Everything that is wrong with our housing market is due to a lack of supply. But policymakers focus on demand. We need better infrastructure, more plots, more houses. And affordability will follow.

It has been a wild ride for Kiwi property. Surging migration, again and again, record low mortgage rates, and then the reversal, have seen property prices fluctuate wildly. What’s next?

Well, house prices are more likely to rise than fall, for the right and wrong reasons. Our housing shortage is getting worse. Activity is improving. And prices are stabilising. It’s déjà vu. Migration surges, prices rise.

Interest rates will play a big role. Rates may rise a little more. And then they may fall, later next year.

As we head into the holiday season, we need to prepare ourselves for the great Kiwi BBQ debate: housing. If you want to sound like an economist, (but hopefully with a bit more personality), here’s some tips, and crushing one-liners.

It’s all about supply! Stop talking about demand

Everything that is wrong with the Kiwi property market can be put down to supply, and a lack of it! We’re hopeless at building houses. And we refuse to build the infrastructure required to expand. We fail to maintain the infrastructure we have. But we insist on adding to the existing (creaking) load. The good news is, we learn from our mistakes.

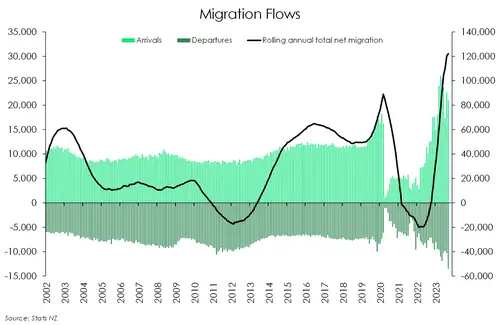

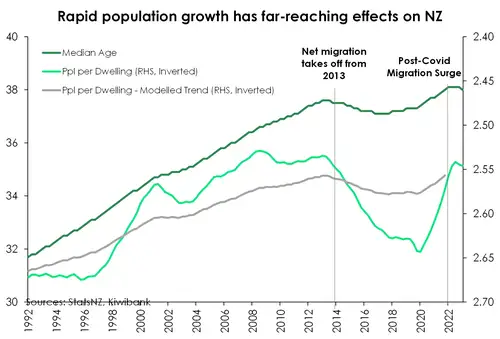

In this century alone, we’ve seen three significant spikes in population growth. At the turn of the century, we saw migration boom. The spike in migration led to a spike in demand for properties, both rentals and houses. House prices rose in response. Did we increase our spending on infrastructure (not to mention health, education and other services) to handle the flow of migrants? No. But we learnt from this mistake.

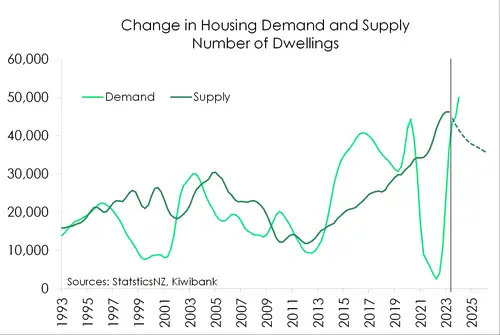

From 2013 to 2019, we experienced the greatest migration boom in recorded history. In 2018, we estimated the shortage in dwellings blew out to a frightening 100,000. The shortage worsened to 130,000 in 2019. Did we increase our spending on infrastructure (not to mention health, education and other services) to handle the flow of migrants? No. But we learnt from this mistake.

In 2020, we went into Covid fearing the worst. We locked down and closed the borders. We saw a net outflow of migrants. We allowed housing supply the chance to catch up. Supply outstripped demand, and our housing shortage improved. This was our best chance to eliminate the housing shortage. We did good, for a while.

But then the borders reopened. And over the last year we have seen a net 120,000 migrants enter Aotearoa in search of a home. That’s the largest increase we’ve seen in one year. Will we increase our spending on infrastructure (not to mention health, education and other services) to handle the flow of migrants? Probably not enough. But we will learn from this mistake [insert sarcastic voice].

Most policymakers focus on demand. It’s the side they can influence. More must be done to increase the supply of land (and all the utilities and services required) for development if we are to respond to surges in population. There are plenty of solutions, including self-fund infrastructure funds and scaled-up builders like Kāinga Ora. We just need the political will-power to execute. The troubles with KiwiBuild highlight the difficulty in getting things done, and deepens the fear of trying.

It’s all about improving the elasticity of supply. Now that sounds like an economist. If you want to sound like a normal human being, say “improving the ability to boost supply”.

So, what has happened?

It has been a wild ride for Kiwi property. We went into lockdown fearing deep double digit house price declines. But our models did not account for two things: First, an unprecedented lockdown forced us to spend (too much) time at home. But we came out with a greater appreciation, and a long list of things to do around the home. Spending on DIY jobs to full-blown renovations surged. We were working more from home, so we wanted to spruce up the place. It was the battle of the zoom backgrounds. More framed art, smart books and a fresh lick of paint. A blurred background was a sign of defeat – or a way to hide drying laundry.

With greater appreciation, came greater value. The covid lockdowns, along with working from home, meant we assigned a greater value to the home. And cheap money fuelled the revaluation.

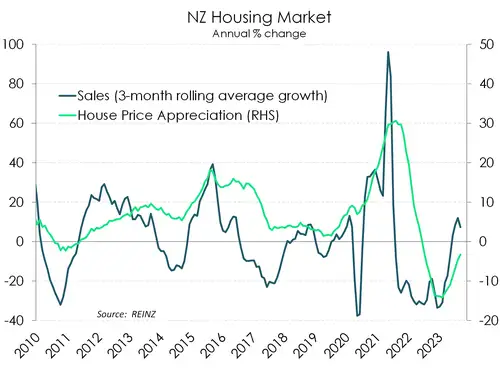

Secondly, the response to Covid was unprecedented. Billions, actually make that trillions, of dollars were pumped into economies around the world. Interest rates were slashed – some even went negative – and freshly minted, electronically printed cash found its way into asset markets. In New Zealand, the record low mortgage rates in 2021 turbo-charged a market already in hot demand. What we witnessed was incredible. The housing market recorded a massive 46% gain in just 18 months. From January 2020 to November 2021 the median house price went from $612,000 to $925,000. Extraordinary.

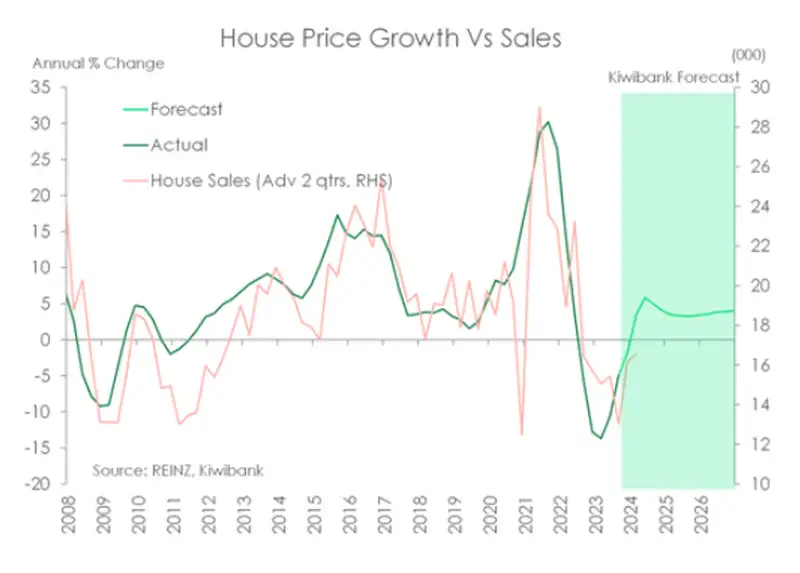

The rapid widening in inequality spurred policymakers into action. Housing became political. And investors bore the brunt of the backlash. We saw interest rates hiked at the fastest pace. At the same time, interest deductibility was phased out, the Brightline test was extended, and access to consumer credit (CCCFA) was tightened. The rapid rise in interest rates, along with the other changes, saw house prices correct lower. Investors have been silently side-lined. The result? We have seen a 17% peak-to-trough decline in house prices. The median house price fell from $925,000 at the peak in November 2021, to $770,000 in what looks like the trough in mid-2023. The median house price has crept higher, now at $795,000.

Houses are more affordable today than they were at the peak in 2021. But they are not affordable, for many. And they may become less affordable, for most.

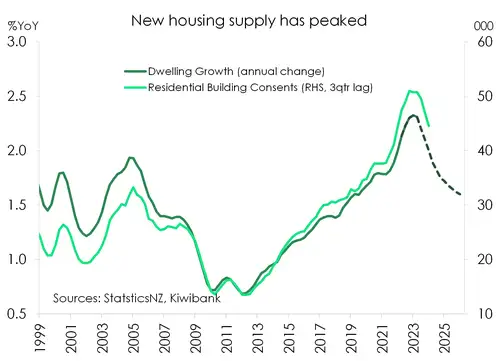

At a time when we need the supply of homes to surge, to meet migration demand, we’re seeing a fall in consents. Over the last year or so, the decline in housing activity and prices have seen builders scale back. It’s expensive to build in NZ, for a variety of unacceptable reasons. And developers are no longer getting the premium price they need. Pre-sales are also soft.

The good news, we’re getting builders. Our migration stats show us that the largest group of migrants are tradies. So we’re increasing our capacity to build. What we need is a stabilising in house prices – and it’s happening now – to shore up demand and therefore boost supply.

So, what can we expect?

Forecasting is as much an art as it is a science. But the data has turned north, and we can feel the lift in confidence amongst mortgage brokers, real estate agents, investors and customers. We think we’re much more likely to see price gains, rather than falls, over 2024.

The surge in migration will play a big role. The demand/supply imbalance will worsen. The surge in migration and the loss of dwellings at high risk of climate change will only exacerbate the housing shortage. The new Government will play a big role. Because the ‘promised’ reintroduction of interest deductibility, shortening the Brightline test timeline, and possible watering down of the CCCFA, will entice investors. Any added infrastructure spend or incentives for new builds will also be welcomed. Interest rates will also play a large role, eventually. We think rates will fall in 2024.

But buyer beware: The RBNZ is threatening to hike again. So there may be a lift near-term.

Our best guess is house prices will rise by 5-to-7% next year. Call it 6% to sound precise.

For anyone who has suffered their way through an economics course, you know we like talking in supply and demand. Demand is likely to outstrip supply. That puts upward pressure on price. It’s overly simplistic, (something that is frowned upon in the economics profession), but for every 120,000 people, we need roughly 50,000 new dwellings (with roughly 2.5 people per house). And if we follow the downtrend in people per house to say 2.1, a more ‘desirable’ number, we need more like 60,000. Regardless of your assumption, 2.5 or 2.1, we need more than we will build. We built 46,000 last year, a record effort, but that pace is slowing fast.

We expect supply to fall back into the low-to-mid 30,000s. The residential construction boom is cooling quickly. Supply is unlikely to keep up with demand for the foreseeable future. Unless we see some significant policy changes. So that’s a big factor behind our forecast.

Interest rates may be another supporting factor, eventually. We believe the RBNZ will keep the cash rate unchanged at 5.5%, well into next year. We’ve pencilled in rate cuts starting in November. We had thought this might come earlier, but the RBNZ is threatening to hike again. The RBNZ has also lifted their forecasts for house prices. And they don’t like the inflation implications that brings (it’s all about migration).

The forward indicators are turning positive

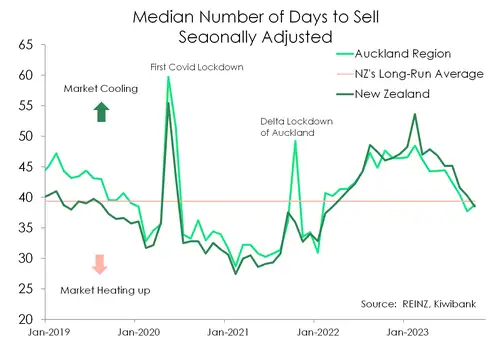

When we look at housing, there are a few high frequency indicators we like to help us gauge the strength of the market. Activity is one, days to sell is another.

“Days to sell” sounds obvious. And it is. We saw the average days to sell drop below 30 days, compared to a long-term average over 39, in the height of the 2020/21 house price boom. FOMO was very real for many would-be buyers. “You have to be quick” was heard from many real estate agents at the time. And prices kept surging.

In what was a dramatic turnaround, the days to sell blew out into 2022. The longer it takes to sell houses, the weaker the market. The “days to sell’ lengthened to over 50 days. Buyers had pulled back, and suddenly they realised they had time on their side (for a change). FOMO became FOOP (fear of overpaying). The gap between the price sellers wanted and the price buyers were willing to pay widened, with not a lot of activity in between. Prices fell.

Now, we’re seeing the days to sell fall back to longer term averages. The housing market is stabilising. Activity is speeding up. And there are more sellers meeting buyers. Sellers have reduced their expectations, and buyers are starting to pay up.

There are more transactions taking place. Sales have bounced strongly, off low levels. It’s a positive sign.

Remember, house sales had fallen a whopping 37% in 2022. So we’re bouncing back, strongly. And where sales go, prices follow.

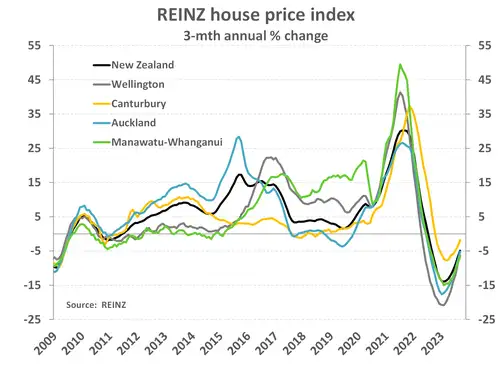

Regions are playing catch up

In Auckland, house sales have bounced 20%, having fallen 40% in 2022. And the average “days to sell” has fallen from over 50 days to around 39 days now. The “days to sell” back to normal. The rebound in activity, and drop in “days to sell”, has seen house prices lift 5% since May. House prices are down 2.5% over the year, and are off 20% from the November 2021 peak. But the momentum points to continued gains from here.

In Wellington, house sales remain soft, after falling 30% in 2022. Activity is taking a little longer to recover, but there has been a material decline in the “days to sell”. “Days to sell” have fallen from close to 70, to 38. House prices are down 3% over the year, and are off 21% from the 2021 peak.

In the garden city, Christchurch, prices have not fallen as far, and the rebound is a little more entrenched. House prices have fallen, but only -8% peak to trough. “Days to sell” is about average, and activity has picked up. Sales continues to record double digit annual growth, with a 13% rise over the last year.

Across the regions, the housing market is primed for a recovery. For much of the past two years, regional housing markets capitulated under the pressure of tightening CCCFA, rapidly rising mortgage rates, investor tax policy changes and stretched affordability. However, the correction may be over. And the regions are now playing catch up to major cities. But it’s still a mixed bag of gains and losses. Nonetheless, green shoots have emerged.

In the Bay of Plenty, sales activity has kicked up, and the “days to sell” has fallen from the lofty levels (over 70!) of last year. Confidence is returning, with “days to sell” back below 50. Given the long-run average of about 50, it’s a positive shift. Prices in the Bay are down just 2% over the year, and 15% from the 2021 peak.

In Northland, house prices declines narrowed to 7%. Sales activity is mixed. And we have yet to see a convincing return. Watch out over spring and summer.

Across much of the South Island, housing markets remain soggy, with weak sales activity and long “days to sell”. Prices are bottoming, and look to recover in coming months. Otago paints the picture. Sales activity was still weak in winter, and the “days to sell” are long and hard. But prices are improving. And we should see a bounce over summer.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.