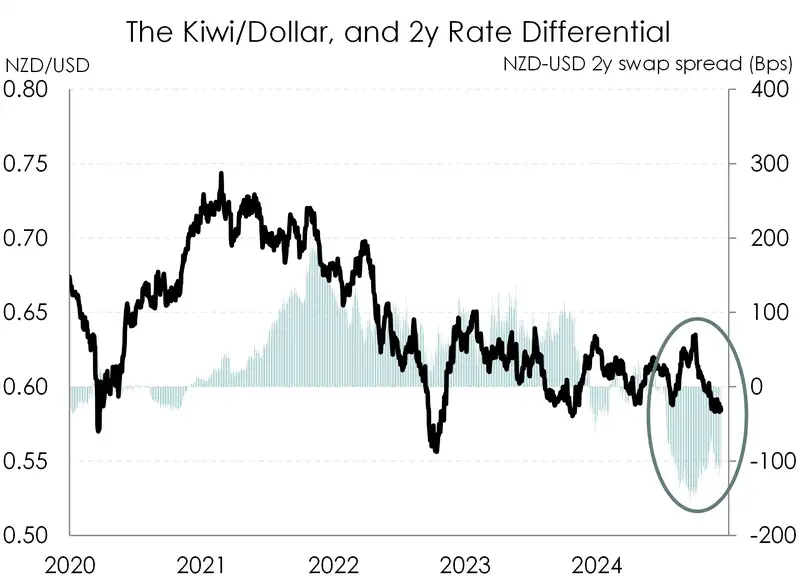

- The carry on the Kiwi has collapsed, with Kiwi cash cut below US cash, and creeping below Aussie cash, causing a calculated claw back in conspicuous longs. Interest rate differentials are working against the Kiwi, and will continue to do so well into 2025.

- If we put our previous forecasts under the microscope, the RBNZ has cut in line with our thinking … and we’ve been the most vocal in support of aggressive easing to reflate us out of recession. On the other side, the Fed has cut by less than we expected, and the RBA hasn’t even started yet. Both the Fed and RBA have surprised us on the slower to move, die from boredom, side of the ledger.

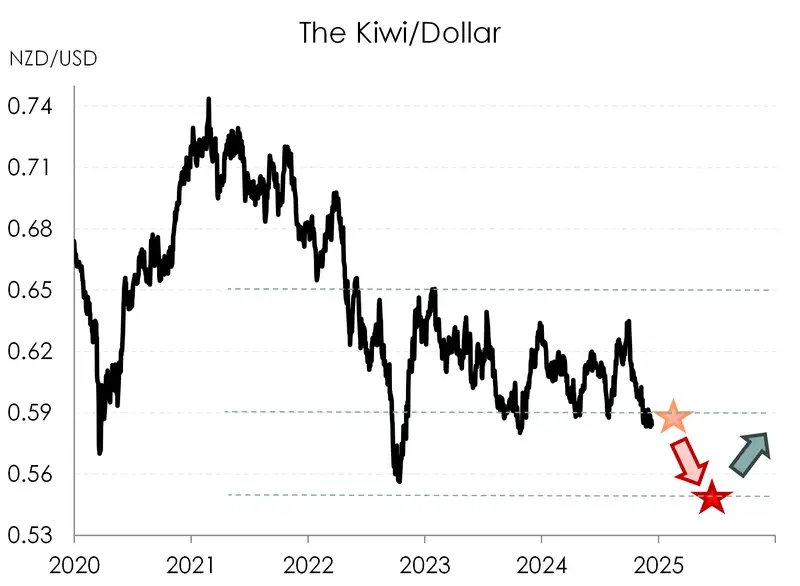

- The RBNZ will cut another 50bp cut in February, and another 25bp in either April or May. That’s fine. That’s priced. But it’s the inevitable move to 3% that’s not priced. And if we’re right, we’ll see the Kiwi currency crumble towards 55 cents. And it may be a year of two halves, with the Kiwi climbing in the second half. Stronger global growth means a stronger Kiwi.

Interest rate differentials can tell you everything you need to know in life… and even the meaning of it (if you love markets). And it is the differential that can drive investor flow. The famous Yen “carry trade” involved Japanese investors, including the fabled Mrs Watanabe or Kimono trader, taking cheap Japanese cash (with really low interest rates) and hunting yield (higher interest rates) elsewhere, especially in Kiwi and Aussie. Until recently, Kiwi offered higher interest rates than the US and Australia. That rate differential has reversed, reducing the attractiveness of the Kiwi dollar. And we expect that to continue as the RBNZ cuts to 3% next year, more so than the RBA and Fed.

In our last FX tactical, written in September, we said: “the RBNZ are responding – late, but in earnest. A rate cut in October is as close to a done deal as you get. In fact, we’d argue the only discussion should be on delivering 25 or 50. We’d advocate 50. And again, 50 in November... We argue the RBNZ needs to get the cash rate below 4%, asap.” The good news is the RBNZ did deliver, two 50s. And there’s another 50 scheduled for February, and 25 after.

And when thinking about the Kiwi against the Greenback, we noted in our last FX tactical that the “current economic conditions (i.e. the US needing a pacemaker, whilst NZ needing the defibrillator) means ultimately the RBNZ will either have to cut faster or possibly even deeper than the Fed.” And we targeted a move from the 62-63c range to 59c. Kiwi / Aussie was no different. We said “The interest rate differentials should see the cross trade lower. The RBA are comfortable to hold rates at their current restrictive levels for now... Once the cross breaks through the 0.9100 support level it opens up the 0.8900 level, which is where we see the cross belongs in the current rate environment.” The bird song remains the same.

As we think about the Kiwi headed into 2025, we see further downside risk. The bird is likely to trade towards 57c, and possibly 55c. Our traders are ‘odds on’ in favour of such a depreciation. And our economists agree, it would certainly help our exporters and tourism operators.

It’s a bit early to be talking about the next move in the Kiwi… but if we’re right, and the Kiwi economy recovers next year… then yeah, we will see the Kiwi dollar rise. But that’s a story for the second half of 2025.

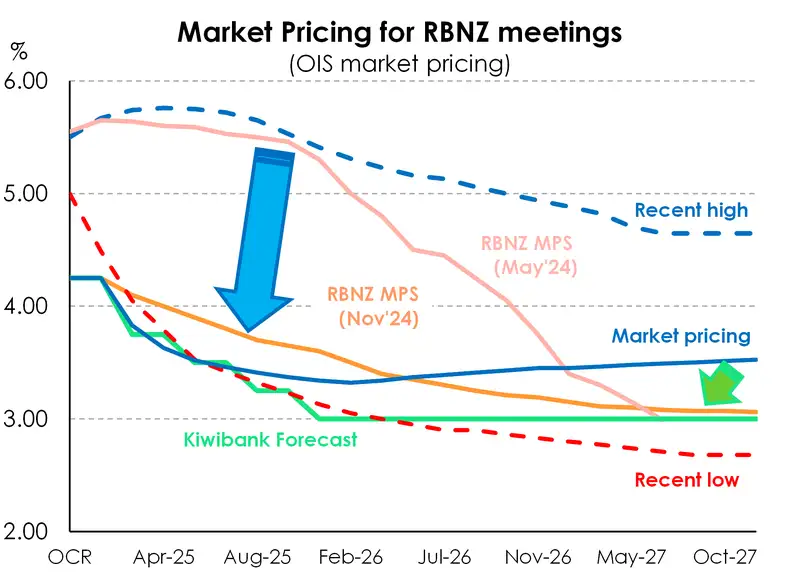

Kiwi rates are adequately mispriced

Our view on Kiwi rates is detailed in “'Alive: in 25' or 'thrive in 25'? Here’s our interest rate forecasts.” The crystal ball is cloudy, but the direction of the Kiwi cash rate is crystal clear. We need to see rates pulled lower over 2025, We have been fierce advocates of lower rates. We believe rates were hiked too high, for too long, and we’re suffering the consequences. The swift reversal of heavy-handed hikes is needed to limit the economic scarring.

If we look at the Kiwi wholesale rate curve, traders have adequately priced the next two meetings, in line with the RBNZ’s OCR track. But the market is mispriced over the medium term. Traders have placed 42bps into the February 2025 meeting, followed by another 31bps over the April (-20bps) and May (-11bps) meetings, taking the implied cash rate to 3.52%. And that’s pretty much it. Whereas we expect a continuation of cuts to 3%. That’ll add downside risk to the Kiwi currency.

Trading view, what’s next?

In our previous FX Tactical, we decided to change our view on the Kiwi. We altered our long-held bearish view from 0.5700 by year end, to 0.5900. A minor tweak that has played out as we envisioned. The deep, 2-year recession meant that the RBNZ needed to start cutting, and aggressively. This has now come to fruition. We have had 125bp of cuts now, and the RBNZ is committed to another 50bp cut to the OCR in February. RBNZ Governor Adrian Orr commented as much at the press conference following their final MPS for the year. Since the last FX Tactical, there has also been another spanner thrown into the works: Trump. When he is inaugurated in January, he is looking to put in place a raft of protectionist strategies for the US economy, the major one being tariffs. At this point in time it is very hard to know just exactly what these will look like. As one financial markets participant put it, it’s very hard to tell when he comes out on social media (of all places!) whether or not he means business. Is he “making a threat, a promise.. or is it a negotiation tactic?” Time will tell. But in the meantime, market participants have taken note. We have seen the ‘Trump Trade’ take centre stage over the last few weeks, with very little to tip the balance in the other direction. This has been very supportive of the US Dollar, and it was the final straw to tip the Kiwi dollar into the 0.5800-0.5900 range.

The interest rate differentials that were also a key part of our previous argument for a lower Kiwi, are still very much in play. The RBNZ are at this point in time, the most aggressive rate cutter in the G10. This may indicate that they perhaps raised the OCR a little too far, but it has appeared to solve the inflation problem, for now. Right now the OCR track is showing some aggressive cutting into the first half of 2025, and this will support our view for the Kiwi to track down to 0.5700 in the earliest part of next year, and from there down to the 0.5500 level. The unknowns around tariffs, will likely create volatility and a risk off environment for the Kiwi dollar to trade in, and we know the Kiwi doesn’t fare well in a risk off environment. The OCR track was of some confusion to us initially, as it seems to come to an abrupt stop in 2025 as far as a tapering down of rate cuts. However, there are some risks around the risk of ‘reinflation’ next year, and a large part of this is down to those Trump tariffs. Central Banks globally are already weary of the potential for their archnemesis, inflation, to come knocking on the door again. So we are picking a ‘game of two halves’ for the Kiwi next year. Initially the outlook is certainly lower, especially as it will take time for the cuts we’ve already seen, and the likely next one, to trickle down meaningfully into the economy. US protectionist political strategies on top of our already bullish view for the Greenback means it could get quite ugly for the Kiwi dollar. From there, once we do see a pick up in our own economic activity and the world gets used to Trump 2.0 in the White House, we see economic relief on the horizon. We expect to see the Kiwi bottoming out in the 0.5500-0.5700 zone and then slowly making a recovery from there.

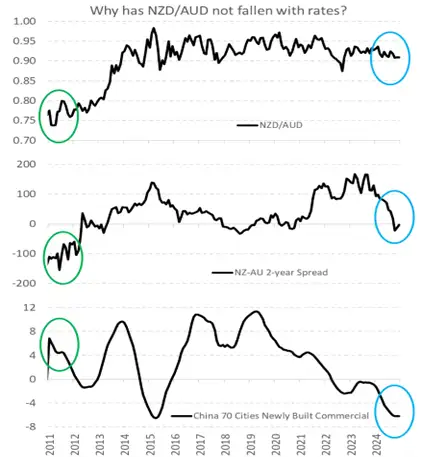

On a special topic: NZDAUD

We have been scratching our heads for some time, about why this cross isn’t lower. Interest rate differentials and overall economic performance variables between Aotearoa and Australia, should mean the NZDAUD cross is already below 0.9000. We did see this briefly, but it just keeps trading higher again. We have surmised that one of the major reasons that the Aussie is underperforming, is that we are yet to see any meaningful stimulus to China’ s economy. The Aussie economy is more sensitive to China’s economic performance. We have looked into Commercial building activity in China, and it has reached its all-time peak in our view, and is now very much stalling. This makes a huge difference to their demand for Australia’s iron ore products. If we were to see a meaningful fiscally designed boost to China’s economy, then this could very reasonably turn around quite quickly. And as for the interest differentials that we have long argued about, they are still there. Traders have been swinging their views on when the RBA is going to start their own cutting cycle. In the last few weeks we have seen them push these cuts from February out to May, based on the RBA’s meeting minutes which see them firmly on hold until they are more confident on inflation, but last week the Aussie GDP print was lower than expected at +0.8% y/y in Q3 (expectations were for +1.0%). Restrictive policy is biting, and traders have now moved their cutting view into April. Either way, the RBNZ will have likely cut another 50bp by then, and Aussie rates may still be on hold. The rate differential also supports a lower NZDAUD, into the 0.8800-0.8900 level. Watch this space.

– Mieneke Perniskie (Trader) & Hamish Wilkinson (Senior Dealer) – Financial Markets

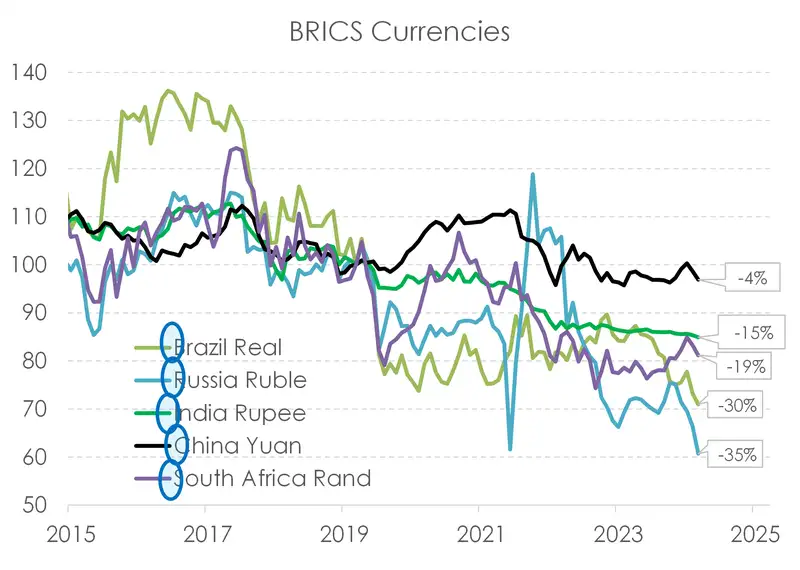

From the audience: BRICS and stones have broke my bones

When we’re on the road, we get a lot of questions on currencies. And there has been another pickup in questions around a BRICS currency. It’s an anti-dollar question. When will the US dollar be dethroned? Our thoughts on BRICS are simple. Take a look at each letter. B stands for Brazil, a commodity currency – not a bedrock currency you need in this block. R stands for wRong side of the war. I stands for India. Absolutely, we fully support this sentiment. Investment in India, either physically or through strengthened trade ties is essential for the next decade(s). India will be a star performer. Of course, the C stands for China, our largest trading partner. So yeah, we agree. But China’s managed currency is unlikely to challenge the US dollar. And now we have S for South Africa. You’re not really adding much here. Maybe in the distant future, but not now.

You can create your own BRICS currency if you want, just buy each currency independently. If you had done so 5 years ago, you’d be quite proud of yourself right now. You would have lost a big chunk (up to 35%) of your money.

The US dollar is the global reserve currency. The dominance of the US dollar in international trade means most central banks and financial institutions hold large amounts. The majority of FX reserves are held in US dollars. The US currency and debt markets are the most liquid in the world. And liquidity (the ability to buy and sell, especially in times of stress) is important..

The next most traded currency is the Euro, but it is nowhere near as popular as the US dollar. About 60% of global reserves are held in dollars, with the Euro attracting only 20%, according to the IMF. BRICS are not yet part of the equation. And cryptocurrencies will continue to emerge, and gain in importance. Cryptocurrencies have a better chance at dethroning the dollar, but maybe not in our lifetimes. Central banks, including the Fed, will fight back with CBDCs. Watch this space. In the foreseeable future, at least, the US dollar will remain on top.

– Jarrod Kerr, Chief Economist

Kiwi crosses in the months ahead

NZDUSD (5-year weekly)

a brave call became reality! As we anticipated in our previous update, following a failure to clearly breach the Dec 23 high at 0.6360, NZDUSD spent much of the previous quarter under sustained downward pressure. Heavy RBNZ easing, combining with Trump trade dynamics that provided support to the US Dollar, the Kiwi now finds itself back within its longer-term downtrend once more. From here, the current zone back to the post Covid 2023 low of 0.5774 is being closely watched as key support by market participants. With a potentially rocky period ahead of political change in the US ahead, we are anticipating this level to be challenged and likely breached – particularly with the RBNZ set to deliver another 50bp of easing in February. From there, watch for moves towards 0.55 / 0.56 cents on the downside. On the upside, previous trend resistance currently circa 0.6000/20 will need to be cleared prior to finding further bullish momentum back towards previous 2024 highs.

NZDAUD (2-year daily)

The cross continues to defy logic. We think we might have cracked the fundamental reason why NZDAUD is not trading below 90 cents as detailed in our “Special Topic” section above. Currency markets are not always driven by interest rate expectations. If they were, NZDAUD should be trading at 88 cents by now! Looking ahead, we are watching key upside levels at 0.9140 and then 0.9170 to understand if the cross can continue to outplay its doubters. From there, 0.9265 and then the 93s become a possibility – but this is not our favoured view. On the downside, the newly created double bottom at 0.8944 is clearly in our sights for an eventual move towards 88 cents.

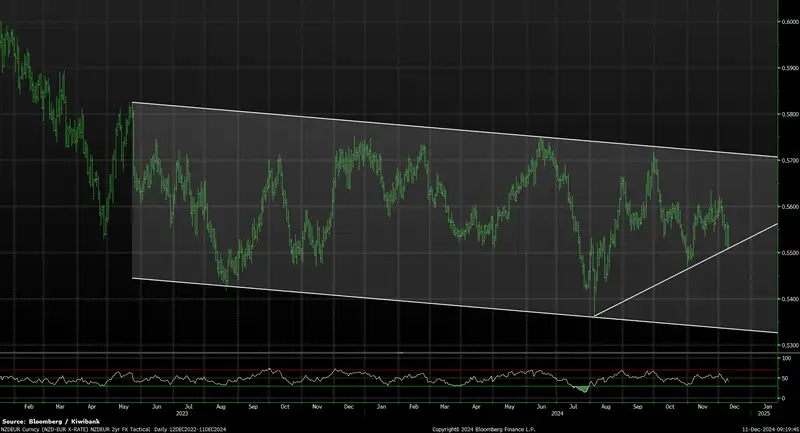

NZDEUR (2-year daily)

With a broadly soft growth outlook across the EU, the risk of US tariffs and traditional powerhouse manufacturers (auto etc) under pressure from a lack of Chinese demand (as well as competition), despite concern of inflation flare-ups, the ECB is expected to continue easing policy into 2025. Current market pricing reflects 150bp of monetary easing – taking the effective ECB rate to below 1.7% by November 2025. This will likely see EURUSD underperformance in the near term, but NZ vs EU rate differentials are likely stay in its current state should the RBNZ ease to a 3% OCR over the same period. For NZDEUR, this should help to provide some form of support around 0.5510 and then down to 0.5420 but moves to the upside beyond 0.5700 will be challenging for now.

NZDGBP (10-year weekly)

In our last update, we favoured a move towards 0.4550 by Xmas driven by the need of aggressive RBNZ easing and a somewhat cautious approach to monetary easing from the BOE. This has proven to be correct as of this week. From here, the BOE provided recent guidance that it expects to deliver a further 100bp of easing over 2025 – taking the UK benchmark rate to a level of 3.75%. Given our current expectations of the OCR needing to reach 3% by the end of 2025, we would expect to see continued downside pressure on NZDGBP. In the shorter term, the current 0.4550 Brexit support level will be a key level to this wider story. Whilst it would be unsurprising to see some support at this level – potentially enacting a move higher back towards 0.4680, ultimately a break of 0.4550 opens up further downside risk from a technical perspective with the historical 10-year 76.4% retracement level of 0.4453 in target in the coming quarter.

NZDJPY (3-year daily)

Despite finding near term support from recent oversold bouts of price action, we ultimately expect to see continued declines as both NZ and JPY rates converge on each other. Whilst it is still hard to envision a world of neutral or negative NZ vs JPY rate differentials, the spread between NZ and JPY 2 year Govt bonds have narrowed by circa 250bp since late 2023. We would expect this theme to continue into 2025 as the BOJ continues to tighten policy. Shorter term, 86.80 provides near term support, and upside resistance into the 61.8% retracement level at 92.94 provides a target for JPY buyers. 80.50 remains a clear medium term downside target and our preferred direction of travel.

Glossary

Commodity currencies: include the Kiwi dollar, Aussie dollar, Canadian dollar, Norwegian krone as well as currencies of some developing nations like the Brazilian real. These countries export large amounts of commodities (raw materials like oil, metals and dairy) to the world. And commodity currencies are highly correlated with the global prices of such commodities. When the global economy is strong and demand for commodities is high, commodity prices and thus commodity currencies, tend to outperform. The Aussie and Kiwi dollars are famously known for the sensitivity to good news (risk on) and bad news (risk off).

Interest rate differentials: The difference between the interest rates earnt on two different currencies. New Zealand may offer a significantly higher interest rate than those in Japan, for example, and we see an inflow of Yen into Kiwi dollars (known as the “carry trade”). The widening, and narrowing, of interest rate differentials can have a material impact on capital flows and therefore the exchange rate.

Monetary hawk (hawkish) and Monetary dove (dovish): Characterisations of central bank monetary policy. The hawk is a bird of prey and describes a central bank aggressively raising interest rates to slow economic growth and tame the inflation beast. The peace-loving dove however, reflects a central bank trying to stimulate economic growth by cutting interest rates.

Moving averages: A common method used in technical analysis to smooth out price data by showing the average over various time periods.

Relative Strength Index (RSI): is a popular momentum indicator used by forex traders to measure the speed and change of movements in currencies. It is a useful tool to evaluate overbought or oversold market conditions, in turn signalling whether a currency pair is due a trend reversal or a corrective pullback in price. Low RSI levels indicate oversold conditions (buy signal), while high RSI levels indicate overbought conditions (sell signal).

Reserve currency: The US dollar is the global reserve currency. The dominance of the US dollar in international trade means most central banks and financial institutions hold large amounts. The majority of FX reserves are held in US dollars. The US currency and debt markets are the most liquid in the world. And liquidity (the ability to buy and sell, especially in times of stress) is important. The next most traded currency is the Euro, but it is nowhere near as popular as the US dollar. About 60% of global reserves are held in dollars, with the Euro attracting only 20%, according to the IMF.

Safe haven currencies: A safe haven currency is one where investors hide from extreme market turbulence. The US dollar tops the list of safe haven currencies. But the Yen and Swiss Franc are also beneficiaries of save haven flows (money searching for safety). If a war breaks out tomorrow, we’re likely to see a spike in the USD, Yen, and Swiss Franc. The Kiwi dollar would be hit quite hard, and fall against these three currencies. Gold is also considered to be a safe haven asset during times of stress.

Support and Resistance levels: These are chart levels that appear to limit a currency’s price movement. A support level limits moves to the downside; a resistance level limits moves to the upside.

Terms of trade: The ratio of the prices at which a country sells its exports to the prices it pays for its imports. Put simply, terms of trade is a measure of a country’s purchasing power with the rest of the world. How many imports can be purchased per unit of exports – import bang per export buck. An increase in our terms of trade means New Zealand can purchase more import goods for the same quantity of exports. And a rising terms of trade lifts the incomes of exporters and the businesses and communities that support them.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.