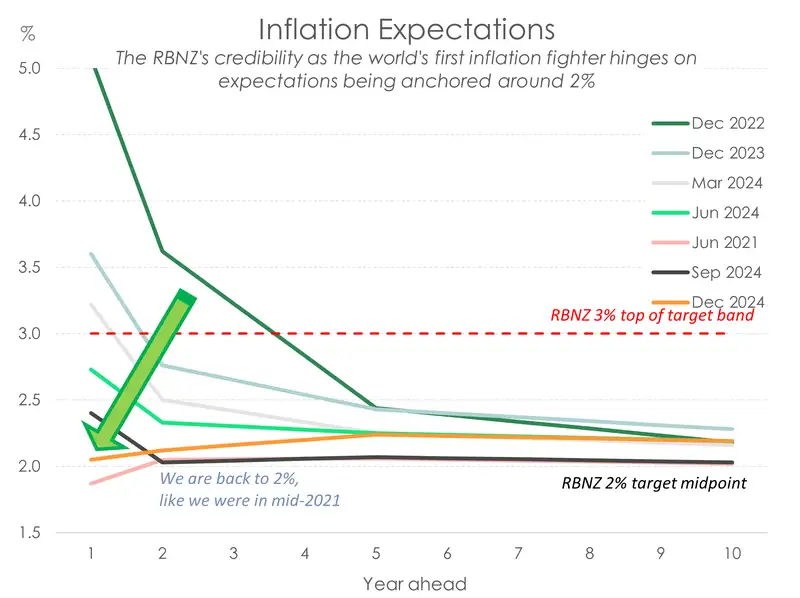

- We may have an annoying complication on the horizon. The RBNZ’s survey of inflation expectations lifted away from their 2% sweet spot. It should pose no threat to the RBNZ cutting 50bps next week. But further moves in inflation expectations away from 2% could temper the size of cuts to come.

- Net migration has cooled considerably in the last year. From a peak net inflow of 136k last October to a little under 45k. And it is the rise in departures that explains the quick descent. See our Chart of the Week

- REINZ data last week showed the Kiwi housing market continues to stagger sideways. Over the last 18 months, house prices have gone nowhere. But we’re betting that will change, next year. See our note Longview: house prices stagger sideways. But we’re looking to 2025, with a strong sense of optimism

We’ve had a bit of an awkward development. After finally hitting the 2% sweet spot last quarter, the RBNZ’s latest survey of inflation expectations lifted slightly. The one-year-ahead measure managed to fall 35bps to 2.05%. No doubt thanks to the large fall in actual inflation over the September quarter. But the medium- to longer-term measures we’re all up between 9 and 16bps. Where forecasters expect inflation to be two years from now has risen from 2.03% to 2.12%. And further out, expectations have returned to where they were earlier in June this year. It’s an unhelpful move. The return of inflation expectations to 2% in the third quarter was, we believe, a major catalyst in getting the RBNZ over the line and cut in August. In the same way, a drift higher in expectations may impact future rate reductions.

But don’t panic yet. We still think the RBNZ will deliver a 50bp cut at their meeting next week. Yes, the lift in the longer-term inflation expectations is frustrating, and somewhat confusing. But broadly speaking, expectations are still well contained, not too far from the 2% midpoint.

However, we must flag the risk that any further moves in inflation expectations away from 2% may put a dampener on the magnitude of rate cuts in 2025. As a result, we’ll be marking our calendars and keeping a close eye on the next release of inflation expectations in February.

For now, we’ll cross our fingers and focus on the present. And we are still confident in our call that the RBNZ will deliver a 50bps cut next week. With the 2% target inflation rate well within reach, we believe the RBNZ needs to get the cash rate below 4% ASAP. And from there, the RBNZ should return the cash rate to neutral – about 2.5% to 3%.

The RBNZ has kept the Kiwi economy in a chokehold over the past couple of years to kill inflation. But now, the inflation beast has been slayed! And we need the RBNZ to loosen its grip fast – before doing any more unnecessary damage to the economy. Inflation pressures are coming off faster than we expected – and we were more optimistic than most about the return to 2%. Meanwhile, activity has continued to frost over. We need rapid rate relief. And without them risk 1. Undershooting inflation. And 2. more avoidable damage to kiwi businesses and households.

Financial Markets

The comments below were provided by Kiwibank traders. Trader comments may not reflect the view of the research team.

In rates, Kiwi rates end higher across the curve.

“Kiwi rates ended the week 10bps higher across the curve as global yields continued to push higher. The US 10 year now back around the 4.50 level last seen in May. NZD rates also giving back some of its recent outperformance as we see the usual de-risking from offshore participants before a MPS meeting.

Although US CPI printed in line with forecast the relief rally for the US short end was short lived, undone later in the week by comments from Powell that there is no hurry to cut rates, bringing chance of a 25bps cut in the December meeting down to 50%.

In the Kiwi short end, the chance of a 75bps cut in upcoming meeting has largely faded. A mild increase to longer term Inflation Expectations making the chance of a 75bps cut seem that much more remote. Though the market remains fully convinced a 50bps cut will be delivered. Also holding up the short end is pay side flow from balance sheets hedging out home loan borrowers fixing on a 1 year tenor.

In fixed interest, BNZ priced a 5-year senior bond on Wednesday at a margin in middle of initial guidance, which was followed by another middling NZGB tender on Thursday. Will have to wait until December for the HYEFU which will set the scene for bond supply heading into 2025.

With lack of domestic catalysts before MPS next week expect to see a continuation of recent volatility exacerbated by typical drying up of liquidity.” Matthew Crowder, Balance Sheet Manager – Treasury.

In currencies, it was another week of NZDUSD declines.

“Confirmation of a Republican sweep of all 3 layers of the US government, and a US CPI reading opening some doubt from Fed officials around the pace (or in fact the actual need) of monetary easing in the US saw another week of declines for NZDUSD. Trading from a start of week high of 0.5980 to Friday’s low of 0.5840, importantly from a technical perspective, a breach of 0.5910 and then 0.5850 are levels to be mindful of from a downside risk perspective. Having travelled from above 0.6350 to below 59 cents in space of seven weeks - and in doing so reaching an end of year target as sighted in our most recent FX Tactical, it would be unsurprising to see some form of retracement as we head into a typically positive Xmas / NY period for risk assets from a seasonality perspective. The counter to this argument however is that markets have already seen a strong run of gains in risk assets following the US election outcome and some investors remain nervous around potentially over extended valuations in certain asset classes. Whilst a 25bp reduction to the Fed funds rate is still on the cards at December's FOMC meeting, investors are on watch as to what 2025 may or may not bring in future Fed easing. As of Friday’s close, US futures now only imply a terminal Fed funds rate of 3.63% as of September 2026. The lift in US yields over the past few weeks driven by both the Trump trade and US economic performance dynamics has also seen the terminal RBNZ OIS lift to around 3.47% by September 2025. Given KiwiEconomics continued view that the RBNZ will need to reduce the OCR to a level below its ‘neutral’ setting because of the continued soft state of the domestic economy and hence inflation outlook, an eventual cash rate below 3% now opens the possibility of a ‘negative carry’ NZ v US interest rate differential not witnessed at least in modern monetary policy setting history before. Whilst there is plenty of water to go under the bridge before this potential outcome could develop throughout 2025, next few weeks ahead may start to provide the clues around whether this could become a reality. Currency markets typically try to price interest rate outcomes of 1 - 2 years ahead. For now, unless impending US economic policy does somehow prove to be deflationary, then that period of time does not look positive for any substantial rally in NZDUSD.” Hamish Wilkinson, Senior Dealer - Financial Markets.

The Week Ahead

- UK inflation likely accelerated from 1.7% to 2.2% in October (in line with the Bank of England's forecast), led by a rise in household energy bills. Services inflation is expected to hold steady at a still-hot 4.9%, and is forecast to cool only gradually from here. The persistent strength in services inflation supports the case for the BoE to proceed slowly in cutting interest rates.

See our Weekly Calendar for more data releases and economic events this week.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.