The backdrop

With pandemic-related supply disruptions and unprecedented amounts of fiscal and monetary stimulus, a familiar foe has emerged – Inflation. Globally, the inflation rate is running at an uncomfortable 9%. Here in New Zealand, inflation sits at a 32-year high of 7.3%. Central banks from Washington to Wellington have been playing catch-up to rein in rapidly rising consumer prices. Cash rates have been lifted steeply, and the liquidity tap (QE) turned off.

There are signs that inflation may have peaked. Because commodity prices, especially oil, have eased back materially in recent months. But the main concern is the strength in domestically generated inflation. Overstimulated demand and acutely capacity-constrained economies have created a breeding ground for inflation. Tight labour markets too are translating into rising wages. More tightening of monetary conditions is necessary to prevent inflation from becoming further embedded.

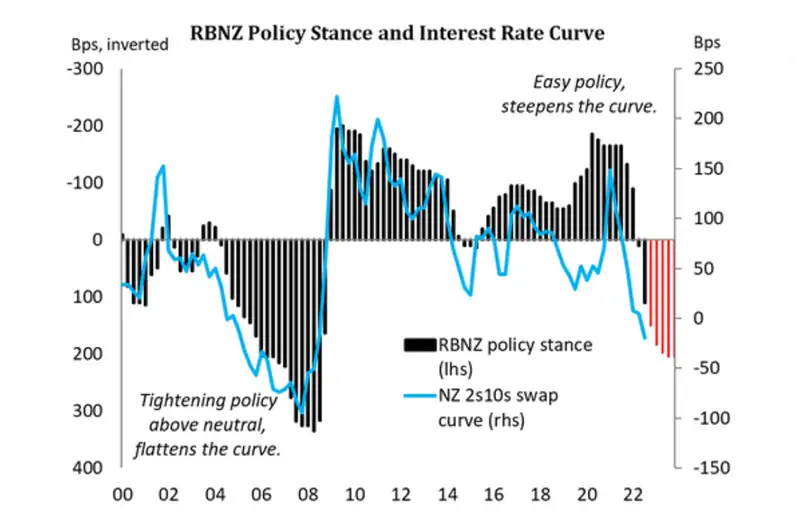

The more central banks tighten, the dimmer the economic outlook. And the recent inversion of the Kiwi swap curve is ringing the recession alarm bells. Short-end wholesale rates have been shunted higher as the RBNZ tightens monetary policy. But the higher interest rates go, the greater the downgrade in growth projections, which is pulling down long-end rates. Traders often take this inversion as a signal that a recession may be on the horizon. We are wary of the growing downside risks to economic growth. Consumer confidence is at recessionary levels, the housing market is in retreat, and firms’ investment intentions are deteriorating. A slowdown in domestic demand is needed to return inflation to target. But with an incredibly tight labour market, the New Zealand economy should be able to avert a recession, for now.

For currency markets, much of the focus in the past 6 – 9 months, has been on the timing, size and ultimately the terminal level of global central bank tightening. Inflation and interest rates have been the words du jour for market participants for many months now. Following a period of arguable consolidation as markets zero in on anticipated peaks in monetary cycles, recent weeks have started to indicate a potential for currency markets to make a move outside of the fairly tight ranges in which they have recently traded.

The US Dollar has been of major focus

When it comes to ultra-hawkish monetary policy settings, the Fed is considered the ‘biggest bull’ in the room. But with inflation potentially having peaked for the US, there’s a possibility that the Fed will not need to hike rates as aggressively in the coming months. However, it is still almost a certainty that they will meet current market expectations of an approximate 3.5% Fed Funds rate by Xmas, and a touch higher into 2023. More tightening is clearly needed to ensure inflation is indeed brought back under control. From this point, expectations have started to build for rate cuts in the second half of 2023 in the US.

This “peak” rates story has seen a reversal in the Greenback’s seemingly endless rally. A falling US Dollar should provide a boost to riskier currencies, like the NZ Dollar. It’s a play we saw unfold following a slightly softer US inflation print. The Greenback weakened, and the Kiwi rallied to 0.6450. So where to from here? We see the Kiwi benefitting from a continuation of the anticipated 2023 intertest rate differential play, strong NZ terms of trade and the slight hint of a soft landing in the US supporting risk assets – including the risk correlated NZ Dollar. But this will be highly dependent on the Fed’s approach into the end of the year. There will likely continue to be dips in the Kiwi with the ebb and flow of risk sentiment, as we wait to see the outcome of a soft landing versus a recession. US Dollar sellers should look to take advantage of such opportunities as they arise.

In the Kiwi crosses

For now with both the RBA and RBNZ interest rate tracks on a similar path, seeing a terminal rate achieved mid-2023, NZDAUD will likely continued to be supported from the 0.8900 / 0.8950 area. Given the earlier discussed improving risk appetite story into the end of 2022, we hold a small upside bias in NZDAUD until such point that a divergence in current interest rate differentials develops.

Across the globe

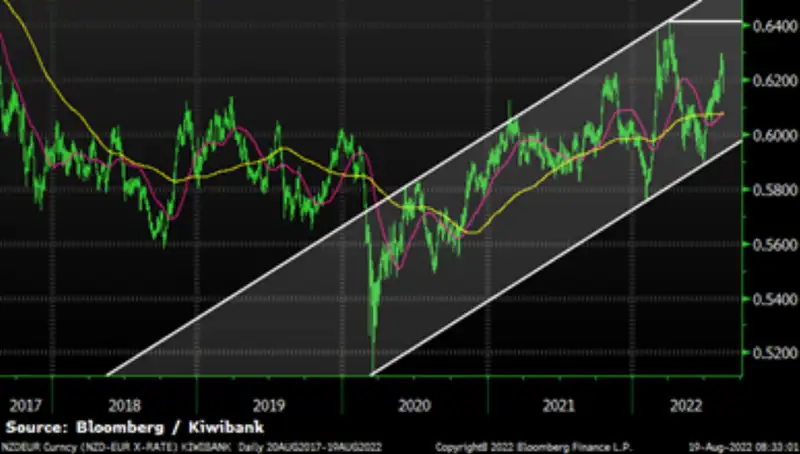

In Europe and the UK, the story is quite complex. With inflation continuing to surge as a result of ongoing energy concerns from the Russia/Ukraine conflict, both the ECB and BOE have a significant balancing act of tightening policy yet avoiding a longer-term recession as the northern hemisphere heads into the winter months. For now, markets are very sceptical that a soft landing can be achieved. Whilst economic textbooks point to a tightening of monetary policy supporting the relative currency strength of an economy, both the EUR and GBP markets are focusing on the potential damage of higher interest rates. In Europe’s case, after a rather addictive prolonged period of negative cash rates, getting the patient clean in the face of a looming energy crisis, the task will be tough. Until there’s evidence that Europe can live in a higher interest rate world needed to contain inflation, we see upside risk to both NZDEUR and NZDGBP.

Kiwi crosses in the months ahead

NZDUSD

Medium term bottom discovered below 61 cents. Retracement into the broader range of 0.6150 – 0.6800 through the next couple months on an unwind of the US Dollar story. Some key levels for importers to consider: 0.6400/0.6450 in short term. Longer term 0.6550 (May / June high) and 0.6800 (declining trend resistance) Exporters: 0.6300/0.6230 (May/June lows) and 0.6100 (2022 low).

NZDAUD

A tighter range as NZD and AUD likely to move in step against the USD given similar interest rate path (differential) developments: Supported at 0.8900 / 0.8950 and biased into 200 day moving average level (yellow line) towards 0.9250 currently.

NZDGBP

The economic outlook for the UK is rather bleak, with a 5-quarter recession forecast by the BoE. Risks developing of a break of longer-term resistance circa 0.5300 should the UK economy continue to deteriorate. Supported at 0.5100.

NZDEUR

The looming energy crisis for the Eurozone should again be fairly supportive for this cross 0.6100 – 0.6400. A caveat on this is the US Dollar performance. If we do see a strong reversal in US Dollar strength, this will see EUR slightly higher, given the weighting of Euro in the .DXY index.

The RBNZ's latest Monetary Policy Statement: letting off some steam

Modal to play video

Jeremy Couchman (Senior Economist) and Mieneke Perniskie (Financial markets Trader) discuss the Reserve Bank of New Zealand’s latest monetary policy decision and the reaction in financial markets.

The cash rate was hiked by 50bps to 3%, and the OCR track lifted. More tightening is needed to rein in inflation and better balance the economy. Given that the move to 3% was widely expected, the reaction in Kiwi rates and the Kiwi currency was relatively muted.

Glossary

Support and Resistance levels: These are chart levels that appear to limit a currency’s price movement: A support level limits downside; resistance level limits upside.

Moving averages: Commonly used in technical analysis to smooth out price data by showing the average over various time periods.

Interest rate Differentials: Show the difference between the interest rates earnt on two different currencies. New Zealand may offer a significantly higher interest rate than those in Japan, for example, and we see an inflow of Yen into Kiwi dollars (known as the “carry trade”). The widening, and narrowing, of interest rate differentials can have a material impact on capital flows and therefore the currency rate.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.