“And I tread a troubled track, My odds are stacked, I'll go back to black.” Amy Winehouse

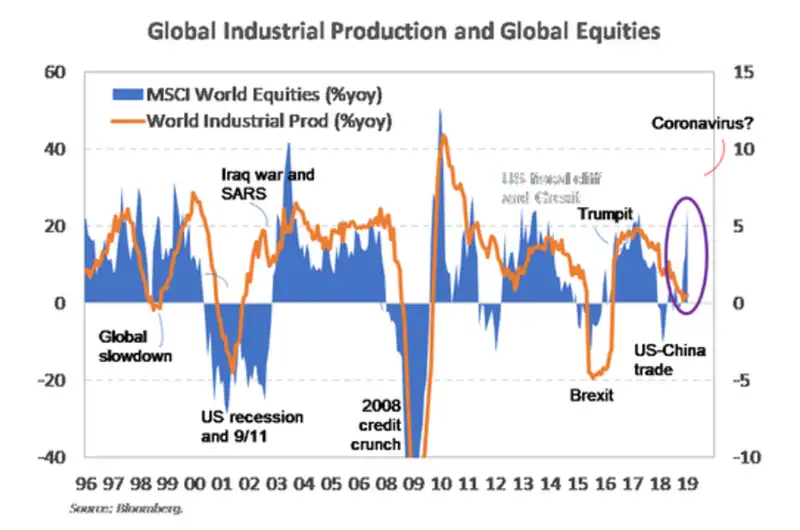

Global output strengthened from last year’s lows, but will take a hit in the first quarter. We believe recession is unlikely, and 2020 will shape up to be a good year for financial markets.

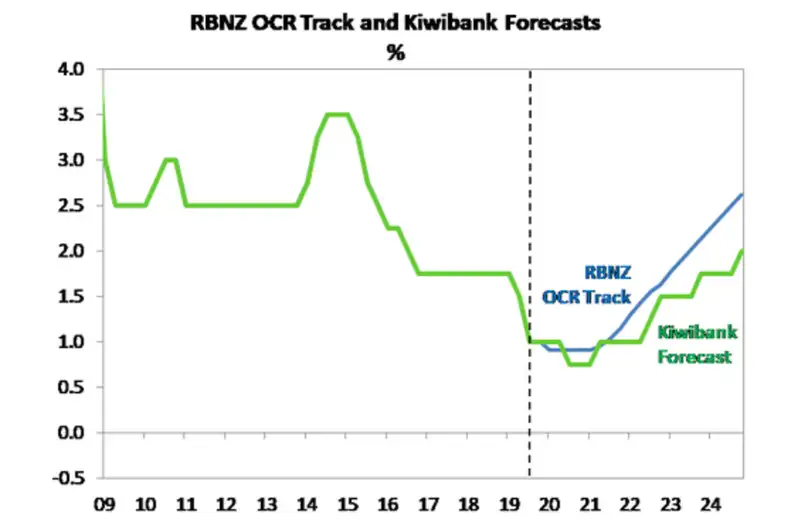

We expect the RBNZ to cut once more. But mortgage rates may rise into 2021. And the Kiwi flyer (NZD) to end the year higher.Jarrod Kerr, Kiwibank Chief Economist

We expect the RBNZ to cut once more. But mortgage rates may rise into 2021. And the Kiwi flyer (NZD) to end the year higher.

Financial markets have risen from the depths of despair, but are plagued with the coronavirus. The US-China trade truce and the decisive Brexiteer election win, enabled a strong finish to 2019. The ‘whatever it takes’ monetary policy mantra, and growing fiscal urgency, are powerful backstops. But the path higher is fraught with danger. The coronavirus outbreak is now a global public health emergency and will impact global activity.

The coronavirus draws comparisons to the 2003 SARS outbreak, impacting confidence, supply chains, and tourism. But comparisons are problematic. China’s economy today is much larger, more integrated (with more Chinese travelling abroad), and more urbanised. The threats are simply greater. And more boarders are being closed to people arriving from China, including NZ. Time will tell, but traders are nervous.

Heightened uncertainty reflects the many risks from green swans to grey rhinos. The rampant rise of the green swan, the climate change black swan (really rare and really bad), will continue to alter investment decisions. Investors must try to account for potential impacts of climate change and carbon reduction on entire industries, and countries. The rampaging grey rhinos (well known, still bad) locking horns include China and the US, and the Brexit battle-scarred UK and the EU. The peak in globalisation occurred with the rise in populist protectionism. Threats to global trade threaten Kiwi exports. But in an exciting development, we have spotted the long-lost fiscal elephant. Conspicuously absent for decades, the fiscal beast has entered the room. The Coalition’s $12bn infrastructure pledge is a belated positive. Now we can forecast more investment, and eventually more productive growth. The fiscal impulse has the potential to be the most important Kiwi economic development in years.

On balance, we expect markets to perform reasonably well over 2020. Because expansive monetary and fiscal policy will be deployed together, as ‘friends’. If so, we will grow. Equities can rebound once the coronavirus is contained, and continue to climb, with secular low discount rates. Interest rates are likely to grind higher without reaching uncomfortable levels. The sensitivity to interest rates is acute. But the demographic influence will keep interest rates well below historical norms. Monetary policy is unlikely to be tightened this year, or next, and remain well below estimates of ‘neutral’ (neither helpful nor harmful) for the foreseeable future.

We forecast equity markets and interest rates to end 2020 higher, after a very disruptive start. Mortgage rates should start to drift higher into 2021. And we expect the Kiwi dollar to rise as risk appetite improves with global growth.

Some unholy war: still rages

“He still stands in spite of what his scars say. I'll battle till this bitter finale.” Amy Winehouse

Early last year, we said “Financial markets are laced with red hot chilli pepper risks: including Brexit, US-China trade, and a loss of economic momentum” in Blood, Sugar, Brex-Magik: markets high on risk. These risks continue to dominate today. And we now have the coronavirus to deal with.

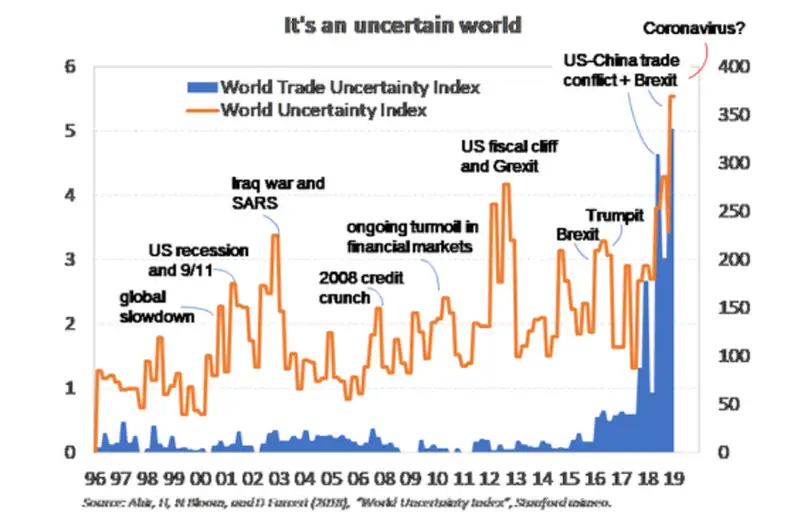

The World Uncertainty Index (WUI) has spiked off the chart. And the spike predates the coronavirus outbreak. There are always risks in financial markets, traders revel in them. At the turn of the century, we worried about the global outlook, and we were rocked by 9/11. Then we saw military action in Iraq, and a SARS outbreak in 2003 (too familiar). Markets then melted in the 2008 ‘credit crunch’. The crisis exposed overleverage and spawned an age of growth sapping regulation. The US fiscal cliff served a stark warning. And Grexit questioned the existence of the EU. The recovery was shackled with regulation and riddled with poor income distribution. Disheartened voters turned populists. And populism produced the promise of change in Trump and Brexit. But during all of this, China expanded its global reach, as traditional Western powers took a backward step.

The US trade (technology) war with China is a battleground for pushback against expanding Chinese political influence, delivered on belts and roads. Underneath the spike in the World Uncertainty Index lies the uncomfortable truth. There’s been a surge in trade protectionism, and trade uncertainty. If a phase II deal is done, markets will grow in confidence. But we doubt the US-China tussle will end, if Trump is re-elected.

Not yet recorded in the WUI data (up to mid-January), is the impact of the coronavirus. RBNZ Assistant Governor Christian Hawkesby referred to the Coronavirus outbreak as a "human tragedy that has emerged that we will need to monitor… provides some potential parallels [to SARS], particularly through the effects on travel and confidence".

When we compare the 2003 SARS outbreak, there are some obvious comparisons, but the scale is glaringly larger today. China’s US$1.7trn economy represented 4% of global GDP in 2003. Today, the world’s 2nd largest US$14trn economy is worth 16% of global GDP. China’s population is more urbanised today at ~60%, compared to ~40% in 2003. The denser population, in larger cities, and with greater ease of travel (domestically and internationally) mean the potential spread of the coronavirus is far greater. And China’s greater global outreach means the likely economic impact is far worse. Cities in lockdown and travel bans will hit Chinese output, depress Chinese demand, and significantly impact Chinese tourism (the most obvious impact on New Zealand’s economy). Global supply chains will also be disrupted. Despite the speed at which officials are responding (after a hesitant start) the virus could take months to contain.

The virus will spread further, before it is contained. And markets will get worse before they get better. Risk assets (equities and NZD) will remain under pressure and safe havens (bonds and gold) will remain sparkly and attractive. An end to the outbreak will see risk assets bounce strongly.

Global growth is forecast to come in at 3.2% in 2020 by the IMF, up from 2.9% in 2019. We were headed in a better direction. But now the coronavirus outbreak will have us scrambling to downwardly revise forecasts. Luckily the economy is working off a stronger starting point. Business confidence had improved. And interest rates had risen with upgraded expectations for growth and inflation. We’re in a better place, psychologically and physically. Decisive action by health organisations, central banks and governments should lessen the impact, and return markets to the course set in late 2019.

We must also remember we’re in an election year, both here and in the US. Leaders struggle to stay in power when the economy is faltering. Trump is in re-election mode (we’re not sure he left election mode to be fair) and should do what he can to shore up confidence. Remember, he wants the S&P 500 higher by year end. Trump is one of the most sensitive US presidents to movements in the S&P 500. No surprise…

At home, the coalition is up for re-election. Armed with a mighty fiscal war chest, we are seeing a step shift in infrastructure investment. Public opinion has shifted in favour of the coalition using cheap Crown funding to address the burgeoning infrastructure deficit. Interest rates are at record lows, and Crown debt is amongst the lowest in the world (no matter how you measure it). A point we’ve been banging the table about so hard, it hurts. Expansionary fiscal policy has helped turn business confidence. And we expect much more in an election year. Fiscal policy is now a helping the RBNZ.

Rehab: more stimulus is a must

“And it's not just my pride. It's just 'til these tears have dried.”

We entered 2020 with interest rates bouncing high off the Sep’19 lows. The US 10-year Treasury bond rate had surged from 1.42% to 1.95%. All that optimism has unwound in the last few weeks, with the US 10-year rate back to 1.50%. And interest rates are destined to fall further as the outbreak continues. Kiwi Government bond rates followed a similar path, rising and falling. The NZGB 10-year rate has dropped from a recent high of 1.67% to just 1.23%. And it won’t take much to get back towards 1.0%.

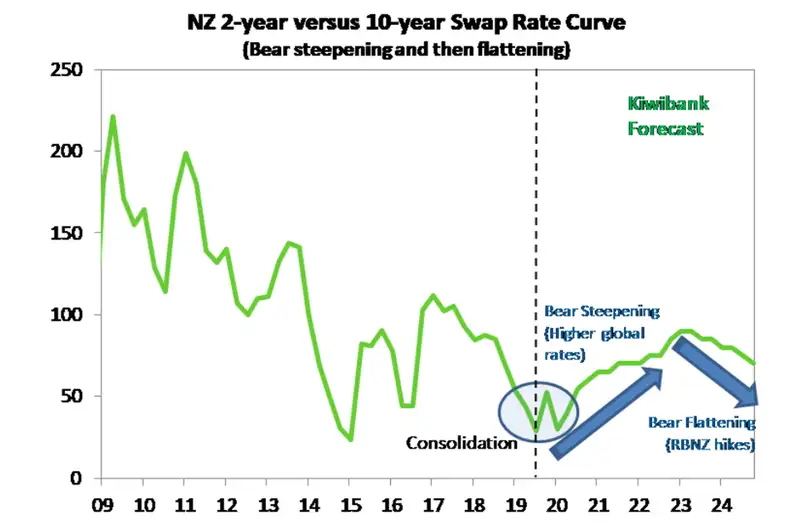

Longer dated bonds (5-years and out) have fallen further and faster than shorter dated bonds (0-3 years). An inverting yield curve is one of the preferred ‘recession’ indicators, globally. An inverted yield curve signals monetary policy today is too tight (with cash rates too high) to generate growth and inflation tomorrow. Traders are betting on a coordinated response from central banks. And it won’t take much for central banks to put their foot on the accelerator again. Because the risks are still asymmetric, to the downside.

China’s central bank has cut interest rates and started pumping cash into the system as part of emergency measures. The US Fed, currently on hold, is likely to cut again this year. And we are likely to see more stimulus from other central banks as well. The path will be paved for the RBNZ to follow. And let’s not forget the devastation from the Australian bushfires. The RBA are likely to cut the cash rate to just 0.25% this year.

The question for us now is whether enough has been done, and how confident we can be of sustainably achieving our dual policy mandate for inflation and employment.Christian Hawkesby, Assistant Governor, RBNZ

It could be argued that the RBNZ had seen enough, with the positive developments of late. The RBNZ cut the OCR 75bps last year to 1.0%, and signalled an ‘on hold’ stance with a slight easing bias. Since then, business confidence has improved, the housing market (especially Auckland’s) has accelerated, and the bank capital changes were made more palatable. Inflation has lifted a little higher than forecast, and the labour market remains tight (although not tight enough). Even without the coronavirus, however, we argued for another cut to 0.75%. We believe more is needed to ensure the economic uplift lasts into 2021. The likely impact from the coronavirus only supports the need for another tweak lower.

We believe there is 60% chance of another rate cut to 0.75% in this cycle. We’ve pencilled in August, but an earlier move May is possible. Of course, there remains a 20-30% risk the world enters a more severe downturn, and greater action is required. If it gets bad enough, negative rates, money printing (QE), currency intervention, strong forward guidance and wishful letters to Santa may be deployed. But we’re far from that. The point here is, the market will price in rate cuts until the coronavirus is contained, and global growth rebounds.

Market pricing has a low in cash rate expectations of 0.79% by mid-2020, or 21bps of a 25bp cut (85% chance). We think market pricing can go a little further, towards 0.7%. The 21bps could grow to 30bps to account for a full 25bps (100%) cut plus 5bps risk of another (20%). Wholesale interest rates can fall a little further from here, and into the second quarter.

Hopefully it’s a game of two halves

We forecast wholesale interest rates to end 2020 higher, in what will (hopefully) reflect positive developments. It’s around the middle of the year we expect the post-coronavirus bounce to really take shape. For the first time, in a long time, interest rates may end the year higher (not lower). If we’re correct and growth lifts over the second half of the year, interest rates will rise. Because traders will naturally start to factor in the chance of rate hikes in late 2021 and beyond.

As wholesale rates make a sound recovery, and lift towards the highs we saw just a few weeks back, funding rates rise. Fixed mortgage rates offered by the major banks will start to creep higher into 2021. Banks use swap rates to hedge the flow of mortgages onto fixed rates. The benchmark 2-year swap rate is 1.07% today. We forecast a fall to 0.95-to-1.0% near term, before a recovery towards 1.4% by year end. If that’s the case, the 2-year fixed mortgage rates could dip initially, before climbing into 2021. Similar moves will be likely across the 1, 2, 3 year and longer tenors. 3.5% mortgage fixed rates could become 3.75% rates. But we doubt they’ll break through 4% this year, and we doubt they’ll break through 5% next year.

A moderate rise in interest rates will temper equity markets. But policy makers are unlikely to jump in and start tightening any time soon. We expect the RBNZ (and most central banks) to keep financial conditions as easy as possible. So with interest rates rebounding, but not spiking dramatically, currencies are where the action is.

Currencies will continue to generate significant volatility as the relativities between nations remain difficult to predict. A lower Kiwi currency will provide a much-needed lift to our small, open economy. The problem with currencies, is they’re a relative price. Unlike magnificent interest rates, that can all fall together, currencies are a different beast altogether. Currencies can’t all fall together. And the time may have come for the Kiwi to grow some wings.

We forecast the Kiwi flyer to end the year higher

Our NZD/USD forecasts have barely changed from early last year, but the complexities around the forecasts have changed substantially. The Kiwi should drop into the low 60s near term, as the impacts of the coronavirus come through. Another RBNZ rate cut will assist the Kiwi’s decline. At 65c today, the near-term risk is asymmetrically lower. We expect to see the Kiwi hit 63c, possibly 61c. But by the end of the year, we expect the world to have returned to the path set at the end of 2019. Risk assets should rally back. And with a rise in risk appetite, the Kiwi flyer surges higher.

Our day will come (NZDAUD parity) if we wait a while

“Our day will come, if we just wait a while.” Amy Winehouse

Go on, send out the parity party invites (again), it’s good to remind everyone it’s possible. Just don’t book the venue. Parity between the Kiwi and Aussie currency cross has been called for since the mid-1990s. The closest we came was in April 2015. I know, I was working on an Australian trading floor at the time. I had a small sack of Kiwi dollar coins. And I was going to pelt the room. We got to 0.9980 (just 20pts away!), then all dreams of parity faded away. Just as all dreams of parity have eventually popped in the post-float era. But here we are again. Traders dreams of NZD/AUD parity are back, and worthy of a mention.

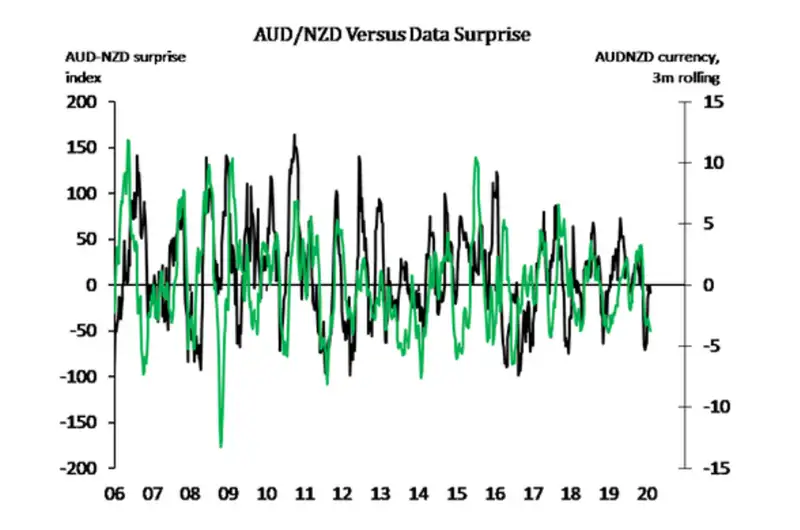

New Zealand’s economic fundamentals have been relatively favourable to Australia’s for a while now. And the bushfires have ravaged a nation already lacking confidence. The economic impacts of the bushfires are being recalibrated higher, and could take 0.5%pts off GDP growth. But then there’s the (offsetting) boost from the rebuild to come through later in 2020 and beyond. In the meantime, the RBA is likely to cut the cash rate to 0.5%, possibly in February, and keep moving to a self-imposed low of 0.25%. That’s all we expect.

There is a real risk, however, that the RBA conducts a strong and forceful quantitative easing program. If needed, the RBA could embark on uncharted territory and buy Government bonds to the tune of A$2-3bn per month, with a goal of removing duration from the tightly held Commonwealth Government Bond (CGB) market. The RBA could easily take down 20% of the CGB market in time, and take 50-to-100bps off the long-end of the Aussie curve. With RBA cuts and talk of money printing in mind, the RBNZ’s ‘on hold’ stance looks relatively rock solid. At least until the same Chinese linkages, and the fact Australia is our second largest trading partner comes back to bite. It’s hard to see a world where the RBA are forced to conduct QE, and the Kiwi economy is unscathed by such forces. Therefore, the RBNZ would likely cut towards 0.25% themselves in such a world. But we’re talking currency markets. It’s all about timing, and the love of volatility.

It is entirely possible to see NZD/AUD parity. And yes, it would be great to see, if only for bragging rights. But expect we won’t. The NZD/AUD cross is struggling to break 97.5. It’s a long climb from 97 to 98. And it’s an even steeper climb from 98 to 99. And we seem to get altitude sickness thereon. But never say never.

We forecast immediate NZD/AUD strength, and we expect a grind towards 98. But that’s as excited as we get, sorry. We expect to end 2020 close to where we started at 97. Conviction on the widowmaker is low. That’s an economist’s way of saying: we’ve been through all the drivers of the currency in great detail, and still have no idea where it’ll end. Have fun.

If you’re an exporter, hedging exposures to a rising currency can assist.

If you’re an importer, stop smiling, it hasn’t happened yet.

The Kiwi dollar is on a glidepath higher

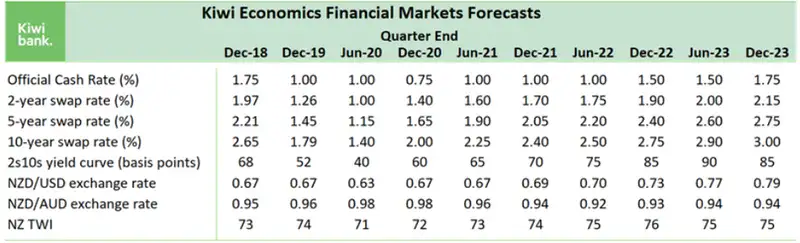

Table 1: Kiwibank’s key financial market forecasts

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.