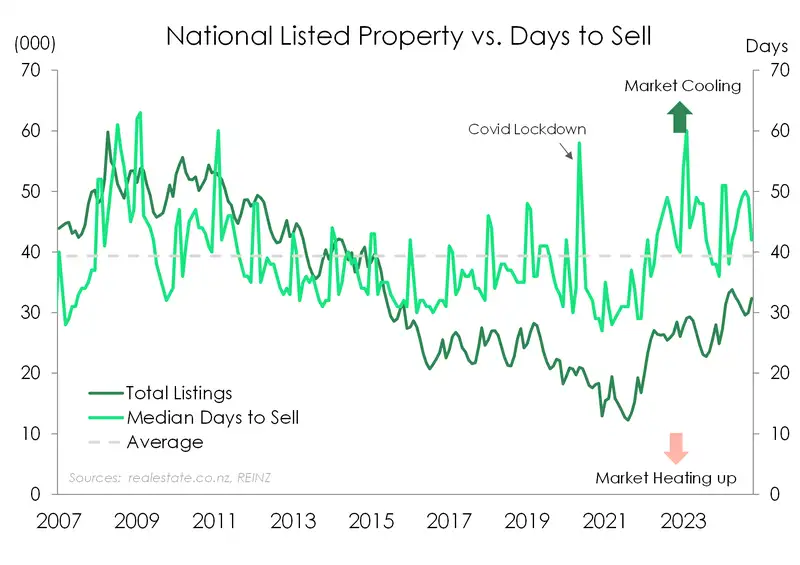

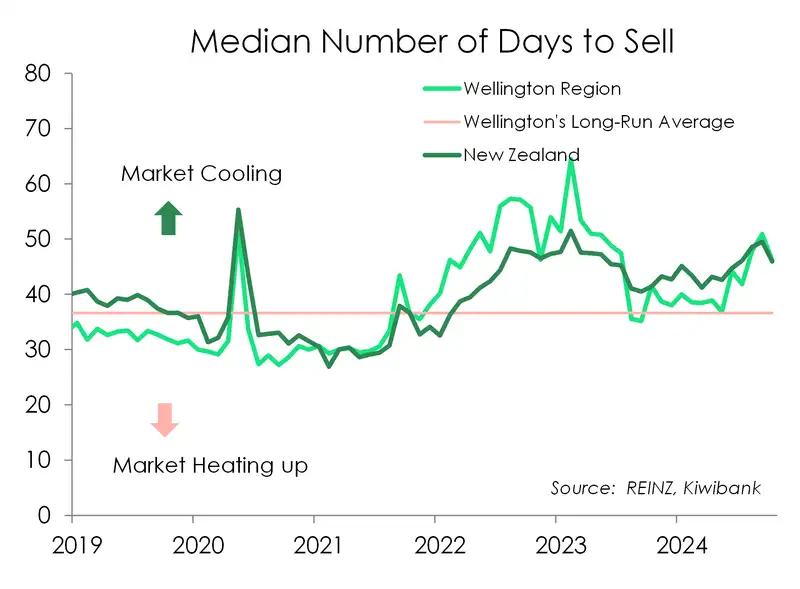

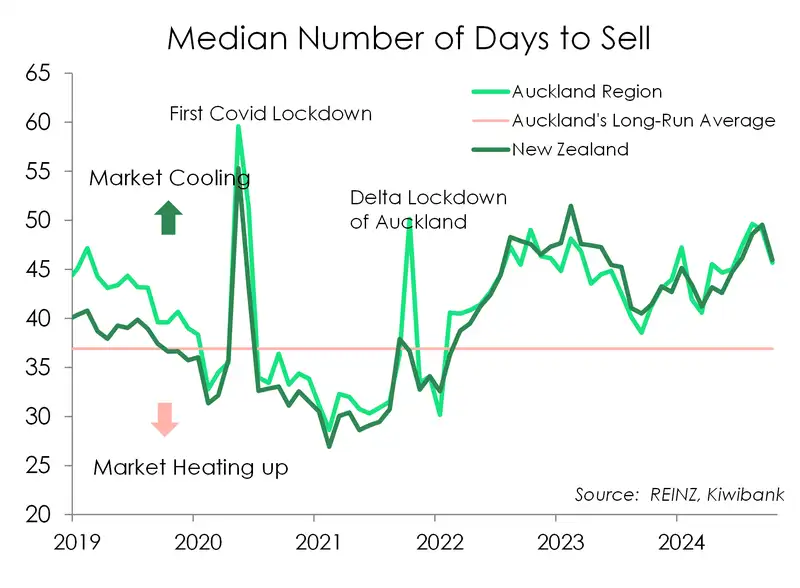

There were some signs of life in October. The number of days to sell a property fell to 42, from 49. The long-term average is 39. The time it takes to sell a property is one of the best real-time indicators of housing market dynamics. And despite some volatility (that will persist into next year), the distance between buyers and sellers is narrowing.

There was also a strong lift in listings. Tis the season. The rise in total listings can reflect the difficulty in selling. But that’s not necessarily the case now. More sellers are testing the market. Anecdotally, we’ve heard that the quality of listings has been a problem. Poor quality stock is hard to sell. But that may be changing, with confidence up.

When I come around: the two capitals are lagging

“So go do what you like, make sure you do it wise. You may find out that your self-doubt means nothing…” Greenday

In the “official” capital, the median house price has bounced around from $765,000 to $795,000, down to $785,000 and now $795,000 again. The peak of $995,000 in 2021 is a distant memory. And Wellingtonians are still feeling the impact of significant job cuts in the public sector. Prices are down 2% over the year, and follow a sharper 25% correction from the post-Covid boom. Wellywood has underperformed. Sales picked up in October, but have been soggy for months. The days to sell have fallen to a seasonally adjusted 46, from 51 last month. The average of 37 days is still elusive.

In the “real” capital, the median house price has just popped back above $1 million. Again, the peak of $1.3mil is a distant memory. Activity in the city of sales has lifted, with the days to sell falling from a seasonally adjusted 49 to 46. The long-term average is 37, and anything above 40 is considered soft. 46 days is still the definition of a buyer’s market. It takes time to sell, and that’s a sign of weakness.

Hitchin' a ride: rate cuts will come through thick and fast

“Troubled times. You know I cannot lie. I'm off the wagon, and I'm hitchin' a ride” Greenday

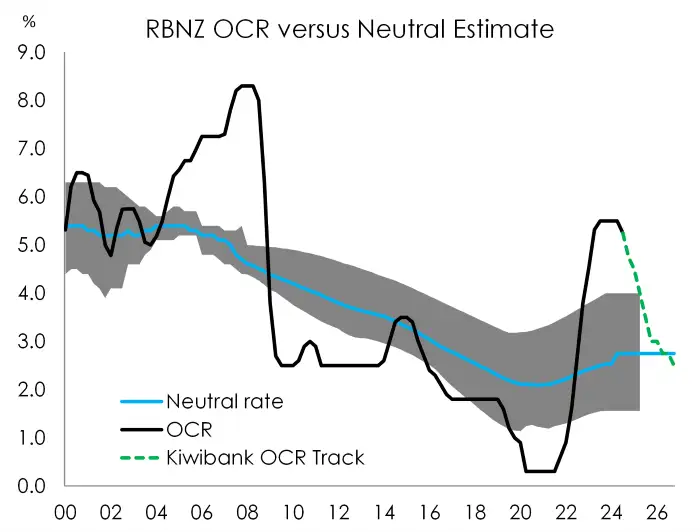

The RBNZ cut the OCR 50bps in October, and they should cut by another 50bps in November, and possibly February. We hope to see the cash rate below 4%, ASAP. And it’s the return to a more neutral setting around 3%, that’s in focus. It’s the magnitude that matters most.

If the RBNZ wants to remove the restrictiveness of interest rates, they need to go back to a neutral setting (a Goldilocks rate that’s not too hot, not too cold). That Goldilocks rate is estimated by the RBNZ to be around 2.75%, a long way from 4.75% today, 4.25% on November 27th, and even 3.75% in February. And we think they need to go a little below neutral, to 2.5%, to get things moving. That’s a big move in all rates, including mortgages, test rates, term deposits, and business banking lending rates.

It’s the magnitude of rate cuts that impacts business decisions, and household confidence. We forecast, with a much greater degree of confidence, that 2025 will be a better year than 2024, and let’s put 2023 behind us.

Brain stew: not long to wait for rate relief. What a relief…

“My mind is set on overdrive. The clock is laughing in my face. A crooked spine. My senses dulled. Passed the point of delirium.” Greenday

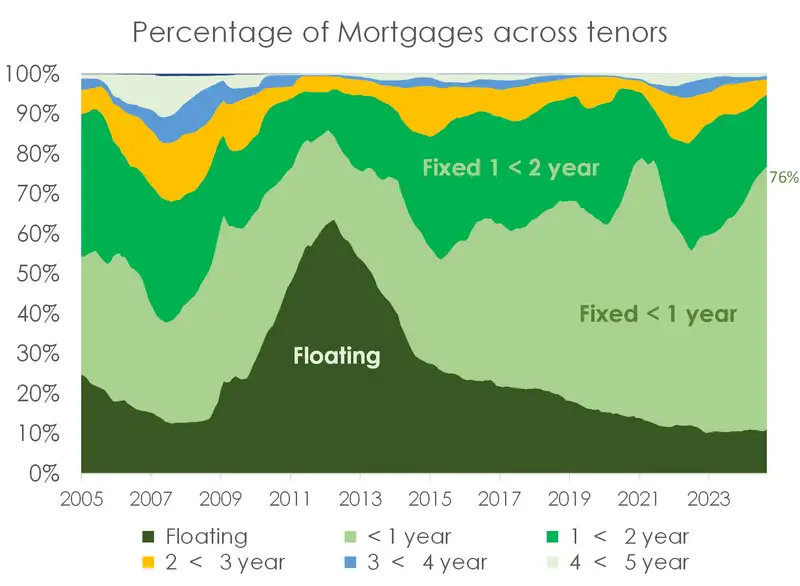

One of the many frustrations the RBNZ has faced over the years is the time it takes for policy changes to be felt (up and down). During the Global Financial Crisis of 2008, over 60% of Kiwi mortgage holders were fixed for more than a year. And 30% were fixed for more than 2 years. The RBNZ was slashing the cash rate in 100 and 150bp moves, desperately trying to provide relief. But it took over 18 months to feed through. The ‘historic’ lag of 18 months, means the RBNZ needs to look deep into 2026 when setting policy today. Well, maybe not quite that long anymore. 76% of outstanding mortgages are fixed for less than a year. Most of our customers have heard calls for cuts, and shortened up their fixing, with the 6 month rate the most popular. That’s great. Because the rate cuts will come through much faster, providing relief much sooner. We’re expecting to see a more buoyant Christmas season.

Basket case: investors remain sidelined, for now

“Sometimes I give myself the creeps. Sometimes my mind plays tricks on me. It all keeps adding up…” Greenday

We’re currently lending more to first home buyers than investors. That’s highly unusual. But we have seen a pick-up in investor activity over the last 2 months, off a very low base. Investors are (highly) likely to return in coming months. Interest rate cuts are sparking an interest, so too is the rise in rents.

As interest rates fall, more investors will be enticed off the side-lines (and out of cash). Rental yields are still rising as rents are running at the fastest pace in over 30 years, while house prices are still falling in (large) parts. And the Government kept its promise to unshackle restraints. The ‘promised’ reintroduction of interest deductibility, shortening the Brightline test timeline, and watering down of the CCCFA, will entice investors back.

Longview: what we expect

“Peel me off this Velcro seat and get me moving…” Greenday

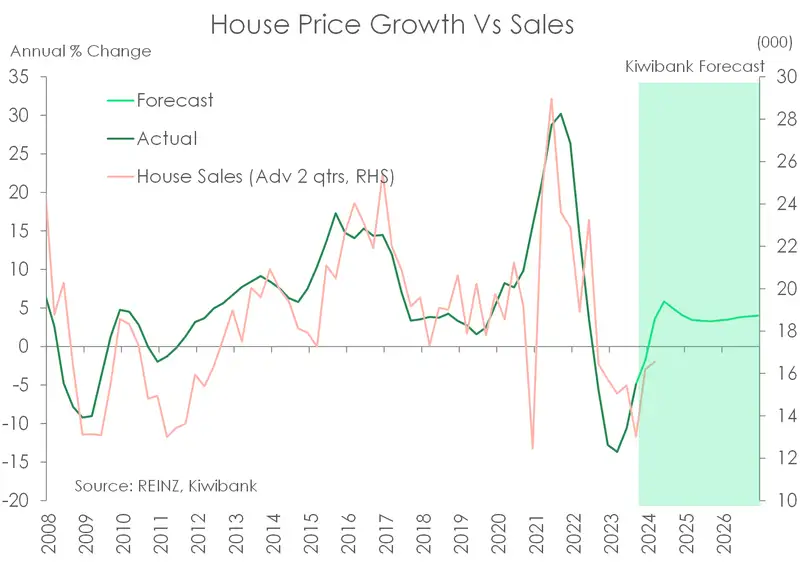

Forecasting is as much an art as it is a science. Looking to next year, the decline in interest rates will lift heads, attract investors, and boost confidence. Interest rates are the biggest driver. But the lift in migration has boosted rents, improving rental yields, and highlighted the shortage we still have in housing.

The demand/supply imbalance has worsened. The surge in migration and the loss of dwellings at high risk of climate change will only exacerbate the housing shortage. The Government will play a big role. Any added infrastructure spend or incentives for new builds will also be welcomed. Interest rates are playing a larger role, from now. Our best guess is house prices will rise by 5-to-7% over 2025. Call it 6% to sound precise.

For more detail on the drivers of the Kiwi housing market, see: “Kiwi housing: all you need to know for the great BBQ debate this summer.” We wrote the note in December last year, but the drivers and key messages are still relevant. We talked through the monumental movements in migration, and the chronic shortage of dwellings. Basically, we have a housing shortage, exacerbated by surging migration, complicated by climate change related risks, and our policymakers focus more on demand than supply. Supply is the issue. It is increased (or elastic) supply that will better balance our housing market. It’s not about limiting demand.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.